A private sector improvement to support growth

Insight

The NAB Business Survey showed Conditions falling just one point to +22 to remain at very elevated levels, above the pre-pandemic highs for the series.

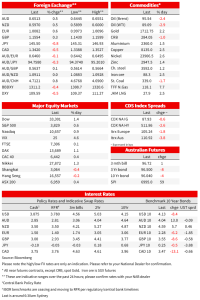

Following a non-descript APAC market day Tuesday, offshore (US) markets were, in the early afternoon, trading with a distinct ‘risk-on’ tone, seemingly anticipating political gridlock to be the upshot of the mid-term elections currently underway and the historical patterns of equities typically faring well in the period between mid-terms and year-end almost regardless of the outcome. US equities have though entered the last ‘hour of power’ with earlier gains wiped out. US bond yields are lower with 10-year Treasuries down 7bps and 2s down 4bps (this is in front of Thursday’s all-important October US CPI release). The US dollar is weaker across the board with major currencies, including AUD, mostly 0.4-0.6% stronger (NOK the exception given oil is smartly lower) with the Bloomberg BBDXY index off 0.4% to be almost 3% below its early November highs.

Echoing Ronald Regan’s famous quip from the early 1980s about the nine most terrifying words in the English language being, “I’m from the Government and I’m here to help” , equity market are not showing any trepidation about political gridlock following on from the mid-term elections, results of which we might know this time tomorrow – or possibly not that soon if some of the Senate races are particularly tight and bearing in mind the current 50:50 split. On the contrary, the historical patterns of the S&P500 rallying in the months following mid-terms and year end – on average by almost 5% and almost regardless of the outcome – is evidently not being lost on markets. Or that was the case coming into the last hour of NYSE trade with some of those earlier gains erased. Maybe it’s a case of ‘tail bites dog’ with the slump in Bitcoin, which has been own as much as 15% to below $17,500, infiltrating broader risk markets? Trickly writing a morning report now that US stocks don’t close until 8:00 AEDT!

Arguably ‘buying the rumour’ of impending gridlock just in front of Thursday’s all-important US CPI release and which could have major bearing on the whether the Fed steps down to 50bps rather than deliver another 75bpos rate rise next week, is a perilous exercise. But for today at least, most S&P500 subsectors have (rather had) been trading in the green, notable exceptions being energy and consumer discretionaries. This would suggest that fears over an impending economic downturn are becoming more elevated, in which respect we’d note crude oil off more than $2 on a day when the USD is weak across the board, and which would typically be associated with higher not lower oil prices. The one US data point overnight, the NFIB survey (small business optimism) and which does have some lead economic indicator properties, fell to 91.3 from 91.4, but this was only trivially different from expeacrtions (91.4) and is still up on its June cycle lows, so we wouldn’t read too much into this.

On the central bank speaker circuit, we have had the ECB’s Wunsch out saying that his base case (for the Eurozone economy) is a technical recession and that adds that if the recession is deep, he suggests there may be more (not less) inflation. And in a ‘same but different’ vein, we’ve had Bank of England chief economist Huw Pill out saying that a sharp drop in the size of the UK’s workforce is keeping upward pressure on inflation and pointing toward further interest-rate increases. Pill said the BoE is especially concerned about signs that inflation expectations might be drifting above the target level, a process described as “de-anchoring.” He said policy makers must prevent a wage-price spiral from setting in.

Pill, talking to the House of Lords and in front of former BoE Governor Mervyn King, also suggested that officials made a mistake in continuing their stimulus program through the pandemic, saying the decisions taken might have been different “with the benefit of hindsight.” Left unsaid was that he wasn’t at the Bank at the time (so not my fault).

Bond markets have been having a good day for no obvious reason, save perhaps some (potentially misplaced) optimism that risks around tomorrow night’s US CPI release lie to the downside (in which respect the Richmond Fed’s Thomas Barkin said yesterday he’s ‘seeing promising signs on inflation’, and overnight we’ve had Manheim report used car prices down another 2.2% in October, their fifth successive monthly drop. 10-year Treasuries are currently down 9bps and 2s -5bps. A 3-year note auction a couple of hours ago has gone well enough not to cause any damage (on the contrary, the 3-year yield is some 5bpos down on pre-auction levels).

In FX, the small rebound in the USD during our day yesterday following Monday’s sharp fall has given way to fresh selling, the Bloomberg BBDXY index currently -0.4% and the narrower DXY -0.5%. AUD/USD is sitting mid-pack amongst G10 currencies but has crept back on to a 0.65 handle (briefly above 0.6550 in fact, though currently back only just above the figure).

Yesterday’s NAB Business Survey made less grim reading than the Westpac-Melbourne Institute October Consumer Confidence survey, the latter plumbing historic lows (below the low point for the GFC (79.0) and only slightly higher than when the covid pandemic fist hit in April 2020 (75.6). The ‘highlights’ were inflation and interest rates weighing heavily on family finances, a poor response to the Federal Budget and some 40% of consumers (a record high) planning to cut Christmas spending.

In contrast the NAB Business Survey showed Conditions falling just one point to +22 to remain at very elevated levels, above the pre-pandemic highs for the series. Trading conditions fell 6pts to a still-strong +31 index points, and employment fell 2pts to +14 index points. Profitability edged up 1pt to +22 index points. So small changes across the components but overall, each of the subcomponents remain at exceedingly strong levels. That said, Confidence fell 4 points to 0, with the fall broad-based, falling most in transport and utilities but also weaker across mining, manufacturing, finance, business & property, recreation and personal services, and wholesale.

Pricing indicators remain off their highs, but both retail prices and purchases costs ticked higher in the month. Retail prices rose from 2.3 to 3.0% (in quarterly terms) while purchases costs rose 4.1% from 3.7%. While the pricing indicators are off their highs and we expect further moderation over time on goods input pressures, they are flagging upside risk to the sharp deceleration the RBA expects in Q1 2023 following a projected Q4 2022 peak.

NAB Markets Research Disclaimer

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.