Coming in for landing in a heavy cross wind

Insight

US CPI, US political gridlock (maybe) and China covid policy tweaks...

All we need now is an early end to the Russia Ukraine war and the misery of equity market bears and US dollar bulls will be complete. We can but hope, in which respect some might try find just that in Friday’s news of Ukraine’s recapture of Kherson, though we aren’t minded to draw the very long required on this one, albeit senior Us officials have reported; begun nudging Kyiv to start thinking about peace talks in the event winter stalls Ukraine’s momentum following Friday’s joyous news.

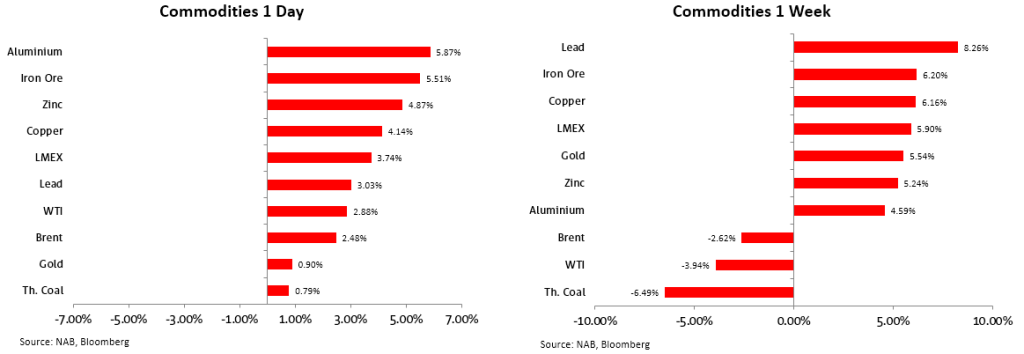

Compounding Thursday’s massive post-CPI risk asset and Treasury market rally and wholesale USD sell-off was news late during our Friday of the first tangible recalibration of China’s zero-covid policy rules. The changes, detailed in a 20-point playbook for officials include a reduction in the time travellers into China are required to isolate. From the prevailing 10 days in quarantine followed by a week in a hotel then 3 days at home, the news rules comprise 5 days in a hotel or government facility then just 3 days at home. The new rules will also apply to close contacts of infected people, while close contacts of close contacts will no longer need to be identified and so have no need to take any action.

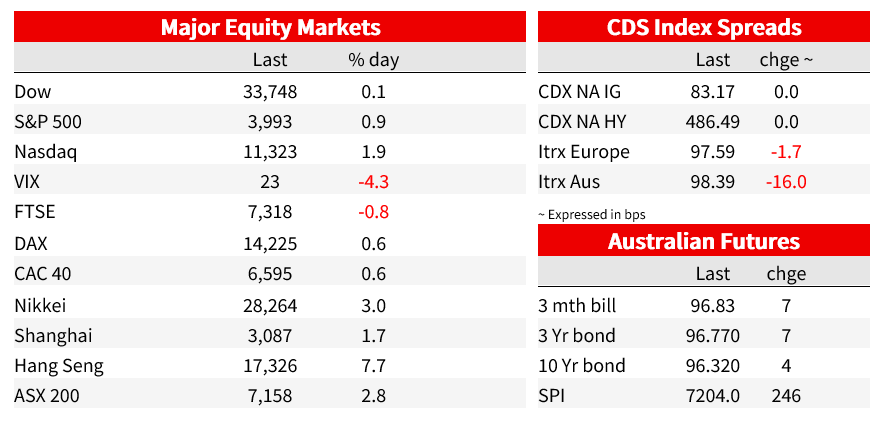

Set against Friday’s news of China’s highest (reported) new covid infection rate since April (more than 10,000) and the highest new case load in Beijing in a year, it’s hard to see how the net effect of the combined news is anything but negative from an economic standpoint. But it’s the symbolism of the movement, however small, in the zero covid strategy that markets are happily latching onto and which saw the Hang Seng jump by 7.75% on Friday, in doing so exceeding Thursday’s post-CPI NASDAQ gain (7.4%) and meaning that on the week the Hang Seng performed almost as well as the NASDAQ (the latter up 8.1% to be the best performing of the major indices globally).

Friday’s Hang Seng surge was evidently not just about the news on covid restrictions. Bloomberg on Sunday reported China has unveiled its most sweeping rescue package to bail out a real estate market mired in a record slowdown and deepening liquidity crunch, according to ‘people familiar with the matter’. They say the PBoC, and the China Banking and Insurance Regulatory Commission on Friday jointly issued a notice to financial institutions laying out plans to ensure the “stable and healthy development” of the property sector.

Unlike previous piecemeal steps, the latest notice includes 16 measures that range from addressing the liquidity crisis faced by developers to loosening down-payment requirements for homebuyers, the people said. As part of the rescue plan, developers’ outstanding bank loans and trust borrowings due within the next six months can be extended for a year, while repayment on their bonds can also be extended or swapped through negotiations, said the people. A Bloomberg Intelligence gauge of Chinese developers’ stocks jumped a record 18% Friday.

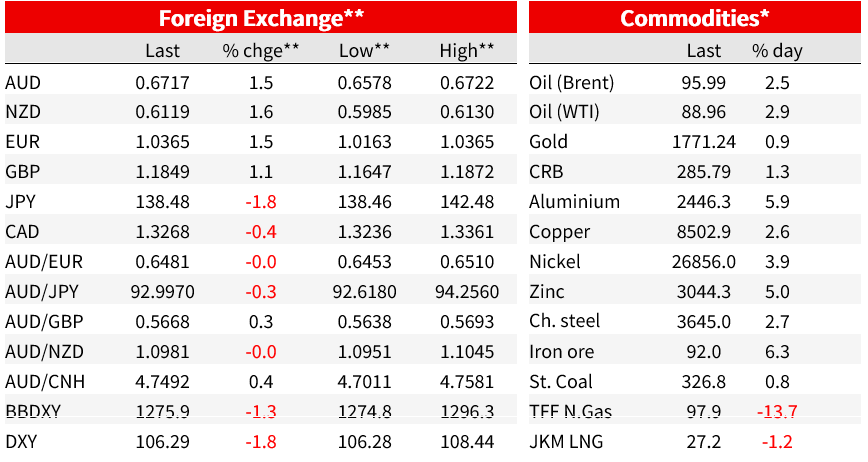

he China news also showed up in sharp fall in USD/CNY, down 1.25% to below 7.10, bringing the two-day CNY gain to 2% to be more than 3% up on its start of November cycle high near 7.33. CNY strength has direct read though for AUD and NZD as we saw Friday, though both antipodean currencies still finished in the lower half of the week’s G10 league table, which was headed by CHF (+5.4%) closely followed by JPY (5.3%). CHF outperformance came in large part from comments by SNB President Thomas Jordan who said that policy was not yet restrictive enough to tame inflation (no surprise there) but that the SNB was ready to sell foreign exchange reserves as part of the anti-inflation effort. EUR/CHF fell by almost 1% on this news.

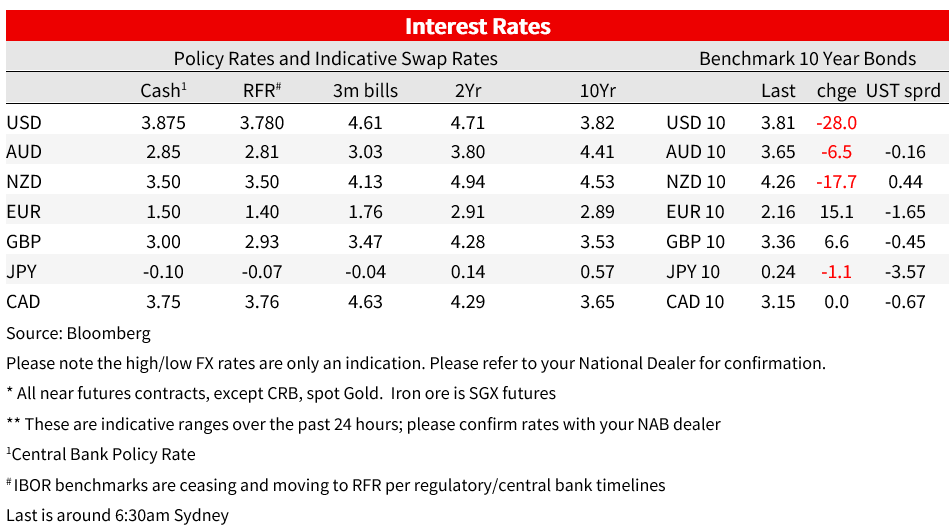

JPY gains were justified by the extent of last week’s fall-back in Treasury yields but also testament to the impact of position squeezes, in which respect short JPY has been a standout for much of this year. Together with gains of almost 4% on the week for both EUR and GBP, the DXY index lost just over 4% on the week and the broader Bloomberg BBDY index 3.5%.

A very minor contribution to GBP gains on Friday derived from Q3 GDP data showing a smaller than expected contraction (-0.2% versus -0.5% consensus), though the September monthly read of -0.6% was 0.2% worse than expected (though explained in large part by the loss of activity due to the Queen’s funeral). So overall it was a less bad than feared outcome (Fridays’ data also including September industrial production rising by 0.2% against a fall of 0.3% expected)

The main US economic new Friday was the University of Michigan’s preliminary November consumer Sentiment survey, where Sentiment fell by much more than expected, 54.7 from 59.9 and 59.5 consensus driven down by both Current Conditions and Expectations, but the closely monitored 5-10yr inflation expectations printed at 3.0% up from 2.9% and 2.9% expected his is up from a recent low of 3.7% and close to the 3.1% 2022 high. 1-yr inflation expectation rose to 5.1 from 5.0% as expected).

The US treasury market was closed Friday for the Veterans day holiday (stocks were open and the Nasdaq added 1.9% to Thursday’s 7.4% gain, and S&P500 0.9% on top of Thursday’s 5.5% jump. On the week though, 2s were down a startling 32.6bps (and 5s an even bigger 39.5bps, 10s -34,6bos), moves that other global benchmarks couldn’t come close to matching (but which unlike the US didn’t get to enjoy any better-than-expected inflation news last week – and are unlikely to be this coming week – see Coming Up below).

As for the US mid-terms, the weekend has brought news that the Democrats have retained control of the Senate following the re-election of Catherine Cortez Masto in the Nevada Senate race. This give the Dems. 50 seats to the Reps. 49, meaning the Georgia Senate election run-off on December 6 is no longer pivotal to who has control of the Senate next year. Control of the House has yet to be decided and might not for be this week (12 of the so far 23 uncalled House seats are in California , which typically takes about four weeks to count all the votes, including mail-ins).

Rather than the political gridlock assured if the House turns red while the Senate remains blue, it is therefore possible that the Democrats retain control of Congress. While this would mean that issues such as the debt ceiling wouldn’t become problematic in 2023, markets would overall prefer the certainty of ‘nothing done’ on political gridlock that the uncertainty of fiscal policy under a continuation of the blue wave that resulted from the November 2020 elections and January 2021 Georgia Senate run-off election.

The only Fed speaker Friday was from recently installed Boston Fed President Susan Collins who said that while more work needed to be done by the Fed, the risk of overtightening had increased.

NAB Markets Research Disclaimer

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.