Spending more subdued in January & February 2025

Insight

As the market waits for the BoJ policy decision today, the ECB has been the market mover overnight following a Bloomberg source story suggesting the Bank may be turning less hawkish.

NZ: QSBO business confidence (net%), Q4: -70 vs -42 prev.

AU: Westpac consumer confidence, Jan: 84.3 vs. 80.3 prev.

CH: Industrial production (y/y%), Dec: 1.3 vs 0.1 exp.

CH: Retail sales (y/y%), Dec: -1.8 vs. -9.0 exp.

CH: Fixed assets investment (y/y%), Dec: 5.1 vs. 5.0 exp.

CH: GDP (y/y%), Q4: 2.0 vs. 1.6 exp

CH: GDP (q/q%), Q4: 0.0 vs. -1.1 exp.

UK: Unemployment rate (%), Nov: 3.7 vs. 3.7 exp.

UK: Avg wkly earnings x bonus (y/y%), Nov: 6.4 vs. 6.3 exp.

GE: ZEW survey expectations, Jan: 16.9 vs. -15.0 exp.

US: Empire manufacturing, Jan: -32.9 vs. -8.6 exp.

CA: CPI (y/y%), Dec: 6.3 vs. 6.4 exp.

CA: Core CPI (avg of 3 series y/y%), Dec: 5.6 vs. 5.8 prev.

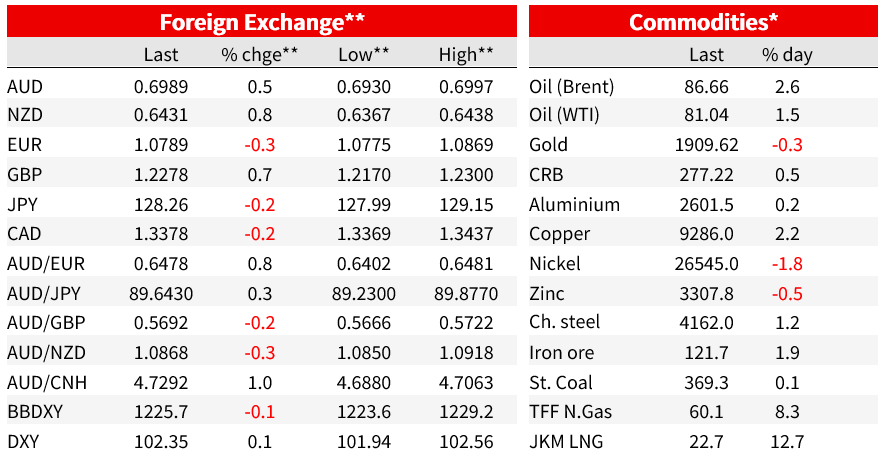

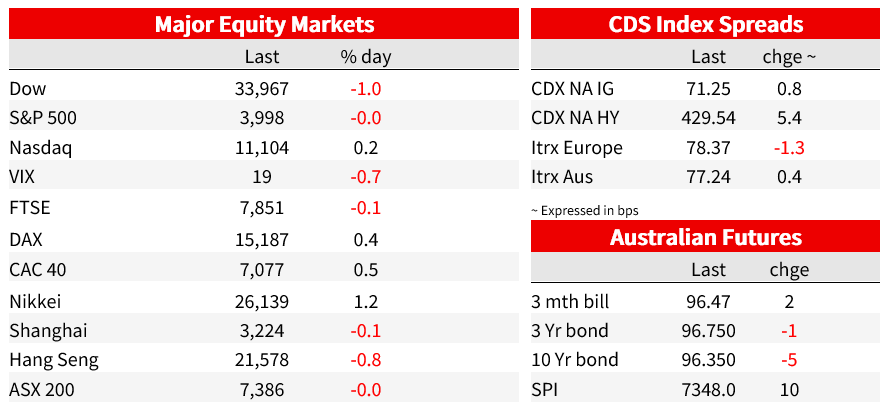

As the market waits for the BoJ policy decision today, the ECB has been the market mover overnight following a Bloomberg source story suggesting the Bank may be turning less hawkish. The news triggered a shift lower in EU rates led by front end yields with the euro also shifting lower. A weak US Empire manufacturing report added to the downside pressure on US rates after an earlier move higher in US Treasury yields. The USD is little changed with gains in NZD, AUD, JPY and GBP offset by declines in EUR. US equities are mixed the Dow is down close to -1% ( weighed down by financials) while the NASDAQ and S&P 500 are trading (just) above water.

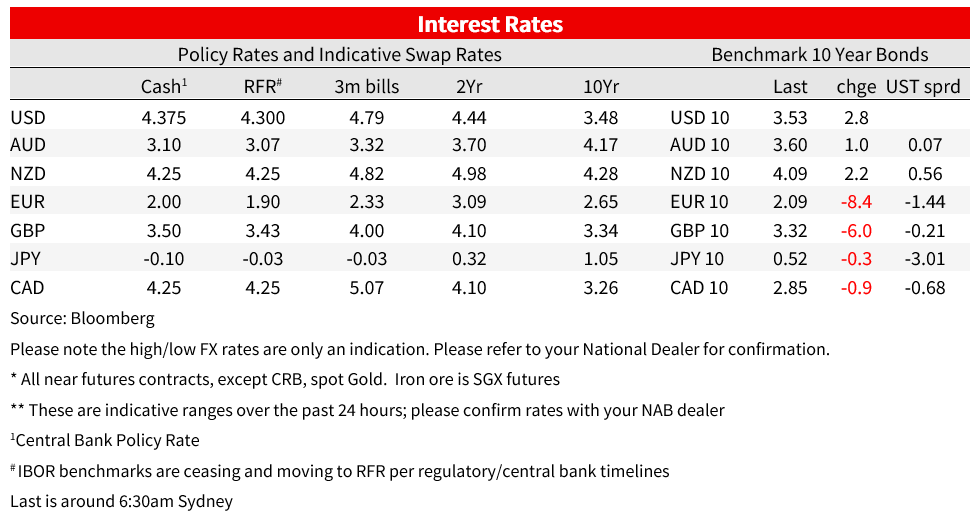

European sovereign bond rallied overnight with Italian bonds outperforming following a Bloomberg report noting ECB policymakers are starting to consider a slower pace of rate hikes than ECB President Lagarde signalled (to the markets surprise) in December. German 2-year yield drops 12bps, the most since November 10 while 2y Italian BTPS fell by 14bps, EU curves bull steepened with 10y Bunds falling by 8.5bps to 0.775% while 10y Italian yields declined by 12bps to 3.880%

Back in December Lagarde suggested we should expect the ECB to deliver ‘significant hikes at a steady pace’ with her expectation of ‘raising by 50bps for a period of time’. The sourced comments now note that “while the 50bps step in February she signalled remains likely, the prospect of a smaller 25bps increase at the following meeting in March is gaining support”. The prospect of a less hawkish ECB is gaining support amid weaker-than-expected EU inflation, a drop in natural gas prices and the possibility of gentler tightening by the Fed. That said, officials quoted in the Bloomberg story stressed that no decision has been taken and that a slowdown in monetary tightening shouldn’t be viewed as the ECB going soft on its mandate.

After trading to an overnight high of 1.0869, the Bloomberg story weighed on the euro with the pair falling to an overnight low of 1.0775. The pair now trades at 1.0799. Rate hike expectations for the ECB next meeting have remained steady at 49bps, but there has been a more notable decline in rate hike expectations for later in the year. The ECB deposit rate is now seen at 3.19% in September compared to 3.31% at the close yesterday.

The ECB news weighed on front end UST yields with the move also supported by a much bigger than expected decline in the NY Empire Manufacturing Survey (Jan -32.9 vs -8.7 exp.). This is the first of the regional manufacturing activity indicators for January, early days but the data is supporting the notion of a shift in global growth dynamics with the US economy slowing down given the aggressive Fed tightening while China and Europe look to rebound from a subdued 2022.

On this score worth noting that overnight Chancellor Olaf Scholz said he’s sure Germany will avoid a recession this year. The Chancellor said that getting through the winter energy crunch in better shape than feared just a few weeks ago adding that diversifying gas supplies has been critical in helping to keep the economy going.

Meanwhile speaking to billionaires among others in Davos, China Vice Premier Liu said his country’s economy will likely rebound to its pre-pandemic growth trend this year after coronavirus infections passed their peak. Beijing’s focus this year will be on boosting domestic demand, which will lead to a notable increase in imports, Liu said.

Moving onto other data releases, Canadian CPI data supported the theme of slower global inflationary pressure, with the headline and core measures falling to 6.3% and 5.6% respectively. The Bank of Canada is nearing an end to its tightening cycle, with a possible 25bps hike next week in its policy rate to 4.5%, but some in the market suggesting that another hike is not necessary.

The UK labour market report was a mixed bag, but for the BoE the key point is that wages growth remains robust, and it may force the Bank to retain an aggressive hawkish stance, favouring current market expectations for a 50bps hike early in February (45bps currently priced). Job hires increased by 28k December, well below the 60k expected by consensus, after a 70k increase in November. Thus, the data suggests the pace of hiring is slowing. The unemployment rate was unchanged at 3.7% in the three months to November 2022, in line with consensus while vacancies fell again in December, reinforcing the recent downtrend. But the big sore point for the BoE is that regular wage growth climbed to 6.4% in the three months to November, from 6.1% in October and above the 6.3% expected by consensus. A 20-year high, excluding the height of the pandemic.

Moving onto FX land, the USD is little changed in index terms although the DXY index is a tad higher given the noted euro decline. Somewhat surprising given soft NZ QSBO report yesterday, the kiwi is the G10 outperformer over the past 24 hours, up 0.71% to 0.6431.

As my BNZ colleague Jason Wong notes, The NZIER’s QSBO painted a clear picture of stagflation, with business confidence and other activity indicators falling to near-50-year lows while measures of capacity pressures remained very tight with heightened inflationary pressure. The question for the RBNZ is whether to put more emphasis on recent business and consumer surveys which are consistent with a GFC-style deep recession or maintain a focus on lagging inflation indicators.

The market has been gradually putting more weight on the former than the latter, with OIS pricing for the February meeting closing at 4.87%, the first time since early December of the implied probability of a 50bps hike being greater than the probability of 75bps.

The AUD (+0.5% to 0.6989), GBP (0.5% to 1.2274) and JPY are the other notable outperformers. AUD gains can be attributed to the growing perception that China will enjoy a solid economic rebound this year supporting a solid demand for commodities with improved AU-China relations an added bonus. Overnight iron ore (+1% to $ 120.59) led a rise in most commodities with metal prices (+0.9) and oil (Brent 0.78%) the other notable gainers.

Ahead of the BoJ meeting USD/JPY trades at ¥1.28.294 (up 0.26% over the past 24 hours. We think the BoJ YCC policy is on borrowed time and while the market is divided on what the BoJ may do today, the pressure on the JGB market in recent weeks alongside the prospect of rising Japanese inflation leads us to conclude that the BoJ will deliver a strong signal that the end of YCC is nigh (see more below).

Ahead of the NY close, US equities are mixed. The Dow trades sub 1% with financials weighing on the index. Goldman Sachs shares fell the most in a year after reporting fourth-quarter net revenue below expectations, while Morgan Stanley rallied as its wealth-management business boosted revenue above forecasts. Earnings reporting is the US equity focus at the moment with investors trying to assess the impact from Fed policy tightens on companies’ outlooks. The NASDAQ and S&P 500 are trading just above water while the Euro Stoxx 600 continued its strong run so far this year, adding another 0.4%.

Using different measures such as liquidity, smoothness of the JGB curve (i.e., kink around the 10y tenor) and spot to futures spread, market functionality has deteriorated over the past month. We think the BoJ will be reluctant to make changes so soon after the widening of the band in December, but from a market functionality perspective the pressure for the Bank to do something this week is hard to dispute. On this basis another widening of the band (to -/+ 0.75%) could be justified with the objective of improving market conditions while still retaining most of the ultra-stimulatory stance (i.e., QE and negative interest rate).

If the Bank keeps its YCC band unchanged, this is likely to come alongside the commitment of more JGB purchase but given market pressure we suspect that at a minimum the Bank will have to give a strong signal that a shift in policy (end of YCC) is coming imminently. Either way and as the RBA would note, exiting YCC is unlikely to be a smooth affair.

This week’s meeting also comes with a new set of forecasts with many economists suggesting the BoJ could estimate core core inflation remaining close to 2% over the forecast horizon. In October core core inflation was seen at 1.8%yoy for FY2022,1.6% for Y2023 and 1.6% for FY2024. The Bank’s new inflation forecast numbers are going to be important in terms of expectations for policy normalisation in 2023. The market is pricing a move away from negative interest rate as early as the (next) March meeting with a policy rate seen at +0.2% by October this year.

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets. Read our NAB Markets Research disclaimer.

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.