Our global forecasts are unchanged and we continue to expect soft global growth of only 3.0 to 3.1% between 2024 and 2026.

Insight

Cautiousness has crept back into markets on the eve of Jackson Hole. Twin suicide attacks outside of Kabul airport has seen 12 US service members killed along with at least 60 Afghans. Coming up today, Fed Chair Powell gives his key mark address at Jackson Hole.

Cautiousness has crept back into markets on the eve of Jackson Hole. Twin suicide attacks outside of Kabul airport has seen 12 US service members killed along with at least 60 Afghans. The attacks are said to have come from the Islamic State which has long been fighting the Taliban in Afghanistan. Equity markets fell in the wake of the news, but this also coincided with hawkish comments from the Fed’s Kaplan, who took flight again after only recently clipping his wings on Friday. Kaplan noted delta had not materially altered his outlook as he initially feared, with firms ‘weathering this resurgence’ and showing ‘resilience’. Kaplan again called for a September taper announcement with tapering over eight months (i.e. finished by June 2022). It is unlikely the suicide attacks in Afghanistan will have an enduring impact on markets.

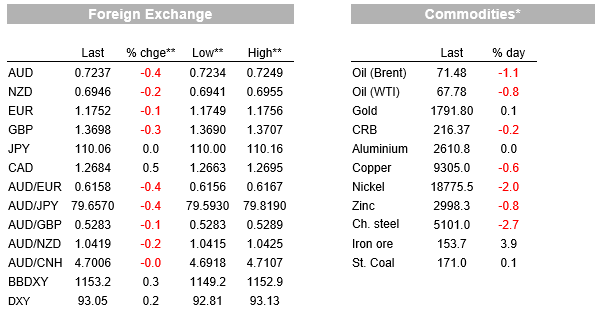

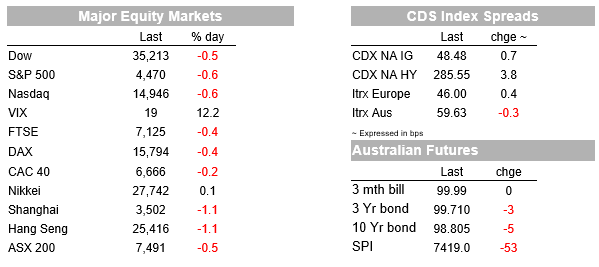

In terms of specific market moves, the S&P500 fell -0.6%, reaching initial lows after news hit of the second suicide attack in Afghanistan and as Kaplan pivoted back to arguing for a September taper announcement after having seemingly backed away last Friday. FX has shown only a very slight hit to sentiment with the USD up (BBDXY +0.3%), but other safe havens flat to lower with USD/Yen -0.0% to 110.03 and USD/CHF +0.5% to 0.9180. Instead gains have been concentrated in the USD with EUR -0.1% and GBP -0.3%. Commodity currencies have been hit though with AUD -0.4% along with NZD -0.2%.

Yields have been broadly steady with the US 10yr +0.8bps to 1.35%. The 10 year did get as high as 1.37% on hawkish Fed commentary after Bullard repeated his already known views that he wanted tapering to finish by the end of Q1 2022. Were such an outcome to eventuate then that would open up the possibility of more than one hike in 2022 (7 of 18 FOMC members had a 2022 hike pencilled in the June SEP).

Outside of Bullard’s comment, the Fed’s Kaplan was the most notable overnight given that last Friday he appeared to have backed away given the uncertainty around the delta variant. In a CNBC interview Kaplan said he had talked extensively to business contacts and “by and large what we are hearing.is they are weathering this resurgence at least as well as previous surges, and many are telling us the impact on their business is more muted”. Accordingly “…I don’t see anything at this point that would cause me to materially change my outlook ”. Kaplan is again calling for a September taper announcement with tapering over eight months (i.e. finished by June 2022) (see CNBC interview for details). Kaplan’ shift back puts the focus on Powell.

Fed Chair Powell speaks at the Jackson Hole Virtual Event at 10.00am local time which is midnight Sydney (00.00 AEST). Fed chairs have a track record of foreshadowing major policy announcements at Jackson Hole, and some investors think Powell will provide further clues around the timing of a tapering announcement, which could come as soon as the FOMC meeting next month. Despite the constant headlines, the reality is that an announcement on tapering is highly likely to come before the end of the year (FOMC meetings at September, November and December), something even the doves on the committee seem to agree on. What will be as much, if not more, important than the start date will be how quickly the Fed decides to taper and whether the Fed attempts to de-link the market’s perception that tapering ‘starts the clock ticking’ on rate hikes.

There wasn’t any reaction to economic data overnight, with the second estimate of US GDP coming in close to market expectations (6.6% annualised vs. 6.7% expected) and US initial jobless claims remaining near post-Covid lows and broadly matched expectations (353k vs. 350k expected). The Kansas City Fed Manufacturing Index was also broadly in line (29 vs. 25 expected) and similar to what the Fed’s Kaplan said on delta, the survey found “ most firms indicated that the recent surge in COVID cases had no change on their business activity”, with only 20% seeing some impact.

In other news, Taiwan Semiconductor Manufacturing (TMSC), the world’s largest maker of semiconductors, was planning to increase prices by 10% to 20%. A global shortage in semiconductors has led to higher prices and production disruption for a wide range of electronic and consumer goods, including cars, in turn contributing to higher inflation. TMSC’s move suggests supply-driven pressures on inflation are set to persist for some time yet (see WSJ: World’s Largest Chip Maker to Raise Prices, Threatening Costlier Electronics).

In Australia, NSW is leading the country to starting to transition to living with the virus. The NSW Premier yesterday announced a very mild easing in restrictions starting from September 13 in terms of gathering sizes outdoors for fully vaccinated people (gatherings up to five will be allowed within a person’s LGA or 5km radius). A more comprehensive easing of restrictions is slated for mid-October when the 70% full adult vaccination thresholds are expected to be reached. The NSW Premier has flagged the possibility of an app to show vaccination status, perhaps linking greater freedoms to vaccination status. It is unclear whether this will be a model for the rest of Australia, but what is clear is that Australia is beginning its transition to living with the virus.

Meanwhile across the Ditch, the NZ government will provide an update on lockdown restrictions following the 68 new community cases that were reported yesterday. It is expected Auckland will remain at Level 4 for some time longer but with some scope for movement elsewhere (particularly for the South Island) or an indication of when movement might occur if conditions allow. The Kiwi short term rates curve is likely to be very sensitive to virus developments given RBNZ Assistant Governor’s Hawkesby’s comments earlier in the week that 50bps was considered in August. The next RBNZ meeting is on October 6. The market continues to price a high chance of OCR rate hike at each of the next three meetings (65bps priced in total).

Domestic focus will be on Retail Sales, while offshore the Fed’s Jackson Hole Symposium looms large with Chair Powell to be watched closely for tapering hints. Details below:

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.