A private sector improvement to support growth

Insight

Bond yields rose sharply on the developing assessment of turmoil in US banking, helped by but largely overshadowing a stubbornly strong US CPI.

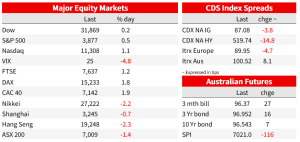

Even a data print as consequential as the US CPI continued to take a back seat to the developing assessment of turmoil in US banking. Equities are higher, with banking stocks also getting some relief, though gains were pared in the US afternoon on geopolitical concerns after news a Russian aircraft collided with a US drone. US yields are higher, led by the 2yr, and market pricing for a 25bp hike from the Fed on 22 March now sits at 71% from 57% yesterday, a stubbornly strong US CPI print helping that cause.

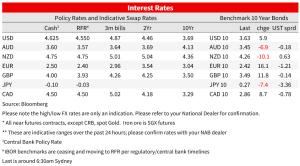

It was another day of wide ranges in Treasuries. The US 2yr plunged as low as 3.82% a bit after 5pm Sydney time on reports that Credit Suisse Group had found “material weakness” in its reporting and control procedures but recovered into calmer conditions into the European trading session. Over the day, the 2yr yield is 25bp higher to 4.23%. That coming after three days of declines to leave yields 83bp below their close on Wednesday last week, but around their levels prior to selloff that ensued after the January Payrolls release on 3 February. Over the past 24 hours, 10yr yields followed a similar pattern in a narrower range, to be 6bp higher.

Trading through most of the US session was comparatively uneventful, with the market apparently taking a view that the worst is now passed. Most of the 22 banks in the KBW banking index showed gains – the two worst banks hit yesterday up around 30-50%. And the KBW regional banking index which covers the smaller regional banks shows a similar pattern. First Republic Bank did trigger a volatility halt as it partly reversed earlier gains after S&P placed the company on watch negative, though the stock was still up around 30%, while getting some attention was news that Moody’s Investors Service cut its outlook for the US banking system to negative from stable.

US equities more broadly are also higher, the S&P500 shows a broad-based recovery, up over 1% and all sectors in positive territory. The index had been up as much as 2.1%, though gains were pared on news that a Russian aircraft and US drone had collided over the Black Sea.

As for the US CPI, a fair summary is stubbornly high . Headline came in in line with expectations at 0.4% m/m, as expected, while unhelpful rounding didn’t flatter the core, up 0.5% (0.452%) m/m vs 0.4% expected. US inflation remains too high and is not telling optimistic stories of disinflation. Core inflation is 5.1% in 3m annualised terms, about the same as its 6m annualised rate of 5.2%. For super-core, excluding used cars and shelter, it is 4.3% 3-month annualised and 4.4% 6m annualised, hardly a compelling downtrend so far.

Within the detail, the core-services ex-shelter, in focus at the Fed, rose 0.51% m/m, the biggest rise since September. Rents prices rose 0.7% m/m, yet to show the meaningfully slowing that timelier rents measures say is coming, but even as that come through it is not enough alone to get inflation back to target. A 6.4% jump in airfares in the month boosted, while used cars actually declined, down 2.8% for an 8th consecutive fall, with auction prices suggesting that won’t persist in coming months. Used autos have been doing the heavy lifting in the goods disinflation story, core goods ex-used autos are running at 4.5% 3-month annualised.

Fed pricing now allows for 34bp by May, up from just 20bp a day earlier, and prices a 74% chance of a 25bp increase in March. The data certainly makes the case for 25bp, and absent the turmoil across banking it would have leant towards 50bp, but a pause could be easily justified on any further market turbulence if conditions don’t continue to settle. Markets are pricing 72bp of cuts after a peak of 4.9% in May.

It was less volatile across currency markets. Less safe-haven flow has seen the yen underperform, USDJPY up 0.6% and back above 134. The AUD was up 0.2% to 0.6680, currently towards the top end of its 0.6632 to 0.6693 range over the past 24 hours.

In other news, UK labour market data showed signs of slower wages inflation for the first time in more than a year, with average earnings ex bonuses nudging down 2 ticks to 6.5% y/y, while the unemployment rate remained unchanged at 3.7% against expectations for a small lift. Market pricing currently slightly favours a 25bps hike over a pause at the meeting next week.

On the Australian data calendar yesterday, the NAB Business Survey showed still-strong conditions . Business conditions edged down 1pt to +17 index points in February, still a very strong level in the history of the survey. The more volatile Confidence fell 10pts to -4, after rising into positive territory in January while forward orders fell 3pts to +3. Overall activity still strong and forward looking indicators showing resilience if a little softer compared to strength at the end of last year. On the prices indicators, labour costs lifted while final prices in consumer industries retail and recreation and person services fell a bit in the month but remain very elevated. The quarter is not over yet, but they point to upside risk to the RBA’s expectation that quarterly trimmed mean inflation could fall 3 tenths to 1.4% q/q this quarter. The RBA’s next meeting is not for 3 weeks with employment on Thursday the next data print in focus.

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets. Read our NAB Markets Research disclaimer.

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.