We expect NAB’s Non-rural Commodity Price Index to fall by 4.9% in Q2

Insight

Bond yields are sharply higher overnight, improved sentiment towards the banking sector one key driver

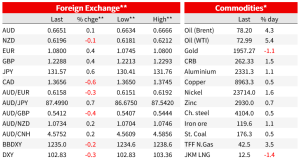

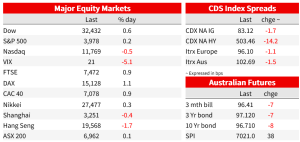

News during out time zone yesterday morning of agreement between the FDIC and First Citizens to take over the loan book of SVB helped set a positive tone of equity markets Monday. Together with the absence of new scare stories over the weekend, banking shares have driven a rally across most major equity indices, the exception being the Nasdaq where significantly higher US and global rates have held the tech.sector back. The US 2-year note is 24bps up on Friday’s close to be (just) back over 4%. Despite higher US yields, the USD is lower led by gains for the EUR, GBP, CAD and CHF but AUD and NZD still can’t buy a trick, both little changed on the day, unlike CAD which has found support from gains of more than $3 in crude oil prices. Retail sales this morning is the local highlight of the day ahead.

Nothing crawled out of the woodwork over the weekend about the banking sector, indeed the one piece of new news was good, namely confirmation that First Citizens Bancare was the FDIC’s chosen suiter to take over the assets of the failed SVB , reportedly at a $16.bn discount to their current marks with the (bank funded) FDIC to take a $20bn hit. The news has seen First Citizens share price up 50% on the day. We’ve also seen a 6% rebound in Deutsche Bank’s share price (now 14% off last week’s lows) and the KBW Bank index is up just over 2% to 80 (albeit at the beginning of March it was around 110).

Within the S&P500, Financials are up 1.4% and together with a big lift to oil prices that sees the energy sub-sector up 2.1%, the S&P500 has closed 0.2% higher. This is though well back from its early-day highs (+0.8%) while the NASDAQ, hamstrung by higher rates, has closed just about on the lows, down 0.7%. The oil price jump (WTI +$3.64) owes something to the improvement in sentiment vis-a-vis the banking sector, though reports of a halt in oil exports from Kurdistan has also reportedly had a hand.

Central bankers have been out re-emphasising the ‘two target, two instruments’ mantra with respect ot fighting inflation (interest rates) and restoring financial stability (macro-prudential policy). Bank of England Governor Andrew Bailey has been speaking at the LSE (after the London close) where the message has been that policy makers won’t be distracted from their fight against inflation by the crisis in the banking system. “We have a strong macro-prudential policy regime in this country,” Bailey said. “With the Financial Policy Committee on the case of securing financial stability, the Monetary Policy Committee can focus on its own important job of returning inflation to target.”

There is no conflict between the BoE and the Financial Policy committee, Bailey says, and while not flagging a rate rise at the next (May 11) meeting, reiterated that the BOE will decide on rates based on evidence that emerges — and that further hikes may be necessary if there’s signs that inflation will persist longer than has been expected. He said growth in the economy has been a little stronger than the BoE expected, but wages are rising a little less sharply than forecast. Of some (small) comfort, he suggests “interest rates will not necessarily have to return fully to, and remain around, the higher levels they once had.” (pre GFC, rates hit a high of 5.75% and were at 5% when Lehmann collapsed)

Meanwhile, the notoriously hawkish ECB Executive Board member Isabel Schnabel pushed for this month’s decision statement to signal possible interest-rate hiking in future, according to a Bloomberg source story. Schnabel, the official in charge of markets, argued against the Governing Council’s avoidance of explicit wording on the path of monetary policy after the half-point hike in borrowing costs on March 16, according to the report.

In economic news, there has been nothing of note out of the US, while in Europe Germany’s March IFO Business Confidence index rose to 93.1 from 91.1 , above the 91.0. It came with a lift in expectations, from 88.4 to 91.2, and in the current assessment from 93.9 to 95.4. the survey gels with the uplift in the Services PMI out Friday (to 53.9 from 50.9) and in the Composite (output) PMI from 50.7 to 52.6. So notwithstanding the recent banking sector volatility, German businesses are seeing some light ahead, aided perhaps by the end of the winter that could have been much worse energy-wise and the related fall back in wholesale gas prices. There were rises in the business climate for manufacturing (from 1.5 to 6.6) and services (from 1.3 to 8.9).

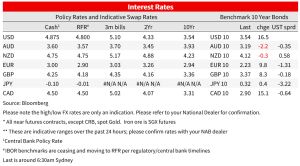

In bond markets , yields were under upward pressure earlier in the day thanks in large part to improved sentiment in banking sector (Schnabel and Bailey’s comments hit the wires only after the European close) and were exacerbated by a poorly received US two-year note auction. This cleared almost 3bps above its when-issued yield (3.954% vs 3.927%) and with a bid-cover ratio of 2.44 down from 2.61 last time (lowest since November 2021) with indirect bids – viewed by some as a proxy for foreign demand – down to 52.8% down from 62.0%. 2-year US yields pushed higher again post-auction to currently be 24bps up on the day at 4.0%. 10s are 16bps higher at 3.53%. The Implied yield on Aussie 10year futures is up 10bps on Monday’s local close.

In currencies, smartly higher US yields have overall been of no help to the USD with the DXY and BBDXY indices both off about 0.2%, thanks to gains for CAD (0.6% – on oil) CHF (0.4%) GBP ad EUR (0.3%) the latter three all seemingly aided on improved risk sentiment. This has proved of no help to the AUD and NZD however, AUD virtually unchanged on the day and NZD -0.2%, outdone on the downside only by JPY, with the higher US rates/improved risk sentiment combo meaning USD/JPY is 0.7% higher on the day.

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.