NAB client Zenith Energy’s innovation is helping decarbonise the mining sector through providing efficient hybrid generation solutions in remote areas.

US treasuries retraced most of their post-CPI rally overnight with core CPI coming in as expected.

NZ: Card spending total (m/m%), Mar: 3.1 vs. -1.7 prev.

US: CPI (m/m%), Mar: 0.1 vs. 0.2 exp.

US: CPI ex food and energy (m/m%), Mar: xx vs. 0.4 exp.

US: CPI (y/y%), Mar: 5.0 vs. 5.1 exp.

US: CPI ex food and energy (y/y%), Mar: 5.6 vs. 5.6 exp.

CA: Bank of Canada policy rate (%), Apr: 4.5 vs. 4.5 exp.

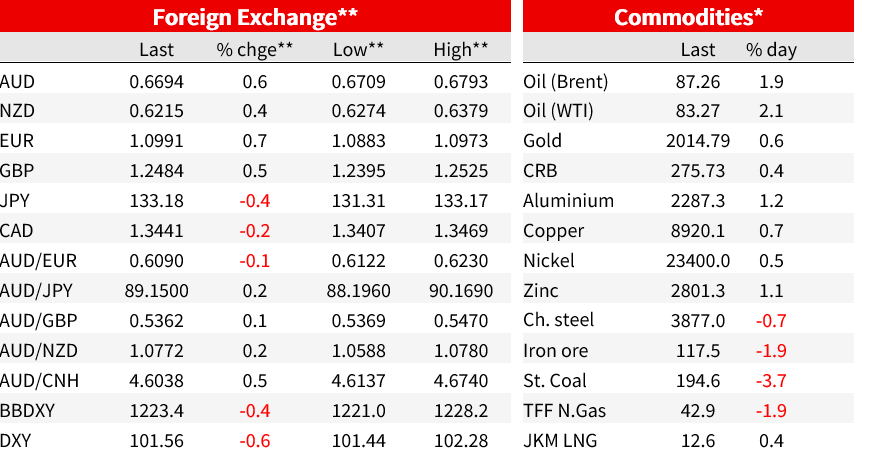

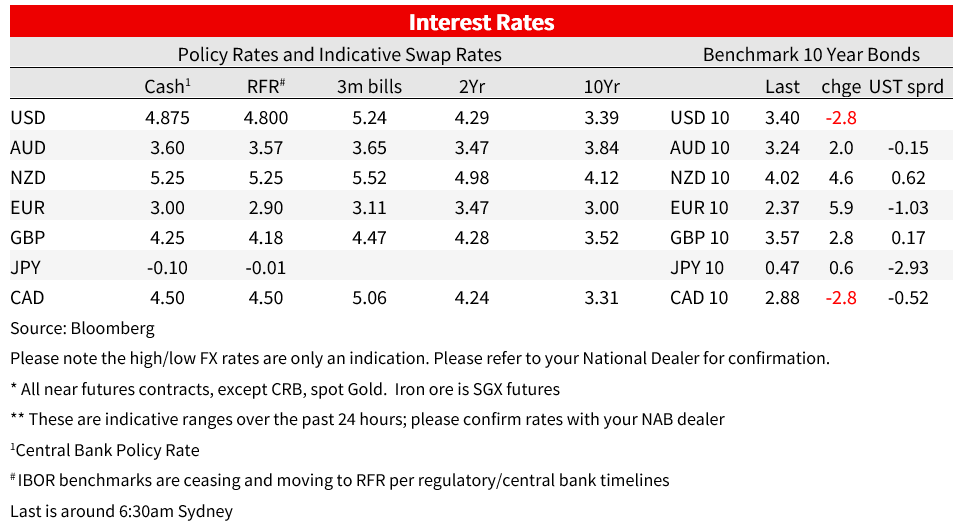

US CPI and the Minutes overnight provided ample fodder for those reading the Fed tea leaves, but after some initial larger movements in rates markets on the back of the CPI data, on net over the past 24 hours there was little to show for it. US 2yr yields were 5bp lower at 3.97%, while the US dollar held on to declines to be 0.6% lower on the DXY.

First to the data, where the US CPI showed welcome, but not overwhelming, progress. Headline CPI rose less than expected, up 0.1% m/m and 5.0% y/y, down from 6.0%, helped by base effects and a monthly decline in food at home prices, the first monthly decline since November 2020. Core inflation, however, was in line with expectations at 0.4% m/m and 5.6% y/y.

In the detail, there was good news in rents inflation , up 0.5% m/m and slowing sharply from its recent 0.7-0.8% pace as it begins to reflect the deceleration promised by leading indicators of market rents. Further falls are likely from here. Core services ex-rents dipped to 0.4% from 0.5% but remains stubbornly high. Used car prices were still falling, though timely auction data suggests that relief could fade in the months ahead. Outside of used cars, goods prices are currently showing much less convincing disinflation, with core goods ex used cars running at 4.0% in 3m annualised terms.

But inflation remains high, and progress is plodding on the Fed’s expected disinflation. On a 3m annualised sense, core inflation is running at 4.7%. On a supercore measure that also excludes used cars and shelter, it is running at 4.4%, higher than the 3.2% reading in December.

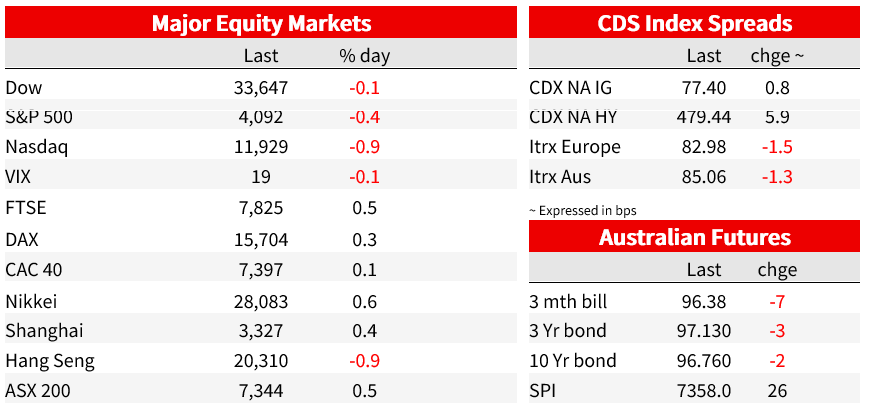

In US rates, the 2yr was 5bp lower to 3.97%, the curve steepening a little with the 10yr down 2bp to 3.41%. The initial reaction to the lower-than-expected headline CPI was a sharp fall in 2yr yields, down around 20bp to 3.87%, but the move wasn’t sustained. The 2yr yield was back above 4% a couple of hours later, where it remained before a smaller leg lower on the back of the Minutes, the 2yr currently trading around 3.97%. Market pricing for the Fed in May was little changed from yesterday, pricing in a 74% chance of a hike, but pricing for cuts deepened a little, with 50bp priced from current rates by years end and an additional 20bp in January 2024, 6bp more than a day prior.

For a Fed that is looking for a string of better inflation data before declaring victory, market pricing still leans towards payrolls last week and the inflation data today being insufficient to knock the Fed off the median participants path for an additional hike, even as there are some encouraging signs in the detail. Ahead of the May meeting, key data to come are the PCE and ECI on 28 April. Speaking after the release of the CPI data, the San Francisco Fed’s Mary Daly noted the possibility that inflation may be able to slow enough to accomplish a return to target without more tightening, but overall concluded that “while the full impact of this policy tightening is still making its way through the system, the strength of the economy and the elevated readings on inflation suggest that there is more work to do.” Barkin was less equivocal, saying “there’s still more to do I think to get core inflation back down to where we’d like it to be,”

The Fed minutes showed that stronger data had led many participants to a ‘somewhat higher’ assessment of the appropriate path for rates, but that after incorporating banking sector developments, policy projections were ‘about unchanged.’ But the size of the banking sector impact was ‘highly uncertain’ and several participants stressed the need to retain flexibility and optionality. Several participants considered a hold ‘in there deliberations’ but in the end the vote for a 25bp increase was unanimous. Discussion noted risks to inflation in both directions, with resilient labour demand pushing prices higher, but a credit crunch having potential to slow inflation. Overall, risks to activity were weighted to the downside, but “upside risks to the inflation outlook remained a key factor shaping the policy outlook”. Fed staff forecasts projected a mild recession starting later in 2023.

North of the border, the Bank of Canada held rates for the second consecutive meeting as expected. They acknowledged stronger activity data so far this year but continue to expect growth to be weak over the rest of 2023 and for inflation to return to 2% by the end of 2024. Nonetheless, Governor Macklem pushed back (softly) against pricing for cuts, saying “that doesn’t look today like the most likely scenario to us.” The BoC maintains a bias toward more rather than less, concluding “ Governing Council continues to assess whether monetary policy is sufficiently restrictive to relieve price pressures and remains prepared to raise the policy rate further if needed to return inflation to the 2% target.” There was little reaction in markets to the as expected BoC, though the CAD had the smallest gain of the G10 currencies, up just 0.2% against the dollar, despite a 2% gain in oil prices.

Elsewhere in currency markets, the USD broadly fell after the CPI release and has sustained the move, seeing the DXY down 0.6% on the day. The EUR traded at 1.10 and sits just below that mark at 1.099, while GBP approached 1.25. The AUD was 0.6% higher, reaching an intraday high of 0.6723 before dipping back below 67c, currently around 0.6693.

In equity markets, after opening higher following the initial response to the CPI data, US equities have ended in the red. The S&P500 was up 0.6% at one point but closed down 0.4%. Declines were seen in 7 of 11 industries, led by Consumer Discretionary. The tech-heavy Nasdaq was 0.9% lower, its sixth decline of the last seven sessions.

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.