Total spending grew 0.9% in June.

The RBA ‘Fit for the future’ review out this morning, with media saying Treasurer Chalmers accepts all 51 recommendations

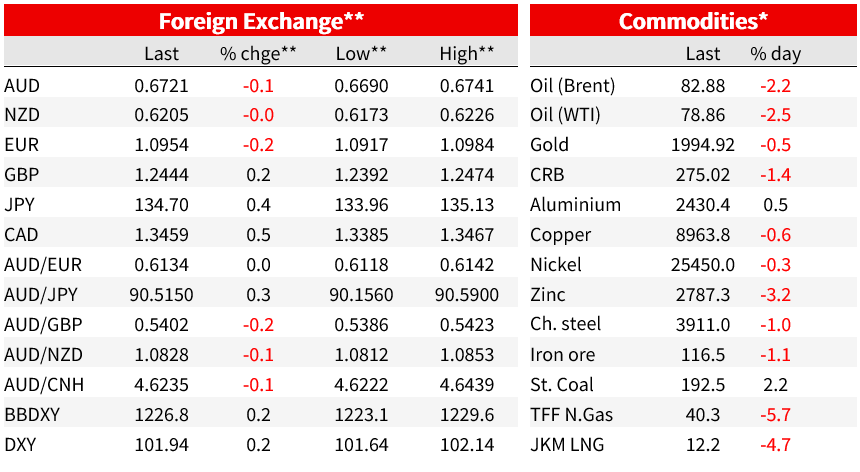

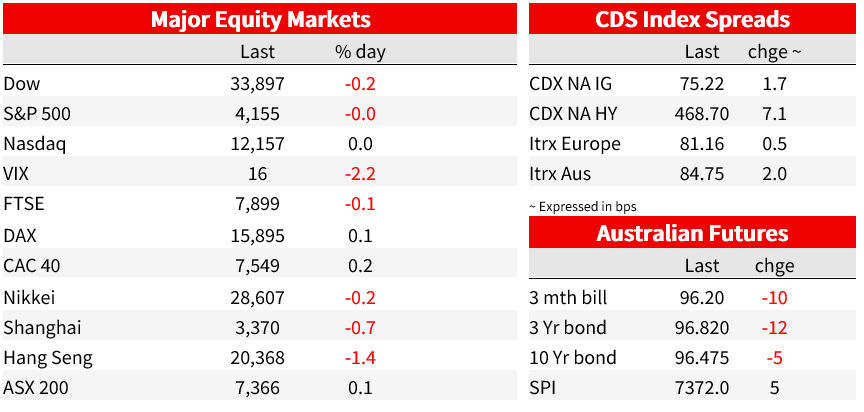

Markets have been fairly subdued overnight, most currencies a little softer against a strengthening USD with GBP the exception after yesterday’s stronger than expected CPI data. Bond yields are modestly higher in most jurisdictions in the slipstream of a more than 10bps rise in UK gilt yields. Equities have ended flat in New York after gains across Europe with the exception of the UK as markets there are forced to ratchet up BoE tightening expectations with all that might mean for the economy later in the year. The ‘Fit for the Future’ RBA review is out this morning, with key conclusions highlighted in this morning’s press (see below). New Zealand has Q1 CPI.

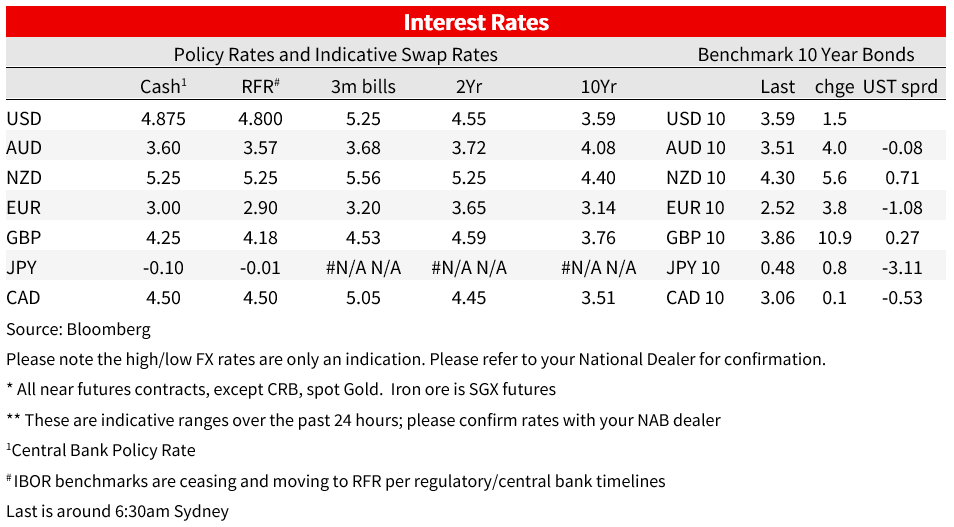

UK April CPI yesterday was a shocker, headline CPI only falling from 10.3% to 10.1% against 9.8% expected and the core measure unchanged at 6.2% against expectations for a fall to 6.0%. Food inflation remained rampant last month, up 19.1% on a year ago up from 18.0 while housing costs – led by household fuel bills – are still 26.1% up a year ago, little changed from February’s 26.6%. Following the news, UK money markets lifted pricing for the May 11 BoE meeting to 28bps from 23bps (so now starting to flirt with the notion of a 50bps May hike) and has 76bps worth of hikes priced in total this year (62bps previously) which if delivered would see Bank Rate up to 5%.

Little other economic news overnight. The Fed’s Beige Book, published two weeks ahead of the May 2-3 FOMC meeting, shows overall economic activity in the US was “little changed” in recent weeks, a small downgrade from the “slight increase” reported in the last March 8 release. “Nine Districts reported either no change or only a slight change in activity this period while three indicated modest growth,” according to the summary. Consumer spending was “flat to down slightly” due to continued price growth, with auto sales steady. Manufacturing activity was also flat or down across districts, though supply chains continued to improve.

Employment growth moderated, with several districts noting slower growth than in previous periods. A few firms reported mass layoffs, which others opted for attrition to reduce staff. Several districts reported that labor markets were less tight, with wages moderating but still elevated. Overall price levels rose “moderately” during the recent period, though the pace of increases slowed. On credit conditions, the Beige book said both lending by banks and demand for loans among consumers and businesses “generally declined.”, with the drop-off especially sharp in the San Francisco area (the erstwhile home of SVB). US money market pricing for the May 3 decisions remains at 22bps post the release.

The RBA ‘Fit for the Future’ policy review is to be released by Treasurer Chalmers this morning ahead of a midday briefing from RBA Governor Lowe on same. Media reports are that all 51 recommendations contained in the report are supported by the Treasurer, the most prominent of which is the proposal to create two separate boards, one for monetary policy and another for governance (this will require legislation). A move to a 6-week policy meeting interval and regular post meeting press conferences, are said to be among the recommendation. It’s doubtful we’ll get clarity today on Dr Lowe’s future (more likely not until mid-year) and whether the Treasurer will be looking outside for the next Governor – assuming it won’t be Dr. Lowe, not just to fill some of the new monetary policy committee roles. The current 2-3% inflation target looks set to remain.

US equities have closed with the S&P500 and NADSAQ virtually unchanged, but the VIX is down another 0.4 points to 16.44, its lowest in just over a year. Morgan Stanley’s share price dropped as much as 3.7% in early day trade after its equity sales and trading revenue undershot expectations, though overall net revenue beat its street consensus and the stock is back to almost flat as of the NY close. Tesla is about to report earnings

Bond yields are modestly higher everywhere, where its been a case of ‘tail wags dog’ following a 14bps rise in UK 2-year yield and 11bps for 10s following the CPI data. 2-year Treasuries are up 4.5bps and 10s less than 1bps, following rise of 3-6bps for 10-year yields across continental Europe.

Higher US Treasury yields have lent a little support to the USD (after lower yields on Tuesday saw the USD pull back a little). No matter that yields have risen by more outside the US. The DXY index and broader BBDXY are both +0.2%, the oil price sensitive NOK (-1.1%) and CAD (-0.5%) faring worse within G10, with the JPY not far behind (-0.45%) and having spent little time above ¥135 (high of ¥135.13). GBP has bucked the trend because of the aforementioned BoE repricing but is a mere 0.1% up on the day against the USD. AUSD/USD is again barely moved, as has been the case all week, currently at 0.6715.

Crude oil is off about $1.80 or more than 2%, fears of weaker demand seemingly the culprit (a little of the fall has come after the Fed’s Beige book, for example). Allied to which, base metals are all lower bar aluminium (+0.3%) while gold is off $10 to $1,995.

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.