We expect NAB’s Non-rural Commodity Price Index to fall by 4.9% in Q2

Insight

Caution prevails in front of Jackson Hole; stocks down, bond yields back up, AUD back lower

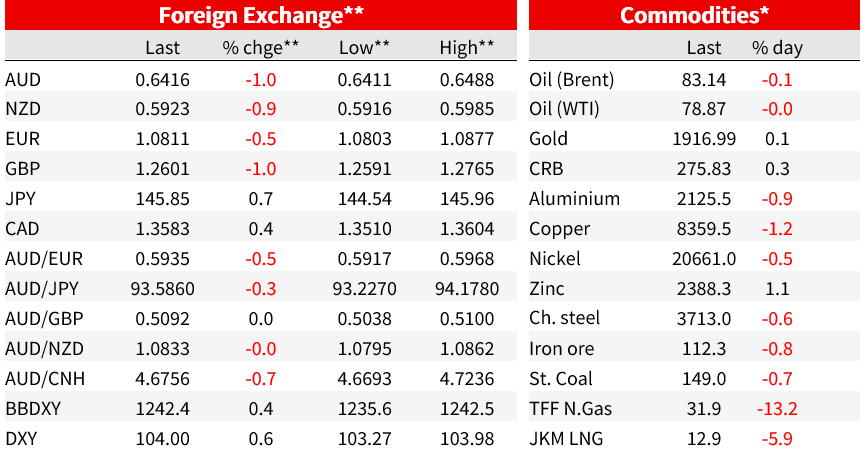

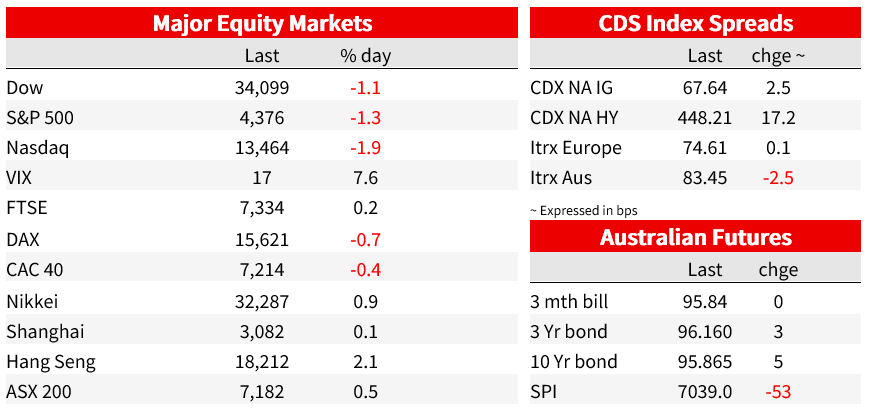

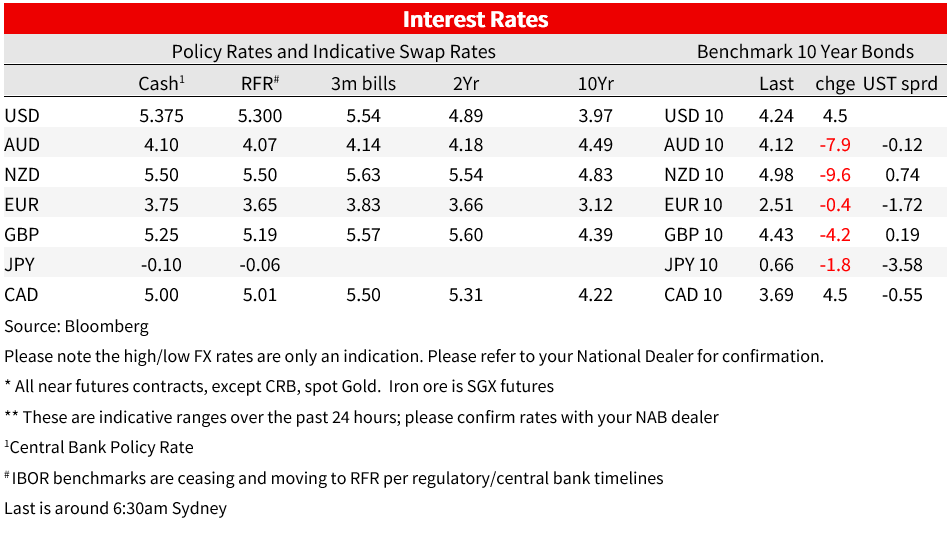

Well, that’s not strictly true. Nvidia, the current leader of the ‘Magnificent Seven’, has failed to hold the 6%+ pop in its share price after hours on Wednesday, following another eye-popping set of results which including a new forecast for Q3 revenue of $16bn against a $12.5bn street consensus and Q2 EPS of $2.70 against $2.05 expected. Nvidia’s stock is almost back to its pre-earnings report levels and the broader market much weaker (S&P500 -1.4%, NASDAQ -1.9%). Anticipation of generally hawkish central bank commentary out of Jackson Hole looks to be the pretext for selling any current rallies in stocks, while US Treasuries have retraced some of Wednesday’s – partly weak-PMI inspired – rally, both 2s and 10s currently up 5bps, to 5.02% and 4.24% respectively. The USD is stronger across the board with losses of 1% for the NZD, GBP and AUD, meaning AUD/USD is now back much closer to 0.64 than 0.65, after earlier trading as high as 6488.

Mixed signals from FOMC members doing the TV and other media rounds at Jackson Hole. Philadelphia Fed President Patrick Harker (a 2023 voter considered quite ‘centrist’) told CNBC, “Right now, I think that we’ve probably done enough….The Fed funds rate increases — they are at a restrictive level, so let’s keep them there for a while. And also we are continuing to shrink our balance sheet that is also removing accommodation.” “I see us staying steady throughout the rest of this year,” and that if the rate of inflation comes down quicker than expected, “we might cut sooner rather than later, but I think we have to let that play out,” he said.

Meanwhile Boston Fed President Susan Collins (not a 2023 FOMC voter) told Yahoo! Finance, “We may need additional increments, and we may be very near a place where we can hold for a substantial amount of time….I do think it’s extremely likely that we will need to hold for a substantial amount of time but exactly where the peak is, I would not signal right at this point

From the ECB, Bank of Portugal Governor and ECB Governing Council member Mario Centeno told Bloomberg TV at Jackson hole that (monetary policy) officials should be cautious in deciding on the next steps as risks for the economy that have previously been identified are now becoming reality. The transmission of the ECB’s monetary tightening campaign is “up and running” and inflation’s retreat has been faster than its rise, Centeno said. These comments come on the heels of the dire Eurozone PMI numbers published earlier this week, though remember Centeno is considered to be in the dovish ECB GC cohort. Madame Lagarde speaks tonight.

US data haven’t been particularly market moving, though weekly jobless claims at 230k, down from 239k last week, conform an ongoing flat trend suggesting no real underlying deterioration in the labour market. Preliminary July durable goods orders fell a bigger than expected 5.2% in headline terms (market -4.0%) though depressed by a fall in aircraft order Orders ex-transport rose by 0.5%, above the 0.2% consensus while Capital Goods Orders ex-Defence ex-Aircraft came in at 0.1% as expected (Shipments -9.2% against 0.1% expected).

In commodity markets, the European TTF gas benchmark has shed another 13% on top of Wednesday’s 14.4% fall, on news that Woodside has reached an in-principle agreement with unions at Australia’s largest LNG project, albeit we await word on finalisation of the agreement following a ballot of union members was that supposed to take place around 19:30 Pert time Thursday. The two-day fall has taken prices back to their lowest since 8 August. Oil prices are little changed overnight, base metals down +/-1% (and too iron ore) while gold is up $1.50 despite the stronger USD and higher US bond yields.

In FX it’s been almost one way traffic upwards for the USD since the local market went home Thursday, save for some ‘up then down’ volatility in early New York trade. Risk-off sentiment and higher US yields – the latter in contrast to further falls in most European yields, e.g. Bunds -0.5bps, Gilts -4bps) has done the damage to currencies, suffering losses ranging from 0.5% for the CAD though to 1.2% for the NOK with losses of exactly 1% for AUD, NZD an GBP. This leaves the DXY USD index up 0.57% in the last 24 hours and the broader BBDXY index +0.4%.

Closing NYSE prices shows the NASDAQ finishing -1.87% and the S&P500 down 1.08%, with the IT, Consumer Discretionary and Communications sector all posting losses of more than 2% (and with all eleven sub-sectors finishing in the red).

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets. Read our NAB Markets Research disclaimer.

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.