We expect NAB’s Non-rural Commodity Price Index to fall by 4.9% in Q2

Insight

A quiet end to a choppy week, with some intra-day volatility following stronger than expected PMIs.

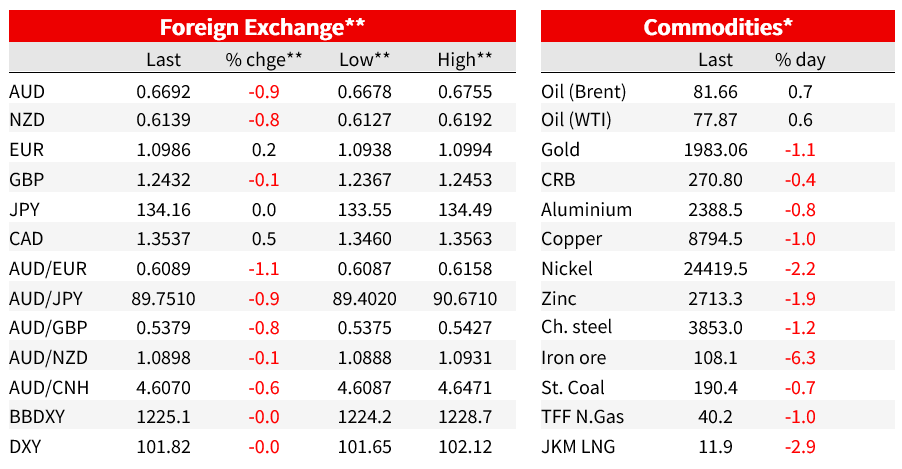

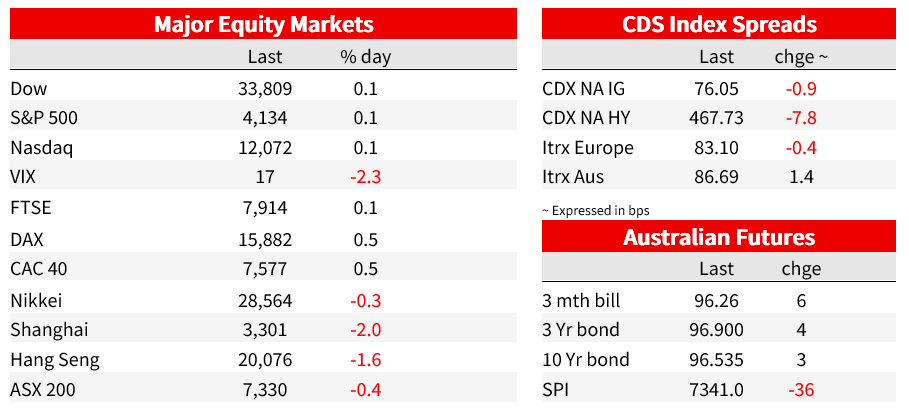

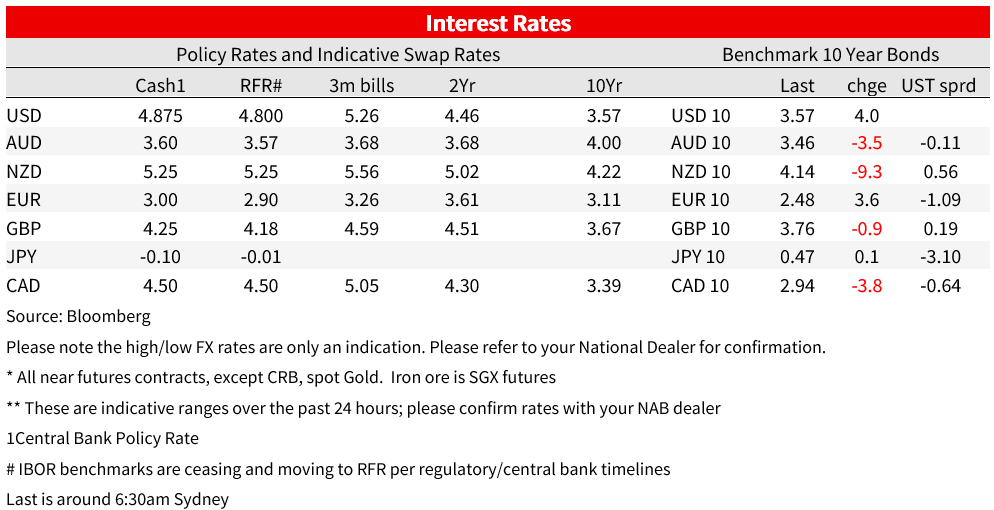

A quiet end to a choppy week, with some intra-day volatility following stronger than expected PMIs. The Eurozone Composite PMI was 54.4 vs. 53.7 expected, while across the pond the US Composite was 53.5 vs. 51.2 expected. The reports were both replete with inflation anecdotes, while the headline figures themselves show services activity was not weak in Q1. While monetary policy has been tightened significantly over the past year, the fading of negative shocks appears to be insulating activity. Yields lifted in the wake of the figures with the US 2yr yield knee-jerking higher to 4.20% from 4.09% before the data, and over 24 hours was up 4bps to 4.18%. A similar story for the 10yr yield which was also up 4bps over 24 hours to 3.57%. US Fed Funds pricing though was not greatly moved with a 90% chance of a May rate hike, while there was some marginal reduction of cuts in H2 2023 to -53bps from -56bps. ECB pricing was also not greatly moved with 32.8bps priced for May and another 49bps of hikes thereafter. The USD initially did lift, but was not sustained with the DXY -0.0%. The AUD (-0.8%) and NZD (-0.8%) underperformed alongside a slide in Iron Ore futures (-6.3%). The S&P500 (0.1%) was little changed.

First to the Global PMIs. Both the US and European PMIs beat expectations, primarily due to strong reads on the services side of the economy. The Eurozone Composite was 54.4 vs. 53.7, with Services 56.6 vs. 54.5 expected, and Manufacturing 45.5 vs. 48.0 expected. The US Composite was 53.5 vs. 51.2 expected, with Services at 53.7 vs. 51.5 expected, and Manufacturing at 50.4 vs. 49.0 expected. Worryingly, the anecdotes around inflation pointed to stickiness and perhaps some acceleration. The US PMI write-up noted: “overall output prices rose at the fastest pace for seven months. Firms stated that more accommodative demand conditions allowed them to continue passing through higher interest rates, staff wages, utility bills and material costs to clients”. (see S&P Global US PMI: Stronger demand conditions support sharper growth in April, but also bring renewed inflation momentum). On the other side of the Atlantic “services sector input costs continued to rise sharply, the rate of increase remaining elevated, often linked to higher staff costs” (see S&P Global EZ PMI: Flash Eurozone PMI hits 11-month high amid resurgent services sector).

Three important implications stem of the PMIs if sustained: (1) March and indeed Q1 was not weak globally with few signs of recession outside of the manufacturing sector. Even though monetary policy has been tightened aggressively on both sides of the Atlantic, during the same time prior negative shocks have faded (e.g. Russia/Ukraine disruptions to supply chains, European energy crisis), while one positive shock has occurred with China pivoting to living with Covid since mid-December with signs of stimulus; (2) there appears to be little divergence in growth relativities between the US and Europe on these figures, which plays against one of the rationales of near-term US dollar weakness; and (3) inflation pressures appear to be sticky, particularly on the services side with anecdotes of ongoing wage costs. It may be too early for central banks to claim victory and underscores outside of a large negative shock, policy is likely to be elevated for longer. Key for the outlook will be the impact of the expected tightening in credit/lending conditions and whether this slows activity and inflation pressures sufficiently. If not, expect higher for longer.

There was also lots of other data out, but not hugely market moving in the context of the PMIs. UK Core Retail Sales were soft at -1.0% m/m vs. -0.6% expected, though there were upward revisions. The statistics office blamed wet weather. Meanwhile a separate survey showed UK consumer confidence rising to its highest level in a year. Canadian Core Retail Sales were also weaker at -0.7% vs. 0.0 expected. In APAC, the Japanese CPI continued to steam ahead at a faster pace than expected, with the core rate (excluding fresh food and energy) up to 3.8%, its highest level since 1981. The headline rate nudged down to 3.2% and has been above the BoJ’s 2% target now for twelve consecutive months. Newly appointed Governor Ueda presides over his first policy meeting later this week and media background suggests don’t expect tweaks to YCC, but clear the writing is on the wall, and the risk is of more substantive change at the next meeting.

In FX, net movements were modest on Friday night and the key USD indices were little changed for the day (DXY -0.0%), but commodity currencies added to their weakness during APAC and were notable underperformers. On Friday iron ore futures fell sharply (-6.3%) and is on track for its lowest since December. Ample Chinese steel supplies are capping market sentiment, which is occurring despite this time of year being the peak building season. Other base metals also fell. Despite the falls, stimulus measures are likely to buoy investment as the year progresses. The AUD (-0.8%) and NZD (-0.8%) fell by similar amounts, and the CAD also underperformed (USD/CAD +0.5%). The EUR (+0.2%) in contrast rose. Finally one last piece of commodity news worth, Chile on late Thursday said the state would take majority stake in lithium joint ventures (many reading as de-factor nationalisation).

A quiet day today with only the German IFO of note.

Markets chart of the day: Mega tech earnings will be important this week for the rally in risk sentiment since the beginning of the year. On our calculations mega tech has been responsible for around 90% of the rally in the S&P500 Index since the start of the year.

Eco chart of the day: No recession in March according to the latest S&P500 Global PMIs with strength in services more than offsetting weakness in manufacturing

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.