We expect NAB’s Non-rural Commodity Price Index to fall by 4.9% in Q2

Insight

Softer US growth but stubbornly sticky prices has seen US yields higher, while US equities recorded their biggest gain since January.

NZ: ANZ activity outlook (net%), Apr: -7.6 vs. -8.5

EC: Economic confidence, Apr: 99.3 vs. 99.9 exp.

US: Initial jobless claims (k), Apr-22: 230 vs. 248 exp.

US: GDP (ann’lsd q/q%), Q1: 1.1 vs. 1.9 exp.

US: Core PCE deflator (ann’lsd q/q%), Q1: 4.9 vs. 4.7 exp.

US: Pending home sales (m/m%), Mar: -5.2 vs. 0.8 exp.

US GDP data showed an unhappy combination of softer-than-expected growth and stronger-than-expected prices increases in Q1. A sharp subtraction from inventories means the growth outcome wasn’t as bad as it looks on face value, but the market’s focus was the signal of stronger prices, seeing US yields higher, led by the short end. Moves across FX markets were smaller, the US dollar flat on the day on the DXY, while equities surged, supported by strong tech earnings. The S&P500 was up 2.0%. The BoJ is today, while it’s a full data calendar tonight headlined by the US ECI.

The US advanced GDP print came in at 1.1% q/q annualised, below consensus for 1.9% q/q. The detail wasn’t as ugly as the headline, with slower inventory building subtracting 2.3ppt from the result. Elsewhere, a weather boost earlier in the quarter helped consumption up 3.7% and domestic final demand up 3.2%, though business capex growth was soft. A read on the March month comes in tonight’s Personal income and Outlays release, with the pattern of slowing consumption through the quarter setting up a much weaker consumption outcome for Q2.

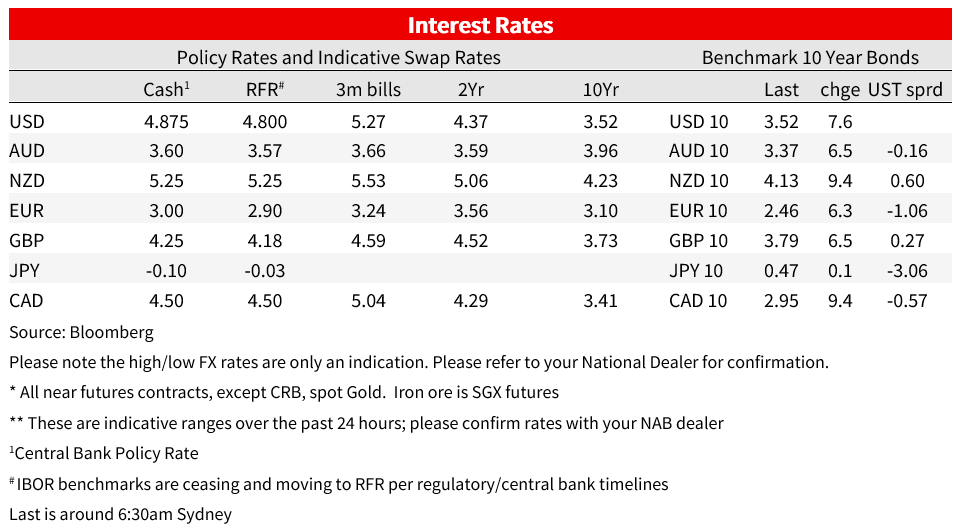

Catching the markets attention though was not the softer GDP print, but an above expected PCE deflator for the quarter. The core PCE deflator rose at a 4.9% annual rate in the quarter, above consensus for a 4.7% gain. Mechanically assuming no revisions to January and February (a big assumption), that would imply a 0.5% m/m outcome for tonight’s March core PCE deflator, where the consensus is for a 0.3% gain. Stubborn inflation data gives the Fed little breathing room to take heed of nascent slowing in activity and the labour market should it continue to develop.

Elsewhere in the US data, weekly Initial Jobless Claims unexpectedly dipped. Initial claims fell to 230k from 245k and 248k expected, challenging, at least for this week in what can be a noisy series, the erstwhile trend higher. Claims have tracked broadly sideways since early March. Pending home sales fell 5.2% m/m, the largest drop since September, against expectations for a 0.8% rise.

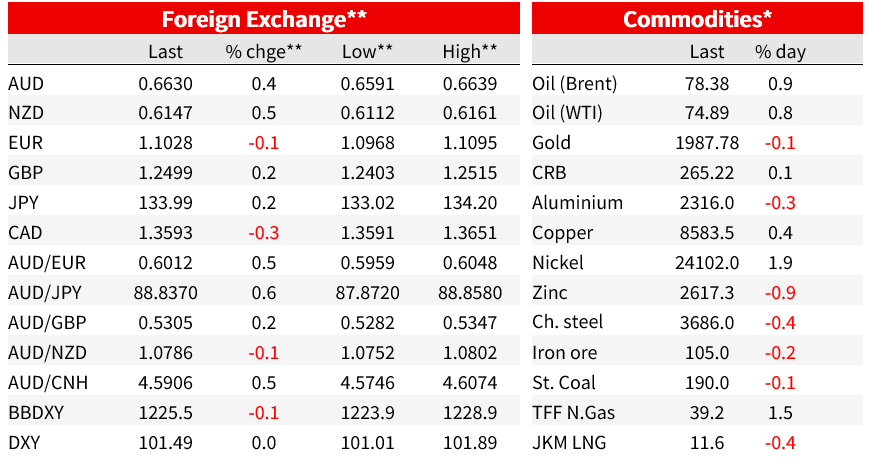

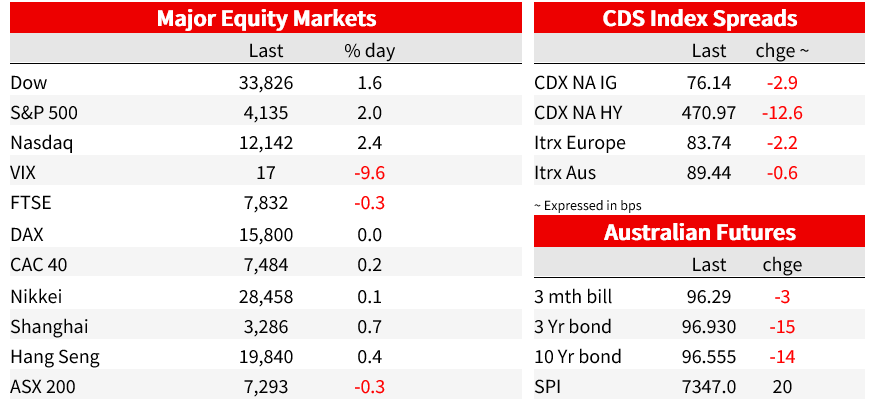

The signal of unhelpfully sticky inflation saw US yields higher, led by the front end. US 2yr yields rose 13bp to 4.08%, largely retracing falls on Tuesday alongside banking fears. US 10yr yields were 7bp higher at 3.52%. Markets now price a 90% chance of a hike next week and 29bp by June, up from 24bp the day before. Fed pricing also pushed out cuts, with just 29bps (from the current fed funds rate) priced by year end, from 43bp yesterday. European yields were also higher, the German 10yr rose 6bp to 2.46.

Equity markets, in contrast, were singing from a different hymn sheet. The S&P500 closed up 2.0%, its strongest one-day gain since January . That after opening 0.5% higher on a strong lead in from Meta earnings after the bell yesterday before a continued rise throughout the session. Meta was 10% higher after revenue beat estimates, helped by strong advertising revenue. The tech-heavy Nasdaq was 2.4% higher. All 11 sectors in the S&P500 recorded gains, led by communication services. Amazon and intel reported after the close, with each up in postmarket trading after topping estimates. It was a more muted affair in across other equity markets. The Euro Stoxx 600 was 0.2% higher, it’s first gain in 3 days, as positive earnings from Deutsche Bank and Barclays eased concerns about the banking sector’s health.

The US dollar initially strengthened alongside higher yields on the back of the US data but has failed to hold onto those gains and is flat over the day on the DXY at 101.49. Across other currencies, commodity currencies have modestly outperformed, a reversal of the prior days fortunes, while the euro and yen are on the weaker side of the ledger. The AUD was 0.4% higher to 0.6629, after an intraday high of 0.6635 in the Australian afternoon yesterday.

In other news, Fed Chair Powell was reportedly tricked by ‘pranksters’, answering questions on the inflation outlook and the Russian central bank with someone misrepresenting themselves as Ukrainian President Zelenskiy.

In NZ yesterday, the ANZ NZ business outlook survey painted a picture of ongoing weakness in activity indicators and high but moderating pricing indicators. PM Hipkins delivered a pre-Budget speech where the emphasis was on a “no-frills” Budget, to which “the government is committed to reducing our proportion of spending to dampen demand in the economy”

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.