We expect NAB’s Non-rural Commodity Price Index to fall by 4.9% in Q2

Insight

US yields are higher and the dollar stronger with little fallout from the failure of First Republic, being acquired by JP Morgan in an FDIC-supported deal.

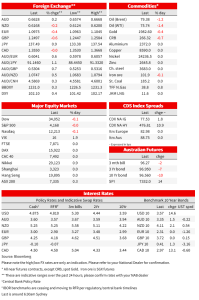

The USD was broadly stronger and US yields were higher overnight, while many markets across Asia and Europe were closed. The yen continued to weaken after the BoJ stuck to its ultra-easy policy settings on Friday. The US ISM Manufacturing survey was a little stronger than expected and JPMorgan won a government auction to purchase First Republic. US Equities were broadly flat.

JPMorgan agreed to acquire First Republic in a government-led deal, with JP Morgan and the FDIC agreeing to share the burden of losses. The cost to the Deposit Insurance Fund was estimated at $13bn. First Republic replaces Silicon Valley Bank as the second largest bank to fail in US history (Washington Mutual in 2008 remains the largest US bank failure). JP Morgan CEO Dimon said he thinks “we’re mostly out of the woods ” for now, adding that the banking system still needs to deal with a number of threats, including commercial real estate exposure and the current rate environment, but “the slate of bank failures in the past weeks ought to be abating”. An FDIC report laid out options for overhauling deposit insurance, highlighting the impact of technological changes and high concentrations of uninsured depositors in pockets of the banking system.

JPMorgan shares were 2.1% higher. Fallout across the rest of the banking sector from another failure has been relatively modest. The KBW banking index is down 1.4% and the smaller regional banking index is down 2.3%.

Broader US equity markets started the week little changed from Friday’s close . The S&P500 was down less than 0.1%, while the Nasdaq fell 0.1%. Health Care and Industrials managed small gains, offset by falls in Consumer Discretionary and Energy. The first-quarter earnings season is around its halfway mark. 54% of the S&P 500 had reported as of Monday and 80% of companies have beaten earnings estimates, compared to the 5-year average of 77%, according to FactSet. Markets in Asia and Europe were mostly closed Monday, though in Japan the Nikkei was 0.9% higher to its highest since August 2022.

On the data calendar overnight was the US Manufacturing ISM Survey, which rose to 47.1 from 46.3. Still in contraction territory but a touch stronger than expectations for 46.8. In the detail, prices paid jumped from 49.2 to 53.2, but not helped by a rise in fuel prices to mid April. Employment rose 3.3pts to 50.2 while New Orders remained in contractionary territory at 45.7 from 44.3. Manufacturing is a small share of the US economy, but the combination of higher prices paid and the rebound in employment don’t allay concerns about the inflation outlook.

Ahead of the FOMC meeting early Thursday Morning Sydney time, the WSJ’s Timiraos writes that “Federal Reserve officials are on track to increase interest rates again at their meeting this week while deliberating whether that will be enough to then pause the fastest rate-raising cycle in 40 years.” He writes that officials are likely to keep their options open as to future moves, suggesting that “ after this week, the Fed’s calculations could flip. Officials could need to see signs of stronger-than-expected growth, hiring, and inflation to continue raising rates.” Evidence on the extent of pullback in lending will be important. The senior loan-officer survey will be available to officials when they meet, but is not publicly until after the meeting.

While only small moves were seen in equities, US rates markets saw larger moves. US treasury yields were higher and the curve a little steeper, the 2yr up 12bp to 4.13% and the 10yr rising 15bp to 3.57% to more than retrace Friday’s rally. The Manufacturing ISM failed to give comfort on the inflation front, though a combination of the First Republic resolution and a slew of corporate bond offerings ahead of the Fed meeting and following earnings blackouts also supported the move. 12 companies look to raise a combined $30-35b. In the last hour or so, Treasury Secretary Janet Yellen told lawmakers that special accounting manoeuvres to stay within the federal debt limit could be exhausted as soon as the start of June.

In FX markets, the US dollar was stronger, up 0.5% on the DXY. The yen was again the weakest of the G10 pack, extending its 1.7% fall against the dollar to be down a further 0.9%. The JPY rose to 137.49, the highest since 8 March. The pair hasn’t been above 138.17 since November last year. The yen weakness over the past 2 days is in the wake of the BoJ’s April meeting, where it left ultra-easy settings unchanged. EUR and GBP are down 0.4-0.6%, following their outperformance through April, seeing EUR back below 1.10 and GBP below 1.25. The CAD and AUD the only G10 currencies rising (slightly) against the broadly stronger dollar. The AUD was 0.2% higher to 0.6628.

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.