Coming in for landing in a heavy cross wind

Insight

Latest US yield curve movements are giving an even stronger signal of imminent US recession

The ECB meeting outcome and surrounding signalling was supposed to be the big overnight news, but the latest travails of the US regional banking system are capturing more of the headlines with First Horizon Corp. and Western Alliance Bancorp joining PacWest as the latest victims of short selling. This just three days after JP Morgan’s acquisition of First Republic Bank and CEO Jamie Dimon declaration that ‘this part of the crisis is over’. First Horizon share price is down 33%, Western Alliance 40% while the week-to-date loss for PacWest now stands at 70%.

With the dust barely settling post Wednesday’s FOMC meeting, banking sector developments have added to conviction not just that the Fed is done tightening with its 500bps of rate rises in the past year, but that the Fed will be cutting rats before year-end – and more aggressively than previously priced for. Indeed, the June Fed Funds futures contract now shows small chance that the Fed will be cutting rats at the next (June 14 meeting), aptly described by my BNZ colleague as an insurance against something rally bad happening before then. The January 2024 contract now prices 115bps of Fed cuts.

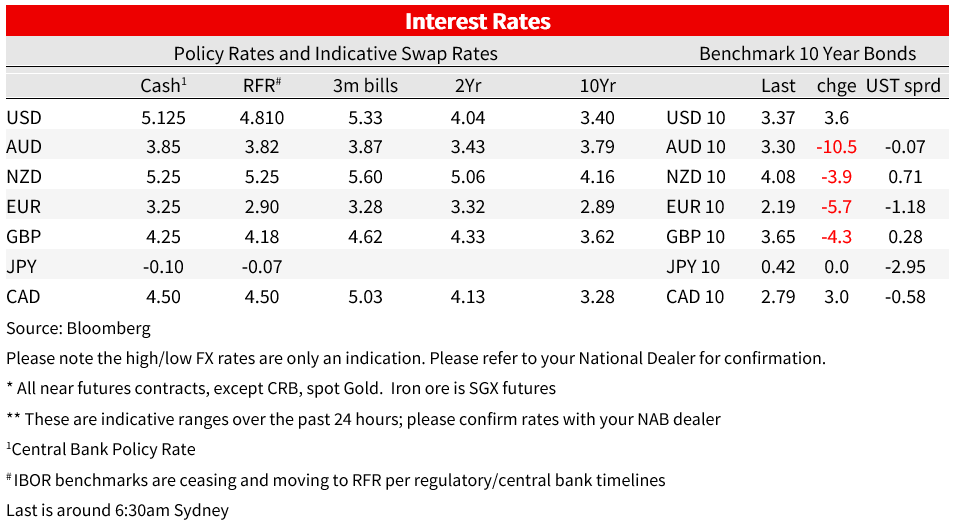

In the bond market, these same sentiments show up in a further re-steepening of the 2s/10s Treasury curve, 2s +3bps in the last 24 hours while 2s are down 3.5bps. This has brought the re-steepening to some 70bps since the collapse of SVB in March (from -108bps to -38bps) which is about as sure fire a signal of imminent US recession as the bond market is ever likely to yield (boom boom).

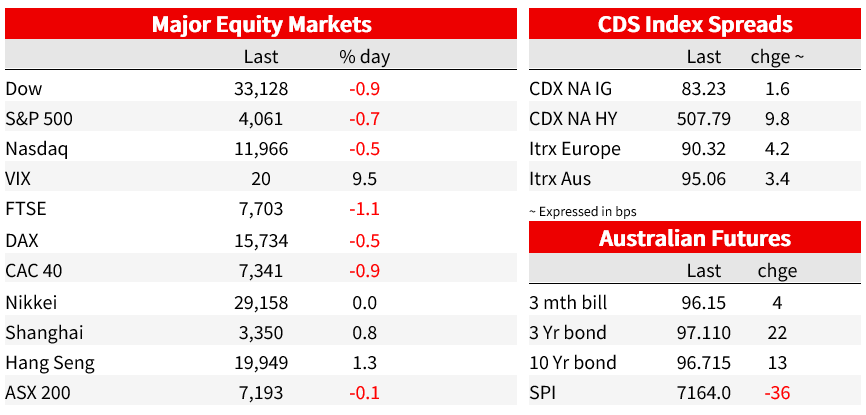

Equity market losses have been limited to 0.7% for the S&P500 and 0.5% for the NASDAQ, the former led by a 1.3% loss for Financials. Energy is also off more than 1%, despite the fact oil is little changed in the last 24 hours. Communications and Industrials are the other sectors showing losses of more than 1%, with the defensives (Real Estate and Utilities) the only sectors to finish in the green. Most close, Apple has re[ported Q2 revenue of $94.84bn against its $92.6bn street consensus thanks to a beat on iPhone revenue ($51.33bn against $49.97bn expected). Apple has just announced an increased dividend and $90bn share buyback. So some relief in sight for US stock futures – NASDAQ at least – during the APAC session.

To the ECB and the widely expected 25bps increase to the Deposit rate to 3.25% was followed by comments from ECB President Lagarde in the post-meeting press conference that “We have more ground to cover and we are not pausing, that is extremely clear.” But borrowing costs were now in “restrictive territory” and signs of a credit crunch had been a big factor in its decision to slow the pace of rate rises, Lagarde added.

Markets were though drawn to a line high up in the statement that “past rate increases are being transmitted forcefully to euro area financing and monetary conditions” (a clear nod to this week’s ECB Q1 Bank Lending Survey findings; at which lending standards were reported to have tightened quite aggressively). This is seen to have introduced sufficient ambiguity into the future policy path – Lagarde comments notwithstanding – such that EUR/USD is the weakest G10 currency pair in the past 24 hours – down 0.4% to 1.1015 and spending a little time below 1.10, a level that was looking like establishing itself as a new floor under the pair. And in the Eurozone bond market, 2-year French and German benchmark yields finished the European day down 15bps and 17bps respectively. Money markets nevertheless still price for at least one and as many as two further 25bps ECB rate hikes from here.

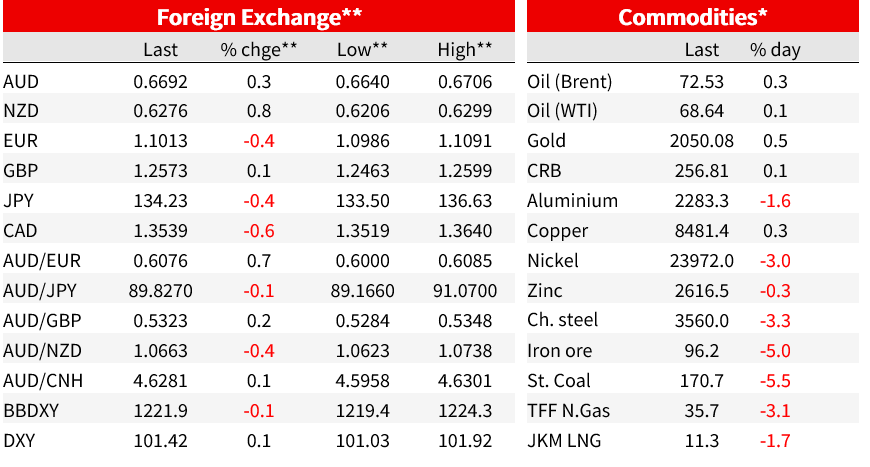

Elsewhere in currencies, the NZD has shrugged aside negative risk sentiment to be the best performing G10 currency (+0.8% on the day Thursday) while AUD/USD managed to just extend its APAC session high of 0.6700 to print 0.6705 before finishing in New York at 0.6694 (still a third of a percent up on the day). USD/CHF is up 0.2% so Swissie not showing any obvious safe haven traits though USD/JPY is down 0.3% even though US 10yr yields are a touch firmer, so some evidence of haven support here. The DXY USD index has finished in NY little changed at 101.4 and the broader BBDXY down 0.1%.

US data was a sideshow overnight, though for the record weekly initial jobless claims were 242k against 240 expected, up from a revised 229k last week (was 230k). Continuing claims were weaker than last week, against expectations for a further rise, at 1.805mn. The March trade balance came in at -$64.2bn down from -$70.6bn in February, while Q1 productivity at -2.7% – the product of weaker growth but strong employment gains – was worse than the -2% expected.

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.