We expect NAB’s Non-rural Commodity Price Index to fall by 4.9% in Q2

Insight

There have been quite a lot of moving parts to the price action overnight.

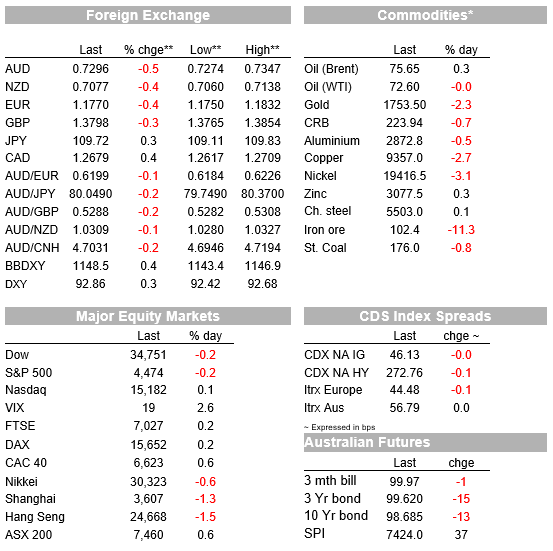

Bob Seger’s classic is about ageing and moving on, but on this note my feeble attempt is to highlight the jump in US retail sales which came against a wind of soft expectations backed by a series of disappointing consumer-related data releases of late. Ahead of the data, the USD and UST yields were already in the ascendency but the stronger than expected data provided an extra momentum. After a soft star the S&P 500 has ended the day down 0.16% while broad USD strength sees the AUD sub 73c, euro sub 1.18 and NZD at 0.7075.

There have been quite a lot of moving parts to the price action overnight. As start the lead from Asia was yet again a negative one with the Hang Seng (-1.5%) and China’s CSI 300 (-1.22%) trading lower as the market struggles to ascertain the full impact from Evergrande’s collapse and possible contagion effects.

Meanwhile in Europe, the broader market is now starting to pay more attention to the unprecedented surge in UK and Europe natural gas prices, up in the order of 250-300% over the past six months . UK gas futures are actually down 10% for the day, but still up over 50% over the past month. Adding higher oil prices into the mix recently, and energy costs across the board are surging, and its inflationary impact acts like a tax on consumers and businesses, a headwind to the economic recovery.

Indeed, looking at the Stoxx 600 performance overnight, although the index closed up 0.44%, utilities underperformed with Spain’s Iberdrola (-1.3%) falling to its lowest level since May 2020 amid growing concern that surging power prices may lead to windfall taxes and regulatory action to cap prices for consumers. Miners were the other big underperformers, down 3.09% weighed down by further declines in iron ore and metal prices. Iron ore race towards $100 accelerated over the past 24 hours with futures in Singapore falling 11.2% ending the day at $102.4. Meanwhile copper closed 2.7% lower while oil prices were unchanged.

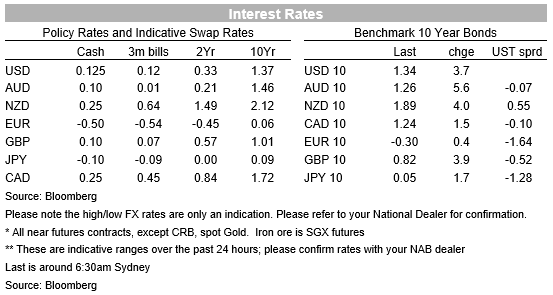

So, against this backdrop, it was not surprising to see the USD in the ascendency early in the European session. Technical factors probably weighed on the Euro with a break below the 1.18 level triggering an acceleration in its depreciation with the stronger US retail sales figures adding an extra boost. Given a string of recently soft consumer related data releases including drop in consumer sentiment on the back of the Delta outbreak, the market was bracing for a soft retail sales outcome, pencilling a 0.7% decline for the headline reading. In the end the report was a solid one with August retail sales rising 0.7% and Sales ex-autos jumped 1.8%, also well above the consensus, 0.0%.. The jump in the core reading was boosted by downward revision to the July print, but they were still a positive surprise, suggesting less impact on the consumer from the delta wave. With Fed officials previously noting that the delta outbreak is feeding into its policy assessment, the data triggered a market reaction, extending the market movements seen earlier in the session, with higher rates (10y UST to 1.35% before ending the day at 1.33%), a stronger USD and weaker equity futures.

Jobless claims and the Philly Fed were the other US data releases, but they didn’t elicit a market. reaction. Initial claims rose to 332k from 312k, above the consensus, 323k. The Philly Fed index rose to 30.7 from 19.4, the consensus, 19.0 and alongside the big jump in the Empire State index, this suggests that manufacturing in the Northeast, at least, is outperforming.

The combination of all the above-mentioned dynamics helped the USD closed broadly stronger with the BBDXY and DXY indices up around 0.4%. CHF a typical safe haven is down the most at -0.73%, perhaps reflecting a it higher degree of sensitivity to movements in the euro which ended at 1.1765, after trading to a low of 1.1750. Meanwhile the AUD traded to an overnight low of 0.7274, before recovering somewhat and now starts the new day at 0.7292. The NZD not fair any better, notwithstanding a stellar Q2 GDP print yesterday. The Kiwi now trades at 0.7075 after trading to a high of 0.7138 post the GDP print and a low of 0.7060 overnight.

After opening lower and trading down to 0.8%, the S&P 500 staged a late recovery, but it was not enough to climb back into positive territory, ending the day at -0.16%. Materials and Energy were the big underperformers, down over 1% while consumer discretionary gained 0.44%. The NASDAQ closed +0.13% ad the Dow was -0.18%.

On other news, China criticized a decision by the United States and Britain to share sensitive nuclear submarine technology with Australia, noting the alliance “seriously undermined regional peace and stability, aggravated the arms race and hurt international nonproliferation efforts.” and with a special mention for Australia, the state-run Global Times editorial noted “Since Australia has become an anti-China spearhead, the country should prepare for the worst,”

Meanwhile shortly after the submarine alliance news yesterday, China applied to join an Asia-Pacific trade pact , the move is likely to increase US concerns over China’s efforts to assert its dominance in the region. For now there there’s no sign US is interested in rejoining the deal.

University of Michigan consumer sentiment is the data release to watch

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.