We expect NAB’s Non-rural Commodity Price Index to fall by 4.9% in Q2

Insight

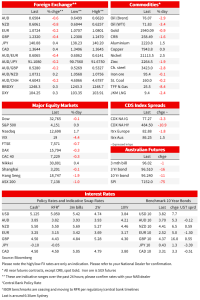

The US dollar extended its positive streak and yields globally were higher despite mixed economic data as AI-related tech saw US equites higher

GE: GfK consumer confidence, Jun: -24.2 vs. -24.0 exp.

US: Initial jobless claims (k), wk to 20-May: 229 vs. 245 exp.

US: GDP (Ann’lsd q/q, 2nd est.), Q1: 1.3 vs. 1.1 exp.

US: Pending home sales (m/m%), Apr: 0.0 vs. 1.0 exp.

US debt ceiling negotiations are still holding focus. Biden and McCarthy say that something will be done in time but little concrete to show for it so far. There are some positive signs though with more positive talk of the gap closing between the two sides. The US dollar extended its positive streak and yields globally were higher despite mixed economic data. US equities were higher, but gains were concentrated in tech, with Nvidia soaring 24 leading a broader rally in stocks linked to AI.

First to the data. US jobless claims ticked higher to 229k from a downwardly revised 225k (245k from an earlier reported 242k expected). On top of the lower weekly figure, the spike a couple of weeks ago that caught market attention has been revised away after fraudulent activity Massachusetts. Other indicators continue to suggest gradual slowing in the labour market, but the four-week average of initial claims is just 232k, above the 218k prepandemic average but below where they were through March. Continuing claims fell to 1794k from 1799k.

US GDP was revised up slightly in Q1 to an annualised 1.3%, mostly on the back of a smaller drag from inventories. The release contained the first estimate of Gross Domestic Income, which fell for a second consecutive quarter, at a minus 2.3% pace in Q1 after minus 3.3% in Q4. More concerning was the first estimate of GDI , which should be identical conceptually but was -2.3%q/q ann after -3.3% q/q. Averaging the two measures of Output gives small declines in Q4 and Q1 and a much less encouraging signal about growth momentum than GDP alone. The same release showed a one-tenth upward revision to the core PCE deflator, running at a 5.0% annual rate in Q1.

Germany Q1 GDP was revised lower, to -0.3% q/q from a preliminary estimate of 0.0%. Following the 0.5% q/q decline in Q4, that is two consecutive quarters of negative GDP growth, which to some trigger the ‘recession’ label, though employment gains over the period question that framing and it did nothing to temper ECB members from communicating more hikes are needed.

Just hours after the German data, Bundesbank President Nagel said “the ECB Governing Council will continue on this monetary tightening path to overcome high inflation.” Knot said hikes in June and July were needed and he was open minded about September with no signs underlying inflation is abating. Villeroy said the ECB should reach the peak in the next three meetings. Vice President Guindos said rates will be brought to sufficiently restrictive levels, and once there will “be kept at those levels for as long as necessary.”

US yields were higher as markets firmed expectations that the Fed is not yet at a peak even as a pause is very live for June. Boston President Collins said that “While inflation is still too high, there are some promising signs of moderation,” and that “I believe we may be at, or near, the point where monetary policy can pause raising interest rates. ” A June hike is now 49% priced, and another 25bp hike is 94% priced by the July meeting. Near term cut expectations have also been pared. With a year-end fed funds rate priced at 4.95%. US Treasury yields are higher across the curve. The 2-year rate is up for the tenth consecutive trading session, adding 13bps to 4.50%. The 10-year rate is up 7bps to 3.81%.

European 10-year yields are up around 5bps, while UK yields have added to the substantial gains after the shocking CPI report the previous day, with 2 and 10-year gilts up 16-17bps and the market now pricing in another substantial 110bps worth of rates hikes from the BoE. MPC member Haskel said that “as difficult as the economy’s current conditions are, embedded inflation would be worse…further increases in Bank Rate cannot be ruled out.”

The lingering absence of a debt ceiling resolution and higher yields couldn’t stop a rally in tech stocks. The S&P500 was 0.9% higher, but with IT accounting for almost all of the gains, that sector up 4.5%, with the next best performer, communication services, far behind at +0.4%. Consistent with the them, the Nasdaq outperformed, 1.7% higher. Tech stocks benefited from AI optimism, with shares of Nvidia up 25% after the company’s AI-related forecast surprised even the most optimistic analysts. Energy was the worst performing sector. Brent oil was 2.9% with Russia saying that OPEC+ is unlikely to take any new steps at the next meeting.

In currency markets the positive streak for the USD has entered its fourth day. EUR, GBP and CAD showed more falls for the day, while the yen is underperforming against the backdrop of higher global rates and USD/JPY scraping just above 140. The AUD has traded at fresh lows for the year 0.6499, down another 0.6% and currently around 0.6505. Similar the NZD, down 0.8% at 0.6061.

Meanwhile, yesterday Fitch Ratings moved the US to “rating watch negative” , the forerunner to a possible downgrade to its current AAA sovereign rating. The agency said “we believe risks have risen that the debt limit will not be raised or suspended before the X-date and consequently that the government could begin to miss payments on some of its obligations”. Separately, a Moody’s Investors Service spokesman said that a 15-June coupon payment for Treasuries will be critical – if it was missed, that’s a default and Moody’s would downgrade the rating one notch from AAA to AA1, and that would be permanent unless there was significant reform of the debt-limit rule.

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets. Read our NAB Markets Research disclaimer.

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.