Online retail sales growth slowed in May following a fairly strong April

Insight

Markets go into today’s RBA decision ascribing a roughly 65% chance to a pause

Not sure Public Enemy lyrics are apt for a publication of this type, but hard to resist letting Chuck D and Flavor Flav’s clever play on the James Dean classic go to waste. NAB is officially in the ‘pause’ camp today, a view conditioned on how ‘finely balanced’ the May decision was and an overall mixed flow of data since then, albeit caveated by saying we will not be surprised if the RBA goes today, in which case it will be hard to resist a conclusion that last Friday’s Fair Work Commission outcomes tilted the balance in favour of further immediate action.

An all-round soft US ISM Services report has been the main market moving event overnight, seeing bond yields reverse course having risen in Tokyo during yesterday’s APAC session and seeing money markets pare back pricing for a Fed rate hike next week to about 25%. Equities were in the green during the New York morning (bad news is good?) and indeed the S&P500 entered bull market terrain off the October ‘22 lows, though stocks have slipped back in afternoon trade with the S&P finishing down 0.2%. The USD suffered on the ISM report, reversing earlier strength to leave the DXY little changed on the day and allowing AUD/USD to recapture – and hold on to – the 0.66 handle it had regained on Friday.

US ISM Services unexpectedly fell to 50.1 from 51.9 against an expected small rise to 52.2. Key sub-series were all soft, notably Employment dropping below 50.0 (49.2 from 50.8), New Orders to 52.9 from 56.1 and Price Paid – a series that should be largely a function of employers’ wage costs – down to 56.2 from 59.9. The Employment index is hard to square with last Friday’s jump in employment, though historically has been more of a (short) leading rather than coincident indicator of non-farm payrolls. Incidentally, the NFIB hiring intentions survey has also been indicating a sharp drop-off in employment but which again has so far failed to show up in Establishment payrolls data. Let’s see what June brings.

Other ISM-related data overnight has been the final Services and Global PMIs across the globe. For the US and Eurozone, the Services readings were both revised down (US from 55.1 to 54.9, EZ from 55.1 from 54.9) while the UK’s was revised up slightly, to 55.2 from 55.1.

During our time zone yesterday, the main Australia-relevant piece of news was the strength evident in the China Caixin Services PMI, rising to 57.1 from 56.4 against 55.2 expected and meaning the Composite reading of 55.6, up from 53.6 in April, was its best level since December 2020 (very much at odds with the earlier official PMIs). Together with intimations about policy support/fresh incentives for high end manufacturing and housing, AUD/USD just about clung on to the 0.66 handle established on Friday post the stronger than expected Caixin manufacturing PMI and Fair Work Commission’s decrees on Minimum and Award wages. AUD/USD dip slip back below 0.66 in Europe amid general USD strength on higher US bond yields, prior to drawing support from the USD-negative reaction to the ISM Services report.

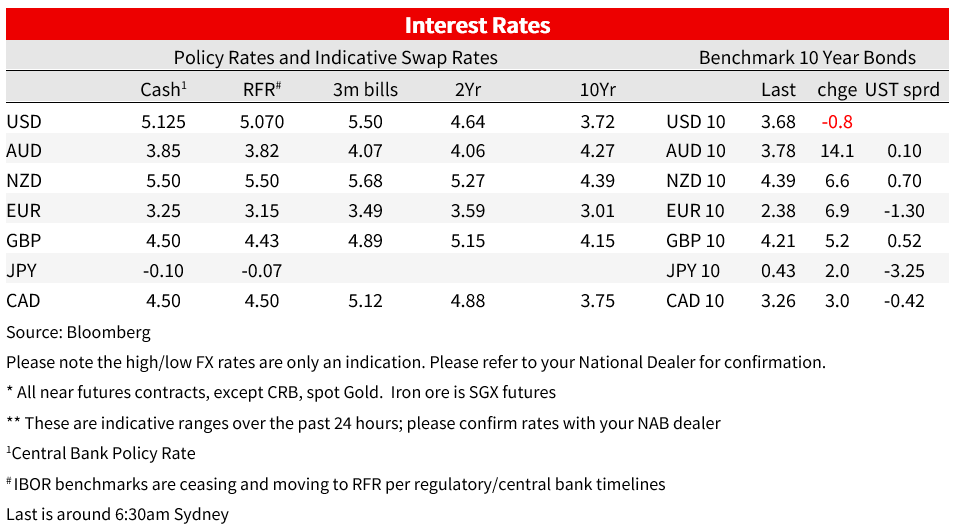

Elsewhere in FX it’s been a fairly quiet night, with no G10 currency bar SEK (-0.8%) more than 0.3% away from where it ended last week. AUD and NZD are both in the green, but the JPY and CHF have outperformed, up 0.24% and 0.3% respectively. Of some relevance to the latter has been the afternoon fall back in US equities, and in the case of USD/JPY reversal of the early-day rise in US Treasury yields (2s coming into the NY close -3bps and 10s -0.4bp) . CAD and NOK, which had both benefited during the APAC day on the jump in oil prices post the weekend news of Saudi Arabia’s announcement of a one million barrels per day cut from July, have morphed into losses alongside the failure of oil to hold its gains (Brent ending in New York up just 30 cents on Fridays close and WTI crude a lesser 13 cents).

On equities, one negative influence and which has seen the Financials sub-sector of the S&P 500 lose a little over 0.5%, has been an early NY afternoon Bloomberg report saying large US banks may have to boost their capital by an average 20% and that a broader swathe of lenders would face strict requirements for setting aside money under a draft plan from US regulators to bolster the financial system, to be unveiled later this month.

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets. Read our NAB Markets Research disclaimer.

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.