Economic and financial market update

Insight

Aussie retail sales were stronger than expected in July, but World Cup fever was a factor says NAB’s Ray Attrill

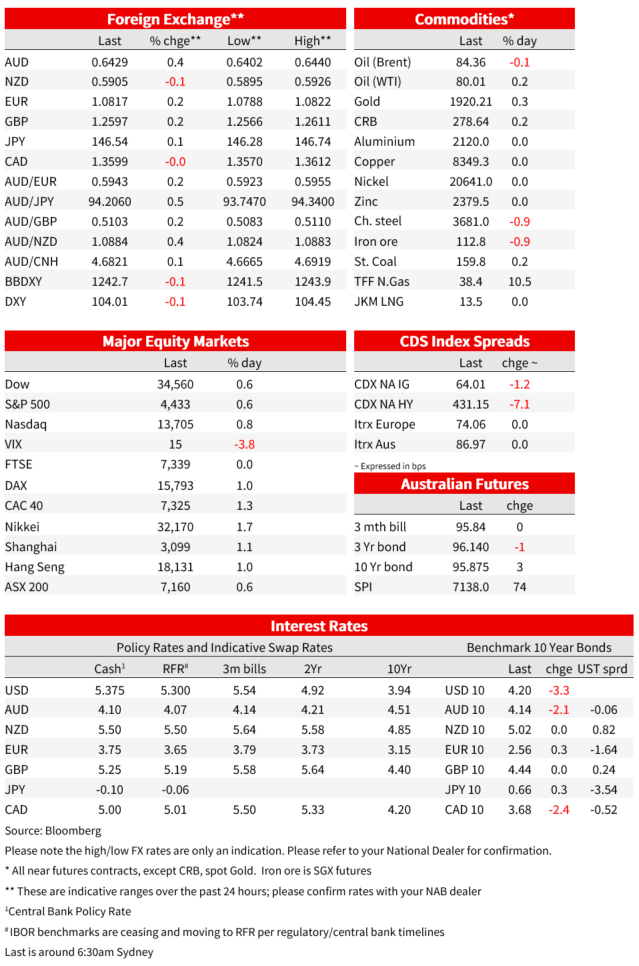

A relatively quiet night, with global equities modestly higher feeding off earlier gains in APAC stocks, even though some four-fifths of the 5%+ opening surge in China stocks, following various weekend announcements aimed at supporting the market, evaporated by the end of the day on reported foreign selling. Bond yields are modestly lower, aided somewhat by latest US Treasury sales (two and five year) getting away okay, even though auction yields were their highest since before the GFC. AUD is a little firmer amid an overall (narrowly) mixed FX picture, aided by a somewhat steadier CNY and stronger than expected local retail sales data.

Yesterday, Australia reported Retail Sales rose 0.5% m/m in July (NAB 0.1% m/m, consensus 0.3% m/m). This continues a string of recently volatility monthly prints, following a 0.8% m/m decline in May and a 0.8% increase in June. Stepping back from the month-to-month volatility, nominal retail sales growth has clearly eased, the 3m annualised rate now running at 2.1%. Importantly though, while growth is modest, retail sales have not fallen off a cliff, and the level of retail sales is still 17 percentage points above a pre-pandemic trend.

Strength in the month was driven by rebounding sales in department stores (+3.6% m/m) and clothing and footwear (+2.0%), but both remain slightly below their May levels after falls in June alongside weaker-than-usual end of financial year sales. Café, restaurant and takeaway spending was another support in the month, up 1.3% m/m. The ABS cited the World Cup as a boost to catering and takeaway services, which was likely also a support in August. Population growth is a key support to the resilience of retail sales. The civilian 15+ population is growth at 2.8% y/y, meaning that in per-capita terms nominal retail sales is -0.7% y/y. We should also remember that Retail Sales makes only about 40% of Australia’s overall Personal Consumption Expenditure

There’s been no economic news of note overnight, save for the Dallas Fed manufacturing activity survey , showing a slight improvement in August to -17.2 from -20.0 and -19.0 expected. Central bank speakers included Austrian central bank chief and ECB Governing Council (GC) member Robert Holzmann, considered the most hawkish of GC members, who said, “We’re not yet in the clear when it comes to inflation,” Holzmann said, adding that he’ll be watching all incoming information to assess the risks to prices. “If there aren’t any big surprises, I see a case for pushing on with rate increases without taking a pause.” Meanwhile Bundesbank chief Nagel opined that while the ECB will wait for the data before deciding what to do in September, the ECB may need to be at a rates plateau for a while once we do get there. A reminder the ECB next meets on September 14 and markets currently price a roughly 40% change of a 25-point rate hike, with a first cut not starting to be (partially) priced before mid-2024. EZ inflation data later this week will be important.

The aforementioned US Treasury sales of two and five year notes drew the highest yields since 2006 and 2007 respectively, at 5.0024% and 4.40%, but both cleared within a basis point of pre-auction when-issued yields, reasonably well supported and confirming that for now at least, the US bond market is not showing any particular unease about increased supply. Treasury yield are on average about 3 basis points down on last Friday’s close.

In currencies, AUD has been one of the better performer since the start of the week, its 0.3% Monday gain bested only by the SEK (0.5%) and against a marginally weaker US dollar backdrop (DXY -0.06%, BBDXY -0.5%.

Helpful to the AUD’s cause yesterday was the upside Retail Sales surprise and also the surge on China stocks at the open following the various weekend announcements designed to “invigorate capital markets and boost investor confidence”. China lowered the stamp duty on stock trades for the first time since 2008, from 0.1% to 0.05%, and included other measures such as reducing the margin ratio for margin trading, encouraging companies to do more buybacks and fund managers to purchase their own equity funds, slow the pace of new IPOs and asking some mutual funds to avoid selling equities on a net basis. China’s benchmark equity index surged 5.5% on the open, but the rally fizzled out as higher prices just encouraged further selling by foreign investors, with the CSI300 index ending the day just 1.2% higher. A (related) strengthening in the CNY in early morning trade also supported the AUD, but its intra-day high of 0.6440 seen shortly after the Retail sales report faded somewhat later in the day as China stocks wilted.

AUD outperformed NZD yesterday, NZD taking a late afternoon dip on news of planned government spending reductions, albeit amounting to just $4bn less spending over a four year period (about 1% of GDP over the entire period). No pre-election fiscal splurge then. Overnight, the IMF released its final Article IV Consultation on NZ. There was a warning shot fired at the government, as the IMF “emphasised the need for medium-term fiscal consolidation to support rebalancing efforts and create space for addressing longer-term challenges related to population aging and climate change”, adding a call for “increasing the efficiency of discretionary spending”. On monetary policy, the IMF noted “persistently high inflation and wage growth could compel the RBNZ to tighten monetary policy further or keep rates high for longer, especially if fiscal policy does not consolidate as planned in the forecast period.”

Worth a reminder here – and a factor behind the NAB/BNZ FX Strategy call for a stronger AUD/NZD cross over time – is that New Zealand’s combined fiscal and current account deficit currently sums to around 13.5% of GDP, against a surplus of close to 2% in Australia, currently running small budget surplus together with a current account surplus of about 1.5% of GDP.

US stocks finished with the S&P500 +0.6% and the NASDAQ 0.8%, both close to the highs for the day after a late day run-up. Communications services were the best performing sub-sector of the S&P and the only one to post a gain of more than 1% (1.05%). Commodities including oil were quite narrowly mixed, while the European TTF gas benchmark was 11% higher. This after news that more unionized workers at Chevron’s gas operations in Western Australia on Monday voted to authorize unions to call for protected industrial action if necessary, workers’ unions said in a social media post. Gold is currently up $5 to $1,920.

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets. Read our NAB Markets Research disclaimer.

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.