We expect NAB’s Non-rural Commodity Price Index to fall by 4.9% in Q2

Insight

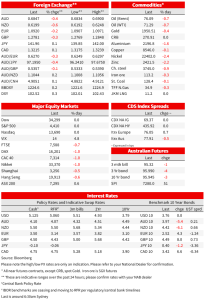

European equity markets have started the new week on the back foot following a negative lead from Asia. Investors are seemingly disappointed by the lack of new news on China’s stimulus, US equities are closed for a holiday with futures contracts pointing to small dips for the S&P 500 and NASDAQ 100.

Events Round-Up

NZ: Perform. of services index, May: 53.3 vs. 49.8 prev.

US: NAHB housing market index, Jun: 55 vs. 51 exp.

European equity markets have started the new week on the back foot following a negative lead from Asia. Investors are seemingly disappointed by the lack of new news on China’s stimulus, US equities and bond markets are closed for a holiday with futures contracts pointing to small dips for the S&P 500 and NASDAQ 100 while UST futures suggest 10y US Treasury yields are biased to open 5bps higher. The latter on the back of a move higher in UK and EU rates with the market lifting expectations on both BoE and ECB terminal rates. The USD has regained a bit of ground amid subdued sentiment and a weaker CNY, AUD starts the new day at 0.6848.

After the PBoC lowered the MLF rate on Thursday last week, the market and media have been speculating on what China could do next to revive the country’s flagging post zero-covid economic. rebound. The State Council, China’s cabinet, concluded it latest meeting on Friday with no new news, merely stating that the government is studying new measures that will be adopted in a “timely manner.”. As we have been speculating, we probably will need to wait for China’s Politburo meeting, headed by President Xi early in July, for any concrete announcement on a new round of stimulus. So far measures have been focused on the demand side, lowering cost of borrowing and new incentives to spend/invest, but with China’s “animal spirit” in struggle street, the market is looking for concrete fiscal spending measures to get the economic recovery back on track.

The burden of waiting usually instigates uncertainty and as such the lack of new China stimulus news weighed on sentiment at start of the new week. Asian equity markets closed lower on Monday (China’s CSI 300, -0.82%) providing a negative lead to European counterparts. China’s sentiment was not helped either by news that Goldman Sachs had joined the growing army of banks/investment houses that have cut their China GDP forecasts. Goldman’s trimmed their China 2023 GDP growth target to 5.4% from 6.0% with their 2024 growth forecast also clipped to 4.5% from 4.6% previously. All EU regional equity indices closed in the red with the Eurotoxx 600 down 1.02%. Of note all sectors fell on the day with declines led by materials ( -2.23%) and real estate (1.72%). At the equity level, Sartorius slumped 15% after issuing a bigger-than-expected profit warning. Meanwhile in the US, futures contracts on the S&P 500 and Nasdaq 100 dipped 0.1%.

The sense of risk aversion in the air was not helped either by the move up in Core European yields and UST Futures. UK Gilts let the move up in yields with the curve bear flattening, the 2y rate climbed above 5% for the first time since 2008 (+14bps to 5.0257%) while ahead of the BoE meeting on Thursday, the OIS market lifted the BoE terminal rate expectations by another 12bps to ~6.04% (March 2024 meeting).

The German Bund curve bear steepened with the 10y rate climbing 4bps to 2.513%. ECB rate hike expectations were also boosted overnight with the market betting on an ECB terminal rate close to 3.90%. ECB speakers were out in force last night with the price action suggesting the hawks managed to outdo the doves in terms influencing the market. ECB (and Slovakian central bank chief) Peter Kazimir said that “a continuation of monetary policy tightening is the only reasonable way ahead”, while central bank board member Isabel Schnabel (also a known hawk) said it had to “err on the side of doing too much rather than too little”.

In contrast to these hawkish remarks, ECB’s chief economist Philip Lane noted that data dependency could also mean not raising rates for one or more meetings and resuming on merit. Lane then added that the Bank was likely to raise interest rates again next month, but it was too early to predict the decision of the September meeting, which will be shaped by incoming data.

Higher European and UK yields have been a drag on US Treasuries, with the 10-year future pointing to a 5bps lift in yield (so 10y UST yields look biased to open ~3.81%) . Meanwhile on the US data front, the NAHB homebuilders’ sentiment index rose for a sixth successive month to an 11-month high of 55. Pantheon economics notes that the improvement in new home sales and activity largely reflects the lack of existing homes on the market, which is pushing buyers into the new home market. Mortgage holders are reluctant to move as they would have to give up their low locked-in 30-year mortgages.

The USD has begun the new week performing across the board (DXY and BBDXY 0.27% and 0.22% respectively). Risk aversion in the air has increased the appeal of the USD’s safe haven nature with CNY weakness an added ingredient. The yuan has been one of the weakest currencies on the day, with USD/CNH and USD/CNY both up 0.5% to be back over 7.16.

The combo of these two dynamics has not helped the pro-growth and risk sensitive pairs such as the AUD and NZD. Both antipodean currencies have traded lower over the past 24 hours with the AUD starting the new day at 0.6849, down 0.38% over the past 24 hours while the Kiwi is -0.59% and currently trades at 0.6200.

Of note too, the uptick in European yields and lift in terminal rate expectations for both the ECB and BoE were only offsetting forces with both the euro and GBP also struggling against the broadly stronger USD. The euro is down 0.15% to 1.0922 and the pound is -0.25% to 1.2786.

Finally on geopolitical news, Antony Blinken, US Secretary of State, became the highest-level American official to visit to Beijing in five years. The good news is that the two superpowers are back on speaking terms, but the not so good news is that there has not been any concrete resolution to the growing list of tensions. Speaking to the media in Beijing, Blinken said that “My hope and expectation is we’ll have better communications, better engagement going forward,”, but then added the US has “no illusions about the challenges of managing this relationship.”.

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets. Read our NAB Markets Research disclaimer.

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.