We expect NAB’s Non-rural Commodity Price Index to fall by 4.9% in Q2

Insight

Powell added little new information in House testimony, but the US dollar was weaker and equities were lower. UK CPI data surprised higher ahead of the BoE later today

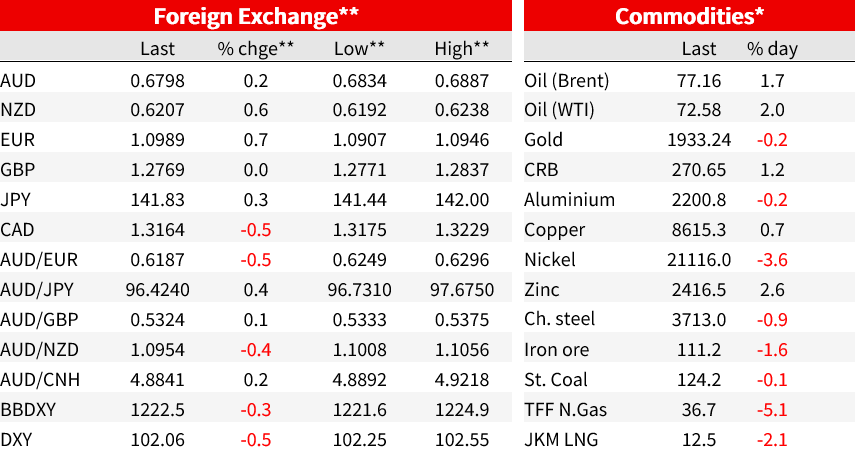

UK inflation surprised higher again, seeing UK yields move higher. That initially support US yields as well, though gains retraced as Powell’s testimony to lawmakers, while largely sticking to the post-meeting script, failed to convince market pricing two more hikes this year was the right baseline. The US dollar was broadly weaker, while equities were lower.

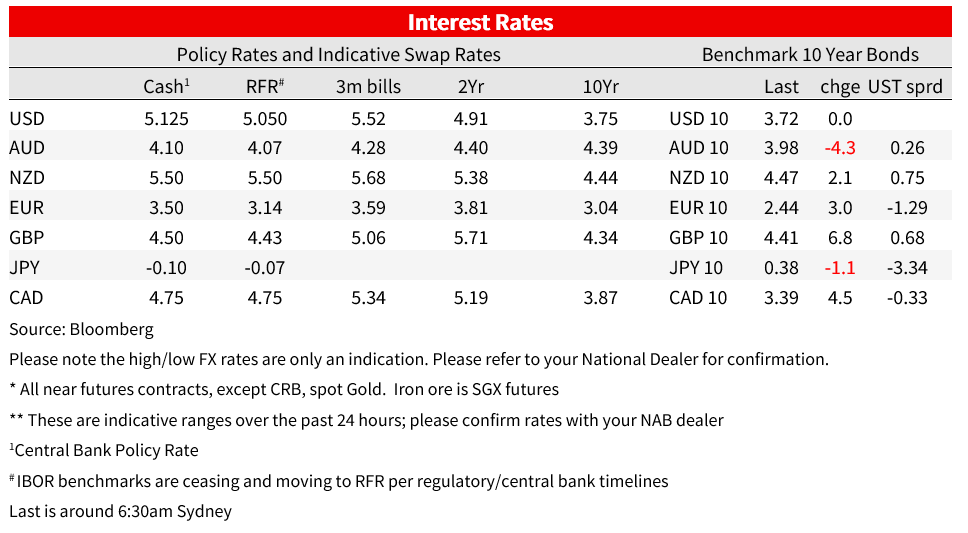

UK inflation disappointed, again. Headline remained at 8.7% against expectations for a fall to 8.4% , while core rose to 7.1% from 6.8% (6.8% expected). Energy base effects as earlier increases drop out and price declines come through still point to meaningful further easing in headline by year-end, with a leg lower likely in July but elsewhere in the detail there is scant relief. Core inflation accelerated to a new high in May, while services inflation rose to 7.4% y/y. Where other central banks’ concern is now slower-than-hoped easing, the UK is still seeing acceleration. The BoE meets today. Its conditional guidance put the burden of proof on the data showing more persistent inflation pressures to continue hiking Bank Rate. Combined with wages data last week, they have got that in spades. 25bp is the universal pick of analysts, surveyed before the inflation data. Market pricing has moved to price a 37% chance of 50bp hike, from 15% a day prior. 75bp are fully priced over the next 2 meetings, and a peak of 6% is priced by February next year.

UK yields jumped at the open following the data, the 2y yield reaching a new cycle high of 5.10% intraday, but pared losses to 5.03%, up 10bp on the day, but below its close on Monday. The UK 10yr was 7bp higher to 4.41%. The pound initially moved higher on the data but quickly reversed lower, down as much as 0.6% to 1.2691 before recovering alongside a broadly weaker dollar to be up 0.1% over the day, though remained 0.5% lower against the stronger euro. That despite the move higher in UK yields, suggesting one eye on the growth implications of more stubborn inflation and higher for longer rates.

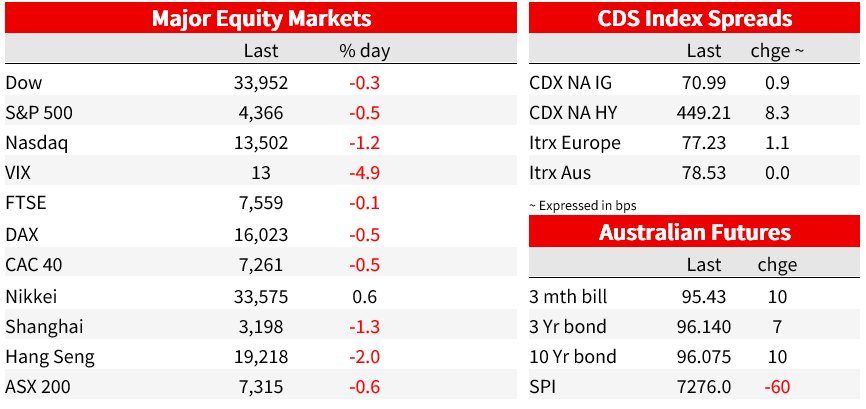

US Treasuries yields also moved higher following the UK inflation data. 2-year treasuries peaked up towards 4.75% before retracing lower while the 10-year yield highs were close to 3.79%, but lost 1bp over the day at 3.71%. Yields began to fall following Powell’s testimony, with a strong 20-Year Treasury auction helping sentiment. European bond yields are higher. 10-year Gilts advanced 7bps basis points to 4.40% and 10-year Bunds added 3bps to 2.43%

In broader currency markets, the dollar was generally weaker alongside Powell’s remarks, although there was little difference from his post-FOMC messaging. The dollar was 0.5% lower on the DXY, with the euro up 0.7% and moving up towards 1.10. The yen was the only G10 currency in the red against the dollar, down 0.3% to 141.83, taking EUR/JPY to fresh multi-year highs above 155. The AUD managed only a 0.2% gain, back near 68 cents after slipping to an intraday low of 0.6741 ahead of the broader US dollar depreciation.

As for the substance of Powell’s semi-annual testimony, the messaging didn’t stray far from his previous comments. Powell justified the decision to skip June despite signalling more to come by noting that “earlier in the process, speed was very important … It is not very important now.” He said that “reducing inflation is likely to require a period of below-trend growth and some softening of labor market conditions” even as he acknowledged the outlook for shelter inflation to recede rapidly. Near term Fed pricing was little changed, with a bit over 70% chance priced for June and just 23bp by a November peak. Powell said the two hikes in the June dot plot “a pretty good guess of what will happen if the economy performs about as expected.” Markets continue to discount the dot plot, evidently focusing on the heavy conditionality of that policy outlook and the absence of urgency evidenced by the June skip. Separately, Bostic, one of only 2 officials who didn’t pencil in additional increases, said that “the bar to justify further rate hikes is higher than it was a few months ago ” and made the point that as inflation slows, real interest rates increase and policy becomes tighter. ‘Passive tightening’ should help us continue on the path to our target if recent inflation trends persist,” he said.

Equities were lower. The S&P500 lost 0.5%, while the Nasdaq was 1.2% lower. Big tech weighed on US stocks. IT and Communications Services were the worst performing sectors in the S&P500, each down 1.4%, while Energy and Utilities led gains. The VIX fell to its lowest level since January 2020. In Asia, Chinese equities were weighed by concerns about the outlook and only gradual steps in the direction of policy support. The CSI300 was 1.5% lower, while the Hang Seng lost 2.0%. The Euro Stoxx 50 was 0.5% lower

The Bank of Canada summary of deliberations contained few surprises. “It was preferable to take the required action and continue to assess economic developments to guide future actions” the summary noted. “All members felt that a broad range of indicators had increased their concern that the disinflationary momentum needed to bring inflation back to the 2% target could be waning. ” There is 71% chance of a July hike priced, and 5.2% by the end of the year, up 6bp on the day. Canadian retail sales data earlier in the day showed April sales beat expectations, up 1.1% vs 0.4 expected.

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets. Read our NAB Markets Research disclaimer.

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.