A private sector improvement to support growth

Insight

Friday capped a risk positive end to the week and the month of June with softer US economic data releases treated as good news. Weaker US consumer spending and inflation boosted US equities with gains over 1%, US Treasury yields traded lower after the data release and the USD closed the week broadly weaker.

Events Round-Up

NZ: ANZ consumer confidence, Jun: 85.5 vs. 79.2 prev.

JN: Tokyo CPI ex-fr.food, energy (y/y%) Jun: 3.8 vs. 4.0 exp.

CH: Manufacturing PMI, Jun: 49.0 vs. 49.0 exp.

CH: Non-manufacturing PMI, Jun: 53.2 vs. 53.5 exp.

GE: Unemployment rate (%), Jun: 5.7 vs. 5.6 exp.

EA: CPI (y/y%), Jun: 5.5 vs. 5.6 exp.

EA: CPI core (y/y%), Jun: 5.4 vs. 5.5 exp.

EC: Unemployment rate (%), May: 6.5 vs. 6.5 exp.

CA: GDP (m/m%), Apr: 0.0 vs. 0.2 exp.

US: Personal income (m/m%), May: 0.4 vs. 0.3 exp.

US: Real personal spending (m/m%), May: 0.0 vs. 0.1 exp.

US: PCE core deflator (m/m%), May: 0.3 vs. 0.3 exp.

US: PCE core deflator (y/y%), May: 4.6 vs. 4.7 exp.

US: Chicago PMI, Jun: 41.5 vs. 43.9 exp.

US: U. of Mich. cons. sent., Jun: 64.4 vs. 63.9 exp.

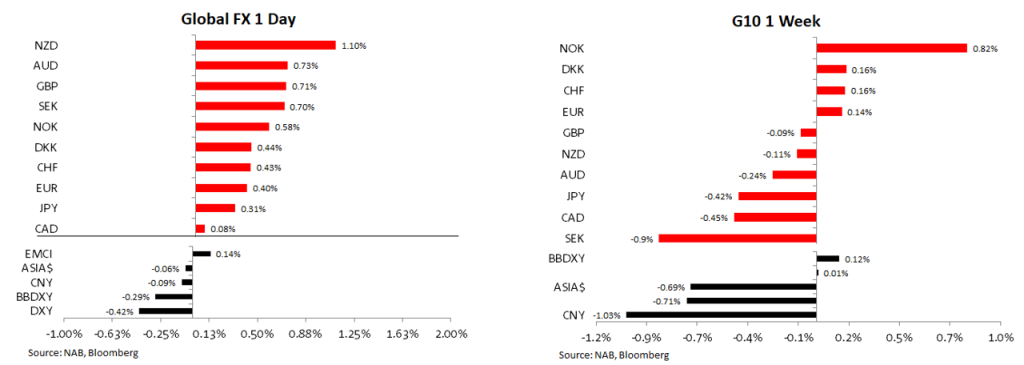

Friday capped a risk positive end to the week and the month of June with softer US economic data releases treated as good news. Weaker US consumer spending and inflation boosted US equities with gains over 1%, US Treasury yields traded lower after the data release and the USD closed the week broadly weaker. Amid a risk positive backdrop, NZD and AUD led the gains against the USD, Core inflation in Europe showed signs of stickiness in June, supporting the euro.

Following a series of strong US data releases in recent days, including a stronger than expected upward revision to Q1 GDP and lower jobless claims figures, on Friday the market was bracing for yet another US surprise. In the end, Friday’s data releases revealed softer US consumer spending and lower inflation readings for May.

US Consumer spending slowed to just 0.1%mom in May, down from 0.6% in April, which was itself weaker than previously reported. Adjusted for inflation, spending in May was flat. The downward revision to April and soft print in May, suggest US consumption in Q2 is set to slowdown significantly, assuming another flat outcome in June, Q2 consumption would print at 1%, a sharp slowdown from the 4.2% recorded in Q1. Overall, the data suggest we should expect downward revisions to Q2 US GDP forecasts.

The income and spending data also included the Fed’s preferred measure of inflation. The headline PCE deflator edged up by just 0.1% vs. 0.4% in April, resulting in a yoy decline to 3.8% vs. 4.3% previously. The May yoy print was the first below 4% since early 2021. The core PCE printed at 0.32%mom vs. 0.4% previously, with a low rounding leading to a yoy rate of 4.6% versus 4.7% expected. Encouragingly too, one of the Fed’s new preferred measures, core PCE services ex-rents, also showed a modest rise, ticking up by just 0.23%mom, its lowest reading in elven months. Adding to the good news, the fall in underlying inflation was also supported by the Dallas Fed trimmed mean PCE deflator, with the annualised rate for the month down to its lowest rate in over a year of 3.2%.

Speaking after the data release, Chicago Fed President Goolsbee said it’s too soon to say whether policymakers should raise rates or hold them steady in July, but said inflation remains well above target and has proved more persistent than expected. Goolsbee then added that some measures of inflation have improved, other categories aren’t coming down as quickly as anticipated. To Goolsbee’s point one could note that the 3m/3m annualized rate of core PCE services ex-rent is still too high, at 4.4%, and inside the range of the past two years. So whilst the data is seemingly travelling in the right direction (lower inflation), it is too soon for the Fed the ring the bell and claim a job well done.

The softer than expected US data releases provided yet another excuse for US equities to perform with all the key benchmarks gaining by more than 1% on Friday, capping off a very strong month and quarter. The S&P 500 gained 1.23% on the day and closed the month of June up over 6%. The US equity benchmark posted its best first half since 2019, Nvidia, which has almost tripled this year, was up about 3.5% and Apple gained 2.3% to $193.97, closing with a market capitalization above $3trn, the first company in history to surpass the threshold. Gains in equities were led by big tech, but of note big US Banks also had a good day and month. Indeed, Big banks saw their first monthly gain since January after passing the Federal Reserve’s stress test. After the bell, JPMorgan Chase, Wells Fargo, Morgan Stanley and Goldman Sachs announced higher dividends as regulators freed the industry to update shareholders on payouts following this year’s pass of stress test. The NASDAQ gained 1.45% on the day and finished the month 6.59% stronger.

European equities also had a good end to the week and month with the Eurosstoxx 600 index up 1.16% on Friday and 2.25% on the month. The Nikkei lost a bit of ground on Friday -0.14%, but was the best performing equity index in June, up 7.45%. Our S&P/ASX 200 gained 0.12% on Friday and climbed 1.58% during the month.

UST yields were on an upward trend ahead of the US data releases, but then reversed course with the UST curve closing flatter on the day. 10y UST yields climbed to an overnight high of 3.8877% prior to the data release but ended the session essentially unchanged at 3.8367%. The 2y Note gained 3.8bps on the day, closing the week at 4.89%. Bloomberg noted that month-end demand flows supported the back end of the curve, including buying from insurance accounts and real money.

Fed pricing expectations didn’t move that much after the US data releases, notwithstanding the decline in yields. A July 25bps Fed hike is now seen at 81% vs 82% on Thursday while the terminal rate (effective) is now seen at 5.41%, 1bps lower relative to Thursday’s pricing.

Looking at European yields, the German Bunds curve twist flattened on Friday after data revealed euro-area core inflation quickened again in June, reinforcing the need for further tightening . The Euro area June CPI was mixed, with the headline rate moderating from 6.1%yoy to 5.5%, but the (Eurostat) core rate picked up from 5.3%yoy to 5.4% ( 5.5% was expected). Bets on ECB peak rate was little changed at ~4%. Shorter dated Gilts underperformed other regions (2y +3.5bps to 5.2534) as traders revised up bets on the Bank of England’s peak by 2bps to 6.29% by February.

The US data releases weighed on the USD with the greenback losing ground across the broad . On Friday the DXY index eased by -0.42% and BBDXY was -0.29%. The positive risk backdrop helped the NZD and AUD outperformed with the kiwi leading the charge, up 1.1% on Friday. The NZD finished the week just under 0.6140 (now at 0.6126), recovering its losses from mid-week to finish flat for the week overall. The AUD was not far behind, gaining 0.73% on Friday and closing the week at 0.6664 (now at 0.6663). Over the past 5 days both antipodean currencies lost a bit of ground against the USD (~0.1%), but looking at June, both currencies made significant gains against the USD, up 1.38% and 1.09% respectively.

Of note AUD and NZD gains vs the USD in June occurred against a backdrop of CNY weakness, often CNY weakness weighs on both antipodean pairs. But with China data releases disappoint of late alongside PBoC easing bias, the RMB has been finding it difficult to perform. On Friday, the PBoC set a stronger CNY reference rate for the fourth day out of five and later in the PBoC said it will adopt “comprehensive measures and stabilise expectations” and will “resolutely prevent risks of big fluctuations”. USD/CNH fell towards 7.25 after the stronger fix, before rising to a fresh high for the year of 7.285, before USD weakness prevailed, and it closed the week just under 7.27 . Over the weekend, China named Pan Gongsheng as the central bank’s new Communist Party chief, putting him in line to be the next governor. Pan is considered a good technocrat with solid market experience, suggesting under a new helm, more of the same should be expected from the PBoC.

Another notable underperformer in June was JPY , the pair briefly trade above ¥145 on Friday with the move lower in UST yields providing a bit of relief into the close. JPY lost 4% against the USD in June and USD/JPY starts the new week at ¥144.4. On Friday Japan’s Finance Minister Suzuki was out again trying to talk the yen up, but with the BoJ on an ultra-easy policy, JPY weakness is likely to persist until the BoJ changes its tune.

Slightly softer than expected Euro area CPI data was spoiled by the fact that annual core inflation still nudged up from 5.3% to 5.4%, which will keep the ECB on edge. EUR closed the week back over 1.09 and up 1.37% against the USD in June.

A quick look at commodities revealed a mix outcome on Friday. Copper (1.6%) and metal prices (1.18%) gained on the day, but iron ore lost ground (-1.7%) while oil prices edged a bit higher (0.75% to 1.12%). That being said, June was good month for iron ore, up 14% while oil prices gained close to 3% with similar gains for copper.

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets. Read our NAB Markets Research disclaimer.

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.