We expect NAB’s Non-rural Commodity Price Index to fall by 4.9% in Q2

Insight

The RBA met yesterday and held rates steady. Other than that, it was a very quiet 24 hours characterised by thin trading alongside the US 4 July holiday.

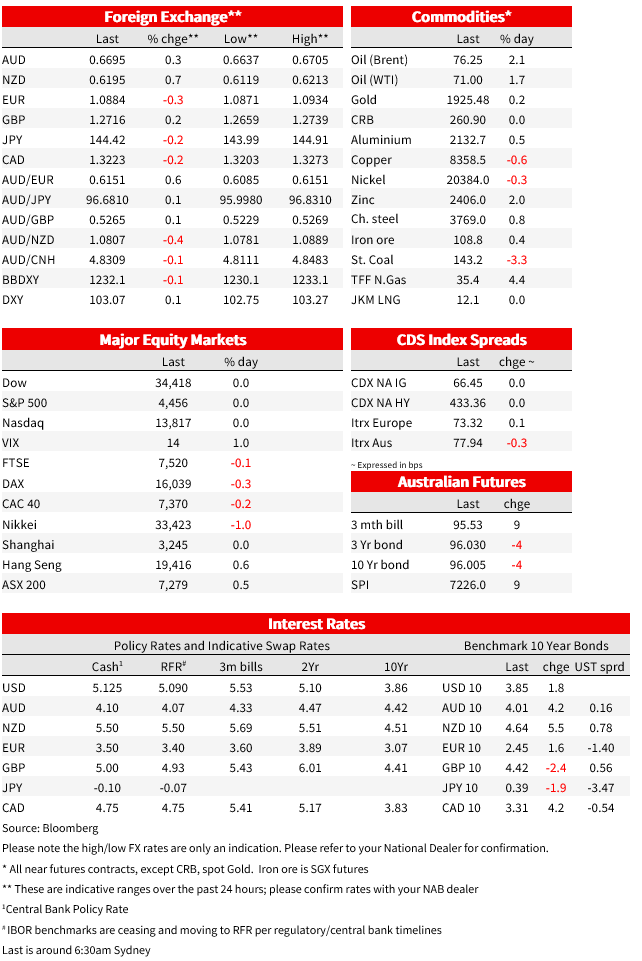

The RBA met yesterday and held rates steady. Other than that, it was a very quiet 24 hours characterised by thin trading alongside the US 4 July holiday. The euro lost 0.3% against the dollar, while the dollar was lower against most of the G10. The aussie was higher on the day, reversing losses immediately after the RBA alongside a stronger yuan. Australian yields had been moving higher ahead of the decision before falling immediately after the announcement. On net RBA pricing was pared only a little, with year-end pricing at 4.51% about 3bp lower than a day prior and yields implied by 3yr futures little changed over the past 24 hours.

The US cash market was closed, S&P500 futures are flat and Treasury futures are little changed. In light trading volumes, the Euro Stoxx 600 was barely higher, led by real estate. The German 10yr yield was 2bps higher to 1.93%, while the UK 10-year rate is 2bps lower. Bigger moves were seen in oil, with Brent up 2.1% to US$76.25 following Monday’s announcement that Saudi Arabia would extend its 1m barrels per day production cuts.

The RBA held rates steady yesterday while retaining the guidance that “some further tightening of monetary policy may be required to ensure that inflation returns to target in a reasonable timeframe”. The July decision in the meeting before a SoMP forecast update follows the precedent set in April, and indeed the final paragraph points explicitly ‘forecasts’ for inflation and the labour market (previously ‘the outlook’). While we had pencilled in a hike, we had flagged a July pause would not be a surprise and NAB continues to forecast two more hikes in coming months.

Markets were 36% priced going into the announcement and a slim majority of analysts picked a pause. 3yr yields had been moving higher ahead of the meeting, with yields falling about 10bp after the decision to an intraday low 3.95% before ending the day around 3.98%. Over the past 24 hours, futures implied 3yr yields were little changed, up 1bp to 3.97%. Pricing for a peak cash rate also retraced some of their post-decision decline now price a cash rate of 4.51% by year end, about 3bp lower than a day prior. August is now 58% priced for a hike.

In currency markets, the AUD was sipped as much as 0.7% on the decision to touch an intraday low of 0.6642, though over the day was 0.3% higher against the dollar at 0.6695. The dollar gained 0.1% on the DXY on the back of a 0.3% fall in the euro, while commodity currencies led gains with Brent oil 2.1% higher. The kiwi was 0.7% higher while the NOK was 0.6% higher. Supporting the reversal in the aussie late in the Australian afternoon was a stronger yuan . USD/CNY lost 0.4% over the day to 7.22, its lowest since 28 June. The PBOC again pushed back on yuan weakness, setting the yuan’s reference rate 315 pips stronger than the average estimate in a Bloomberg survey, the widest gap since November. We also saw a report on Bloomberg that China’s biggest state banks have been offering Local Government Financing Vehicles loans with 25-year ultra-long maturities and temporary interest rate relief. That should help prevent a near-term credit crunch in the sector.

Barring a sharp move in market pricing or analyst calls, the cash rate assumption underlying the August forecasts is likely to embed a peak of at least 4.35%, and the forecasts are likely to present a case to deliver on that in August . Growth forecasts will likely be revised down, but some upward revision to near term outlook for wages is likely. For inflation offsetting revisions from slower growth but some centring of the upside risks to inflation the RBA has been flagging are unlikely to result in a large enough downgrade to the inflation profile for the RBA to remain on hold. The May minutes after the April pause noted one factor in favour of an increase was that the forecasts “were predicated on a technical assumption for the path of the cash rate that involved one further increase”

The RBA is giving the data every opportunity to make the case that the cash rate does not need to rise much further and is comfortable moving more slowly than 75bp a quarter at this stage of the cycle. While y/y rates of headline and underlying inflation will continue to slow, we expect little sequential progress on the quarterly pace of underlying and services inflation in Q2 data released ahead of the August meeting, or indeed in Q3 data, and the risks the RBA has noted to its inflation outlook, including from accelerating wages relative to sluggish productivity, have not gone away. Maybe more of a curiosity than genuine information, but the long held ‘even keel’ metaphor, which had appeared in the Governor’s post-meeting statement since August last year, is gone. So too is the reference to ‘soft landing.’ “The Board is still seeking to keep the economy on an even keel…” was replaced with “the Board is still expecting the economy to grow as inflation returns to the 2–3 per cent target range, but the path to achieving this balance is a narrow one.” The change may hint at some downgrade to the more optimistic growth outlook of the soft-landing framing. Of course, it may also be a more benign phrasing change. Deputy Governor Bullock, for instance, is on record saying “sailing analogies aren’t really my thing.”

In NZ yesterday, though occasioning little market reaction, the QSBO showed a less-improved activity backdrop compared to the monthly ANZ survey and, in fact, the expected own-trading conditions indicator fell from a net minus 8% to a net minus 17%, consistent with the weak growth backdrop persisting. The value-add of the survey was the plethora of data that suggests easing capacity pressures. There was a continued increase in the proportion of firms reporting sales as the primary constraint on their business and a continued decline in those reporting finding labour as their primary constraint, and a reduction in reported difficulty finding labour. Our BNZ colleagues suggest it supports the view that next move in interest rates will be down.

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets. Read our NAB Markets Research disclaimer.

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.