We expect NAB’s Non-rural Commodity Price Index to fall by 4.9% in Q2

Insight

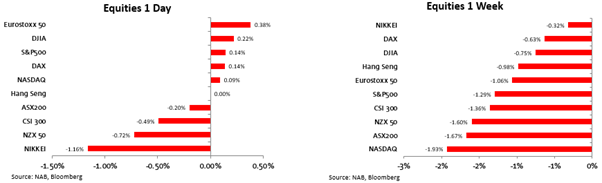

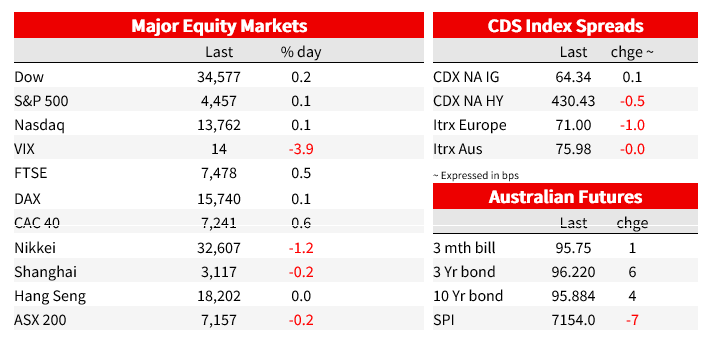

US equities manage a marginal gain on Friday, but lower over the week and yields edge higher.

Events Round-up

CA: Unemployment rate (%), Aug: 5.5 vs. 5.6 exp.

CH: CPI (y/y%), Aug: 0.1 vs. 0.1 exp.

CH: PPI (y/y%), Aug: -3.0 vs. -2.9 exp.

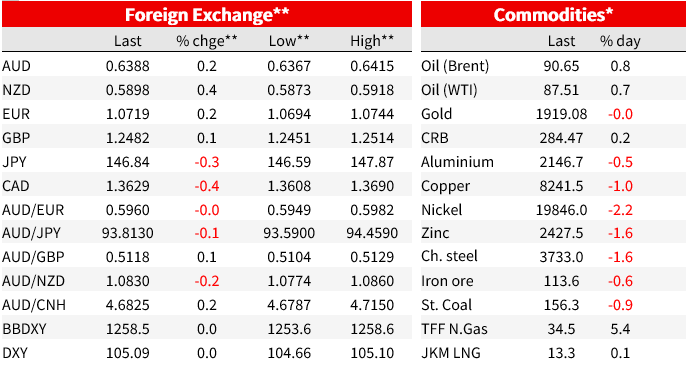

It was a relatively quiet end to the week on Friday with little data flow of note. The S&P 500 managed a marginal gain on Friday but ended the week lower. US Treasury yields gained, and the US dollar rose was marginally higher on the DXY to cap its eighth straight week of gains, the longest streak since 2005. The USD begins the week under pressure in early Sydney today, with the USDJPY starting the week around 0.6% lower at 147.00

In geopolitical news, on Sunday in Hanoi Biden said China “has a difficult economic problem right now” and that “I don’t think it’s going to cause China to invade Taiwan, matter of fact the opposite, probably doesn’t have the same capacity as it had before.” Meanwhile, Treasury Secretary Janet Yellen said on Sunday she is increasingly confident about the prediction the US will be able to contain inflation without a recession. “ Every measure of inflation is on the road down,” Yellen said.

Chinese CPI and PPI data were out on Saturday. Chinese CPI was in line with expectations, creeping back above 0 to 0.1% y/y from -0.3%, supported by summer travel. CPI rose 0.3% m/m, picking up from 0.2% m/m in July. The core rate excluding food and energy costs rose to 0.8% y/y, a long way from a domestic inflation problem amid sluggish domestic demand, but supportive of the view that the headline rate’s dip into negative territory last month did not reflect the beginnings of a deflationary spiral. Falls in PPI narrowed from -4.4% y/y to -3.0% y/y, near the -2.9% consensus, with base effects and a rise in fuel prices supportive.

On Friday, bumper preliminary Q2 GDP figures for Japan were revised lower . GDP was revised to a still robust 1.2% q/q from the preliminary 1.5% q/q. Expectations were for a revision to 1.4% q/q. Business spending drove the revision, revised lower to -1.0% q/q from flat and not a complete surprise given MoF data on corporate activity. Also out on Friday was labour earnings data. Labour cash earnings were up just 1.3% y/y, down from 2.3% prior and well below the 2.4% y/y consensus , the anticipated boost from higher spring wage rounds failing to show up in earnest in the June or July numbers. The BoJ’s scepticism wages are strong enough to sustain inflation won’t disappear, but the data isn’t as weak as it looks at first blush. Using a matched sample of firms, wages were a less soft 2.1% y/y, and, while base pay gains for full time workers picked up to 2.3% from 1.6% in June.

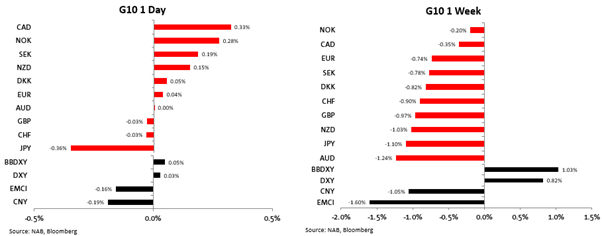

It was quiet on the US data calendar on Friday, though north of the border Canadian employment data was a little stronger than expected. Employment +40k (consensus +20) and the unemployment rate flat at 5.5% (consensus +5.6%). Average hourly wages also moved higher to 5.2% from 5.0% against expectation for a fall. The CAD was the best performing G10 currency on the day, though only up 0.3%.

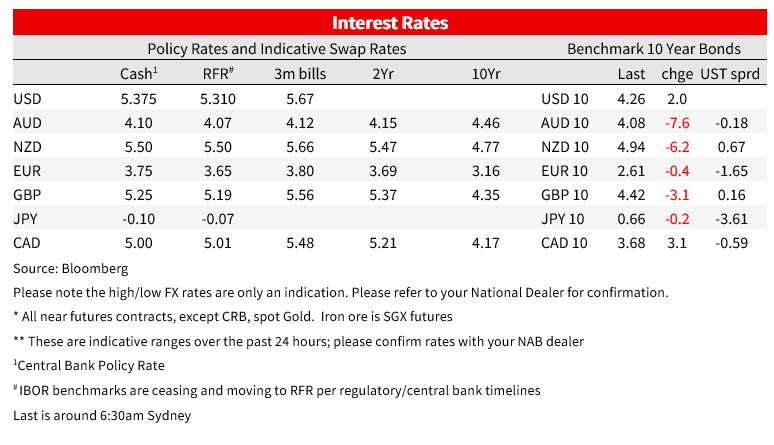

US yields were higher across the curve over the week. The 2yr was retraced an earlier rally to be 4bp higher in yield on Friday. 2yr yields were 11bp higher over the week, ending the week just below 5% at 4.099%. The curve was slightly flatter, with the 10yr 9bp over the week to 4.26%. Yields were generally also generally higher globally. German bunds were 6bp higher, but gilts outperformed, 10yr yields down 1bp. Fed speakers go quiet this week ahead of the FOMC on 20 September, where the chance of a hike is priced 7%. US CPI on Wednesday is the last big test, but absent a very large surprise is probably more about setting up what it would take to tip the scales to coming off the sidelines in November, where pricing is currently for a peak in the funds rate at 5.45%, implying around a 48% chance of a hike by November.

US equities were marginally higher on Friday. The S&P500 gained 0.1%, but was 1.3% lower over the holiday-shortened week. The tech-heavy Nasdaq gained 0.1% on Friday but was 1.9% lower over the week. Apple gained 0.4% on Friday, but was still down around 6% over the week on concerns around Chinese government restrictions on oPhone use.9 of 11 S&P500 sectors fell over the week, with industrial and IT leading declines and each down over 2%. Energy outperformed, gaining 3.5%. Equities were generally lower globally last week. The S&P500 is 2.9% from its 2023 closing high.’

A dip in the US Dollar was quickly reversed overnight Friday with the DXY making marginal gains and closing near multi-week highs. That marked an 8-week streak of gains for the DXY, the longest since 2005. EUR/USD spiked briefly above 1.0740 on Friday but retraced to close near 1.07, the lowest level since June as weaker activity indicators in the Eurozone contrasted resilience of the US economy. The Canadian Dollar outperformed amongst G10 currencies after stronger than expected labour market data.

The Australian dollar was 0.2% higher on Friday, paring losses over the week to 1.2%. The AUD spent most of the latter part of the week below 64c after falling below that level on Tuesday. The yen was 0.4% lower on Friday to take its weekly loss to -1.1%. Japanese policy makers have continued to warn about excessive Yen weakness. Finance Minister Suzuki said that the ‘FX market should reflect fundamentals’ and policymakers ‘will watch FX moves with a high sense of urgency and will not rule out any options to address excessive moves’. USD/JPY dipped temporarily following the comments but closed the week near highs at 147.83. The yen is stronger to start the week in early Sydney trade with the USDJPY down around 0.6% to 147.0, helped by comments from Bank of Japan Governor Ueda, who said it’s possible the central bank will have enough information and data by the year-end to judge if wages will continue to rise.

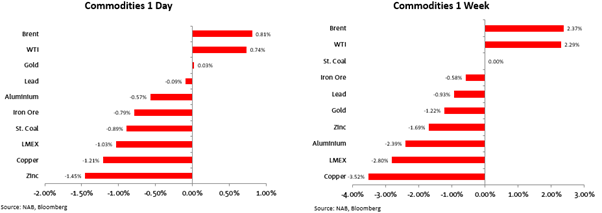

Benchmark European Gas futures jumped as much 13% on Friday in Europe on news that liquefied natural gas workers at key Chevron sites in Australia began partial strikes. Partial strikes began at 1 pm Perth time at the Gorgon and Wheatstone facilities, which accounted for about 7% of global LNG supply last year. TTF futures pared earlier rises to be 5% higher over the day, but down 3% over the week and still a fraction of their peaks following Russia’s invasion of Ukraine.

Oil prices were gained on Friday, with Brent up 2.4% over the week, rising above $90/bbl. Since July 1, Brent has risen about 20%. Saudi Arabia and Russia announced extensions to production and exports cuts on Tuesday. The IEA had forecast a halving of the supply deficit to just over 1 million barrels a day in the fourth quarter prior to the announcement. Outside of the energy mix, commodity prices were generally lower over the week, not helped by the stronger dollar and lingering concerns about Chinese growth. Copper lost 3.5%.

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets. Read our NAB Markets Research disclaimer.

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.