We expect NAB’s Non-rural Commodity Price Index to fall by 4.9% in Q2

Insight

Todays podcast ECB opts to hike, but taken as dovish with guidance read as a peak in rates Euro -0.8% and European yields are lower US Retail Sales data stronger in August, though offset by revisions AU Employment bounced in August Coming up: China Activity & MLF rate, NZ Manufacturing PMI, US UMich confidence […]

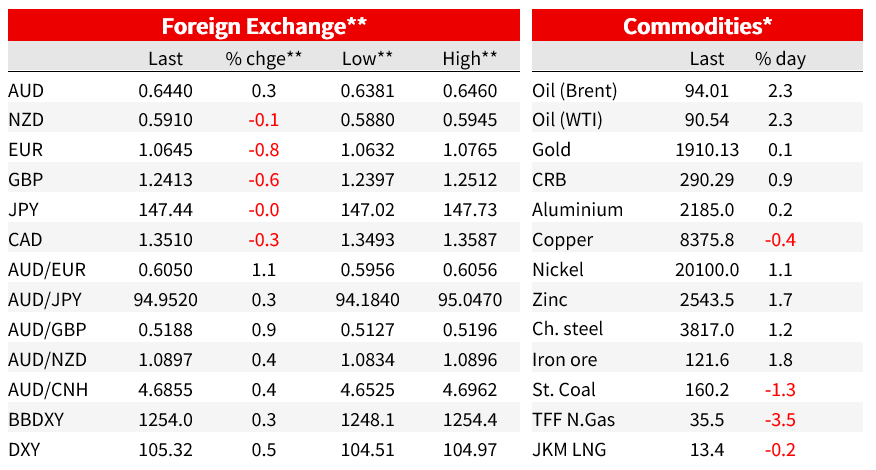

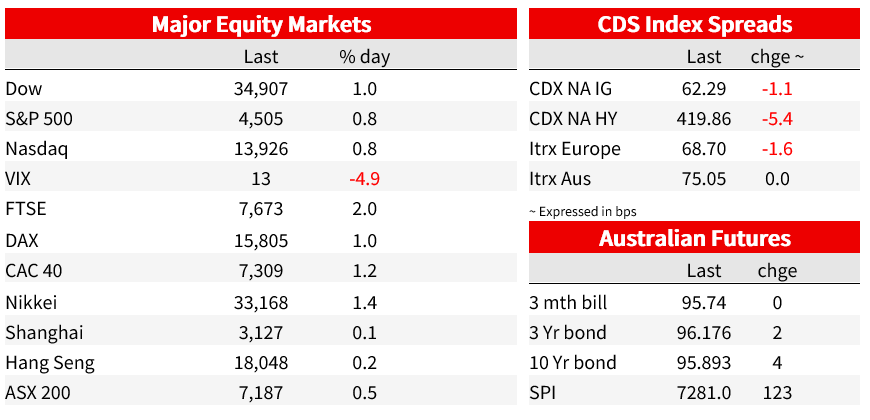

A hike by the ECB was of less impact than the guidance suggesting a peak in rates. European yields are lower and the EUR fall to a fresh six-month low, with other European currencies also lower against the USD. Equities are higher and oil prices are up further, while US yields are 3-4bp higher alongside some resilient US economic data.

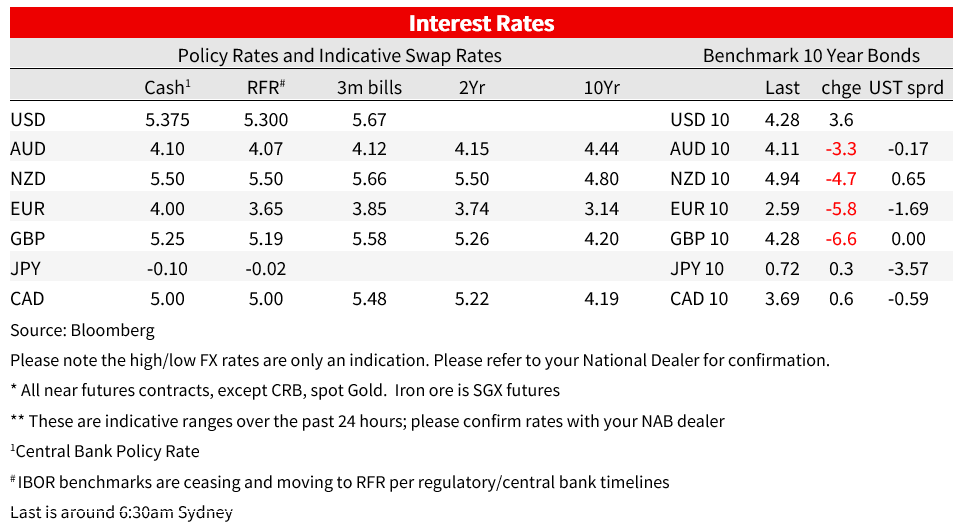

The ECB raised interest rates 25bp, taking the deposit rate to 4.0%. Economists had been split, skewing 34 to 32 for a pause in the Bloomberg Survey. Markets priced around 65% chance of a hike, having shifted from about 50% prior to Reuters report ECB inflation forecasts would be revised higher. The reaction in markets however, took its lead not from the hike, but the seemingly emphatic guidance the ECB is done. The press release read “ Based on its current assessment, the Governing Council considers that the key ECB interest rates have reached levels that, maintained for a sufficiently long duration will make a substantial contribution to the timely return of inflation to the target.”

The euro was 0.8% lower against the USD to 1.0645 after a fresh 6-month low of 1.0635 intraday. German 2yr yields were 2bp lower at 3.15%, while the 10yr yield was 6bp lower to 2.59%. That contrasts the US, where 2-year and 10yr yields were 4bp higher, at 5.01% and 4.28% respectively.

The statement also said that decisions would be data-dependent, and in the press conference, Lagarde said a “solid majority” favoured the increase over a pause, and stressed that the press releases guidance was based on the current assessment, which could change. Largarde said, “the focus is probably going to move a bit more to the duration, but it is not to say – because we can’t say – that now that we are at peak”.

Forecasts for growth were pared, while inflation forecasts were revised higher. Growth forecasts were trimmed for all three years of the projection period, from 1.5% to just 1% for next year and from 0.9% to 0.7% for this year. Inflation forecasts were increased from 5.4% to 5.6% over 2023, from 3% to 3.2% for 2024, but trimmed from 2.2% to 2.1% for 2025.

US retail sales beat expectations, rising 0.6% m/m against 0.2% expected. Gas prices boosted sales, with the ex-autos and gas measure up 0.2% m/m vs -0.1% expected) and the control group (+0.1% vs -0.1% expected). But the stronger August outcomes was fully offset by net revisions of -0.4%. Those downward revisions take some of the shine off the initially reported strength in the consumer through Q3 (Atlanta Fed’s GDP now was trimmed to 4.9% from 5.5%) but consumption is resilient and is still set to increase in Q3. Initial jobless claims rose by just 3k to 220k, consistent with lingering labour market resilience. Core PPI inflation data were in line with expectations, with the core increasing by 0.2% m/m, The headline was higher than expected at 0.7% m/m (0.4% expected) as fuel boosted and electricity failed to fall.

Locally yesterday, Australian employment strongly bounced back by 65k in August (consensus +25k, NAB +50k) confirming that the soft July employment figure did not mark an abrupt shift in the still-tight labour market. The unemployment rate remained at 3.7% as the participation rate increased to a record higher of 67.0% and amid rapid population growth estimates. Markets still sees very little chance of a hike from the RBA in October, but November pricing is around 36%, from 31%.

The fall in the euro spilled over into other European currencies. In contrast, the yen was flat against the dollar, and commodity currencies have held their ground, with CAD (+0.3%) supported by higher oil prices and AUD supported by further policy easing by the PBoC. The AUD is 0.3% higher over the day to 0.6440. The PBoC cut the reserve requirement ratio for most banks another 25bps, the sixth reduction this policy cycle and the first cut since March. The cut will add further liquidity to the banking system but can do only so much in the face of soft credit demand.

US equities were higher. The S&P500 rose 0.8%. Gains were broad-based, with all 11 sectors in the green, led by Real Estate. In Europe, the Euro Stoxx 50 was 1.3% higher.

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets. Read our NAB Markets Research disclaimer.

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.