We expect growth in the global economy to remain subdued out to 2026.

Insight

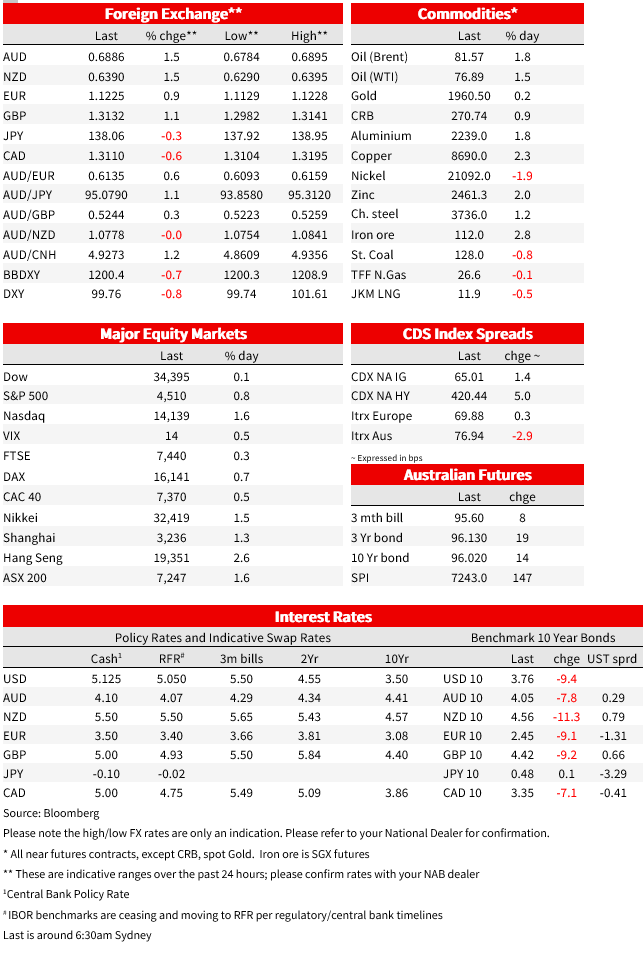

After the softer US CPI print on Wednesday the cooling US economy narrative was further supported overnight by a softer than expected US PPI print. Megacaps have led gains in US equities while front end bonds have led a decline in UST yields. The USD is broadly weaker with several FX pairs breaking through key support/resistant levels.

– US June PPI 0.1%mom vs 0.2% exp. and 0.2% prev.

– US June core 0.1%mom vs 0.2% exp. and 0.2% prev.

– US Initial jobless claims 237K vs 250k exp. and 248K prev.

After the softer US CPI print on Wednesday the cooling US economy narrative was further supported overnight by a softer than expected US PPI print. Megacaps have led gains in US equities with the S&P 500 extending its recent wining streak to a fourth consecutive day. Front end yields have led a decline in UST yields with European yields also lower. The USD is broadly weaker with several FX pairs breaking through key support/resistant levels, AUD briefly touches 69c.

The US Producer Price Index for final demand rose 0.1% from a year earlier, the smallest advance since 2020 (0.4% exp. and 1.1% prev.). The y/y core reading fell to 2.4% from 2.6%, but the index rose at a mere 1.0% annualized rate in the three months to June. Looking at the month on month readings both the headline and core readings printed at 0.1% and below expectations for a 0.2% outcome.

The decline in the US PPI figures added to the cooling US narrative and as one of the US economists that we followed noted, is also worth highlighting that the core PPI is a whole economy output price measure, so it moves closely in line with the GDP deflator and the core PCE deflator ex-rent.

Going somewhat against the trend of a cooling economy/labour market, US jobless claims overnight printed at 237k, well below expectations for a 2k rise to 250k. The market dismissed the better than expected outcome with seasonality always an issue at this time of the year given the variation in the timing and extent of the annual automakers’ retooling shutdowns.

US equity markets embraced the PPI news with megacaps spearheading the overnight gains. The NASDAQ closed 1.58% higher with Amazon (2.68%) hitting a 10-month high after reporting record sales during its Prime Day sale. Alphabet rallied over 4% and bank stocks also gained ahead of some earnings reports tonight. The S&P 500 advanced 0.85%, climbing above the 4500 mark in the process. Energy was the only sector in the red, down 0.45%, notwithstanding gains in oil prices (WTI +1.72% and Brent +1.77%). Earlier in the session the Eurostoxx 600 index closed 0.62% higher.

UST yields’ reaction to the softer PPI data was driven by a decline in front-end yields, steeping the curve. The 2y and 5y tenors fell 13bps (over the past 24 hours) to 4.611% and 3.937% respectively while the 10y Note declined by 10bps to 3.763%. Fed pricing expectations for the July FOMC meeting were little changed, still pricing around an 88% probability for a 25bps hike to 5.25-5.50% by the end of the moth, instead the CPI and now PPI data have emboldened the notion that after July the Fed is more likely than not done with the current tightening cycle with an increase in expectations for rate cuts over 2024. For instance, at the start of this week the market was pricing a Fed funds rate of 4.10% by December 2024 and now the market is pricing a rate of 3.71%.

European yields followed the mover lower in UST yields, although German Bunds had a flattening bias while the UK gilts curve shifted lower in a parallel fashion.2y Gilts fell 9bps to 5.10% while the 10y tenor fell 9bps to 4.413%. 10y Bunds closed 8.5bps lower to 2.469%.

Moving onto FX, the USD is broadly weaker with the DXY index breaking below key support levels . DXY now trades sub the 100 mark (@ 99.75), down 0.733% over the past 24 hours and looking at the chart the index decline looks significant as it has broken through the support area around 100.70 mark which has held twice this year. False breaks are part and parcel of FX moves but looking the chart the move sub 100 suggests DXY now has plenty of room to trade lower.

In a mirror fashion, the euro (+0.83) also looks perky after breaking the 1.12 mark and inline with our FX forecast to head above 1.15 over coming months. The AUD and NZD have also performed well overnight, both up around 1.5%. The AUD briefly touched the 69c mark after the US PPI print and now start the new day at 0.6889. NZD now trades at 0.6393 showing a steady rise over the course of the overnight session.

Playing into the positive vibes for antipodean currencies, we also had positive China US relationship news following a candid and constructive meeting between US Secretary of State Antony Blinken and Wang Yi ,China’s top foreign policy official . The news may instigate further gains in CNY today.

Looking at other major pairs, USD/JPY now trades with a ¥138 handle after breaking through key support levels around the ¥139.20/50 area . The move lower in UST yields has been a key factor for JPY gains with the market also increasing speculation on what the BoJ may do at its end of the month meeting. GBP has also performed, up 1.09% to 1.3136.

Lastly, worth noting that Fed St. Louis President James Bullard has resigned after 15 years in the position to become dean of a university business school. Bullard has been a leading voice in the current Fed tightening cycle, calling for an aggressive tightening cycle well before the FOMC delivered.

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets. Read our NAB Markets Research disclaimer.

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.