Firmer consumer and steady outlook

Insight

Global markets were relatively stable overnight ahead of tonight’s key risk event of US CPI.

Key events/headlines

US: PPI ex food, energy (m/m%), Sep: 0.3 vs. 0.2 exp.

US: PPI ex food, energy (y/y%), Sep: 2.7 vs 2.3 exp.

US 10-year note auction: bid/cover ratio 2.5 from 2.52; indirect bidding 60.3% from 66.3%

NY Times: ‘Early Intelligence Shows Hamas Attack Surprised Iranian Leaders, U.S. Says’

“It’ll be okay; It’s gonna hurt for a bit of time; So bottoms up, let’s forget tonight; You’ll find another and you’ll be just fine”, Be Alright, Dean Lewis 2019

Global markets were relatively stable overnight ahead of tonight’s key risk event of US CPI. The big pieces of news was a hotter than expected US PPI (though details were a bit of a dogs breakfast), and a NY Times article that said ‘early intelligence shows Hamas attack surprised Iranian leaders U.S. says’. The later was partly a driver of oil prices given it reduces the risk of Iran being dragged into the conflict with Brent down -1.6% to $82.26 and not far off the $84 mark it was trading at prior to the attack. As for the Fed, Governor Waller said “financial markets are tightening up and they are going to do some of the work for us ”, putting him in the Bostic/Daly/Logan camp, and further reducing the probability of further hikes from the Fed. The FOMC Minutes did not contain much new. Market pricing for the Fed now stands at just 1.9bps for November and a cumulative 7.6bps by December. Pricing for cuts in 2024 has increased to -86bps from -76bps early last week.

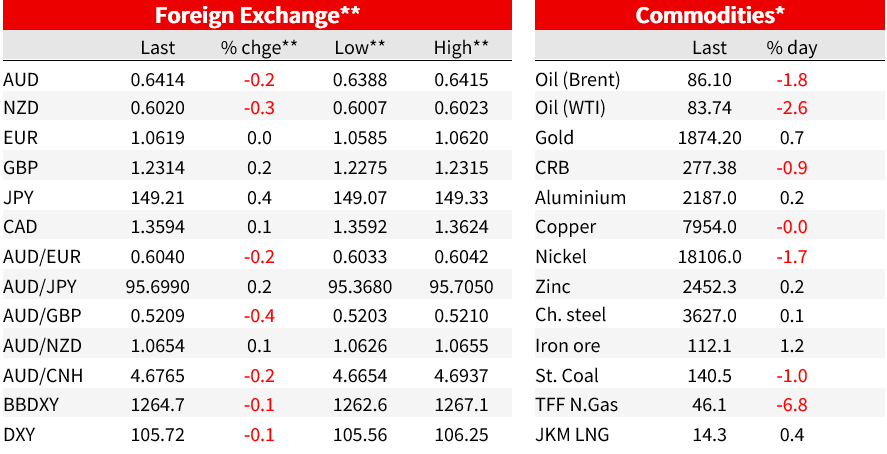

Yields over the past 24 hours are lower, though it was a little choppy with the PPI seeing yields lift a little before falling back later in the session. The US 10yr yield is -8.0bps to 4.57% (24hr high 4.65% and low of 4.54%). Short covering/squaring up remains the main narrative, though PIMCO was out overnight saying they were bullish on bonds, citing a likely slowing in CPI and fading fiscal support. The USD was broadly steady with that backdrop: DXY -0.1%; EUR -0.0%; GBP +0.2% and USD/Yen +0.4%. Commodity linked currencies underperformed (AUD -0.2%; USD/CAD +0.2%) with one driver being the fall in oil prices (Brent -1.6% to $82.26). The NY Times article of “ Early Intelligence Shows Hamas Attack Surprised Iranian Leaders, U.S. Says” may reduce the chances of additional sanctions on Iranian oil and help prevent Iran being drawn into the conflict. Equity markets were mixed, though the S&P500 managed a late rally to close up 0.4% along with the NASDAQ +0.7%.

The FOMC Minutes didn’t add anything new. The Minutes revealed policy makers agreed that the central bank should ‘proceed carefully’ on rate decisions and that incoming data would help determine if another rate hike was required in coming months, and “all participants agreed that policy should remain restrictive for some time…”. The Fed’s Waller who has previously been one of the more hawkish FOMC members spoke before the Minutes and said the central bank can ‘watch and see’ what happens before raising rates further as financial markets conditions tighten. Waller seemed more sanguine and in the Bostic/Daly/Logan camp of “ financial markets are tightening up and they are going to do some of the work for us”. Helping boost the case for a soft landing, Waller also noted “the real side of the economy seems to be doing well. The nominal side is going in the direction we want. So we’re in this position where we kind of watch and see what happens on rates”.

As for the US PPI, it was a ‘dogs breakfast’ of a report. Headline PPI was hotter at 0.5% m/m vs. 0.3%, boosted by a 0.9% increase in food prices and a 3.3% jump in energy prices. Excluding food and energy the beat was only a tenth at 0.3% vs. 0.2%. There was a 7.0% annualized jump in the trade services component – which measures gross wholesale and retail margins – driven by a leap in margins for retailers of hardware, building materials. If you exclude trade services from core then PPI was bang in lien at 0.2% m/m. Of more important will be US CPI tonight (see Coming Up below for details).

Finally in Australia, a few interesting developments yesterday worth noting. The RBA’s Kent gave a speech on channels of transmission with the key takeaways being in the Q&A. Kent noted: (1) despite variable rates in Australia, the overall impact from all channels of transmission for a given change in the cash rate is similar to other countries; (2) wages growth is only consistent with at target inflation if productivity picks up and we know that productivity has fallen sharply in Australia. And you can’t measure productivity well in real time, so you need to infer these trends from other sources such as CPI; and (3) on QT the RBA had no plans. Kent said “we don’t have any current plans to sell bonds to pursue what’s called active QT” and that “its not about financial conditions I think” “we have an instrument, its called the cash rate, when you are off the lower bound, we can move that around as you need to, to tighten financial conditions” “nothing yet but look when the Board feels the need to tell you, review the case” “you will have to wait for the Minutes”. NAB also published its CPI Preview yesterday – email Tapas.Strickland@nab.com.au if you would like a copy.

Coming up:

Market Prices

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets. Read our NAB Markets Research disclaimer.

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.