Coming in for landing in a heavy cross wind

Insight

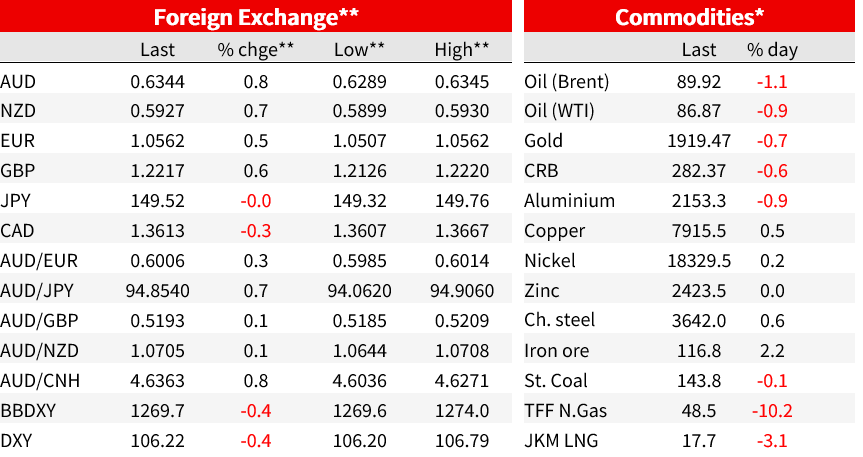

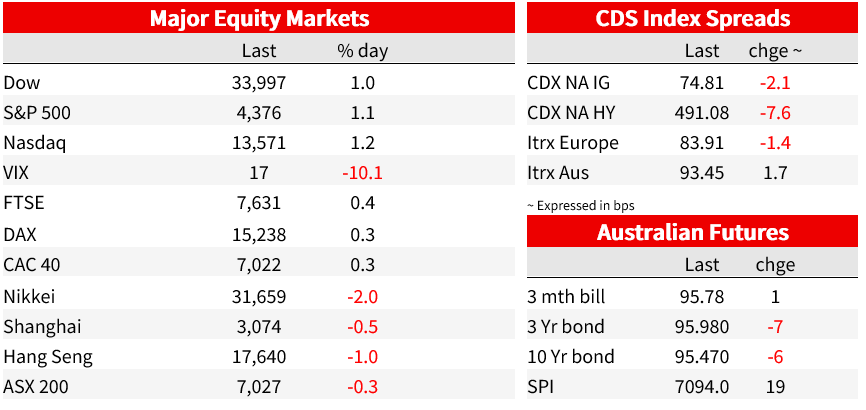

Todays podcast Positive risk appetite to kick off the new week Equities higher, S&P500 +1.1% Yields higher, US 10yr +9bp to 4.70% Dollar loses 0.4% on the DXY with AUD an outperformer, +0.8% to 0.6344 Coming up: NZ CPI, RBA Minutes, US Retail, CA CPI, UK Wages, FED & ECB speakers Events round-up NZ: Performance […]

Events round-up

NZ: Performance of services index, Sep: 50.7 vs. 47.7 prev.

US: Empire manufacturing, Oct: -4.6 vs. -6.0 exp.

Diplomatic efforts to avoid a regional broadening of the Israel-Hamas have supported a more positive start to the week for risk sentiment, amid a quiet day for economic releases. US equities are up, the S&P500 gaining 1.1%, to be back around Wednesday’s close, unwinding losses towards the end of last week as the VIX index fell to 17.2, after ending last week above 19. US yields were higher, the 10yr up 9bp to 4.70%, while the dollar lost 0.4% on the DXY.

In equity markets, the S&P500 was 1.1% higher, with all 11 sectors in the green, led by consumer discretionary and communications. Aside from geopolitical developments, earnings results will be in focus this week. Goldman Sachs and Bank of America report today, ahead of Morgan Stanley, Netflix and Tesla tomorrow.

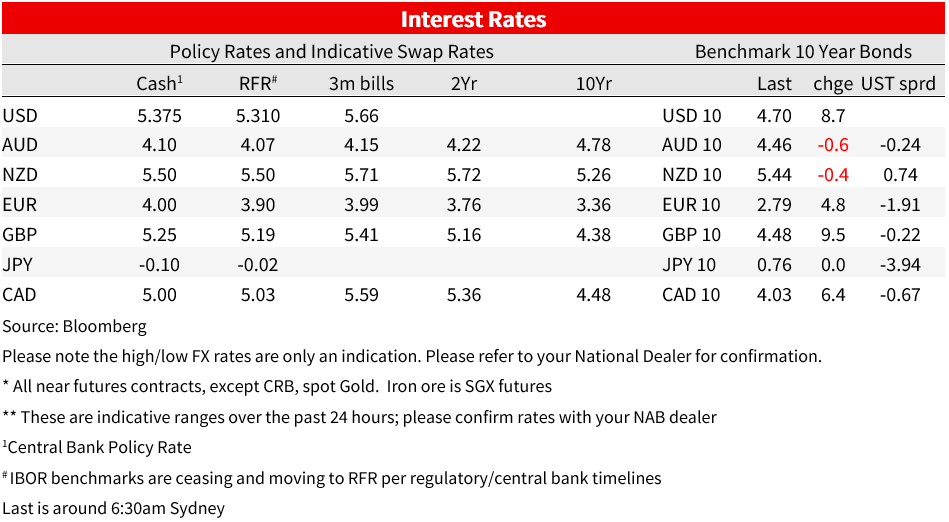

US yields were higher and the curve a little steeper. 10yr yields rose 9bp to 4.70%, while the 2yr was 4bp higher at 5.09%. That takes the 2yr yields back above its close on Friday 6 October, before the news out of the middle east. European yields also rose, with the German 10yr 5bp higher at 2.79% and the 10yr gilt yield 9bp higher to 4.48%.

Oil prices were lower, with Brent down 1.1%. Oil ended to week stronger, up over 5% on Friday, amid fears an escalating or broadening conflict could threaten supplies, but that move was not extended into the new week. A report that the U.S. may have reached a deal with Venezuela to ease sanctions supported the small declines on the day. Brent is currently just below US$90, up 6.5% from 6 October but still 8% below its 28 September intraday high above $97.

The more supportive risk backdrop was also the dominant theme in currency markets. The USD was 0.4% lower against the DXY. The dollar was little changed against the yen, losing less than 0.1% at 149.52, and was lower against all other G10 currencies. NOK and CAD underperformed, up 0.2% and 0.3% amid softer oil. The positive risk backdrop saw the AUD and NZD near the top of the G10 leaderboard. The AUD was 0.8% higher to 0.6344, currently sitting around its highs for the day after a mostly steady drift higher. The NZD saw some knee-jerk support to start the week after Saturday’s election result with the NZDAUD rising close to 94, but with the outcome broadly in line with pre-election polling, NZD crosses against AUD, GBP and EUR are all lower from the levels traded early Monday morning as the dust settled. The NZD was 0.7% higher on the day.

Ahead of a full data calendar in prospect today, there was little data of note overnight. The Empire Manufacturing Survey dipped in October, down to -4.6 from +1.9 , though a little better than expectations for -6.0. There is elevated volatility in regional surveys and further improvement would be needed to signal a rebounding manufacturing sector, but the NY Fed noted ‘firms remained relatively optimistic about the outlook’ even as the index for future conditions eased slightly to +23.1. Selling prices fell 8pts to 11.7, while price paid was stable at 25.5 and employment was 6pts higher at 3.1.

There was also little new to shift the dial from Fed officials. Philadelphia’s Harker said a ‘resolute, but patient’ stance is appropriate, and that the Fed can hold rates steady absent a sharp turn in the data. He made similar comments last week. He also acknowledged that higher rates were contributing to lower inventory in the housing market. Chicago’s Goolsbee told the FT that improving inflation was a trend not a blip (See FT). Higher shelter inflation in September was a ‘negative surprise’ that would be monitored for the speed of further falls in inflation, while strong jobs gains amid easing wages growth was a positive supply story rather than a concern. He said he had not yet made up his mind about November but that the policy debate was rapidly shifting to how long policy rates need to be maintained rather than how high they go. Markets price just an 8% chance of a November hike, and 29% of a hike by December. Amid a full Calendar of Fed speakers, Powell on Thursday will be the focus, following US Retail Sales tonight.

In China, the PBoC left the 1-yr MLF rate on hold at 2.5%, in line with the consensus of analysts, likely setting up another month of no change for LPRs on Friday. With very little domestic inflationary pressure, some further easing before year-end is likely.

Coming Up

Market Prices

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets. Read our NAB Markets Research disclaimer.

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.