Firmer consumer and steady outlook

Insight

Strong US retail sales sees yields rocket – 10yr yield +14bps to 4.84%

Key data/events

BBG: Biden Plans High-Stakes Israel Visit to Keep War From Escalating

BBG: BOJ Is Said to Discuss Raising FY24 Price View to 2% or More

US Retail Sales MoM Sep: 0.7% vs fcst 0.3%, previous 0.6% (revised from 0.8%)

US Retail Sales Control Group: 0.6% vs fcst 0.1%, previous 0.2% (revised from 0.1%)

US Industrial Production MoM Sep: 0.3% vs fcst 0.0%, previous 0.4% (revised from 0.0%)

UK Average Weekly Earnings 3M/YoY Aug: 8.1% vs fcst 8.3%, previous 8.5%

CAD CPI YoY Sep: 3.8% vs fcst 4.0%, previous 4.0%

Good morning

“And I’ve made up my mind; I ain’t wasting no more time; Here I go again, here I go again”, Here I Go Again, Whitesnake 1982

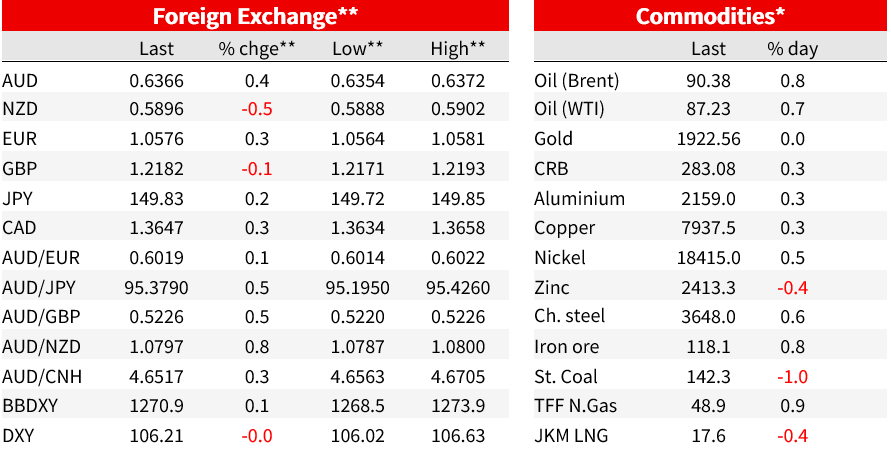

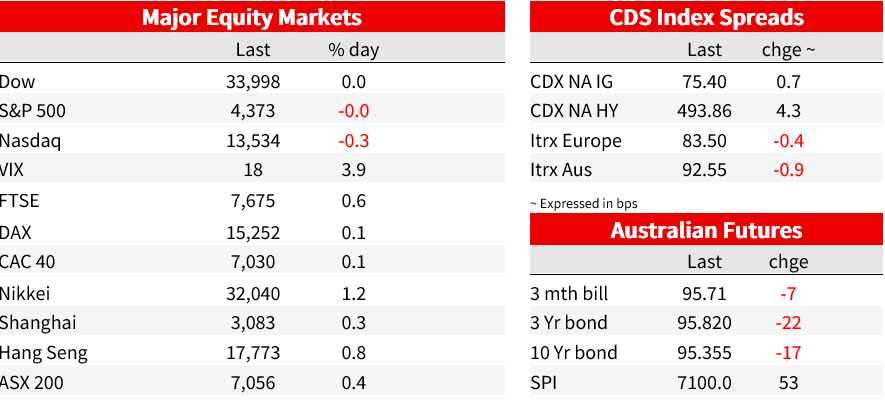

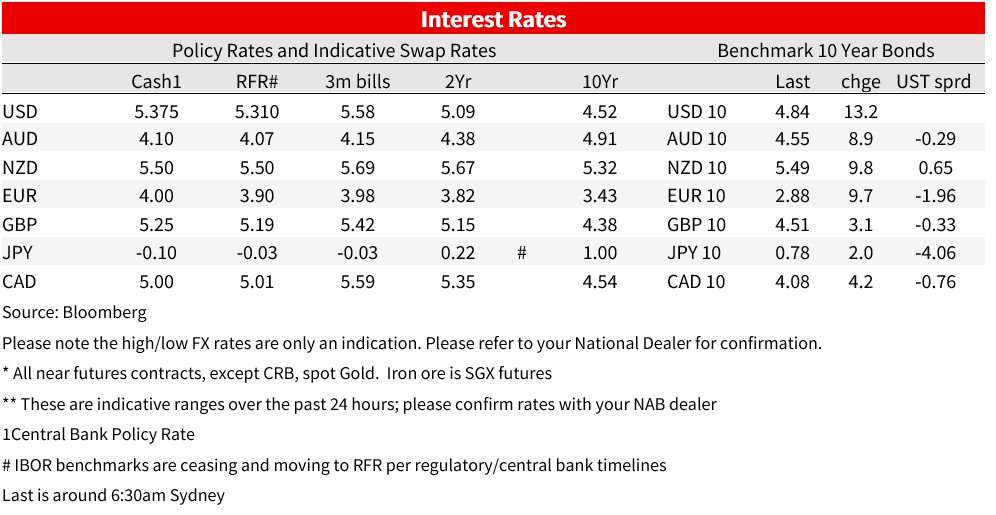

Two big pieces of news overnight. The first was a very strong US retail sales number (core control +0.6% m/m vs. 0.1% expected). The second being news that President Biden is visiting Israel today, while a mooted Israeli ground operation that was pencilled to start last week has yet to commence. The strong US retail sales number saw yields surge with the 2yr yield hitting a 16yr high. Over the past 24 hours the 2yr is up 11.0bps to 5.21% (high 5.24%) and the 10yr is up 13.9bps to 4.84% (high 4.86%). The rise in nominals continues to be fully reflected in real yields with the 10yr TIP yield +10.0bps to 2.41%; implied breakevens are little changed at 2.41%. Fed funds pricing moved higher following the numbers with a cumulative 15.9bps now priced by January 2024, up from 9.9bps yesterday. With that lift in pricing there is now only 69bps worth of cuts priced in 2024. No surprises then to see why 2yr yields hit a 16yr high. US equities were little changed (S&P500 +0.0%), with BofA (+2.3%) beating, but Goldmans (-1.6%) missing.

The potential for the Israel/Gaza conflict to be contained has seen oil and gold relatively steady overnight (Brent +0.7% to $90.28; Gold +0.1% to $1923). The situation remains in flux and Israel did tell its citizens to leave Turkey. The USD has been surprisingly steady, getting little enduring support from the lift in yields. DXY did show a knee-jerk rise, but the index is now flat on the day. Already long positioning may be one factor, as well as reduced risk aversion given President Biden’s visit today (USD/CHF +0.0%). There was a bit of volatility in the major pairs. The Yen late yesterday rose on a BBG BoJ inflation story, but quickly retraced with USD/JPY now +0.1% to 149.77 (BBG said the BoJ was mulling lifting the near-term inflation forecasts, but outlook for fiscal 2025 is likely to remain around the current forecast of 1.6%). Closer to home the lower than expected NZ CPI saw the NZD fall and over the past 24 hours is -0.5% to 0.5895. Against that the more hawkish RBA Minutes provided some AUD strength (+0.3% to 0.6361) with AUD/NZD +0.8% to 1.0791.

US retail sales was the major piece of data and it was strong across the board. Headline retail sales were 0.7% m/m vs. 0.3% expected, and the core control measure which feeds into GDP was 0.6% m/m vs. 0.1% expected. Also beating was industrial production (0.3% m/m vs. 0.0). Following those numbers the Atlanta Fed’s GDP Now for Q3 stands at 5.4%, well up on its 5.1% of last week. It is clear activity in the US remains strong. The Fed’s Barkin also spoke and said “data will tell you that demand is not weak” and “data will also tell you that the labour market is not weak”. However, for Barkin he is picking up anecdotes of softness which is why he is more cautious: “ there is somewhat of a disconnect between the data and what I hear on the ground”, “I’m hearing demand is softening. Interest-sensitive sectors like yours are of course feeling the impact of higher rates. Businesses that sell to lower-income consumers tell me those consumers are stretched thin and reprioritizing their spend. Middle-income consumers are trading down” (see: Barkin: Looking beyond recent data).

In Australia, the RBA October Board Minutes were more hawkish than recent RBA communications. Key was this statement: “The Board has a low tolerance for a slower return of inflation to target than currently expected” which was inserted into the concluding paragraph . The November RBA Meeting is clearly live. NAB expects the RBA to hike rates by 25bps to 4.35% given our Q3 trimmed mean CPI expectation of 1.1% q/q vs. the RBA’s 0.9%. If the RBA does hike in November as we expect, we think the RBA would still retain a tightening bias given ‘low tolerance ’ for a slower return of inflation to target. The downside skew of risks to the consumption profile appears to be lessening given rising household wealth via house prices. There was no talk of active QT. Market reaction to the Minutes was sharp alongside the syndication of the new 54 bond (the 3yr future was down some 10bps, and overnight extended further by 7bps. Over the past 24hrs it is down by 21bps). The OIS market though still only prices around 10.0bps for November and a full hike is note really priced until May at 24.3bps.

Elsewhere, Canadian CPI figures for September slightly undershot expectations, with the headline rate falling to 3.8% and the average of the trimmed mean and weighted median core measures down to 3.75%. The softer print reduced the chance of the BoC hiking again next week from 45% to 15% on market pricing. Canadian rates didn’t follow the move higher in US Treasury yields but there was little evident damage done to CAD, with the currency only modestly weaker for the day. UK wages growth showed signs of some easing in pressures, with the headline figure down to 8.1% y/y in the three months to August from 8.5% previously and the ex-bonuses figure down to 7.8%, from an upwardly revised 7.9%. The data helped support the view that the BoE won’t probably hike in early November, although CPI data released tonight will also be keenly awaited.

Yesterday, NZ’s Q3 CPI report showed notably lower annual inflation of 5.6% compared to the RBNZ’s estimate of 6.0%. All key core inflation measures conveyed a picture of weaker underlying inflation pressure, with the average of four measures published by Stats NZ (10% and 30% trimmed means, weighted median and CPI ex food and energy), down to an eighteen-month low of 5.3%, after spending the past four quarters at, or above, the 6% mark.. The data supported the RBNZ’s “neutral” policy outlook, believing that it has done enough tightening to bring inflation back down to target and the market priced out some chance of further tightening. However, the market still prices a near-even chance of a 25bps hike by February, down from a 75% chance.

Coming up:

Market Prices

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets. Read our NAB Markets Research disclaimer.

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.