Online retail sales growth slowed in May following a fairly strong April

Insight

US stocks had a positive day on Friday, so further recouping some of last Tuesday and Wednesday’s pre and post CPI weakness

https://soundcloud.com/user-291029717/us-facing-higher-prices-more-quits-falling-sentiment?in=user-291029717/sets/the-morning-call

US stocks had a positive day on Friday, so further recouping some of last Tuesday and Wednesday’s pre and post CPI weakness. Following the day’s main economic event – a sharp and unexpected fall in consumer sentiment – US Treasury Yields fell, in bull-steepening fashion while the USD weakened slightly, but with losses for the DXY index restrained by the failure of the EUR/USD exchange rate to rally, spending most of Friday below 1.1450. AUD staged a decent rally though, back to above 0.7330 to be Friday’s strongest major currency. Focus today is on China’s latest (October) activity readings to gauge the current state of play vis-à-vis China’s evident sharp growth slowdown.

The University of Michigan’s preliminary Consumer Sentiment Index on Friday was a bit of a shocker , the headline index falling to 66.8 from 71.7 to its lowest since November 2011 and versus 72.5 expected. Both the Expectations component (62.8 from 67.9) and Current Conditions (73.2 down from 77.1) were to blame. Unlike the weakness seen in the UoM – and Conference Board – readings during the summer months when covid infection rates were rising, this latest fall comes amid a backdrop of recent sharp falls in infection rates, hospitalisations and deaths. This then lays responsibility for the latest fall squarely at the feet of inflation and the impact it is having on households real incomes – and for the time being expected to continue doing so. The latest lift in gasoline prices, to above $3.70 a gallon (highest since 2014) is one such culprit, with the proportion of respondents expecting gas prices to rise over the next year rising sharply this month, to 31.9% from 22.0%.

This said, and as we learned over the US summer, it will be important to watch what (still cashed-up) US consumers do rather than what they say, in which respect tomorrow night’s October Retail sales figures take on added importance . So too will the equivalent Conference Board Consumer Confidence reading due at the start of December, which has tended to be more sensitive than the UoM survey to the (improving) covid situation. Suffice to say if consumer confidence, and (real) spending is seen to be suffering under the weight of 6% consumer price inflation, then it suddenly become a political problem for the White House, not just a headache for the Fed.

As for the Fed, NY Fed President John Williams , one of the heavy hitters on the FOMC, didn’t comment directly on last week’s inflation data in remarks on Friday. He was asked about maximum employment, and said “I think about, in terms of maximum employment, in terms of what can we achieve, if you talk about a balanced growth path or a steady state in a really strong economy, that is consistent with 2% longer-run inflation”. Hardly illuminating vis-a-vis the current near 6% CPI inflation rate and employment still some 4 million shy of pre-pandemic levels, though Williams did acknowledge that higher inflation does not affect all households equally, with people on fixed incomes taking a bigger hit. A statement of fact, though in the context of the Fed’s socio-economic agenda of maximising employment and reducing inequality, is of some note (i.e., if you’ve already got a job, your real income is now going backwards). If the Fed needs a pretext for lifting rate ahead of what it perceives to be maximum employment, then here’s one. Minneapolis Fed President Neel Kashkari has just been out saying the Fed ‘has taken appropriate steps in the face of (now 6%+) inflation. Right.

JOLTS (job openings) data for September was also out Friday, and at 10.438 million was above expectations and came off an upward revised 10.629 million in August. Of note here is that the ratio of job opening to job seekers rose to 1.59 in September to be the highest in the more than twenty year history of the series. It will like have risen further in October. Within the report the quits rate, a favourite indicator of former Fed Chair Yellen, hit its highest level on record (since 2001), at 3%. A high quits rate is often indicative of growing wage pressure, with employees quitting to move to better paid jobs elsewhere. Wage growth, as measured by the Atlanta Fed’s Wage Growth Tracker, was at 4.1% y/y in October, its highest level since 2008.

Market-wise, US stocks put in a better showing Friday with the S&P500 up 0.7% and the NASDAQ +1.0%, in which respect it may be worth noting the rise in break-even inflation rates on Friday, with 10-year break even inflation rates rising to 2.71% and close to record highs, implying that real bond yields are falling back once one (10-year TIPS yields by some 25bps this month alone (to -1.15%). This is one possible explanation for the outperformance of the more-interest rate sensitive NASDAQ, though on the week, it was a down one for both the S&P500 and NASDAQ and the latter underperformed (-0.7% vs -0.3% for the S&P), in which respect the potential Fed policy implications of high and rising inflation are what carried the week. European stocks were mixed Friday, the Eurostoxx 50 up but UK FTSE down. In APAC, the Nikkei continues to do well, (+1.1%) and where hope for strong fiscal stimulus are one currently supporting influence, while on the week Europe and most of APAC had a better week than North America (e.g. the Hang Seng was up almost 2% against the NASDAQ’s -0.7%).

In the nominal bond world , the US Treasury curve initially bull steepened on Friday in the wake of the consumer confidence report, with the 2-year Note down some 3bps at one point, though comparing Friday’s to last Wednesday’s closes (market was shut Thursday) 10s were about 1bp higher while 2s finished unchanged. On the week, both 2 and 10-year Treasuries are a11bps higher, testament to the dominant influence of the mid-week CPI shock. European 10 year yields were also mostly higher on the week (but Bunds by only 2bps) while the implied yield on Australian 10-year futures was actually down, by 2bps.

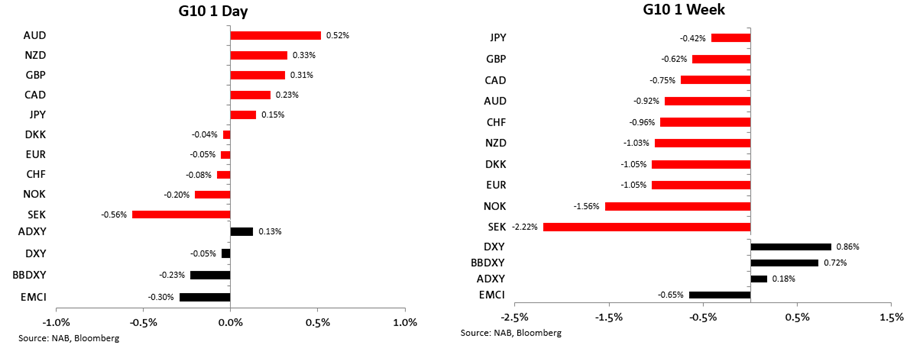

FX had an interesting week last week dominated by USD strength, reflected in the DXY index being up 0.9% (and little changed on Friday). While this was in large part of a story of outright USD gains post the CPI report, some of it has to do with independent EUR weakness. EUR/USD fell below the psychological 1.15 level last Thursday and languished near 1.1450 all Friday. Covid infection curves moving in the wrong direction are part of the reason (e.g. in Germany now above the late 2020 and Spring 2021 prior peaks) while renewed restrictions are being imposed in Austria and the Netherlands. The implications or both growth and ECB policy are not being lost on currency markets. As for AUD, it managed to pull its socks up Friday to be the best performing G10 currency, up 0.5% to above 0.7330, for no obvious reason (albeit we continue to highlight a still very short speculative market). On the week though, AUD/USD lost 0.9%, putting it mid-back on the G10 scoreboard

Finally a mixed week for commodities, but a big fall in iron ore futures on Friday (down 4.4%) after what had been a fairly steady week through Thursday, taking the Singapore contract (just) to fresh year to date lows. Base metals had a better week though amid some hopes for relief for China’s embattled property sector, Aluminium up over 5% and copper almost 3%. Oil was weaker on Friday, WTI and Brent both off 1%, but loses ion the week were slightly less than this.

Read our NAB Markets Research disclaimer

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.