Online retail sales growth slowed in May following a fairly strong April

Insight

Fed speak was not market moving, but it is worth noting it is mostly turning slightly hawkish.

https://soundcloud.com/user-291029717/us-continues-a-slow-recovery-europes-mounting-issues?in=user-291029717/sets/the-morning-callOverview

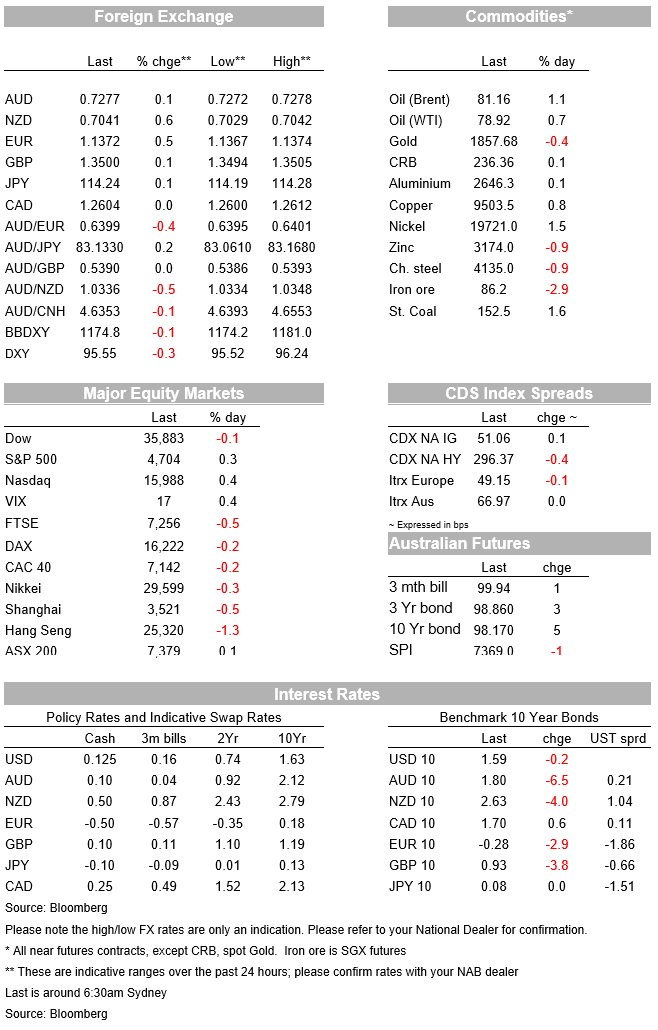

A quiet night in terms of news flow with markets similarly little moved. The S&P500 is up 0.3%, while yields are slightly lower with the US 10yr -0.3bps to 1.59%. The implied 10yr inflation breakeven was little changed at 2.72% with real yields also little moved at -1.15%. Data has been mostly second tier, but positive. US Jobless Claims fell marginally to a new post-COVID low (268k v. 260k expected) and the Philly Fed Manufacturing Index bounced sharply (39.0 v. 24 expected) with notable price pressures with the prices received lifting to its highest since June 1974. The USD (DXY -0.3%) has weakened after it reached a 12m high on Wednesday with the EUR (+0.4%) rebounding. The outperformer was the NZD (+0.5%) with the 2yr ahead inflation expectation yesterday bolstering the case for the RBNZ hiking cycle (2yr ahead inflation expectations rose to 2.96% from 2.27% last quarter). Note the RBNZ meets next week (24 Nov) with the market pricing 35bps of hikes, meaning there is a 40% chance of a supersized 50bp move.

Fed speak was not market moving, but it is worth noting it is mostly turning slightly hawkish. The Fed’s Williams in a fireside chat noted acknowledged inflation had picked up (“we are seeing some broader-based increases in inflation”) and while “supply constraints are a major factor”, “you wouldn’t want those long-run inflation expectations to move significantly further up”. Williams who is the NY Fed President is seen at centre of the FOMC along with Powell and Clarida, and suggests the centre is starting to shift towards a hawkish direction given the persistence of inflation. An MNI interview on Wednesday with the Dallas Fed economist Dolmas also highlighted that there has been a clear rightward shift in price changes within the PCE basket and that the alternative trimmed mean measure of underlying inflation is set to hit 2.5% in 2022. Come the December FOMC meeting it is very likely the Fed pencils in at least one rate hike in 2022 (at the September FOMC it was 9 v. 9 on a 2022 hike). Markets price the first hike by June 2022.

The second-tier data is worth a glance with the Philly Fed Manufacturing Index showing immense prices pressures. The headline index was better than expected at 39.0 v. 24, but of more interest was the prices received index lifting to its highest level since June 1974! To be clear, that’s priced received, not prices paid, which suggests manufacturers are passing on price increases. The survey noted nearly 66% of firms reported increases in prices of their own manufactured goods. In terms of the rate of future price growth, respondents forecast an increase of 5.3%, up from 5.0% when the question was last asked in August – over the past the price increase was 5.0%. Worryingly for the Fed, especially with the Fed’s William’s comments on inflation expectations above, the survey’s median forecast for the long-run (10-year average) inflation rate was 3.5%, an increase from 3.0% in August. Long-run inflation expectations within this second-tier survey are thus clearly shifting higher.

As for yields, they were slightly lower with the US 10yr -0.3bps to 1.59%, with steeper falls in Europe (German 10yr -2.9bps to -0.28%; UK 10yr -3.8bps to 0.93%). The market has pushed back its expected timing of the first 10bps ECB rate hike to early 2023 following recent dovish comments from ECB officials and the surge in Covid cases in the region, which has led several countries to implement tougher COVID restrictions. There’s been no word yet on the future US Fed Chair, though Senator Manchin seemed to line up behind Powell which is notable given Manchin’s insistence that the Fed needs to act to rein in inflation (Manchin said: “Well we’re looking very favorably towards that, because I needed that conversation with him. But I have not made up my mind yet. But I’m just saying that it helped an awful lot having him clear up a lot of the concerns I had ”). At the risk of reading too much into appointments, a Manchin backing may indicate a Fed that is prepared to turn slightly hawkish to tame inflation.

Also in rates, Turkey’s central bank cut its cash rate 100bps overnight, with the Turkish lira plunging 3.6% to a new record low. President Erdogan has replaced senior central bank officials over the past year with officials sympathetic to his unconventional view that higher interest rates are a cause of higher inflation. The policy experiment is going to be put to the test with Turkish CPI already running at around 20% y/y and the fall in the lira only likely to exacerbate inflationary pressures. The lira has weakened more than 30% against the dollar this year, and over 15% this quarter alone, the worst performer among all major currencies.

As for broader FX moves, the USD was weaker overnight after its recent strong run. The BBDXY and DXY indices, which reached 12-month highs on Wednesday night, are down by 0.1-0.3%. The EUR has recovered some lost ground, up 0.4% overnight to 1.1387. The NZD has outperformed after the RBNZ’s 2-year ahead inflation expectations series hit a 10-year high (see more below). The NZD is up 0.5% from this time yesterday, at 0.7030, while the AUD/NZD cross has pushed down to 1.0338 with the AUD little moved overnight (+0.1% to 0.7275), the AUD/NZD is now at its lowest in two months.

Equity markets have been broadly positive with the S&P500 +0.3%, but the NASDAQ -0.1%. Both a near record highs. Strong earnings continue to be supportive with chipmaker Nvidia (+8.5%) beating expectations with other chipmakers also higher. Other notable reports included Macy’s (+21%) which also beat estimates by a long way with same store sales +35.6%, along with Kohl’s (+7%). The positive earnings by retailers suggests there has been little impact so far from consumers’ fears around inflation and their spending patterns. The potential for that to occur of course remains if policy makers do not act and inflation remains persistently high. Other moves worth noting include Apple (+2.5%) and Amazon (+3.0%); Apple’s moves comes as it gave heightened focus on its electric vehicles.

Finally, in Japan, the Nikkei reported that the government was planning a ¥55.7tn (~10%/GDP) fiscal stimulus, larger than previously reported, with details due to be announced today. The size of the stimulus reportedly includes loans and previously unused funds, so the net ‘new’ stimulus will be lower than the headline implies.

Very quiet in Australia with no data scheduled. Offshore the focus will be on central bank speakers with BoE Chief Economist Pill speaking, while across the pond Fed Vice-Chair Clarida and Governor Waller are on the wires. Details below:

Read our NAB Markets Research disclaimer

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.