Our global forecasts are unchanged and we continue to expect soft global growth of only 3.0 to 3.1% between 2024 and 2026.

Insight

Rising COVID infections around Europe and news that Austria will go into lockdown rattled markets on Friday with 10y Bunds leading a decline in core global bond yields.

https://soundcloud.com/user-291029717/a-speedy-taper-and-european-tantrums?in=user-291029717/sets/the-morning-call

Rising COVID infections around Europe and news that Austria will go into lockdown rattled markets on Friday with 10y Bunds leading a decline in core global bond yields. Hawkish talk from Fed officials contributed to a flattening of the UST curve while the USD got a double boost from rates and a safe haven bid. European equities were the big underperformers on Friday with AUD and NZD also weaker. The US House passed Biden’s Build Back Better Bill, but its Senate fate remain uncertain.

After a steady start to the overnight session, market sentiment was dented by news that Austria would go into a 20 day nationwide lockdown with the government also outlining its intention to make vaccination compulsory by February 1st – the first major developed country to do so. A week ago, the Austrian government introduced lockdown plans for the unvaccinated, but exponential rise in infections has forced it to introduce more drastic measures.

This of course is not just an Austrian story, covid infections are rising at an alarming rate around Europe with other EU governments also introducing restrictions with the risk that they may also need to follow Austria’s drastic measures. Germany, which currently has a higher vaccination rate than the US just above 67%, is one big focus with the country also experiencing a record high in covid cases. The government has imposed strict restrictions on the unvaccinated and as of Friday it ruled out a nationwide lockdown, but that’s where Austria was a week ago. Slovakia and the Czech Republic have imposed restrictions on people who are unvaccinated while in Belgium, employees will be made to work from home for four days a week until mid-December.

The introduction of restrictions has triggered a series of protest around Europe over the weekend with thousands of demonstrators taken to the streets in the Netherlands Austria, Croatia and Italy as anger mounted over new curbs.

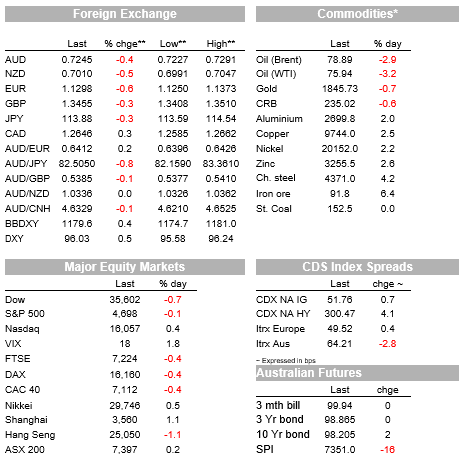

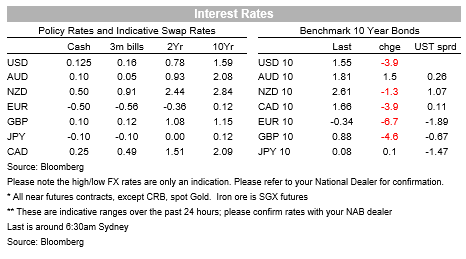

News of Austria’s lockdown triggered a broad risk off reaction in markets with a fall in 10y Bunds leading a decline in core global yields. 10y Bunds fell 7bps on the session to a two-month low of -0.34%, with the market pushing back the expected timing of ECB rate hikes into 2023. Crude oil plummeted 3%, as markets contemplated the possibility of similar measures in other countries, which would dent travel and oil demand.

Bond moves were also affected by hawkish Fed commentary with Fed Vice Chair Clarida and Board Governor Waller noting a faster QE tapering might be appropriate . Clarida reiterated that there were upside risks to inflation and said it “may well be appropriate at that [December] meeting to have a discussion about increasing the pace at which we’re reducing our balance sheet.” Waller highlighted the “rapid improvement” in the labour market and high inflation as reasons for a faster tapering, which would give the Fed flexibility to raise rates earlier “if necessary ”. The Fed Board which also included Fed Chair Powell and Governor Brainard has so far represented the centrist view, but hawkish remarks coming from Clarida and Waller could be signalling a shift in the group thinking or alternatively a break in the consensus board view. No governor has dissented from a monetary-policy decision since 2005.

Reaction to Fed hawkish remarks lifted short term rates, playing into a flattening theme. The 2-year rate reversed an earlier 6bps fall to finish 1bp higher on the day, at 0.51%, near its highest level in 18 months. The market is back to pricing the first Fed rate hike by July next year, just after its current tapering plan is scheduled to end, with around 65bps priced in by the end of 2022. 10y UST yields closed 3.7bps lower on the day to 1.549% while the 30y Bond was 5.8bps lower at 1.912%.

US equities closed mixed on Friday while Europe counterparts were broadly lower . The fall in longer dated UST yields contributed to tech shares outperformance while decline in oil and UST yields weighed on energy and financial stocks. The NASDAQ was up 0.4%, to a fresh record high, while the large weightings of mega-cap tech stocks, such as Apple, limited the S&P500 to a small loss of just 0.1%.

Looking at the week’s performance the NASDAQ is at the top of the leader board, up 1% while European indices had a mixed week. Of note the industrial heavy Dow Jones was the underperformer down 1.3%. The week’s equity performance reflects a rotation back into stay-at-home stocks with reopening sectors underperforming.

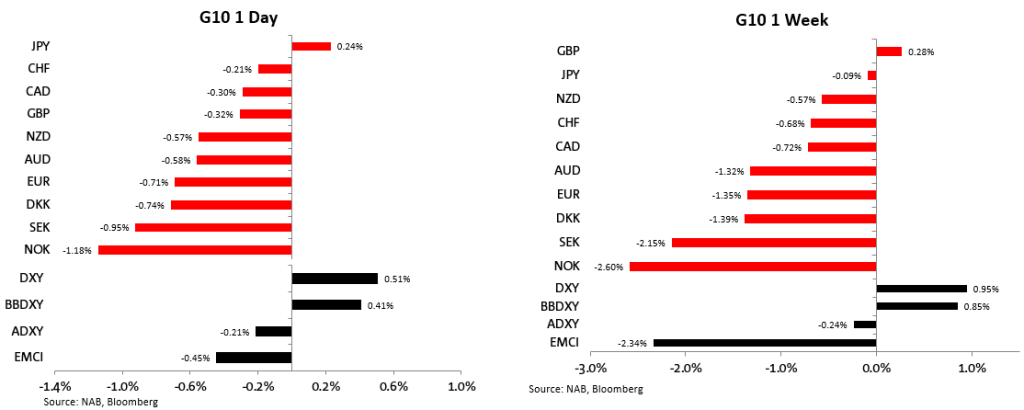

Moving onto FX. The USD remains in the driving seat broadly stronger on the day and the week with both the BBD/XY and DXY indexes closing at 12-month highs. JPY was the only G10 to outperform the USD on Friday, reflecting its safe haven attributes ( USDJPY opens the new week at ¥113.99) while to a large extent the USD gains on Friday and on the week come as a result of euro and other European currencies weakness.

The euro fell to an intraday low of 1.1250% on Friday, closing the week at 1.1280, 0.8% lower on the day. NOK (-1.18%) was the big underperformer on the day, in addition to the European covid related woes, the pair was also weighed down by the decline in oil prices.

AUD and NZD also struggled on Friday, but to a lesser degree compared to European pairs. The AUD traded to a low of 0.7227 and now start the new week at 0.7245. Meanwhile the kiwi briefly traded below the 70c mark and opens the new week at 0.7016.

In a latest sign that Beijing may be growing uncomfortable with the ongoing yuan appreciation, Bloomberg reports the China Foreign Exchange Committee encouraged lenders to be risk-neutral when trading foreign exchange for themselves and for clients. Banks were advised to better track their proprietary trading and improve risk management, citing a proposal made by core members of the organization that was circulated to members.

The Yuan is the best performer in emerging markets this year as it benefits from robust exports and foreign investments in onshore bonds. Against a basket of trading partners, the yuan last week soared to the highest since 2015, when the authorities devalued the currency to aid growth.

Looking at commodities, Brent and WTI were Friday’s underperformers on Friday with Iron ore enjoying a decent rebound. Iron ore advanced Friday amid expectations of more policy easing for the embattled property sector in China, closing 5.5% higher at $91.06 in Singapore.

In other news, US Congress passes Biden’s $1.75tn ‘Build Back Better’ social spending bill, which includes funding for, amongst other things, universal preschool and climate change. The bill now heads to the Senate where it is likely to encounter resistance from moderate Democrats, such as West Virginia’s Joe Manchin, and amendments are likely. Top Democrat Senator Schumer said he wants to pass the bill before Christmas, although it remains uncertain whether it will be able to satisfy both the progressive and moderate elements of the party. There is no margin for error with the Democrats holding a wafer-thin majority in the Senate and the Republican party lined up against the bill.

In a Sunday Times interview, BoE Governor Bailey said the state was, in effect, competing against the recovering private sector in a tight labour market by hiring extra workers. He also dismissed the “unreliable boyfriend” label in reference to the misguided market impression that the Bank was going to hike in November, Bailey added that the Bank was in the “price-stability business” — meaning its core purpose is to control inflation, not support economic growth. The BoE remains concern over the two-sided risk to inflation with providing no hints a December hike is a consideration

The FT this morning is running an article confirming yet again that China’s hypersonic weapon test in July included a technological advance that enabled it to fire a missile as it approached its target travelling at least five times the speed of sound – a capability no country has previously demonstrated.

Read our NAB Markets Research disclaimer

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.