Long-term signal vs. Short-term noise

Insight

Omicron uncertainty triggers a rethink on the global economic outlook

https://soundcloud.com/user-291029717/did-the-markets-overreact-to-omicron-news?in=user-291029717/sets/the-morning-call

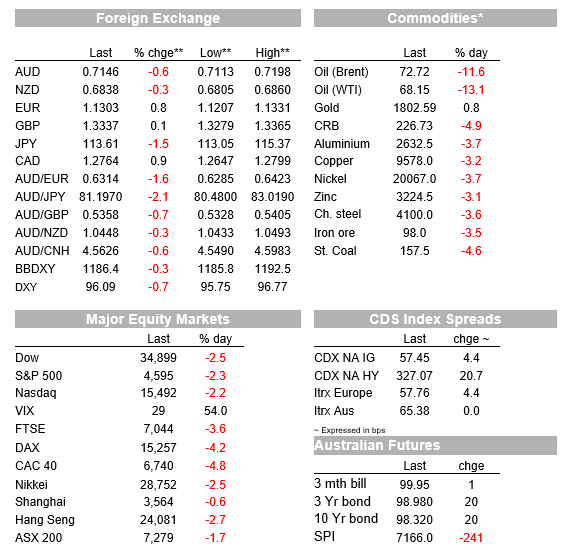

Against expectation for a quite end to the week, given a US post-Thanksgiving half session, news of a new covid variant of concern (Omicron) sent markets into a tailspin on Friday. There is a lot we don’t know about Omicron, but markets have been forced to reassess the global growth outlook until we know more. European and US equities recorded sharp declines with the flight to safety triggering a big drop in core global yields alongside a delay in central banks rate hike expectations. True to form safe-havens FX pairs, JPY and CHF, outperformed while the Euro also gained on short covering flows. Main USD indices edged a little bit lower and pro-growth risk sensitive currencies like the AUD and NZD fell. Pfizer expects to know within two weeks if Omicron is resistant to its current vaccine

others suggest it may take several weeks. Until then markets are likely to remain jittery

News of a potentially dangerous new Covid-19 variant originating from Southern Africa hit the headlines during our APAC session on Friday triggering a broad risk off price action across markets . The WHO has formally designated it a variant of concern and named it Omicron. Preliminary studies suggest Omicron is outcompeting other variants a very fast pace. For instance, in the Gauteng province in South Africa, Omicron has become the dominant variant with around 900 of the 1018 new infections detected last Wednesday. These are still early days, but the new heavily mutated variant is also seemingly spreading a lot faster than previous variants, detected cases and percent testing positive are both increasing rapidly. Given what we know from previous variants, Omicron’s high level of mutation is typically associated with greater transmissibility and immune evasion. Scientists have warned that Omicron’s large spike protein number could potentially mean vaccines, which target the spike protein, might be less effective against it. On a more positive note, the Chair of the South African Medical Association observed that the cases she had seen so far had caused “mild disease ”, without prominent symptoms, in healthy younger people.

Cases have been detected in many countries outside of Africa including Israel, Belgium, Germany, the UK, the Netherlands and Australia with governments around the globe introducing new travel restrictions in order to stem Omicron’s spread . UK PM Johnson said arrivals from all countries would have to self-isolate until receiving a negative result from a PCR test, that face masks must be worn in retail settings and it was time to step up booster jabs. Similar measures have also been introduced in other countries.

From a market perspective Omicron’s uncertainty has triggered a rethink on the global economic outlook. A new covid wave may or may not be more infectious or deadly, but until we know more markets are likely to remain jittery . Pfizer expects to know within two weeks if Omicron is resistant to its current vaccine, others suggest it may take several weeks. Professor Sir Andrew Pollard, who helped create the Oxford/AstraZeneca vaccine, said experts would need to wait “several weeks” for confirmation but encouragingly he also said existing jabs could still be effective at presenting serious illness.

Risk assets were sold abruptly on Friday as investors asses the potential impact on the global economic recovery from new lockdowns and restrictions. European equity markets endured their worst day in 17 months with the Eurostoxx 50 index down 4.74%. Omicron has come at a time when Europe is still battling a fourth covid wave. US equity markets fared a little bit better in a post-Thanksgiving holiday shorten session. The S&P500 was off 2.4%, its biggest one day fall since January with cyclical sectors, including energy (-4%) and financials (-3.3%), hit particularly hard while the tech and stay-at-home stocks that benefited from last year’s lockdown (think Zoom and Peleton) outperformed. The VIX index jumps 10pts to 28 with low liquidity withthe post -Thanksgiving session probably exacerbating the increase in volatility.

On the week European equities endured the biggest decline the Eurostoxx 50 index fell over 6% with the DAX not too far behind. The S&P 500 was -2.20% while China’s CSI 300 faired better, down just 0.61%.

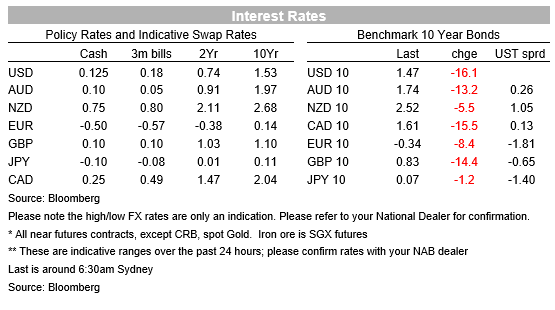

The flight to safety resulted in a sharp decline in core global yields with the market reassessing the global growth outlook alongside a delay in major central banks rate hike expectations . The US 10-year rate was down 16bps, to 1.49%, the 2-year rate was off 14bps, to 0.50% and the 5-year rate dropped 18bps to 1.161%. Looking at the week’s price action the UST curve bull flattened with the 30y leading the decline, down 9bps to 1.825%.

Similar moves were seen in other markets, with the German and UK 10-year rates down 9bps and 15bps respectively on Friday. On Thursday the market was pricing a Fed Funds rate of 0.58% in a year’s time and now it sees a rate of 0.43%. Meanwhile the market now prices only a 50% chance of a 15bps Bank of England rate hike next month.

Moving onto FX, the USD ended the week slightly lower with safe haven pairs outperforming. JPY and CHF gaining 1.72% and 1.38% respectively. Somewhat surprising the euro gained 0.96%, reflecting, in our view, the unwinding of Fed rate hike expectations and a short covering flow as investors took risk off the table, the euro opens the new week at 1.1331.

Commodity and risk-sensitive currencies naturally took a hit, as they typically do when markets worry about the global growth outlook. The plunge in oil prices ( see chart further down) saw the CAD and NOK down more than 1%, while the AUD was down 0.9%, to near its lowest level in 12 months , the AUD begins the new week at 0.7143, a few bps higher relative to its closing level on Friday. The NZD performed comparatively well, down only 0.4% on Friday, ending the week near its year-to-date lows, at 0.6820, but just like the AUD, it is up a little bit early on Monday, now trading at 0.6839.

Oil prices were hit hard on Friday with the market downgrading the demand outlook for energy. WTI fell around 13% to $68.17 while rent fell around 11% to $72.90. Gold was little changed on Friday and down 3.57% on the week. Iron ore was the big performer on the week, up 6.24% with metal prices around the middle of the pack, down around 2% on the week.

Read our NAB Markets Research disclaimer

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.