Todays podcast

https://soundcloud.com/user-291029717/theres-a-certain-uncertainty?in=user-291029717/sets/the-morning-call

Overview You Need to Calm Down

- Risk sentiment recovers alongside Omicron/vaccine headlines being net positive

- Fed rate hike pricing brought forward with Fed officials open to taper acceleration

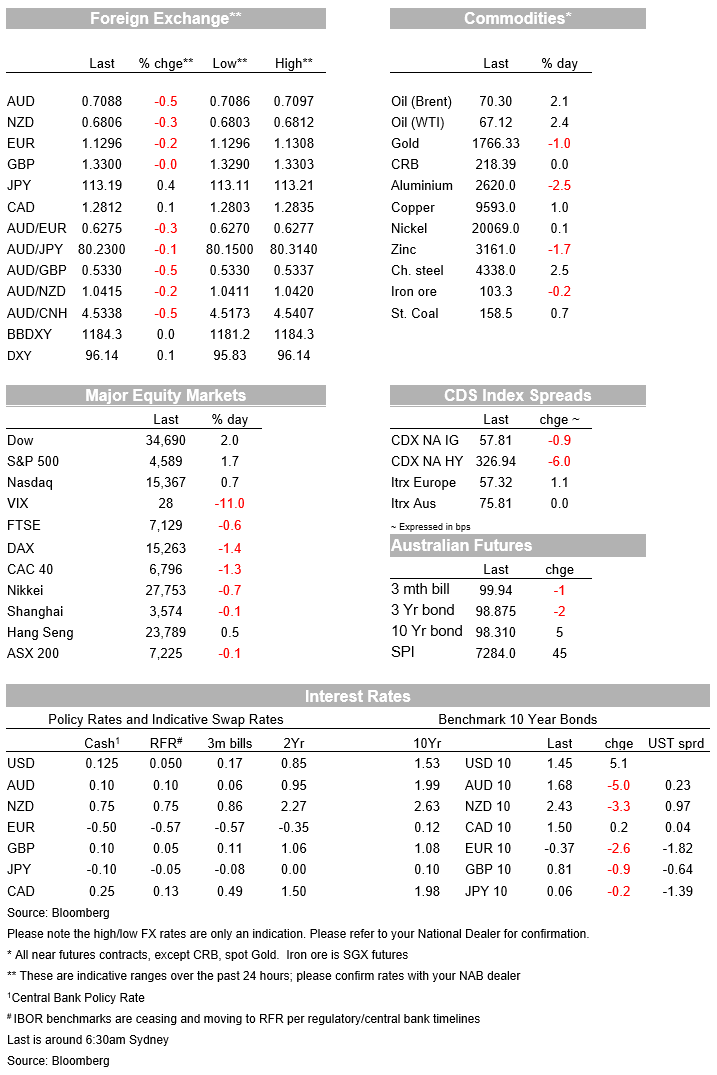

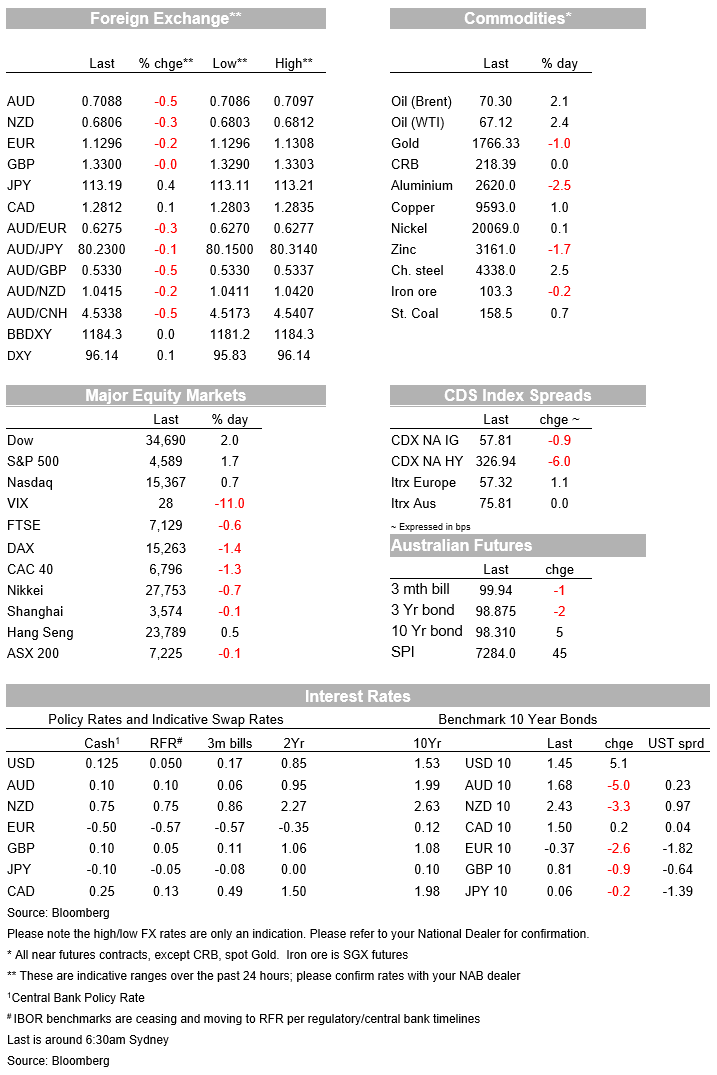

- S&P500 +1.7%: US 10yr yield +5.1bps to 1.45%; Brent Oil +2.1% to $70.30

- Coming up today: Caixin PMI, Final PMIs, US Payrolls, ISM Services

“You need to calm down; You’re being too loud; And I’m just like oh-oh, oh-oh, oh-oh, oh-oh, oh-oh; You need to just stop; Like, can you just not step on my gown?; You need to calm down”, Taylor Swift 2019

Risk sentiment recovered overnight with virus/vaccine news flow being net positive (note we should expect ongoing volatility as it will take at least two weeks to assess the severity of the Omicron variant and the efficacy of vaccines). News from South Africa continues to point to ‘mild’ symptoms for those who are fully vaccinated, Pfizer repeated what its vaccine partner BioNTech said earlier that it didn’t expect its vaccine would see a significant drop in efficacy, while early studies suggest that one Covid-19 antibody treatment by GSK/VIR is effective against certain omicron mutations. US Fed talk meanwhile continued to be hawkish with markets bringing forward rate hike pricing.

The S&P500 is up 1.7%, along with yields with the US 10yr +5.1bps to 1.45%. 2yr yields have lifted by more +8bps to 0.62%, meaning the 2/10s curve has flattened again -2.9bps to 83bps. With the Fed having tilted hawkish and more hawkish comments overnight by Bostic, Barkin, Daly and Quarles, markets have brought forward pricing for the first rate hike with May 2022 now 95% priced, from 86% yesterday. There is now 73bps worth of tightening priced for 2022 from 63bps yesterday. With the Fed expected to move earlier, market proxies of the terminal rate remain lower than they were last week with the 5Y1Y at 1.45%. As for equities, the rally was broad with all sectors in the green, especially re-opening stocks.

Fed talk overnight was undeniably hawkish with Daly, Quarles, Barkin and Bostic on the roster. Outgoing Fed Governor Quarles was the most open, noting that the Fed’s average inflation targeting framework/maximum employment was about “wait until we see the whites of their [inflation] eyes,”, but importantly ” we never said we’d let the army march over us. And so the army is upon us, and so now we’ll begin to fire.” For most FOMC speakers the broadening of price increases over the past two months have rung alarm bells which the Fed appears ready to react to. An acceleration in the taper profile so they finish by March 2022 (instead of June 202), which gives them optionality to hike in 2022 multiple times. As for how high rates will go, the Fed’s Daly said “I have no expectation right now that we will need to raise the rate beyond the neutral rate of interest, which I think by most estimates nominal-neutral is 2.5%,”. Markets of course price neutral/terminal significantly lower with 5Y1Y OIS at 1.45%.

Oil meanwhile has been volatile with OPEC+ meeting and sticking to its schedule of increasing production by 400k barrels in January, but importantly is open to immediate adjustments to production should the outlook worsen. Oil prices fell as much as 4.8% on the initial headlines, before rebounding to now be higher on the day (Brent crude +2.1% to $70.30). This has helped market-based inflation expectations recover, with the 10-year breakeven inflation rate in the US rising 4bps to 2.47%. FX meanwhile have been have been relatively stable with the BBDXY +0.0%. Reflecting of the recovery in risk sentiment USD/Yen rose +0.4% to 113.19. Meanwhile both the AUD and NZD remain close to their year-to-date lows and are trading around 0.7100 and 0.6810 respectively this morning. Both remain sensitive to the outlook given Omicron.

As for virus/vaccine news it was on net positive. News out of South Africa reveals a surge in new Covid cases and hospitalisations with the Omicron variant expected to quickly outcompete Delta and become the dominate strain. Within that news though there were glimmers of hope with the Anne von Gottberg, an expert at the South Africa’s NICD noting: “ we believe the number of cases will increase exponentially in all provinces of the country. We believe that vaccines will still, however, protect against severe disease. Vaccines have always held out to protect against serious disease, hospitalisations and death.” Scientists from the same institute have also noted initial data suggests Omicron may provoke less severe illness than previous variants although that may be skewed by the cases having been identified in younger individuals.

That cautious positivity was reflected in words by Pfizer, who re-iterated the comments from their vaccine partner BioNTech in stating that it didn’t expect its vaccine would see a significant drop in efficacy. Also overnight one early lab test suggested the Covid-19 antibody treatment by GSK/VIR is effective against certain omicron mutations (WSJ: Glaxo Says Its Covid-19 Antibody Drug Is Likely Effective Against Omicron ). You scribe also notes that it of course remains still early days as far as lab testing for existing vaccines which will likely take at least two weeks. Given vaccine makers had started those efforts earlier in the week, we may have the first assessment of efficacy in 8 or so days. Meanwhile Germany is said to announce new restrictions on unvaccinated people to motivate more people to become vaccinated. Merkel also flagged that Germany might follow Austria in making vaccination mandatory from February next year as an “act of national solidarity”, with a vote in parliament likely to happen soon.

Finally, there was little in the way of data overnight. US Jobless Claims were 222k against 240k expected. There had been a lot of uncertainty around whether the fall in jobless claims last week to 190k and the lowest since November 1969 was real, or whether it reflected favourable seasonal factors. This week’s data suggests there was a signal despite the data usually being noisy around thanksgiving and into the holiday season. Meanwhile across the pond the Eurozone PPI printed hot at 5.4% y/y against 3.8% expected. It is likely the same challenge to the inflation is transitory theme will play out in Europe over the next few months. Meanwhile back in the US Treasury Secretary Yellen has flagged the possibility of easing some of the China tariffs as a way to reduce inflationary pressures.

Coming up today:

It is very quiet domestically with no data of note scheduled. In China we get the Caixin Services PMI which comes after the Caixin Manufacturing PMI disappointed at 49.9. The final services PMIs are also out today, though consensus sees little change on the preliminary number as is usual. Details below:

- CH: Caixin Services PMI: Will be looked out more closely given the Caixin Manufacturing PMI disappointed expectations at 49.9 earlier in the week. Consensus sees the Caixin Services PMI being above 50 at 53.0, but falling back from last month’s 33.8.

- EZ: Final Services PMI, Retail Sales, ECB’s Lane: The ECB’s chief economist is giving a key lecture at the ECB’s fifth biennial conference on fiscal policy and EMU governance. Datawise the final services PMI is expected to be unrevised at 56.6, while retail sales are expected to rise 0.3% m/m.

- UK: Final Services PMI, BoE’s Saunders: BoE MPC member Michael Saunders speaks at a BoE hosted event on “The outlook for Inflation and Monetary Policy”. Pertinent ahead of the December BoE meeting where markets price an 89% chance of the BoE lifting rates by 15bps on 16 December

- US: Payrolls, ISM Services: Payrolls would normally dominate, but Omicron headlines risk stealing the show as far was market impacts are concerned. The consensus looks for 545k jobs with the risks around that balanced with the high frequency HomeBase data pointing to around 570k jobs in November. The unemployment rate is expected to dip down to 4.5% from 4.6%, and average hourly earnings is expected to be 5.0% y/y. Also out is the Services ISM with the consensus for a still very high 65.0.

Market Prices

Read our NAB Markets Research disclaimer

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets