We expect NAB’s Non-rural Commodity Price Index to fall by 4.9% in Q2

Insight

Commodity market news overnight is a fresh surge in European gas prices

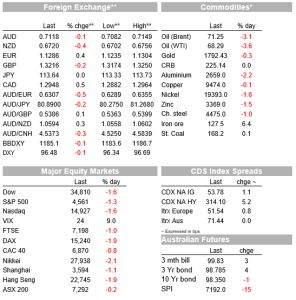

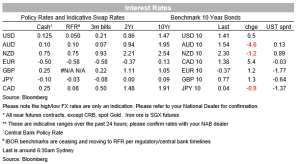

Risk asset markets come into the last hour of NYSE trade well into the red, but it’s not the bloodbath some might have feared when we left off yesterday, when US index futures were already off more than 1% (the S&P 500, Dow and NASDAQ are all currently down +/- 1.2%). The US Treasury curve has steepened slightly in ‘twist’ fashion (2s -1.4bp, 10s +1.4bp) while the USD is actually a touch softer overall, but only thanks to an (inexplicably) firmer EUR, which makes up nearly 60% of the DXY index. Certainly there’s no positive news around in Europe, where for example gas prices have surged another 8%. This is in sharp contrast to oil prices which are feeling the full force of cancelled travel plans, whether because of new restrictions or simply self-restraint as friends and families do what they can now to improve their chances of being able to be together, covid free, over the upcoming holiday period.

Emerging Markets worth a mention up front, with the Chilean Peso the latest to join the EM naughty corner following the election of the 35-year old leftist Gabriel Boric to the Presidency in the weekend run-off election. Investor concerns regarding taxation, social spending aimed at reducing inequality, and government regulation (with its potential impact on foreign investment) have collided to see the CLP off 3.5%. This was (past tense) alongside fresh weakening in the Turkish Lire yesterday morning – down over 10% – but which has rapidly reversed in the last hour or so, TRY now 25% up on its intra-day lows! The rebound has come, reportedly, on measures just announced by President Erdogan’s government aimed at protecting domestic savings from fluctuations in the currency.

Also to note is a generally unexpected reduction in China’s Loan Prime Rate yesterday, albeit by a token 5bps (to 3.80%) so economically rather meaningless, but confirmation at least that monetary policy has a distinct easing bias in contrast to most other central banks around the world. The move has had no detrimental impact on the Yuan however, USD/CNY rock solid near 6.37.

US stock market weakness is not all about the rise of Omicron (and other Covid-19 variant) caseloads and where the US is now following, as it typically has with a short lag, trends in Europe, though that is a big part of the story. The death, for now, of President Biden’s Build Back Better spending bill at the weekend after Virginia Senator Manchin’s outright rejection of it in anything close to current form – in part because of his view it will add to US inflation pressure at a time when prices are front and centre of US politics – has had some negative impact. One train of logic is that without ‘BBB’ the US will be subject to stronger fiscal headwinds next year at the same time that monetary conditions are tightening (Infrastructure bill spending notwithstanding, but which is small beer in comparison)

Oil prices, currently down 3.7% on the day for WTI but more than 5% a little earlier in the night, are proving the cleanest read on the impact of travel restrictions – whether mandatory or self-imposed – related to the spread of Omicron (and other Civid-19 variants). Positive vaccine news, with Moderna reporting high efficacy of its vaccine after a third (booster) jab, joining similar findings from Pfizer, isn’t resonating just at the moment (nor too news that former President Trump has just had his booster!). We are also on the lookout for Pfizer being granted EUA for its antiviral drug, application for which was submitted over a month ago (more time than it took for Pfizer’s vaccine to gain EUA last year). For now though, it’s the short term economic impact of the virus spread and related restrictions that is front and centre of market focus.

The other big commodity market news overnight is a fresh surge in European gas prices, up another 10% so binging the rise in December alone to 60% and year-to-date 7.7 times higher. In contrast, the equivalent Asia gas price is just over three times higher, and in the US (Henry Hub) just 28% higher.

In FX quite why EUR/USD is up 0.3% so holding the DXY USD index just in negative territory is a mystery to this scribe, given the complete absence of positive news, but which probably says something about rapidly shrinking market liquidity and the impact that order flow can then have on price. CAD and NOK have both taken an oil price hit, but NZD is, for now, proving to be the whipping boy for negative risk sentiment. AUD is off just 0.2% its flirtation with level back sub-0.71 (low of 0.7082 overnight) so far proving brief.

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.