Our global forecasts are unchanged and we continue to expect soft global growth of only 3.0 to 3.1% between 2024 and 2026.

Insight

Two events late in the session dominated price action. The first was a poorly received US 30yr Treasury auction. The second was not dovish comments by Powell who sounded still hawkish.

Key data/headlines

US: Initial jobless claims (k), wk to 4-Nov: 217 vs. 218 exp.

US: 30y Bonds draw 4.769% vs 4.716% pre-sale when-issued yield

BN: Powell: Not Confident We’ve Achieved Stance to Hit 2% Inflation

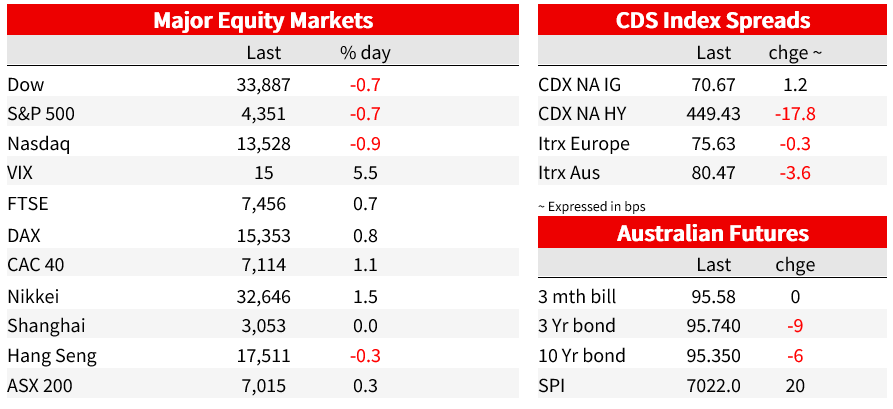

Two events late in the session dominated price action. The first was a poorly received US 30yr Treasury auction. The second was not dovish comments by Powell who sounded still hawkish. Yields leapt first in reaction to the poorly received 30yr auction (draw 4.769%; 4.716% pre-sale when-issued yield; bid-to-cover 2.24 from 2.35 previously; indirect 60.1% vs. previously 65.1%). Moves then extended (particularly at the short-end) as Powell spoke. This comment sounded particularly hawkish: “we are not confident that we have achieved such a stance [to bring inflation back to target],” though Powell did say “we will continue to move carefully, however, allowing us to address both the risk of being misled by a few good months of data, and the risk of overtightening. ” Expectations of rate cuts were pared slightly with 82bps of cuts in 2024 now priced, down from 87bps just prior to the remarks. Equities are in the red half way into the last hour of power with the S&P500 -0.8%.

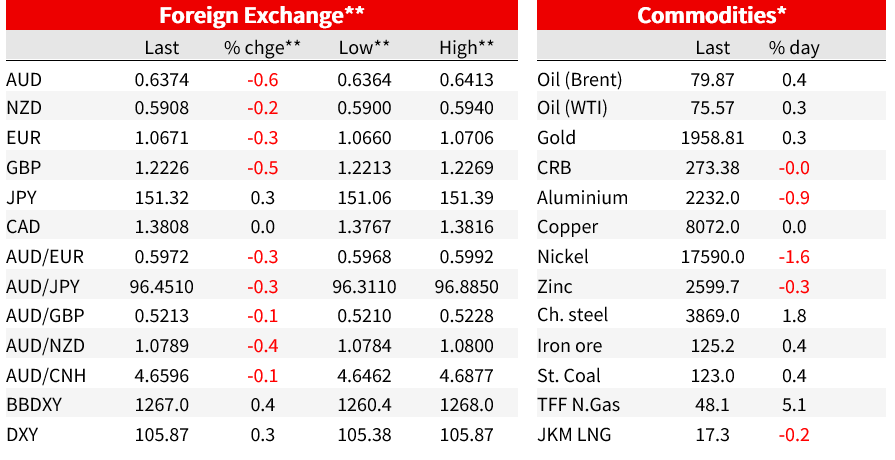

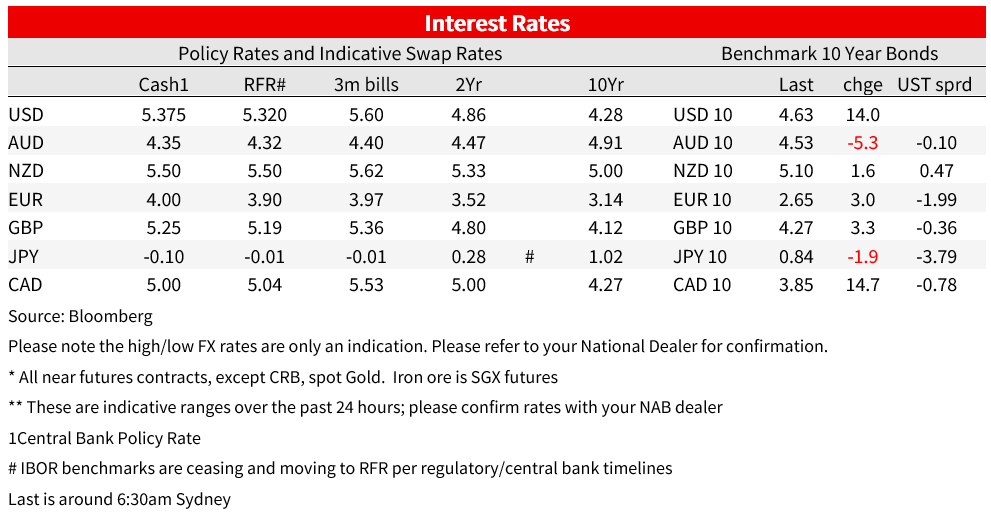

Over the past 24 hours the US 10yr yield is +13.8bps to 4.63% and the 2yr is +9.5bps to 5.02%. Ditto 30yr at +12.6bps to 4.78%. The USD rose alongside higher yields (although your scribe questions the logic given the poor Treasury auction) with the DXY +0.3% and most major pairs lower. EUR -0.4%; GBP -0.6%; USD/JPY +0.3% and now well above the 150 market at 151.31. BoJ Governor Ueda also spoke at the FT conference overnight and outlined a very cautious approach to unwinding ultra-easy policy (“ when we normalise short-term interest rates, we will have to be careful about what will happen to financial institutions, what will happen to borrowers of money in general and what will happen to aggregate demand…it is going to be a serious challenge for us.”). The AUD is one of the weakest at ‑0.6% to 0.6370 and is lower on the crosses with AUD/NZD -0.4% to 1.0788 with NZD -0.2% to 0.5908.

Fed speak was superseded by Powell’s comments which sounded hawkish to your scribe. The three key headlines that seemed to move markets were: (1) : “we are not confident that we have achieved such a stance [to bring inflation back to target],”; (2) wary of two sided risk – that is being “misled by a few good months of data, and the risk of overtightening”; and (3) expect activity to slow but that is what may have to happen – “Going forward, it may be that a greater share of the progress in reducing inflation will have to come from tight monetary policy restraining the growth of aggregate demand ”. Speaking earlier, the Fed’s Goolsbee was still optimistic of the gold path, while Barkin said he believed there was a slowdown was coming, but importantly “I believe we’re going to need that slowdown, because I think that’s what it’s going to take to convince price-setters the days of pricing power are over.”.

Data was relatively sparse and not market moving. US initial jobless claims were close to consensus at 217k vs. 218 expected, and consistent with a still tight and resilient labour market. Earlier in Asia, Chinese inflation data was soft but did not change the narrative given the recent run of soft data. CPI -0.2% y/y vs. -0.1% expected and PPI -2.6% y/y vs. -2.7% expected. The data though does keep the pressure on the government to continue with its incremental easing in monetary and fiscal policy.

Coming up:

Market Prices

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets. Read our NAB Markets Research disclaimer.

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.