We expect NAB’s Non-rural Commodity Price Index to fall by 4.9% in Q2

Insight

Central bankers globally seem to have switched to a more measured tone recently. Overnight tapas

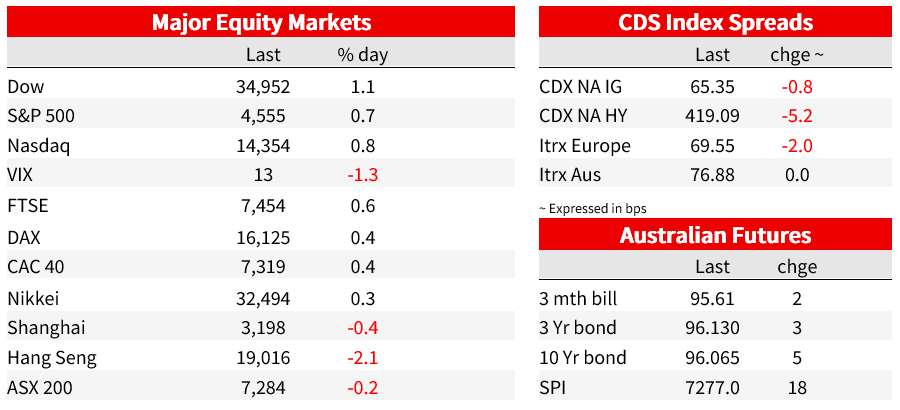

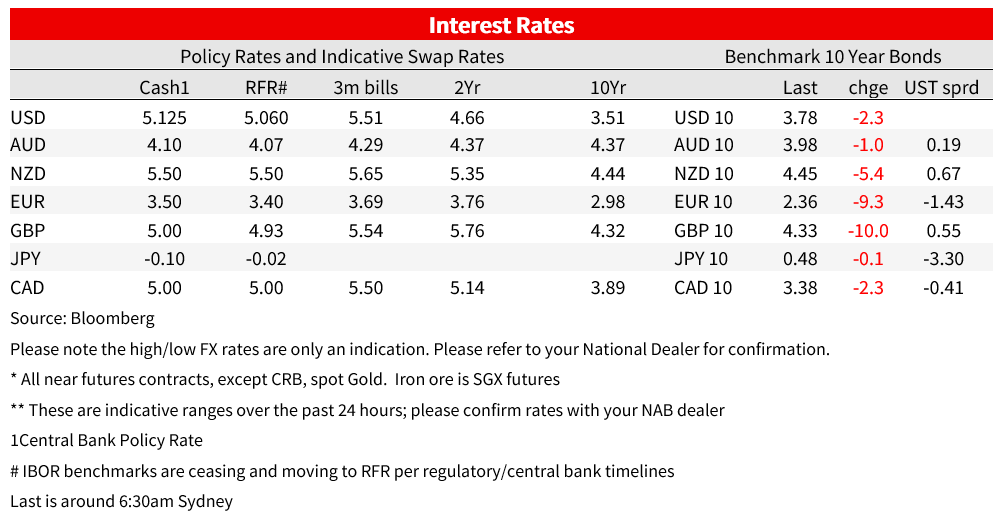

Central bankers globally seem to have switched to a more measured tone recently. Overnight it was the ECB’s turn with traditionally hawkish Knot saying that for a rate hike beyond July “it would at most be a possibility but no means a certainty…we have to carefully watch what the data tells us ”. European yields fell sharply in response with the German 2yr -13.2bps to 3.06% and the 10yr was -9.3bps to 2.36%. Peripheral spreads tightened (Italian-German 10yr spread -4.7bps to 163bps) and ECB pricing was pared with terminal now 3.87% by December from 3.91% yesterday. UK Gilts also rallied ahead of CPI figures later today (UK 10yr -10.0bps to 4.33%). A Bloomberg post of ECB Knot was “optimistic to see inflation hitting 2% in 2024” (which supported the rally in bonds) was later corrected to “ECB’s Knot says 2% 2024 inflation view is optimistic”.

As for US yields they mostly retraced the earlier German-led Bund rally, though were buffeted by US Retail Sales which while disappointing on the headline, was better on the details (core control sales 0.6% m/m vs. 0.3% expected). The Atlanta Fed’s GDP Now for Q2 was marginally upgraded to 2.4% annualised from 2.3% last week. US yields on net were little changed with the 10yr -2.3bps to 3.78% (low 3.73%, high 3.80%), and 2yr +1.9bps to 4.76%. Fed pricing was also little moved with a 96% chance of a July rate hike, and a 30% chance of a follow up hike by November. Beyond that there is 150bps worth of cuts by the end of 2024.

US equities were buoyed by the earnings season, with stronger than expected earnings reports from banks, including BofA (+4.4%) and Morgan Stanley (+6.4%), while Microsoft (+4.0%) rose after it announced charges for businesses to access its AI-assisted products. Microsoft said it would charge $30 a month for AI features in its widely used Microsoft 365 suite, a bigger than expected premium. For customers who sign up, the new features are set to add a hefty 53-83% increase to the average monthly cost of business-grade versions of the Microsoft 365 service (see FT: Microsoft to charge $30 per month for generative AI features ). Overall, the earnings season is off to a strong start with 84% of those reporting so far exceeding profit expectations. The S&P500 rose 0.7%, extending the strong rally seen over recent months, and is now only 5% away from its all time high, having rallied 27% from its low of 2022.

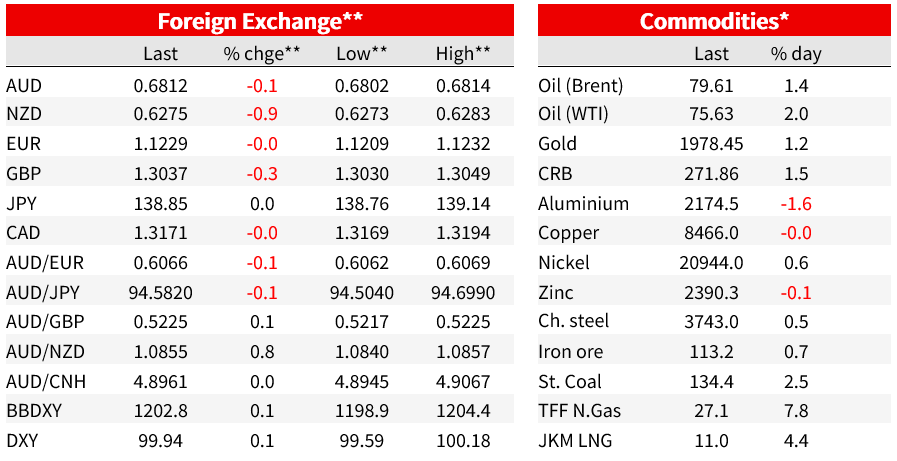

In currency markets the key mover has been a weaker NZD, for no obvious reason , apart from some anticipation of a softer Q2 CPI print this morning, against a backdrop of a broadly stronger USD. The NZD found some support at 0.6260 but is still down a chunky 0.9% overnight to 0.6275. The AUD meanwhile is -0.1% to 0.6812, broadly matching USD strength with DXY +0.1%. EUR (-0.0%), GBP (-0.3%) and JPY (USD/JPY +0.0%) are all modestly weaker against a well-supported USD. Ahead of the BoJ’s highly anticipated meeting at the end of next week, Governor Ueda overnight said that the Bank has continued with its ultra-easy policy stance under the “premise” that there is still distance to stably hitting its inflation target and “…unless the premise is shifted, the whole story will remain unchanged”. The implication is that unless the Bank’s inflation forecasts are significantly revised higher, its persistent monetary easing will continue. USD/JPY was back over 139 overnight and currently sits just below that level at 138.85.

As for data, US Retail Sales for June were mixed. Headline retail was softer than expected (0.2% m/m vs. 0.5% consensus), but there were upward revisions to history. Meanwhile core control sales, which feeds into GDP, was stronger than expected (0.6% m/m vs. 0.3% consensus). Overall, the data suggest that real consumers’ spending rose at around a 1% annualized rate in Q2, down sharply from the 4.2% surge in Q1. Industrial Production missed expectations at -0.5% m/m vs. 0.0% consensus, with manufacturing -0.3% m/m. Not much to see there given already well known weakness in the manufacturing sector which doesn’t appear to be spillover to the services side. On that note the Atlanta Fed’s GDP estimate for Q2 was marginal revised up to 2.4% quarter annualised, from 2.3 last week. Finally Home Builder sentiment was as expected at 56.

Also out overnight was Canada’s June CPI figures. Headline CPI came in lower at 2.8% y/y vs. 3.0% expected and 3.4% previously. The core measures showed less improvement with Trimmed at 3.7% y/y vs. 3.6% expected and 3.8% previously. The Median was 3.9% y/y vs. 3.7% expected and 3.9% previously. The BoC has been emphasizing that the last part of the disinflation process (from 3%-4% to 2%) will take time, and that view was supported by this data. Market pricing for the BoC was little changed with a 62% chance of a follow up hike by the end of the year.

Finally in Australia, the RBA Minutes for the July meeting did not contain much new information from Governor Lowe’s recent speech, where he seemed less definitive on the need for further rises and more attuned to potential growth risks. This tone was arguably reflected in the Minutes, though there was a strong case presented for further tightening. On balance, it seems that the data and risks will need to make the case for further tightening, by challenging the RBA’s stated aim of returning inflation to 3% by mid-2025. The Board is clearly waiting for the Q2 CPI (26 July), updated staff forecasts and a revised assessment of risks to make that call. NAB’s Q2 CPI preview suggests the RBA should raise rates again in August, but the reasons they paused in July present the risk that they may wait for more information on cost pass through (from higher energy prices and the recent minimum/award wage increase that take effect from July), which we expect to print during Q3 (see NAB note: AUS: RBA Minutes mark out Q2 CPI and updated staff forecasts for whether the RBA decides to hike in August for details).

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets. Read our NAB Markets Research disclaimer.

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.