28 August 2025

Market research

November 22, 2023

Markets Today – Proceed Carefully

The FOMC Minutes out 6am Sydney time didn’t do much to excite markets. The euro is a little weaker over the past 24 hours, while the equity market rally has lost some steam.

By Taylor Nugent

Todays podcast

- FOMC minutes not all participants agree to ‘proceed carefully’

- Canadian CPI broadly in line, US existing home sales weak

- US 10yr little changed at 4.42%

- USDJPY has a look below 148, but little changed over the day at 148.3

- Coming up: RBA’s Bullock, UK Autumn Statement, US Jobless Claims

Events round-up

NZ: Trade balance (ann $b), Oct: -14.8 vs. -15.4 prev.

CA: CPI (y/y%), Oct: 3.1 vs. 3.1 exp.

CA: Core CPI trim, median avg (y/y%), Oct: 3.55 vs. 3.6 exp.

US: Existing home sales (m/m%), Oct: -4.1 vs. -1.5% exp.

The FOMC Minutes out 6am Sydney time didn’t do much to excite markets, reflecting a FOMC that is ‘proceeding carefully.’ Elsewhere, there was commentary from ECB and BoE officials, each concerned about persistence in services inflation and warning further progress on disinflation would be harder fought. That was more forthright in the UK, where the pushback on market pricing was more explicit. The US dollar is a little higher on the DXY, the gain coming against the euro. The equity market rally has lost some steam. The S&P500 is tracking 0.2% lower, with the Nasdaq 0.6% lower.

The Minutes were generally read as balanced. All officials agreed the FOMC ‘was in a position to proceed carefully’ and would be watching whether sufficient progress has been made in bringing down inflation. All officials also thought it was appropriate to keep rates restrictive “for some time until inflation is clearly moving down sustainably.” Officials noted that financial conditions had tightened significantly, and that “ persistent changes in financial conditions could have implications for the path of monetary policy” but many noted it was uncertain whether this tightening would persist. US 10yr yields are around 50bp lower than at the time of the meeting. Most participants continued to see upside risks to inflation. There was little immediate reaction to the Minutes. 2yr yields were about 1bp lower after the minutes, and are down 2bp on the day to 4.88%. US yields more broadly were little changed, with the 10yr less than 1bp higher to 4.43%. German 10yr bunds were 5bp lower to 2.57%, while 10yr gilts were 2bp lower.

In the UK, BoE officials were in front of Parliament’s Treasury Select Committee and offered some pushback to market pricing for cuts. Bailey said “I really think the market is putting too much weight on the current data releases and the fact that we’ve seen inflation come down quite rapidly” and that “we are concerned about the persistence of inflation on the rest of the journey.” He saw inflation risks were still on the upside, and said that “a restrictive policy stance is likely to be warranted for an extended period of time. ” Haskel suggested disinflationary goods dynamics could be less helpful going forward than in the post-GFC period. Market pricing for cuts pushed out a bit. 20bp of cuts are now priced by June from 24bp a day prior.

There was also some commentary from ECB’s Lagarde. She noted that “given the scale of our policy adjustment, we can now allow some time for them to unfold,” Lagarde said. She emphasised that the ECB will ‘remain attentive’ to “ensure that our policy rates will be set at sufficiently restrictive levels for as long as necessary” but “can act again if we see rising risks of missing our inflation target. ” Separate comments from Board member Schnabel expand on why. She said that “We’ll need two years to get inflation from 2.9% to 2%” and that “overall inflation is likely to accelerate again.” She said persistent is due to a strong labour market, which is fuelling wages and stubbornly strong prices in services. Not new themes, and markets price 50bp of cuts by July, up from 46bp prior.

Also of note in Europe was a deepening of the German budget crisis, with Germany imposing an emergency spending freeze in response to last week’s ruling by the country’s top court. The ruling called into question hundreds of billions of euros of financing in special funds that are not part of the regular federal budget.

In currency markets, the US dollar was up 0.2% on the DXY. That was due to a weaker euro, down 0.2% to 1.0913. The yen was little changed at 148.36, USDJPY having earlier reached a low of 147.15, before some rebound in the broader US dollar during the US session. The AUD sits around 0.6556, also little changed on the day after touching an intraday high of 0.6589, the highest since 10 August. Of note, CNY has enjoyed much better support over the past week, requiring less heavy handedness from the PBoC, with the reference rate fix at the smallest premium to market estimates (as surveyed by Bloomberg) since July. After the CNY fix, the yuan strengthened beyond that rate for the first time in four months and was 0.3% higher yesterday

Further aiding the yuan’s performance was reports that Chinese regulators were drafting a list of 50 private and state-owned developers eligible for a range of financing, to alleviate some concerns that currently overhang the property sector. The so-called allowlist is intended to guide lenders as they weigh support for the industry via bank loans, debt and equity financing, and may help alleviate fears of further contagion in China’s property sector.

Canadian inflation in line with expectations. Encouragingly, underlying measures have also shown some moderation. The trimmed mean was 3.5% from 3.7% and 3.6% expected, while the median was 3.6%, as expected but from an upwardly revised 3.9%. In 3m annualised term, the average of those two core measures slowed to 3.0% from 3.7%. Markets were already discounting no chance of another BoC hike, and have 32bp of cuts priced by June, up from 29 yesterday. The only other data of note was US existing home sales which fell a much larger than expected 4.1% m/m in October, a fifth consecutive monthly fall, to their lowest level since 2010, reflecting the impact of high mortgage rates.

RBA Governor Bullock yesterday added little in a panel appearance, while the Minutes of the November meeting continued to reflect a disconnect between the Staff forecasts, which readily justify an additional hike absent a downside surprise in the near-term data flow, and a seemingly more equivocal tightening bias. The ‘whether’ qualifier was repeated in “whether further tightening of monetary policy is required… ” The Minutes outlined the cases to hold or raise the cash rate. The decision to raise the cash rate was “to mitigate the risk that progress in returning inflation to target is further delayed” while interestingly, the losing case for a hold noted a ‘credible case’ for tolerating a somewhat slower return of inflation to target given uncertainties around underlying resilience of the economy. While it didn’t win the day, that argument does clash with the ‘low tolerance’ framing given “forecasts would be for higher inflation if they had not been predicated on one or two rate rises.”

Discussing the upwardly revised forecasts for activity and inflation, the Minutes note “it would take longer to bring aggregate demand and supply into balance than previously expected,” “lowering inflation from its current level would require growth in aggregate demand to remain subdued; this was unlike the disinflation achieved to date, which had occurred largely because of fading supply shocks” and that “ the risk of not achieving the Board’s inflation target by the end of 2025 had increased and that it was appropriate that monetary policy should be adjusted to mitigate this.” The Minutes also note forecasts were predicated on “one to two increases in the cash rate over coming quarters” (one of which was delivered in November) and that “even a modest further increase in inflation expectations would make it significantly more challenging and costly to return inflation back to target.”

Coming Up

- RBA’s Bullock speaks this evening and will talk about the recent monetary policy decision and progress on the implementation of recommendations of the Review of the Bank. Any clarification on the bounds of the Boards tolerance for higher inflation, and whether a further upside surprise is required to see the Board act on their tightening bias, will be key.

- With Thanksgiving on Thursday, US Jobless claims comes a day early. Consensus for initial claims is 227k, after the pick up to 231k from 218k last week. The final read of UMich Consumer Sentiment is also released, with the 5-10yr inflation expectation worth a look given the jump to 3.2% in the preliminary.

- The UK Chancellor delivers the Autumn Statement. Celebrating progress on inflation to date, Sunak on Monday said that “we can and we will cut taxes.” Data yesterday showed that the fiscal deficit over the first 7 months of the fiscal year was £16.9 billion less than had been forecast in March, buoyed by receipts from VAT, income tax and corporation tax that are about 10% higher.

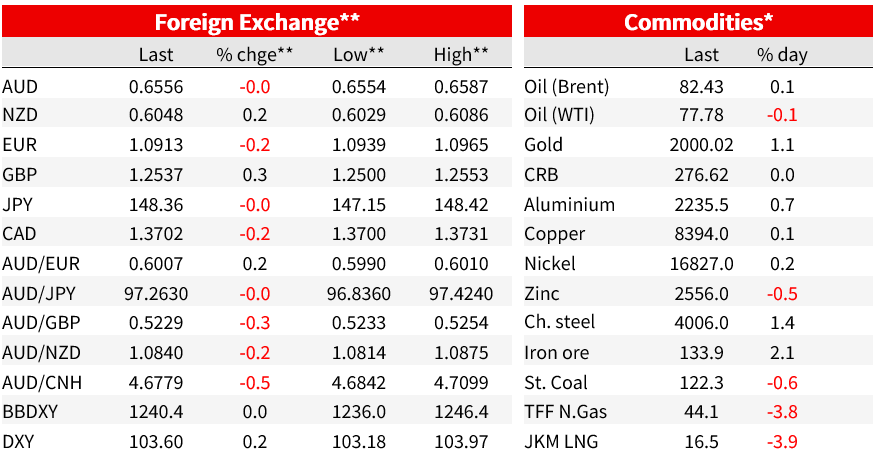

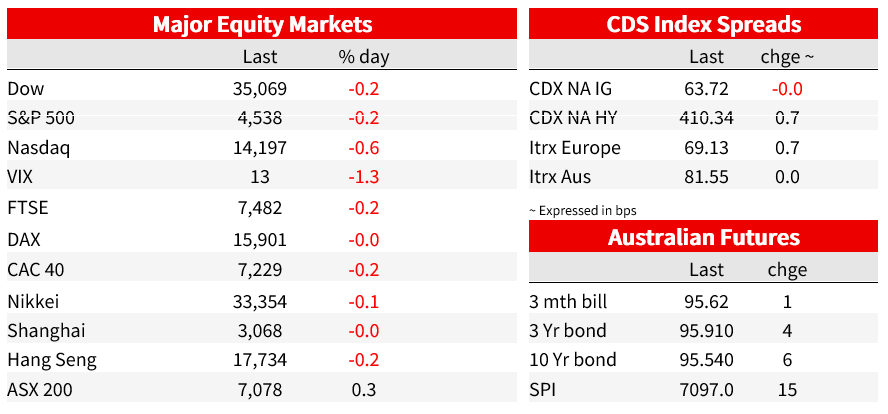

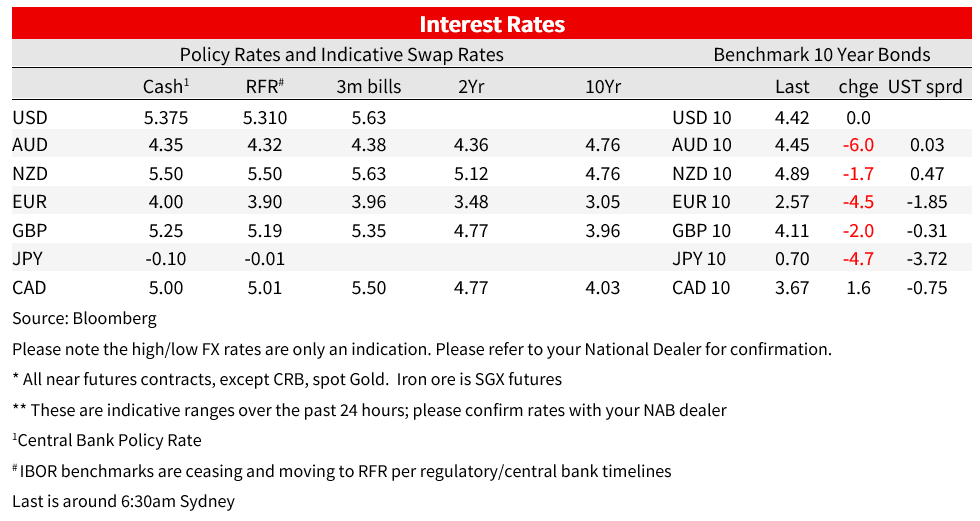

Market Prices

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets, opens in new window. Read our NAB Markets Research disclaimer (PDF, 131KB), opens in new window.

Commodities Corporate and Institutional Foreign exchange International Markets research Podcasts