A private sector improvement to support growth

Insight

Russia/Ukraine headlines weighed heavily on risk sentiment late Friday with the US again warning Russia could invade at any time.

https://soundcloud.com/user-291029717/war-talk-rocks-markets-all-eyes-on-the-east?in=user-291029717/sets/the-morning-call&utm_source=clipboard&utm_medium=text&utm_campaign=social_sharing

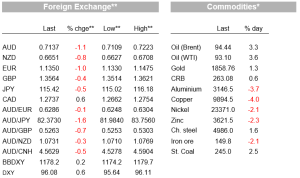

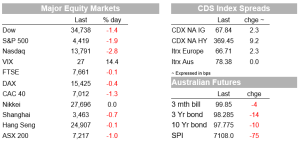

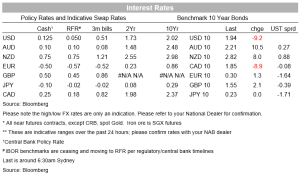

Russia/Ukraine headlines weighed heavily on risk sentiment late Friday with the US again warning Russia could invade at any time. Equities fell (S&P500 ‑1.9%), yields tumbled (US 10yr -9.2bps to 1.94%) and oil rallied (Brent +3.3% to $94.44, briefly hitting $95 for the first time since September 2014). A soft University of Michigan Consumer Sentiment also weighed early in the session with consumer confidence at its lowest level since October 2011, acting as a counter to hawkish Fed expectations and playing to the view that the peak in the rates cycle is unlikely to be high. Note yields curves are starting to invert with 7s10s slightly inverted and 5s10s not far off inversion, while terminal fed proxies fell (5Y1Y 1.75% from 1.87%). Three Fed speakers added to the mix, pushing back on a 50bps move with markets now pricing a 54% chance of a 50bp hike in March, down from being fully priced earlier on Friday. The USD rose (DXY +0.6%), EUR fell sharply (EUR -1.0% to 1.1350) and safe havens outperformed (USD/JPY -0.5% to 1.1542; Gold +1.3%). The AUD (-1.1%) and NZD (-0.8%) both fell.

First to Russia/Ukraine headlines. US National Security Advisor Sullivan said on Friday that a Russian invasion of Ukraine could begin at any time (“distinct possibility that there will be major military action very soon”), and this could happen during the Beijing winter Olympics (a moot point given the Olympics end on 20 February). What was more catching was the actions by Washington and Moscow to withdraw diplomatic staff from Kiev. The US said it was withdrawing most embassy staff from the Ukraine. Russia also said it was withdrawing diplomats to “optimise” staffing in view of “possible provocations by the Kiev regime or third countries”. Your scribe is no geopolitical analyst, but it is fair to say the next two weeks will be important as far as tensions go – the end of the Winter Olympics on Sunday removes one apparent constraint of respecting peace during the games, and ice will start to thaw in early spring with the terrain becoming less conducive to a land-based operation, meaning there is a relatively narrow window.

A weak University of Michigan Consumer Confidence report early in the session also weighed on sentiment, with some taking it as an amber signal that something is not right in the hike narrative. No doubt inflation and a decline in real wages is a factor. The headline index fell to 61.7 from 67.2 (consensus 67.0) and is now at its lowest level since October 2011. The survey write-up notes “ the Sentiment Index now signals the onset of a sustained downturn in consumer spending. The depth of the slump, however, is subject to several caveats that have not been present in prior downturns” (see Uni Michigan Survey for details). Those caveats being accumulated savings and some notion of pent-up demand for services. Near-term inflation expectations rose as expected to 5.0% for the year ahead (from 4.9%), but the more important 5-10yr expectations was steady at 3.1%. Note former BoE MPC member Blanchflower in late 2021 cited the sharp fall in consumer sentiment from July 2021 as a reason to worry about recession risk, those worries continue.

The fall in US rates at the short-end (US 2 year yield -8bps to 1.50%) was given added impetus as the Fed released its bond buying schedule for the next month, effectively quashing speculation that there could be an extremely rare inter-meeting rate hike before the scheduled March decision (the only inter-meeting hike in the Post-Volcker era was a 25bps hike in April 1994). The scheduled release of its bond buying schedule was important because the Fed has repeatedly stated that it won’t raise rates while it was still buying bonds. Fed President Bullard had mused that past Feds would have considered inter-meeting hikes, while former Treasury Secretary Summers told Bloomberg “the Fed should have a special meeting, right now, to end QE”. Senator Manchin also argued the Fed needs to “stop pussyfooting around” and “tackle inflation head-on” The odds of an inter-meeting hike have fallen sharply to around a 10% chance.

Fed speak was also more measured, pushing back on the need for a 50bp hike in March. CNBC reported they “ found that several Fed officials were already looking for a bad inflation number and the January report was not substantially worse than expected. Improvement is not expected until midyear and only then, if it remains high and rising and does not respond to rate hikes and plans for balance sheet reduction, would these officials want to accelerate the pace of tightening” (see CNCB: The Fed is still likely to take a measured approach to rate hikes despite calls for bigger action). As for on the record comments, the Fed’s Bostic said “my views have not changed ” for three or four rate hikes this year, likely beginning with a 25 basis point increase. The Fed’s Barkin also said “I’d have to be convinced” of the need for a 50 bps hike, though also did state he wanted to get the cash rate to pre-Covid levels “relatively soon”.

The Fed’s Daly did a Sunday CBS interview in which she highlighted “history tells us with Fed policy that abrupt and aggressive action can actually have a destabilizing effect on the very growth and price stability we’re trying to achieve”. (see CBS: Transcript: San Francisco Fed CEO Mary Daly). Markets have listened with a 50bp hike now 54% priced for March, well down from being fully priced earlier on Friday. Interestingly hike expectations for 2022 have not come down greatly with 6.2 hikes still priced for 2022, marginally down from 6.5 hikes on Thursday. In line with the fall in bond yields, longer-term Fed Funds pricing has also fallen with the 5Y1Y OIS FWD Swap back to 1.75% from 1.87% on Thursday. Yields curves have also started to invert with 7s10s -0.81bps and 5s10s are on the verge of inverting at 8b. OIS was already there with 2Y1M at 1.92% and 3Y1M 1.79%, an effective inversion of 13bps in 2024. Note Eurodollars have been showing inversion for some time (EDZ3 Dec 2023 effective rate is 2.26%, EDH4 Mar 2024 is 2.20%).

As for FX, with Europe likely to suffer more from any potential Russia moves into Ukraine, the EUR was down a sharp 1% on Friday to 1.1350. The fall in the EUR was also assisted by comments from ECB President Lagarde who is trying to temper escalating ECB rate hike expectations. In an interview with German media, Lagarde reiterated what she said earlier in the week, that any tightening would be “gradual”, adding that raising rates now “would not solve any of the current problems.” Reflecting the fall in risk appetite, safe havens were bid with USD/JPY -0.5% and gold rose +3.3%. The USD rose with DXY +0.6% and the broader BBDXY +0.2%. The two pre-eminent global risk proxies fell with AUD -1.1% and NZD -0.8%.

Finally in Australia, RBA Governor Lowe’s testimony on Friday revealed the RBA’s central scenario is consistent with discussing an interest rate increase later this year. This is the first admission that the central scenario is consistent with a hike in late 2022, with the inference being if the data surprises by more than multiple hikes are likely earlier. For those who missed it, the relevant words were: “ But it is certainly plausible, if the economy tracks in line with our central forecast, that an interest rate increase will be on the agenda sometime later this year. We are looking for certain things we have talked about before: evidence that inflation is sustainably in the two to three per cent range, evidence about the development of labour costs and evidence about the resolution of supply chain problems. They are the things we are looking at. We get the CPI quarterly. I think just having one more CPI is not enough for that evidence to emerge, but, over time, if things line up in a positive direction then we will be discussing this later in the year.” (see Lowe’s Hansard Transcript)

There is nothing scheduled domestically. It is also very quiet offshore with the most notable being the Fed’s Bullard. Details below:

Read our NAB Markets Research disclaimer

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.