28 August 2025

Markets research

November 27, 2023

Markets Today – Proceed Carefully

The Aussie dollar came within kissing distance of 66 US cents on Friday

By Ray Attrill

Todays podcast

- Fresh falls in the USD and oil prices in thin (US half-day) Friday markets

- AUD/USD makes its strongest close since 1 August at 0.6585 (high 0.6591)

- US PMIs sees small improvement in services, fall back below 50 for manufacturing

- Week Ahead: AU monthly CPI, Retail Sales, RBNZ, China PMIs, US PCE, Powell

Events round-up

US Nov. Manufacturing PMI 49.4 from 50.0 vs 49.9 exp.

US Nov. Services PMI 50.8 from 50.6 vs 50.3 exp.

US Nov. Composite PMI unchanged at 50.7 vs 50.4 exp.

German IFO Business Climate 87.3 from 86.9 vs 87.5 exp.

German IFO Current Assessment 89.4 from 89.2 vs 89.5 exp.

German IFO Expectations 85.2 from 84.8 vs 85.8 exp.

Germany final Q3 GDP unchanged at -0.1% q/q as expected

Canada Sep Retail Sales 0.6% vs 0.0% exp.

Canada Sep Retail Sales ex-autos 0.2% vs -0.1% exp.

Japan Oct CPI ex-fresh food 2.9% from 2.8% vs 3.0% exp.

Japan Oct CPI ex-fresh food, energy 4.0% from 4.2% vs 4.1% exp

NZ Q3 Real Retail Sales 0.0% vs -0.7% exp. .

Good Morning

There was plenty of economic data out Friday but not a whole lot of market price action across rates, or equities with only half day trading in the US, bigger movements coming (once again) in oil where WTI crude fell another 2% to $1.56 to $75.5, and too currencies where the USD continues to leak lower (DXY -0.5%). Losses came against all G10 currencies led by gains for GBP and the commodity linked pairs, CAD, NZD and AUD. AUD/USD came within kissing distance of the 0.66 handle, with a high of 0.6591 and closing right on the 200-day moving average at 0.6585 – its best close since 1 August. Geopolitically, the Hamas-Israel temporary ceasefire commenced on schedule Friday morning with the first prisoner/hostage exchange taking place a few hours later.

The S&P Global US PMIs, held over from Thursday due to Thanksgiving, were the main economic data draw and showed small unders (Manufacturing) and overs (Services, Composite) versus expectations. Manufacturing fell back into contraction territory at 49.4 from 50.0, while services pushed a little further above 50 to 50.8 from 50.6. Since services represents close to 90% of US economic activity it is the more important series, but judgment on just how fast the sector is expanding, if it indeed still is, is probably best left to next week’s ISM release. Early indications on holiday season/Black Friday retail spending were positive with some big online retailers reporting sales up on the same time last year in the order of 6%, though presumably higher prices are part of the story.

In Europe the German IFO survey showed small improvements across all three series consistent with the suggestion the economy is at least not going backwards as fast it was, albeit in all case a little shy of expectations. German Q3 final GDP confirmed the -0.1% q/q earlier estimates.

No Fed official were minded to put aside their Thanksgiving turkey and speak to the public on either Thursday or Friday. ECB President Lagarde did speak and confirmed the Governing Council’s current watch and wait disposition, noting “We have already done a lot,” and that, “Given the amount of ammunition we have used, we can observe very attentively the components of our lives like salaries, profits, like fiscal, like geopolitical developments and certainly the way in which our ammunition is impacting our economic life to decide how long we have to stay there and what decision we have to make — up or down.”

Bank of England chief economist Huw Pill also spoke – to the FT – the gist of which was that the Old Lady will not relent in its fight against inflation despite signs that the UK economy is weakening. Domestic inflation pressures such as wage growth and services inflation remained “at very elevated levels,” Pill said. Any signs that economic activity was slowing had also been driven by a lack of supply rather than demand, he added, meaning it was “not as associated with easing of inflationary pressures.” There was a small money market reaction to his comment, for example pricing for the 1 August 2024 meeting reduced from -20bps to -17bp.

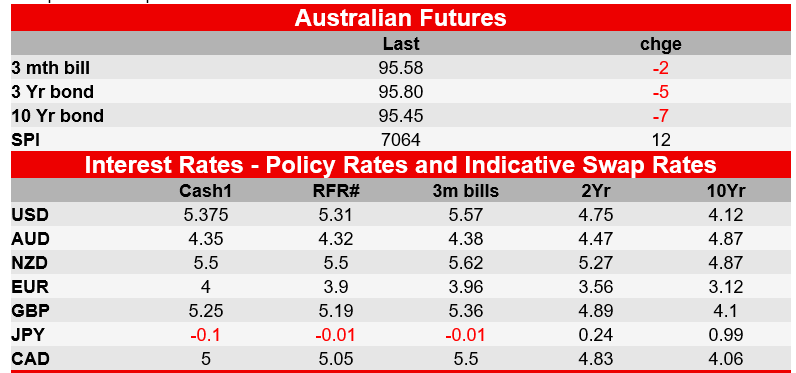

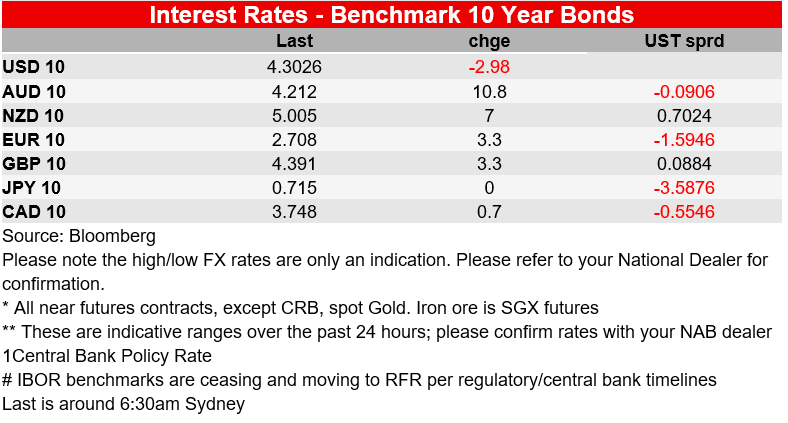

In markets, the Treasury cash market returned from Thursday’s holiday for a half-day session which saw 10-year yields opened 4bos up on Wednesday at 4.44% in line with Thursday’s futures market trading, with yields then pushing up to end the day at 4.47%. European benchmark yields (were 2-3bps higher (Bunds and Gilts). On the week gilts were the big benchmark biond underperformer (10s up 18bps due to better-than-expected economic data and, on Friday, the above-mentioned Pill comments, while treasuries added just 3bps, less than Bunds (+5.5bps) or Aussies 10-year futures (+7bps)

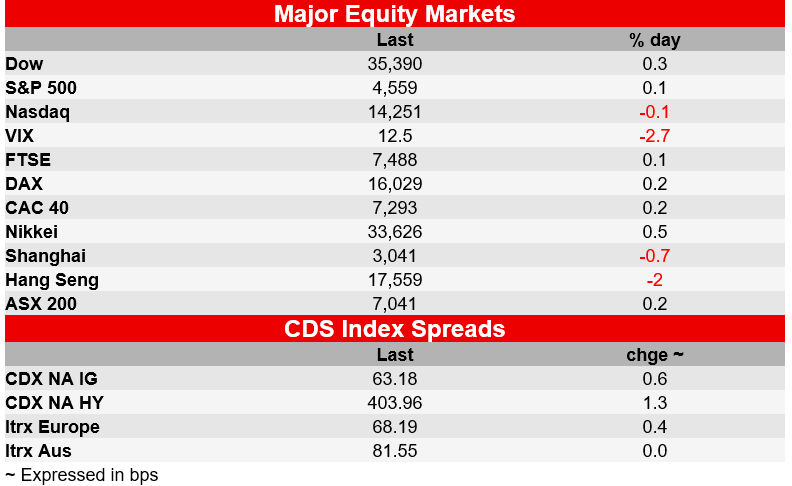

The US equity market could barely find a pulse in its half-day session Friday, the S&P500 finishing up by just 0.06% (+1% on the week) and the NASDAQ -0.11%. the UK FTSE also finished up just 0.06% while Eurozone bourses performed a little better with the Eurostoxx 600 gaining a third of a percent. China and Hong Kong were the big underperformer Friday, with the Hang Seng down 2% and China CSI 300 down 0.7%, also making it the worst weekly performer (-0.8%). The ASX 200 also had a down week, albeit just -0.1%.

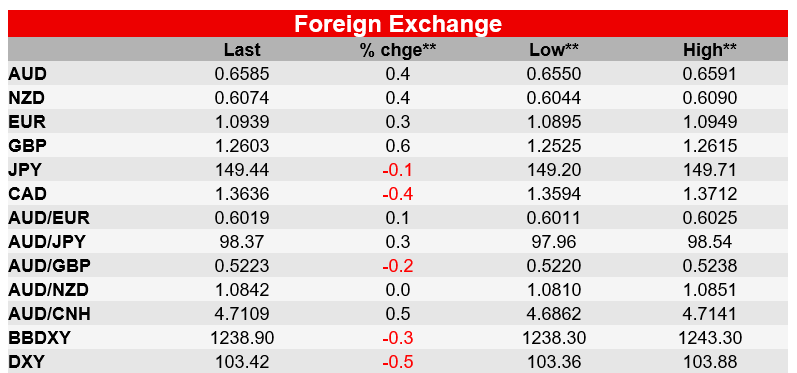

The weekly FX performance table shows both the DXY and broader BBDXY dollar indices down 0.5% (so all of the weekly loss for the DXY coming on Friday). NZD tops the G10 leader board (1.6%) with GBP and AUD the only other two currencies to score gains of more than 1%. NZD and AUD have seen hitherto CNY headwinds turn tailwinds, USD/CNY losing another 0.9% last week to now be some 2.5% off from its early November highs. This is despite the broader China/HK equity market yet buying into the positive signs of more meaningful fiscal support for the economy, albeit property developers’ stocks have keyed positively off the news that some 50 (‘allowlist’) developers were to be eligible for financial support.

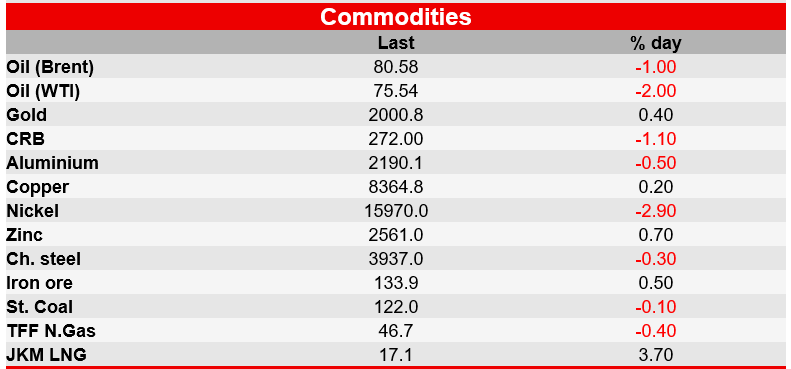

Commodities were mixed Friday with oil the biggest mover, WTI crude down 2% and Brent 1% amid indications of some OPEC disarray (agreement on African producer quotas reportedly one sticking point) and the OPEC+ meting delayed to Nov 30 and now to occur on-line, not in Vienna. At the other end of the commodity price spectrum iron ore continue to perform well, comfortably holding above $130 with a gain of 4% on the week.

Coming Up

- Nothing of real note today. See out What to Watch publication for a full preview of the week ahead.

- On the week, locally, RBA Governor Bullock appears on a panel at an HKMA-BIS conference on Tuesday (‘Inflation, Financial Stability and Employment’ is the title) but it’s doubtful we’ll get too much more on the domestic outlook following her speech this week and coming so close to the 5 December meeting, AU Retail sales and the CPI indicator for October are the highlights of the data calenda, but there is also a raft of second tier data, including pre-GDP partials in the form of Construction Work Done and Capex and October reads for private credit and building approvals.

- For the CPI Indicator, we expect 5.2% y/y from 5.6% in line with consensus. Year-ended core measure are also likely to slow, but the October number is overweight goods, and has low coverage of services, which means October data won’t help much to gauge domestic pressures.

- In New Zealand, the RBNZ is on Wednesday, where the Monetary Policy Statement is likely to see the RBNZ convey that CPI inflation and the labour market are easing comfortably along the lines desired and previously forecast. So much so, the Bank is likely to soften its projection on the OCR, albeit not nearly as much as the market already has.

- Globally, preliminary euro area inflation, US PCE (both Thursday) and the Manufacturing ISM (Friday) are the picks of the data calendar. We also get October Retail and Industrial Production data for Japan on Wednesday and Chinese PMIs on Thursday. The hope is Chinese PMIs will reflect some stabilisation. Fed Chair Powell speaks in a fireside chat on Friday. The Fed published the Beige Book on Wednesday. The other event to be watchful for is the OPEC+ meeting, which as noted above is now on Thursday.

Market Prices

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets, opens in new window. Read our NAB Markets Research disclaimer (PDF, 131KB), opens in new window.

Commodities Corporate and Institutional Foreign exchange International Markets research Podcasts

The Forward View – Australia: August 2025

INSIGHT

21 August 2025