On a seasonally adjusted basis, the NAB Online Retail Sales Index recorded a drop in growth in July

Insight

US President Biden is convinced Russia has decided to attack Ukraine

Russia-Ukraine tensions and Fed policy expectations remain the dominant themes in markets. Heightening concerns on the former weighed on risk sentiment on Friday with US and EU equities closing lower on the day and down for another week. Geopolitical news over the weekend not helping sentiment either. Key Fed members talked down the prospect of a 50bps hike in March with a preferred steady hiking approach data dependent. The VIX index remains elevated ending the week at 27.78 while the UST curve bull flattened with the 30y Bond down 5bps to 2.244%. EU FX pairs fell modestly against the USD on Friday with NZD and AUD the outperformers on the week, up 0.75% and 0.56% respectively. Oil posted its first weekly decline since December; Nickel printed its highest closing price since 2011 while iron ore recorded a weekly decline of 11%.

Speaking on Friday, after the US equity market close, US President Biden said he’s convinced Russian President Vladimir Putin has decided to attack Ukraine and that an invasion — including a strike on Kyiv – could come within days. Over the weekend the US told allies that any Russian invasion of Ukraine would potentially see it target multiple cities beyond the capital Kyiv. Biden also dismissed Russia’s claims that the Kyiv government had provoked fresh violence separatist in eastern Ukraine. “There’s simply no evidence for these assertions and it defies basic logic,” he said.

Adding fuel to concerns over an imminent war, on Saturday Russia claimed to have successfully test-launched hypersonic and cruise missiles at sea during nuclear forces drills in Belarus and overnight the BBC reports that Mr Putin and Belarusian leader Alexander Lukashenko have decided to extend their military drills which were due to end on Sunday. A statement cited the “deterioration of the situation” in east Ukraine as one reason for keeping an estimated 30,000 Russian troops in Belarus

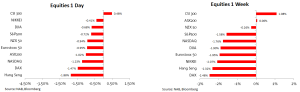

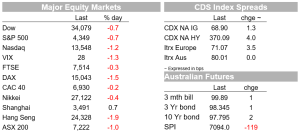

US and European equity markets closed in negative territory on Friday with the Euro Stoxx 600 down 0.81% while the S&P 500 was -0.72% and the NASDAQ -1.23%. Ten of the 11 S&P 500’s major industry sectors closed in the red, with IT and Industrial stocks leading declines. After President Biden’s remarks, an exchange-traded fund tracking the S&P 500 reversed an earlier gain and fell as much as 0.2%, suggesting APAC equity indices are likely to begin the new week in defensive mode, after a volatile week that saw the VIX index closed Friday at 27.8.

On company specific news it was interesting to note that GE fell the most in three weeks after warning that supply-chain problems, labor shortages and material inflation will be a drag on its businesses at least until the middle of this year . GE Shares fell 5.77% on Friday.

Looking at equity’s weekly performance, the S&P 500 fell 1.6% on the week, recording a second weekly decline, following a loss of 1.8% in the prior week. The NASDAQ fell 1.76% on the week while the Dow was -1.90%. In Europe the DAX was the big underperformer, down 2.48% while the Eurostoxx 600 index fell 1.87%. Our S&P/ASX200 was unchanged on the week while China’s CSI 300, was the standout performer, up 1.08% on the week.

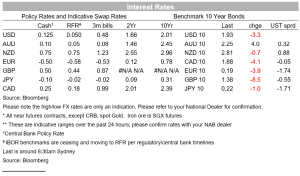

Against the cautious equity backdrop, core government bonds benefited from a safe haven demand on Friday. The UST curve bull flattened led by a 5bps decline in the 30y Bond to 2.244% with the 10y UST Note not too far behind, down 3bps to 1.9286%. On the day, the 2y UST yield was unchanged notwithstanding the repricing in Fed rate hike expectations following comments from Fed Williams, Brainard and Evans. On the week, the 2y and 5y UST tenors ended 3.5bps lower while the 10y Notes was 1bps lower and the 30y Bond was unchanged.

Speaking on Friday, NY Fed President Williams said that the Fed should begin raising rates next month and, once rate hikes are underway, begin to “steadily and predictably” trim its $9 trillion balance sheet. When asked about the prospects of a 50bps hike in March, Williams said “I don’t see any compelling argument to taking a big step at the beginning,” . Stressing the Fed’s data dependency, Williams also noted that he expects the personal consumption expenditures price index to decline to about 3% (in 2022) and for it to fall further next year as supply challenges improve. Williams then added that policymakers can speed up or slow down the pace of rate increases later as needed. A path in which the overnight federal funds rate moves to a range of 2% to 2.5% by the end of next year makes sense, he said.

So, while Fed William’s remarks poured cold water on pricing expectations for a 50bps rate hike with market-implied probability of a 50bps Fed rate hike next month now down to around 25%, having been almost fully priced in the wake of the US CPI report just over a week ago. Governor Brainard, also an influential Fed member, spoke after Williams, and she appeared to endorse market pricing of almost seven rate hikes this year, saying it would be appropriate to start a “series of increases” next month, which markets are “clearly aligned with”. Brainard added that balance sheet reduction (so-called quantitative tightening, or ’QT’) could kick off “in the next few meetings”. Chicago Fed President Evans, seen as one of the most dovish voices on the committee, said “the current stance of monetary policy is wrong-footed and needs substantial adjustment”, noting that inflation pressures had broadened beyond just those items most affected by supply-chain issues.

Fed Chair Powell, will have a chance to shape expectations on March 2 and 3 when he gives his semiannual monetary policy update to Congress in hearings announced on Friday by the House Financial Services Committee and Senate Banking Committee.

Moving on to Europe, over the weekend Bloomberg reported that a consensus is emerging before the March 10 policy meeting to set September as the end-date for asset purchases. This is an important deadline for markets, given the Bank has previously said that once its stops QE the door is open for hikes. On Friday money markets priced in 44 basis points of ECB tightening by year-end, compared with 42 basis-points on Thursday and importantly there are about 20bps of rate hikes priced by the September 8th meeting, so if Bloomberg’s report is correct, there will be a few traders disappointed.

Core European yield traded lower on Friday with 10y Bunds (0.188%) and Gilts (1.37%) down 4 and 8bps respectively while the German two-year bond trimmed gains to leave the yield three basis points lower at minus 0.46%. Russia Ukraine concerns have played a big factor in the demand for core European bonds on the week with 10y Bunds and even 10y Italian BTPS down 10/11bps on the week.

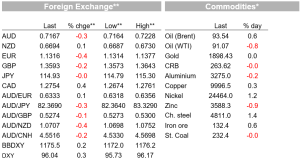

FX markets continue to behave in a more subdued manner relative to the volatility that we have seen in Equity and Bond markets. Amid risk aversion in the air, the USD gained on Friday with the DXY and BBDX index up 0.17% and 0.25% respectively. Looking at G10 pairs USD gains came largely from EU FX weakness with NOK (-0.8%), SEK (0.56%) and the euro ( -0.34%) all lower on the day. Meanwhile and notwithstanding the spike in risk aversion, the Kiwi was the USD outperformer, gaining 0.12% on the day while the AUD was 0.14% weaker. Geopolitical news over the weekend have not helped the antipodean currencies this morning with both pairs starting the new week a little bit lower at 0.6694 and 0.7167 respectively.

On the Week the USD is little changed in terms of its main indices, but a little bit weaker against Asia and EM. The AUD and NZD have performed with safe havens JPY and CHF the other USD gainers over the past week. Russia Ukraine tensions have clearly affected European currencies with NOK the big underperformer, down 1.45%, oil prices weakness not helping the latter either (more below).

Oil prices recorded their first weekly loss in two months as traders weighed heightened Russia-Ukraine geopolitical tensions vs. the potential for Iranian oil supply to be added to the market. WTI oil fell 0.75% on Friday with Brent up 0.61%. On the week, however, both WTI and Brent fell, down 2.15% and 0.95% respectively.

Nickel on the other hand has stolen a few headlines, recording its highest closing price since 2011, the Nickel rose 1.1% to settle at $24,144. Demand for batteries and EV’s continue to support Nickel amid tight supply. Aluminium was little changed on Friday, but was the outperformer on the week, up 4%. Gold was little changed near an eight-month high while Iron ore, after Beijing’s intervention was the big underperformer on the week, down 11%.

The Russia Ukraine tension has not gone unnoticed in the commodity market with investors now becoming increasingly concern over the potential impact from energy in the event of a conflict in Ukraine and sanctions on Russia. A move up above $100 in oil prices look easily conceivable in such an event, but worth emphasising too that Russia is a big supplier of natural gas ( specially to Europe), wheat ,aluminium and palladium.

In other news, my BNZ colleague Nick Smyth notes this morning that there is a strong likelihood that New Zealand government bonds have qualified for the FTSE-Russell World Government Bond Index (WGBI), the primary government bond benchmark used by global investors. The semi-annual snapshot of market size was taken at the 4pm London fix on Friday and we estimate that there was US$50.078b of eligible NZGBs outstanding, just creeping above the US$50b minimum threshold for inclusion in the index. We will need to wait until late March for formal confirmation that New Zealand government bonds will join the index although we may receive provisional confirmation sometime this week. If Nick is right, then NZGBs should officially join the index later this year, probably at the start of November. This should benefit both the bond market (implying lower yields than otherwise) and the NZD. Of course, its likely to be very much a second-order factor compared to other drivers such as the OCR outlook, broader economic developments and trends in key global markets.

Read our NAB Markets Research disclaimer

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.