Economic and financial market update

Insight

Markets remain volatile unable to confidently price implications from the news flow given the complex state of the global economy

https://soundcloud.com/user-291029717/a-glimmer-of-hope?in=user-291029717/sets/the-morning-call&utm_source=clipboard&utm_medium=text&utm_campaign=social_sharing

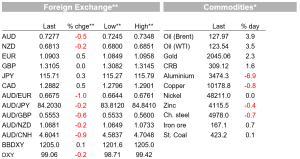

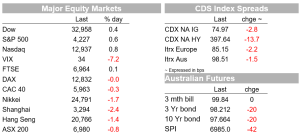

Markets remain volatile, jumping around on headlines and keeping the VIX index in the mid-thirties. Early this morning, risk assets were boosted by comments from Zelensky opening the door to a compromise noting the Ukraine was no longer seeking NATO membership, but after a decent jump in the S&P 500, the benchmark has now given most of its gains back. Oil prices remain elevated, jumping higher following confirmation of US and UK ban on Russian oil imports. Talks of a new round of EU bonds to fund a defence and energy strategy lifted 10y Bunds and narrowed EU peripheral spreads. NOK is leading a recovery of EU currencies with the euro now above 1.09 while the AUD has continued to leak lower, now at 0.7274.

Markets remain volatile unable to confidently price implications from the news flow given the complex state of the global economy. Signs of a potential compromise coming from Ukraine president are now confronted with the reality that even if a compromise is reached consequences from sanctions are adding another layer to supply constraint issues, logistic and many tight commodity markets, including oil, nickel, gas and so on.

A couple of hours ago, President Zelensky said he is no longer seeking NATO membership for the Ukraine and in a clear sign at soothing Moscow’s demand, the president also said that he was open to “compromise” on the status of two breakaway pro-Russian territories. Justifying his new position, Zelensky said that he understood NATO is not prepared to accept the Ukraine as a new member adding that “”The alliance is afraid of controversial things, and confrontation with Russia,” and that he does not want to be president of a “country which is begging something on its knees.”. Zelensky reiterated his openness to dialogue with Russia and willingness to discuss how the two separatist pro-Russian “republics” in eastern Ukraine can live on.

Reaction to Zelensky’s comments triggered a jump in US equity markets with the S&P 500 turning an intraday loss of 0.96% into a temporary gain of 1.79%, but a fair bit of that positive vibe has now been erased in the last hour with the index now trading at 0.70%. The S&P 500 energy sector is having another positive day with oil prices leading a surge within commodities prices while company news has been mixed. Apple unveiled new ipad air, iphone se and speedier m1 chip, helping the stock trade in positive territory. Meanwhile, McDonald’s is temporarily closing all 850 Russia locations, following mounting criticism that the fast-food chain failed to act quickly following the nation’s invasion of Ukraine while Pepsi is also said to be exploring options for its Russia business including writing off. As I type the NASDAQ is 1.40% and the Dow is 0.94%. Early in the session EU equities closed mixed with the Euro Stoxx 600 index ending the day down 0.51%.

Oil prices gained overnight after President Joe Biden announced the US would ban imports of Russian energy, while the UK said it would phase out Russian products by the end of this year. The US is a smaller Russian oil buyer than Europe and thus for now the bigger risk for the oil market is whether Europe decides to join the US and the UK. On this score worth noting Shell said it will stop buying Russian crude on the spot market and will not renew its term contracts, unless directed by governments to do otherwise. It will change its crude oil supply chain to remove Russian volumes, though this could take some weeks, and will lead to reduced throughput at some of its refineries. Brent oil traded to an overnight high of $133.15, before easing below 130, now trading at $128.13 with WTI at $123.55.

Other commodity markets remain in turmoil. The LME suspended trading in Nickel after a short squeeze drove prices above $100,000 yesterday. These transactions would be cancelled to reduce the fallout to traders caught on the wrong side of the trade and facing onerous margin calls. Other metals pared or erased gains following the LME’s announcement and other commodities are taking a breather. After a massive upward run, wheat prices are down over 6%, while corn and copper prices are slightly weaker. Gold prices continue to be well supported on the safe-haven trade, reached as high as USD2070 per ounce, before paring gains

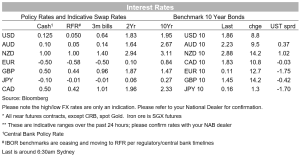

Early in the session, headlines hit the screens noting the EU is discussing a plan to jointly issue bonds on a potentially massive scale to finance a new energy and defence spending plan. The proposal may be presented after the EU’s leaders hold an informal summit France, that starts Thursday. My colleague Gavin Friend notes that just as governments (fiscal spending) acted as the bridge in the early days of the pandemic, the reality of Europe having to face into weaning off Russian gas means it is only governments that have the heft to make this move possible. However, it will take a lot of joined up thinking and getting everyone on board, s never easy for 27 member states and apt to miss-steps. Following the news, peripheral spreads to Germany narrowed significantly, with Germany’s 10-year rate up 13bps for the day against no change in Italy’s 10-year rate. The move up in Bunds, boosted 10y UST yields with the benchmark yield now trading at 1.8594%. Six hikes remain priced for the Fed this year and the 2-year rate is up 8bps to 1.63%.

Moving on to FX, EU currencies have outperformed in a volatile session with NOK, up 0.96% leading the charge. The euro is up 0.48% to 1.0907 while NZD is the best performing commodity linked currency, down just 0.18%, after finding some support around 0.68 (now at 0.6813). Supporting the kiwi, yesterday ANZ bank changed its OCR call to predict back-to-back 50bps hikes by the RBNZ over the next two meetings, which drove a surge in domestic short rates. CAD and AUD are at the bottom of the G10 leader board, down 0.48% and 0.70% respectively. The AUD now trades at 0.7277, reflecting an ease in commodity prices after big jumps in recent days. LMEX is down 2% and Aluminium down 6.5%.

Read our NAB Markets Research disclaimer

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.