Coming in for landing in a heavy cross wind

Insight

Eurozone inflation printed a new record high with ECB hawks calling for policy action.

https://soundcloud.com/user-291029717/fed-ready-for-a-big-move-ecb-staring-inflation-in-the-face?in=user-291029717/sets/the-morning-call&utm_source=clipboard&utm_medium=text&utm_campaign=social_sharing

The March US labour market report was a strong one notwithstanding a miss by nonfarm payrolls. The data solidified market expectations for a 50bps Fed hike in May and triggered a big sell off in short-dated UST yields, inverting the 2s10s curve again. Eurozone inflation printed a new record high with ECB hawks calling for policy action. After trading in and out of positive territory, main European and US equities indices began the new quarter with modest gains with subdued moves also the theme within FX. The USD was a tad higher on Friday and AUD/USD starts the new week sub 75c. Oil and coal extend declines on Friday.

US nonfarm payrolls increased by 431k in March, below the 490K consensus estimate but with 95k net revisions from previous months. The unemployment rate fell to 3.6% (vs 3.7% exp. and 3.8% prev.), just one tenth above the pre pandemic level. US labour force participation rose one tenth to 62.4% and average hourly earnings met expectations with a 0.4% monthly increase, better than the 0.1% print in February, but below the prior 6 month run rate of 0.485%. Participation rate remains 1% lower than before the pandemic, due in part to lingering impacts including early retirements, shifting childcare arrangements and public health concerns.

Reaction to the solid US labour report triggered a big jump in front end UST yields with the 2y rate closing the day 12bps higher to 2.45% while the 5y tenor rose 10bps to 2.56%. The 10y rate rose just 4.4bps to 2.38%, inverting the 2s10s curve again to -7.4bps. The solid report also helped solidified expectations for a 50bps hike in May, now 90% priced with 216bps of hikes priced by the December 14 meeting, taking the funds rate to 2.50%. Looking at the week the 2y rate rose 18bps while 10y tenor fell 9.5bp with the 30y Bond fell 15.5bps to 2.434%.

Speaking after the labour market report, Chicago Fed Evans reiterated his preference for six quarter point rate hikes this year , in line with the median of policy makers, although he also acknowledged “the great deal of uncertainty we face today” which may eventually alter his position. In an FT interview over the weekend, San Francisco Fed Daly said that the case for a 50bps hike at the next meeting had grown. She added “I’m more confident that taking these early adjustments would be appropriate” and that getting to neutral efficiently translated into “multiple” half-point adjustments. Also over the weekend, NY Fed Williams said the Fed needed to take the cash rate to more normal/neutral levels, but then noted “Do we need to get there immediately? No. We can do this in a sequence of steps.” Adding “Uncertainty about the economic outlook remains extraordinarily high, and risks to the inflation outlook are particularly acute”.

The US ISM Manufacturing was the other major US data release on Friday, but it didn’t elicit much of a market reaction. The PMI eased to 57.1 in March against expectations of a 0.5 rise from prior the 58.5 February reading. New orders and production gauges fell notably while employment was the largest upward contributor (+3.4 points to 56.3, highest since March 2021). The latter suggesting labour shortages are becoming less of a constraint as the Omicron waves fades and higher wages attract workers into the labour market. The prices paid index shot up by 11.5 points to 87.1, on the back of recent strength in commodity prices.

EU inflation printed at 7.5%yoy from a revised 5.9% in February and well above consensus estimate of 6.7%. Higher readings from Spain and Germany this week pointed to upside risks to eurozone headline number, food, alcohol and tobacco climbed to 5% from 4.2% in February while energy prices rose an eyewatering 44.7% vs 32% previously. The broad nature of price increases also resulted in the core reading printing at a new record level, up to 3% yoy, below expectations but up from 2.7% previously.

Reacting to the data release Bundesbank Nagel urged the ECB to respond to the accelerating price pressures, saying “the inflation data speak for themselves.”, adding “Monetary policy should not pass up the opportunity for timely countermeasures,”. Governing Council member Klaas Knot said the ECB could raise rates any time from September while Chief Economist Philip Lane said the central bank would need to reassess its timetable for withdrawing stimulus if the souring economic outlook weighs on the prospects for consumer prices.

10y German Bunds closed just 1bps higher at 0.56%, after gaining as much as 7bps earlier in the session while the 10y Italian BTP to Bund spread widened by 5bps to 154bps , the widest since March 10. ECB pricing expectations were little changed with the market estimating an ECB deposit rate at -0.035% in December, 1bps lower relative to Thursday’s level. Looking at EU core yields weekly moves, 10y Bunds fell 3.2 bps, 10y BTPS gained 2bps with 10y UK Gilts down 8.7bps to 1.608%.

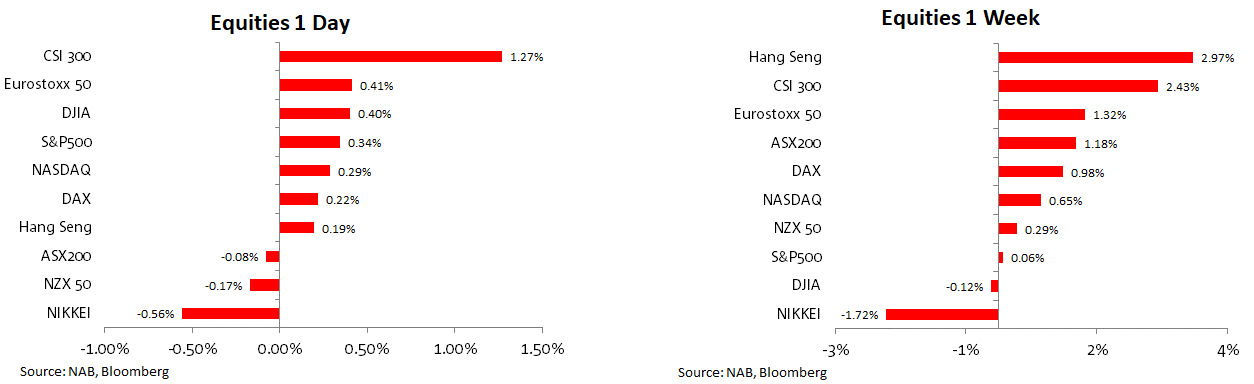

After trading in an out of positive territory US and EU equities managed to eke out small gains on Friday, recording a positive start for the new quarter. S&P 500 gained 0.3% on Friday with eight of its 11 major sectors advancing, including real estate and utilities, while industrials and financials declined. The tech-heavy Nasdaq 100 rose 0.2%, and the Dow gained 0.4%. On the week the S&P 500 and Dow were little changed while the NASDAQ gained 0.65%.

European equities were not bothered by the stronger than expected eurozone inflation and started the new quarter with a positive tone . The Stoxx Europe 600 Index closed 0.5% on the day and up close to 1.5% on the week, basic resources and retail shares led gains on Friday. China’s CSI 300 was the outperformer on Friday, up 1.27% on the day, joining the Hang Seng as the outperformers for the week.

FX moves were rather subdued on Friday. The USD was a tad stronger on the day with European pairs losing a bit of ground, down between 0.2% and 0.4% while the yen showed its usual greater degree of sensitivity to moves in UST yields, down 0.67%. The euro starts the new week at 1.1037 and USD/JPY is 122.61.

The NZD was flat around 0.6925 and the AUD/USD was a tad stronger on Friday (+0.19%), but not enough to climb back above 0.75c. For now, last year’s October high of 0.7556 remains the big hurdle for the AUD/USD to break higher on a sustained basis and our sense is that given so many uncertainties, including from China (see more below), the AUD is probably going to do some work around the 75c for a little bit longer before making a more decisive upward move.

Shanghai on Sunday ordered its 26 million residents to undergo two more rounds of tests for COVID-19, extending the lockdown for the entire city instead of allowing half the city to get back to normal . Shanghai on Sunday reported 7,788 daily locally transmitted asymptomatic cases, up from 6,501 the day before, while symptomatic cases rose to 438 from 260. Low by international standards, but not good enough for China strict strategy that aims at stamping out the virus through strict curbs and aggressive testing and tracing.

Commodities had a mixed Friday with oil, copper, aluminium, and gold all down on day while zinc lead and iron ore edge higher . Looking at the week oil and thermal coal were the big underperformers as the US announced the release of oil reserves and Shanghai entered its two stage lockdown. News of the latter extending its lockdown over the weekend may weigh on oil prices at the start of the new week.

Finally, news from Ukraine have been mixed . Ukraine’s top negotiator in peace talks with Russia said Saturday that Moscow had “verbally” agreed to key Ukrainian proposals, raising hopes that talks to end fighting are moving forward, reports also suggested a Zelensky-Putin meeting now looks more probable. Meanwhile, following multiple reports that Russian troops executed unarmed civilians in Ukrainian towns, some European Union governments are pushing for the bloc to quickly impose new sanctions. A reminder that a Ukraine -Russia peace agreement is unlikely to result in a material removal of sanctions.

Read our NAB Markets Research disclaimer

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.