We expect NAB’s Non-rural Commodity Price Index to fall by 4.9% in Q2

Insight

Slight risk aversion to start the week with equities down, yields down and US dollar up

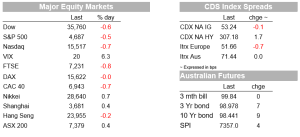

The 2 week stretch into Christmas started with a cautious tone with falls in equities (S&P500 -0.5%), driven by banks, travel and energy, while stay-at-home stocks outperformed. Rising Omicron cases have certainly contributed, but overall there hasn’t been much in the way of data or news flow given key risk events are later in the week – the US Fed meets on Wednesday and the ECB, BoE and Norgesbank meet on Thursday. Omicron headline were mainly concentrated to the UK where the Omicron variant now makes up 44% of all new COVID cases in London, while the UK reported its first death – though it was unclear at the time of writing whether it was due to Omicron. China also reported its first Omicron case.

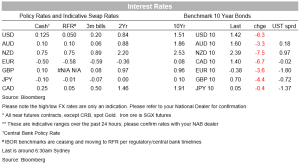

Yields fell with US 10yr yields -6.1bps to 1.42%. Moves in nominals were reflected in both real yields (-2.7bps to -1.03%) and the implied inflation breakeven (-3.8bps to 2.44%). Curves continue to flatten with the 2/10s curve down by 4.5bps to 77.8bps, while 5s30s were down 2.9bps to 59.8bps. Possibly also supporting the ultra-long end of the treasury curve was the Feds bond purchasing program with today’s purchases targeted in the 22.5-30-year sector, while Omicron headlines also likely contributed. Even with the cautious tone markets still fully price the first US Fed rate hike in June 2022, while there is around 65bps of tightening priced for 2022 and is little changed from Friday.

Interestingly Eurodollar future effective rates continue to be inverted beyond December 2024, while USD OIS FWD swaps are inverted beyond 2Y1Y (2Y1Y is 1.39% compared to 3Y1Y at 1.38%). Clearly there are some out there that see a relatively aggressive Fed means the peak in the rates cycle is lower and perhaps some fears that the Fed could overdo the tightening cycle. Here the Fed dot plot will be important to look for, especially in regards to two hikes versus three hikes in 2022. NAB’s view is the Fed is likely to hike three times in 2022, but if the dot plot also shows this markets will likely start to price in the chance of a fourth hike. In the press conference Powell will also likely be asked where neutral is, with his “long way from neutral” comments back in October 2018 no doubt in some people’s minds.

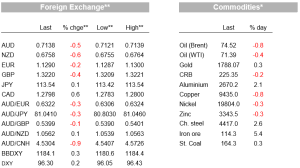

As for FX moves, safe-haven currencies have been well-supported, including the USD (BBDXY +0.3%) , while safe havens have outperformed with USD/Yen +0.1% to 113.54. Commodity currencies are at the bottom of the leader board. The AUD is down 0.5% along with the NZD -0.6%. The NZD went briefly below 0.6750, before finding some support. The AUD trades near 0.7125.

As for Omicron headlines, UK PM Johnson warned the UK was facing a “tidal wave” of Omicron infections and called on adults to get a booster shot ahead of the New Year. The UK’s Health Minister noted Omicron represents over 20% of cases in England and over 44% in London and that it is expected to become the dominant Covid 19 variant in the capital in the next 48 hours. There was one death from a person who had Omicron reported, though it was unclear if they had died due to the disease. Meanwhile an Oxford studied confirmed the results of others, that a two-dose vaccine regimen showed a substantial drop in neutralising antibodies when exposed to the Omicron variant compared to Delta, while some participants failed to neutralise the virus at all. China also reported its first reported Omicron case, albeit from an overseas arrival rather than in the community, and given China’s zero-COVID strategy tighter restrictions are likely in Tianjin.

Finally, European and UK gas prices are up in the order of 9-10%, the former surpassing the early-October high to close at a new record, after Germany hardened its view on the Nord Stream 2 gas pipeline. The German foreign minister said it didn’t comply with EU law and that the build-up of Russian troops on the Ukrainian border was “also a factor”. The read-through is that geopolitical factors are clearly an issue. It suggests little relief on additional gas supply required as winter takes hold, raising the prospect of power shortages and much higher costs for consumers and businesses across the region. The vulnerability of energy supplies could extend into next winter, given the time required to rebuild low gas inventories.

A quiet day mostly with most risk events later in the week. Domestically is the NAB Business Survey, while offshore UK employment data is the most market relevant piece. The calendar is fairly light until the FOMC Meeting on Wednesday, and then Thursday brings a speech by RBA Governor Lowe, Aussie Jobs and MYEFO, followed by the BoE and ECB meetings on the same day. See details below:

Read our NAB Markets Research disclaimer

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.