On a seasonally adjusted basis, the NAB Online Retail Sales Index recorded a drop in growth in July

Insight

Bond yields have fallen sharply overnight, but that doesn’t mean inflation expectations are going away, or does it?

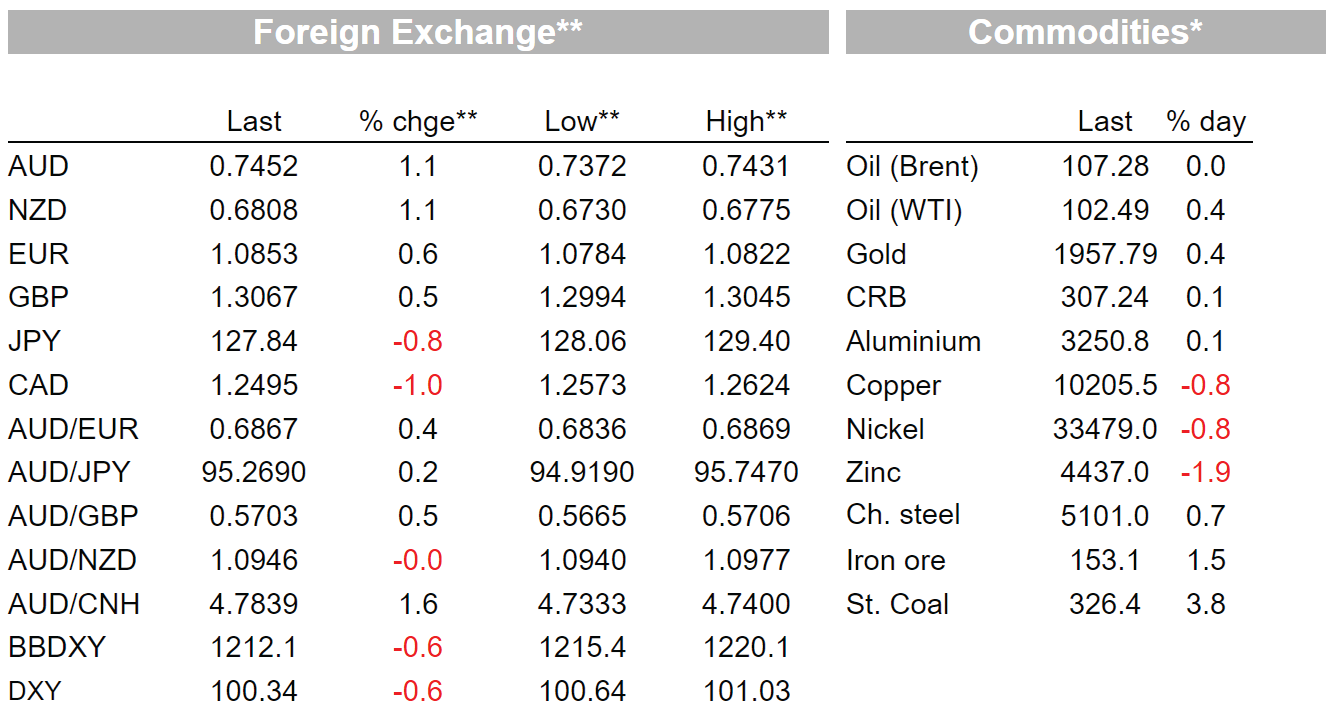

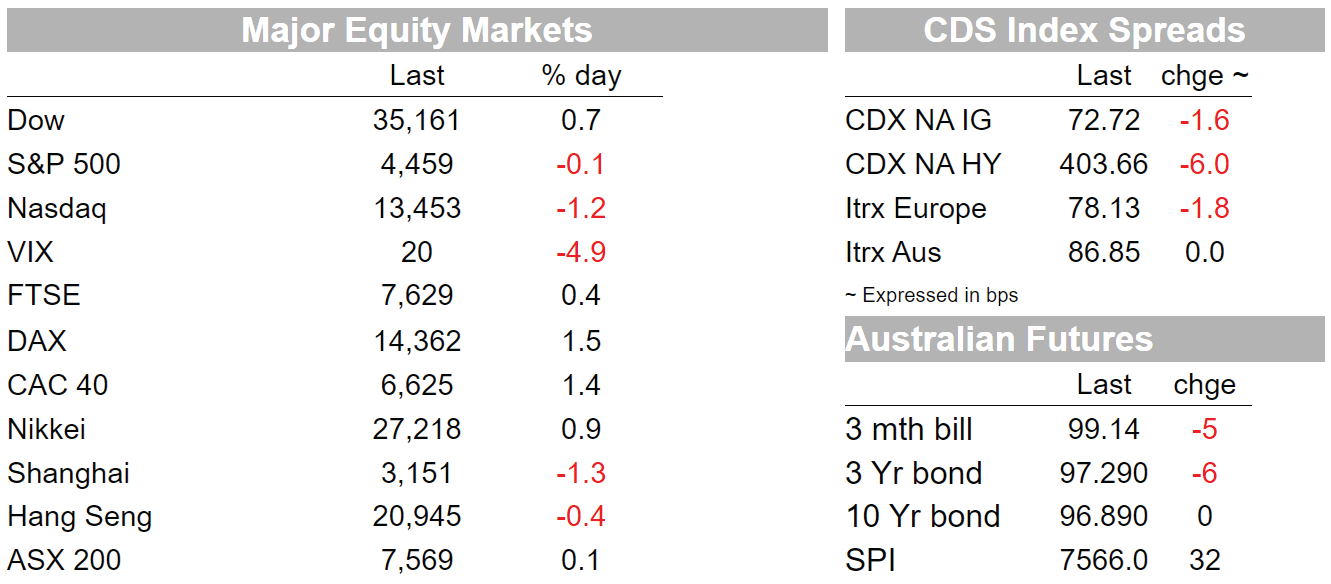

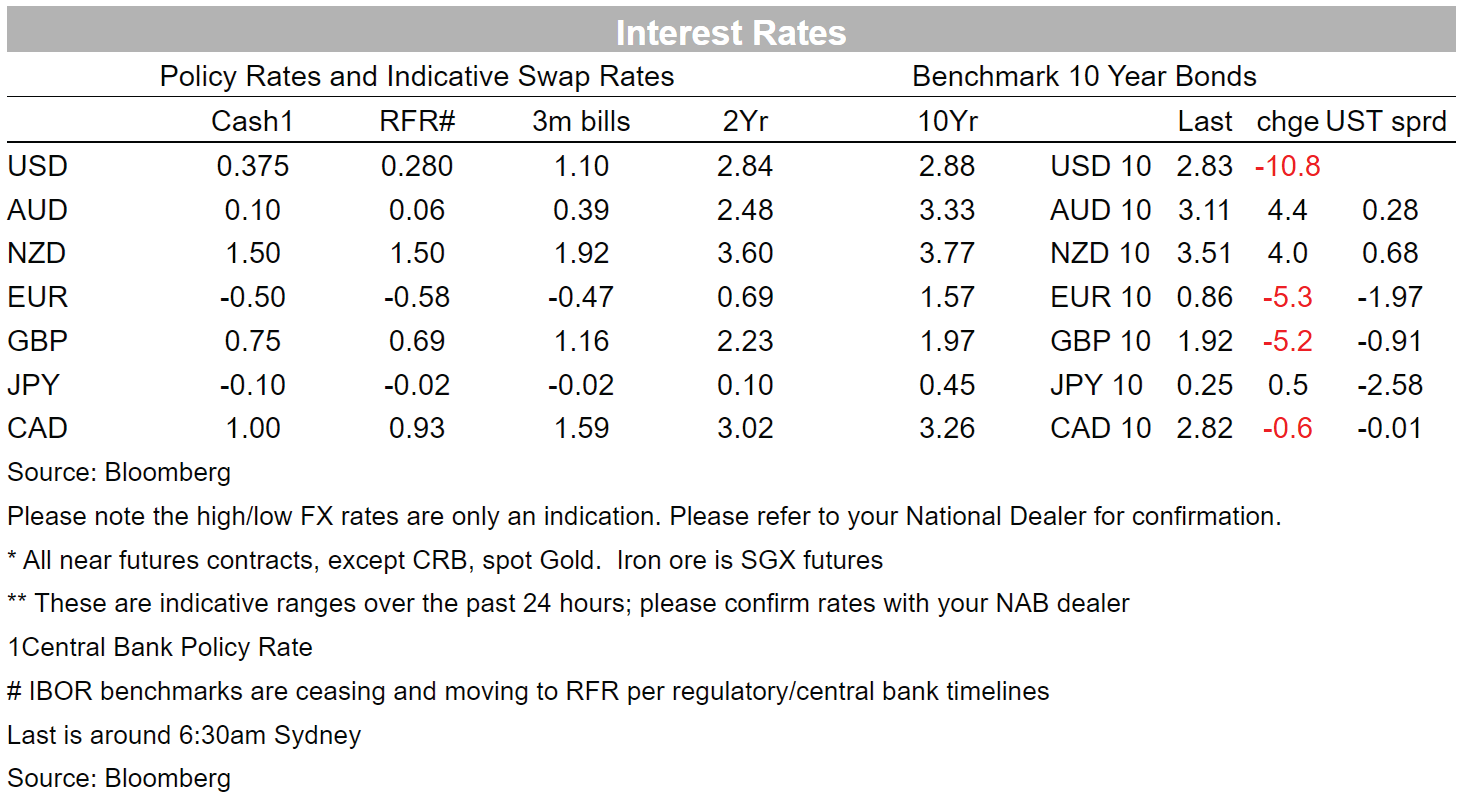

A reversal of recent trends the theme in markets in the past 24 hours. The USD lost 0.6% on the DXY, depreciating against all G10 currencies. The AUD benefitted, gaining 1.1% to 0.7452, back around levels seen a week ago after dipping as low as 0.7343 on the 19th . The dollar lost 0.8% against the yen, the pair back down to 128.06 after trading as high as 129.4 yesterday afternoon. Yields were also lower, the US 10yr yield down 11bps, back to 2.83 after reaching 2.97% early in the day. That earlier peak also saw 10yr real yields briefly turn positive (by 2bps). There was no obvious catalyst for the change in direction, but expectations inflation may be nearing its peak have been cited as a factor. The BoJ announced another unlimited bond buying operation to support its YCC target around the time of the turnaround. Fed communication (more below), in contrast, was singing from the same chorus of a march to neutral by year-end. In that context, 2-year yields held up better, down just 2bps as Fed pricing moved to fully price a 50bp move by the Fed at each of the next 2 meetings. Benchmark 10yr European yields were down 5bps.

Equity markets were mixed. The S&P 500 little changed, losing 0.1%, but with most sectors in the green. The Dow was up 0.9%, while the NASDAQ was off 1.0%. Netflix’s earnings after the bell yesterday disappointed sharply, showing a 200,000 fall in subscribers, its first decline in over a decade, in Q1 and projected a 2m subscriber loss for the current quarter, seeing Netflix shares down more than 30%. Other streaming stocks fell in sympathy, but the report failed to set the broader tone as other earnings painted a more positive picture. In other markets, equities were mixed. Stoxx Europe 600 rose 0.8%, Hang Seng Index slid 0.4% and the Nikkei 225 rose 0.9%. Tesla earnings out after the bell beat estimates, contrasting with the tone set by Netflix yesterday. First quarter profits and gross margins beat estimates, with Tesla reporting a record EPS of $2.86, blowing past the average estimate of $1.84 per share.

The reversal in the direction of 10yr yields was despite no change in tune from Fed speakers. In our afternoon yesterday, Kashkari said the Fed will need to do more to curb “much too high” inflation if supply chains remain constrained. Overnight, San Francisco’s Daly, who has been on the dovish side of the Fed spectrum, added to the chorus of calls for neutral (by which she means something like 2.5%) by year-end, saying “I see an expeditious march to neutral by the end of the year as a prudent path.” She added that “ the case for a 50 basis-point adjustment is now complete,” and that “the economy is resilient; it can handle these adjustments.” On the risks of tightening tipping the economy into recession Daly said that she expects “something that looks like below-trend growth, but not tip into negative territory, but could potentially tick into negative territory.” Earlier Evan’s agreed the Fed should be at neutral by year end, and said we’ll probably end up with restrictive rates.

Also out of the Fed was the Beige Book. The report noted that both economic activity and employment rose at a moderate pace since mid February. The labour market remained tight, the report noting “inflationary pressures were also contributing to higher wages, and that higher wages were doing little to alleviate widespread job vacancies. But some contacts reported early signs that the strong pace of wage growth had begun to slow. ” Inflation pressures remained strong and firms continued to pass on cost increases ‘swiftly.’ Elevated commodity prices following the Russian invasion of Ukraine and lockdowns in China were both cited as contributing.

In Europe, ECB officials continued to edge open the door to a rate rise as soon as July. Latvia’s Kazaks said “we are on a solid path to policy normalisation” and that he has “no reason to disagree with what markets are pricing for the second-half of this year.” Market pricing sees policy rates getting to positive territory by the end of the year. The Bundesbank’s Nagel said an increase could come in the third quarter if officials decide to end bond purchases at the end of June. The EUR is up around 0.6% to 1.0853.

On the data side, German PPI rose an eyewatering 4.9% in the month of May to 30.9% y/y. That number underscored the German exposure to Ukraine that led the IMF to revise down forecasts for German growth this year 1.7ppt to 2.7% earlier this week. Energy price rises, especially natural gas, drive gains alongside price increases for other products with Russia and Ukraine as key producers including fertilisers, feed and wood products. Canadian CPI rose 6.7%y/y in March from 5.7% in February against expectations for 6.1%. That’s the highest print since January 1991. All the core measures also rose, with the closely watched median rate moving to 3.8%y/y

Chinese policymakers were also in focus yesterday, setting a weaker-than-expected fix, seemingly an implicit endorsement of recent depreciation. That’s despite little recent appetite for movement on policy rates. The PBOC set the reference rate for the onshore yuan at 6.3996 per dollar, 101 pips weaker than survey estimates. The PBoC reported the Loan Prime Rate unchanged yesterday. That was against the (narrow) consensus for a 5bp reduction and follows an unchanged MLF rate on Friday and a 25bp reduction in the reserve requirement ratio announced on Friday but taking effect on Monday.

Read our NAB Markets Research disclaimer

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.