Online retail sales growth slowed in May following a fairly strong April

Insight

US inflation rose as expected, but there’s still been a reaction in the bond markets.

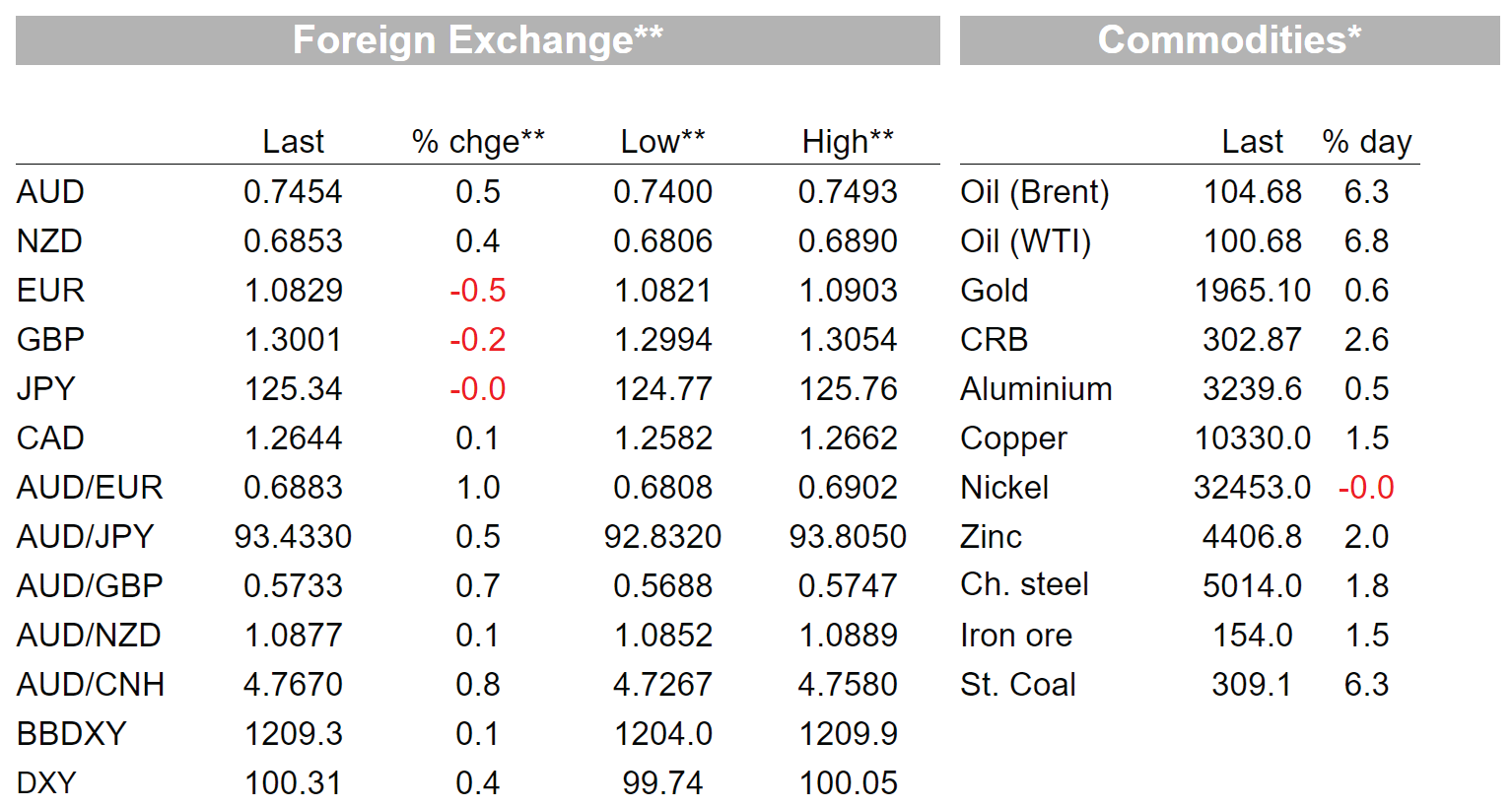

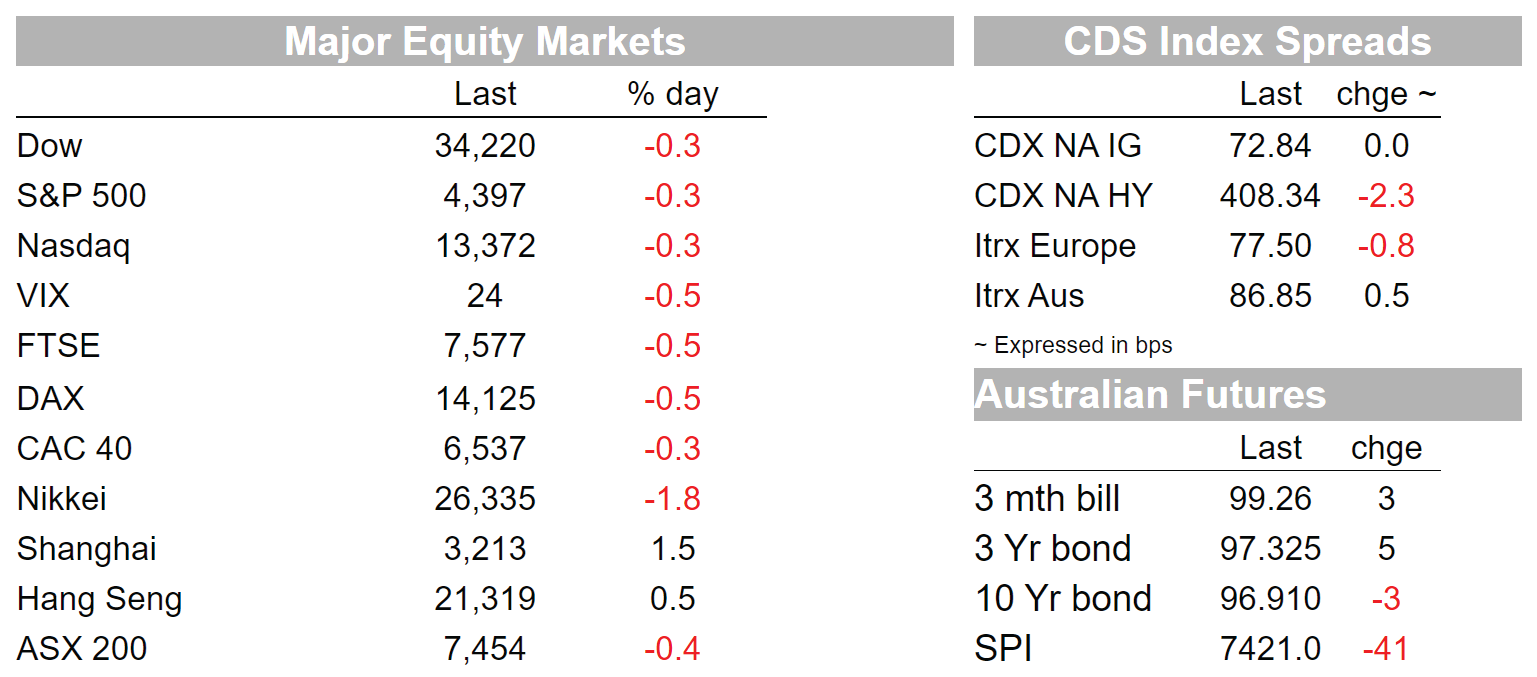

US yields were lower across the curve after core CPI surprised to the downside, rising a still quick 0.3%m/m against expectations for a 0.5%m/m rise, taking the y/y number to 6.5%y/y. Equities were initially higher, the S&P500 at one point up as much as 1.3%, but retreated through the session to be 0.3% lower. Oil prices rose 6%, seemingly supported by Chinese demand hopes amid speculation of a softening in lockdown approach. The US dollar more than retraced earlier losses to be up 0.4% on the DXY as the euro depreciated. The commodity backdrop boosted the AUD, up 0.5% to 0.7454.

As for the US CPI numbers. Headline inflation rose 1.2%m/m and 8.5%y/y against expectations for 1.2/8.4 . Gasoline prices, up 18.3% drove much of the increase. The core measure slowed to 0.3%m/m. Weighing down the core read was a reversal of the used car prices contribution compared to recent months. Used car prices declined 3.8%m/m but are still up 35.3% over the year. Elsewhere, some of the other key pandemic-affected components provided some offset, airline fares (+10.7%) and lodging away from home (3.3%) rebounded out of earlier Omicron impacts. Rents inflation remained supportive, up 0.43%. Base effects begin to put downward pressure on the year-ended reads from next month, suggesting the peak in the CPI numbers may be in, but the strength of inflation in the persistent rents series and tight labour markets suggest the fallback is unlikely to be precipitous.

Speaking after the release of the CPI, Brainard indicated that she’s not taking too much signal from any one month, but did note that “core goods, which has been the source of an outsized amount of core inflationary pressure, moderated more than I had anticipated,” she said. “It’s very welcome to see the moderation in this category. And I will be looking to see whether we continue to see moderation in the months ahead. ” On the balance sheet, she noted that “could be as soon as May, which would lead to reductions in that balance sheet starting in June.” Brainard continued to indicate policy should head to neutral, saying with balance sheet run off and rate hikes, “the combined effect will bring the policy stance to a more neutral posture expeditiously later this year.” Brainard struck an optimistic tone, saying the labour market and underlying demand backdrop “bodes well for the ability to bring inflation down while also continuing to sustain the recovery”

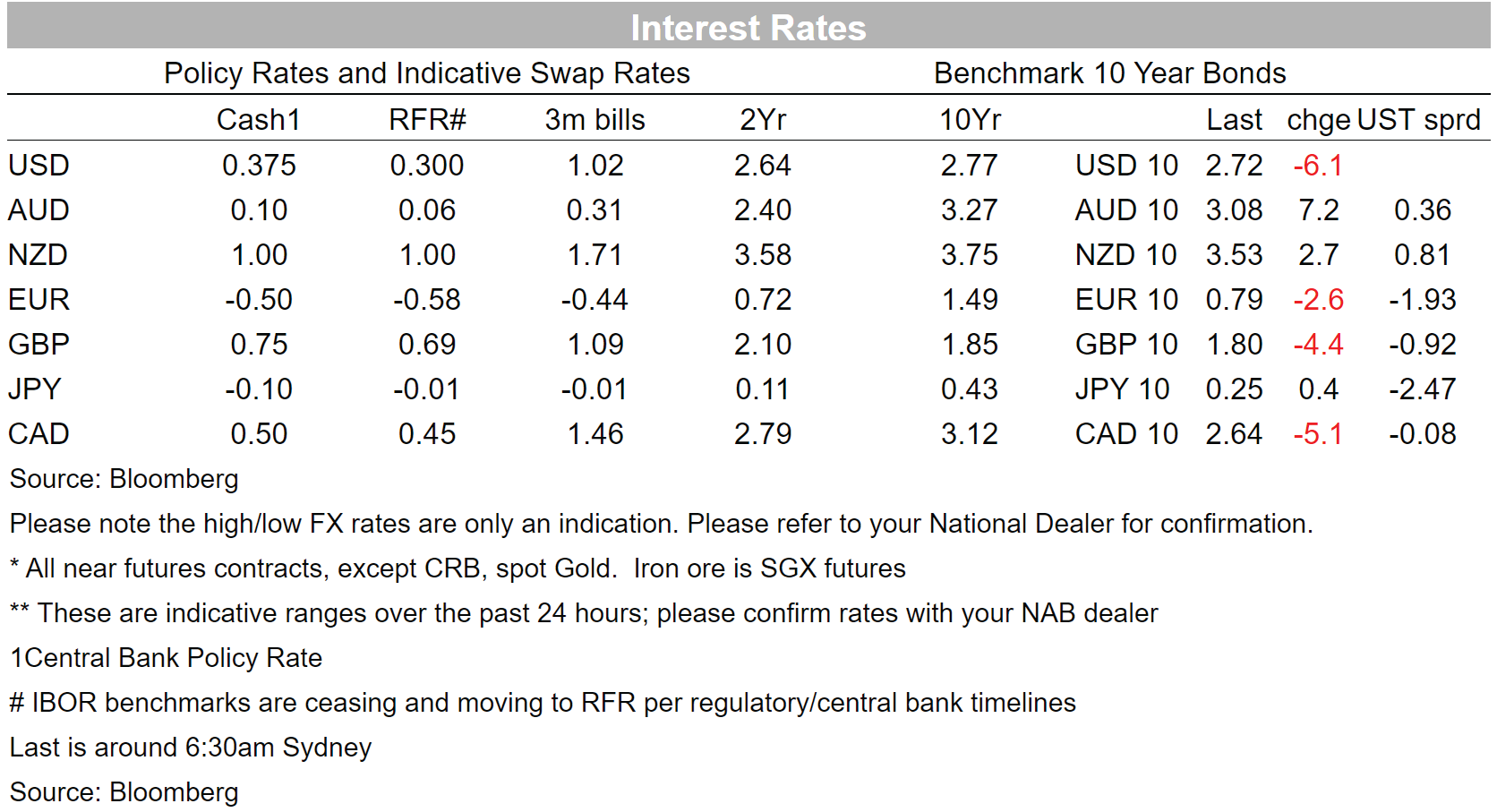

The weaker core read saw markets pare US rate hike bets at the margin. Market pricing now implies around 210bps of tightening by year end, against 220bps yesterday. US 10yr yields were off 6bps to 2.72%, paring their recent march higher after reaching as high of 2.82%. But curves steepened as moves were led by the front end and the belly of the curve. US 2yr yields were off 13bps to 2.38%, and 5yrs were down 11bps to 2.68%. The 5s10s spread moving into positive territory for the first time since mid-March.

Currency markets reflected the higher commodity price backdrop. The AUD was up 0.5% to 0.7454 after trading as high as 0.7493 on US dollar weakness following the CPI release. NZD and NOK were up 0.4% and 0.5%. The DXY ended up 0.4% higher at 100.31, more than reversing a dip to 99.74 immediately after the CPI release as the euro weakened. The euro was 0.5% lower against the dollar. The yen was little changed.

Brent oil was up 6.3% to US$104.7 and WTI rose 6.8%, back above US$100 a barrel . That appears to be helped by optimism around the demand outlook with news of some easing of restrictions in Shanghai. Restriction were eased on compounds that had no virus cases in the past two weeks, but reports suggest the vast majority of the city’s 25 million residents still subject to tight movement restrictions. There were 23,342 cases in the city Monday, a drop from Sunday’s record but still up from about 5,000 just two weeks ago. News on Ukraine also provided little cause for optimism. Russian president Putin said peace talks with Ukraine are “at a dead end” as he dismissed as fake accusations of war crimes. Adding to the oil news, OPEC cut forecasts for both oil demand and supply in its latest monthly report, suggesting the group will stick to its modest supply hikes plan.

Equities were generally lower. The S&P500 down 0.3% after giving up early gains with similar declines seen in the NASDAQ. Financials led the declines ahead of the earnings season, down 1.1%, with energy stocks adding 1.7% offsetting some of the declines elsewhere. European bourses were also lower, the DAX losing 0.5%.

NFIB small business optimism showed pricing pressures remained elevated. The optimism read declined to 93.2 in March, its lowest since the 90.9 reading plumbed in April 2020. That decline was led by short term expectations, which fell 14 points to -49, the lowest in the survey’s 48-year history. 72% of owners reported raising average selling prices, an increase of 4pts and the highest reading in the history of the survey

UK unemployment fell a tenth to 3.8, matching the lows seen in 2019 prior to the pandemic. Earnings numbers matched expectations, accelerating in year-ended terms to 5.4%, and 4.0% ex bonuses. The ZEW survey showed expectation and conditions still deep in negative territory in April after plummeting in the March read.

The March NAB Business Survey was the pick of the local data flow yesterday. It showed business conditions and confidence soar further., and cost pressures at the highest in the history of the survey. Business Conditions rose to 17.8 from 8.5, well above its long-run average of 5.8. Business Confidence was also higher at 15.8 from 13.2, also well above its long-run average of 5.4. Cost pressures also spiked higher in the month from already elevated levels. Higher fuel prices likely contributed in the month, but inputs costs at 4.2% and retail prices at 3.7%, both highs in the history of the series, show continued price pressures that are flowing through into end consumer prices. Further evidence if any more were needed that inflation prints will be very strong through at least the first half of 2022.

Read our NAB Markets Research disclaimer

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.