Confidence and Conditions Lift

Insight

It has been a super risk positive night courtesy of a big downward surprise in the US CPI release.

Events Round-Up

CH: Aggregate financing (CNYb), Oct: 908 vs 1600 exp.

CH: New yuan loans (CNYb), Oct: 615 vs 800

US: CPI (m/m%), Oct: 0.4 vs. 0.6 exp.

US: CPI ex food, energy (m/m%), Oct: 0.3 vs. 0.5 exp.

US: CPI (y/y%), Oct: 7.7 vs. 7.9 exp.

US: CPI ex food, energy (y/y%), Oct: 6.3 vs. 6.5 exp.

US: Initial jobless claims (k), 5-Nov: 225 vs. 220 exp.

It has been a super risk positive night courtesy of a big downward surprise in the US CPI release. US equities have surged with S&P 500 north of 4.5%, UST yields are sharply lower with the 5y tenor leading the decline and the USD is weaker across the board with JPY, GBP and AUD leading the charge. AUD starts the new day just above 66c.

The CPI rose “only” 0.4% in October taking the yoy reading to 7.7%, below the 7.9% pencilled in by consensus. Excluding food and energy, the so-called Core CPI reading was just 0.272% well below the 0.5% expected, helping the yoy reading down to 6.3% vs 6.5% expected . Core CPI remains uncomfortably high for the Fed, but the downward surprise is an encouraging sign with details in the report suggesting further declines should be expected.

Looking at the Core CPI components in more detail, core goods prices declined 0.4% from September, registering their first drop since March. The biggest single drag on core goods prices came from a 2.4% drop in the used vehicle component. Encouragingly the decline is consistent with falling auction prices, which suggest another drop in November should be in the offing. A lot of other goods prices also fell, including for furniture, appliances and apparel, these price declines imply an ease in price pressures is finally coming through from loosening in supply-chain bottleneck as well as a reversal in elevated inventories.

Details in core services inflation were also promising. Rents inflation is now showing signs of easing, albeit from very elevated levels. Owners’ equivalent rents rose by 0.64%, the smallest increase since May, and consistent with the sudden reversal in most measures of private sector rents. Health insurance was the other big services mover, falling by a huge 4.0%, abruptly ending 2%+ per month increases seen over the previous 12 months. Pantheon economics notes that the BLS uses variations in insurance companies’ earnings as a proxy for insurance prices; these data changes only once per year, but the CPI spreads that change across 12 months, starting in October. This means that the health insurance component will now fall by some 4% per month until next September, replacing a 0.03pp contribution to month-to-month changes in the core index with a 0.05pp drag.

One swallow doesn’t make a summer but looking ahead the expectations of further declines in core goods prices as supply chain pressures continue to ease (including car prices) alongside further declines in health insurance cost plus an ease in rental pressure are encouraging signs pointing to further declines in US core CPI. The data is building the case for the Fed to moderate its aggressive interest-rate hiking path, more of the same and the case for no more hikes will become stronger.

The big uncertainty from here comes from the outlook on the remainder of services inflation (eating, travel and accommodation for instance) as well as wages growth. Inflation looks set to decline from hugely elevated levels, but will it head back down towards the 2% Fed target? If core CPI declines towards the mid 4% and then proves sticky, the Fed may still be forced to do more and keep policy restrictive for longer.

Speaking after the data release, fed officials welcome the inflation news, but warned further tightening is still warranted. San Francisco Fed President Mary Daly said the report was “good news.” Dallas Fed President Lorie Logan said it “may soon be appropriate to slow the pace of rate increases,” though such a move “should not be taken to represent easier policy.”. Fed Harker also suggested the Fed could slow the pace of interest rate increases in “upcoming months” but will continue to tighten monetary policy until financial conditions are “sufficiently restrictive,”. Notably Harker and Logan used plurals in increases and months. Finally, Kansas Fed George called for slower interest-rate increases in coming months, arguing a “steady and deliberate approach” to hikes would help avoid contributing to market volatility.

Moving onto markets, US equities surged on the inflation news. The S&P 500 now trades 4.63% on the day with all 11 sectors trading in green. IT is leading the charge up over 7% with consumer discretionary and real estate not far behind in the 6%. Energy shares are the laggards up only 1.7%. The sentiment shift also helped crypto markets stabilize despite the turmoil surrounding crypto exchange FTX. Year to date the S&P 500 is still down ~18% and the NASADQ is close to -30%, but the change in fortunes in October now have a good chance of extending in November. Earlier in the overnight session, European equities closed with positive returns with the Stoxx 50 +3.18%, the CAC 40 + 1.96% and the DAX +3.51%.

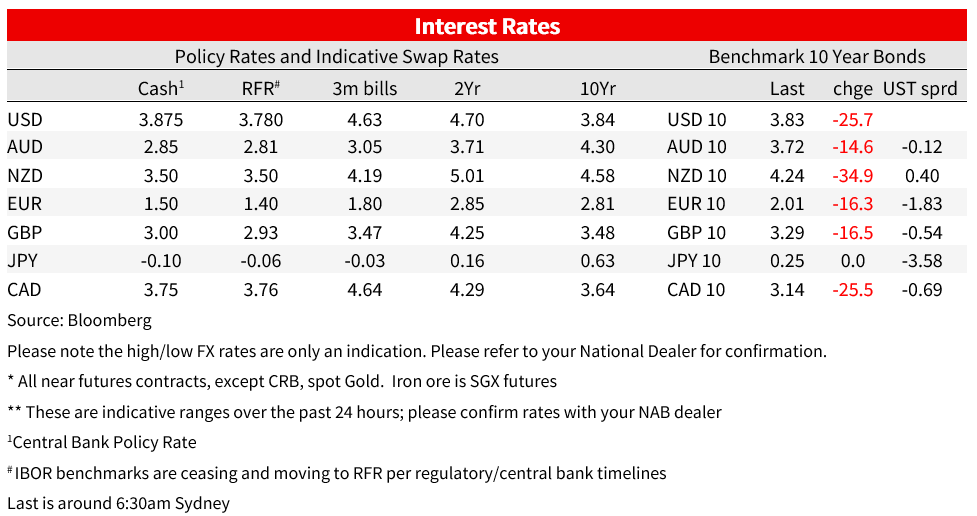

UST yields plummeted following the CPI release with the 5-year part of the curve leading the move lower in yields. The 5y Note is down 30bps to 3.94% while the 10y is down 26bps to 3.866%. Pricing expectation for Fed hikes over the coming year have also been pared. Looking at expectations for the Fed Funds rate in May next year, the OIS market now sees a rate of 4.88%, yesterday expectations were at 5.03% and on Monday 5.12%.

Moving onto FX the broad surge in risk appetite as well as the paring back in Fed rate hike expectation as has been a double punch for the USD. BBDXY and DXY indices are down close to 2% with the USD down on all G10 pairs. Gain within majors have been led by JPY and GBP, both up over 3%. USD/JPY now trades at ¥141.63 with the sharp decline in UST yields turbo charging the gains in JPY thanks to the BoJ YCC policy, we are now a long way from intervention levels just above ¥150. Meanwhile the pound has punched above 1.17 , perhaps reflecting a few short caught off-side by the big move in the USD. The euro trades at 1.0189, up “just” 1.74%.

Antipodean currencies have also performed well. The AUD is up 2.55% and now flirting with a move above 66c, prior to the US CPI release the AUD was trending lower, printing an overnight low of 0.6386, after the CPI the move up has been almost vertical, with gains losing momentum just below the big figure. The NZD is up ~ 2.25%, piercing the 0.60 mark and now trading at 0.6015. We have been projecting a sustained break of 0.60 from early next year, but the weaker CPI data might be bringing forward that move.

In other economic news, China credit data were very weak, with aggregate financing of CNY907b well below consensus and the lowest since 2019. Bank loans rose by the smallest amount in almost five years. Capital Economics noted the extremely unusual outright fall in lending to households, underlining the difficulty policymakers are facing stimulating growth while activity is suppressed by the zero-COVID policy.

On that note, the new Politburo Standing Committee chaired by President Xi and made up of close amigos, reinforced the need to stick with the zero-COVID policy while urging officials to be more targeted with their restrictions so as to avoid damage to the economy . Guangzhou looks like a test case for this policy, not heading into a Shanghai-style lockdown after the recent surge in cases, but a more targeted lockdown of only 3 of its 11 districts.

NAB Markets Research Disclaimer

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.