Online retail sales growth slowed in May following a fairly strong April

Insight

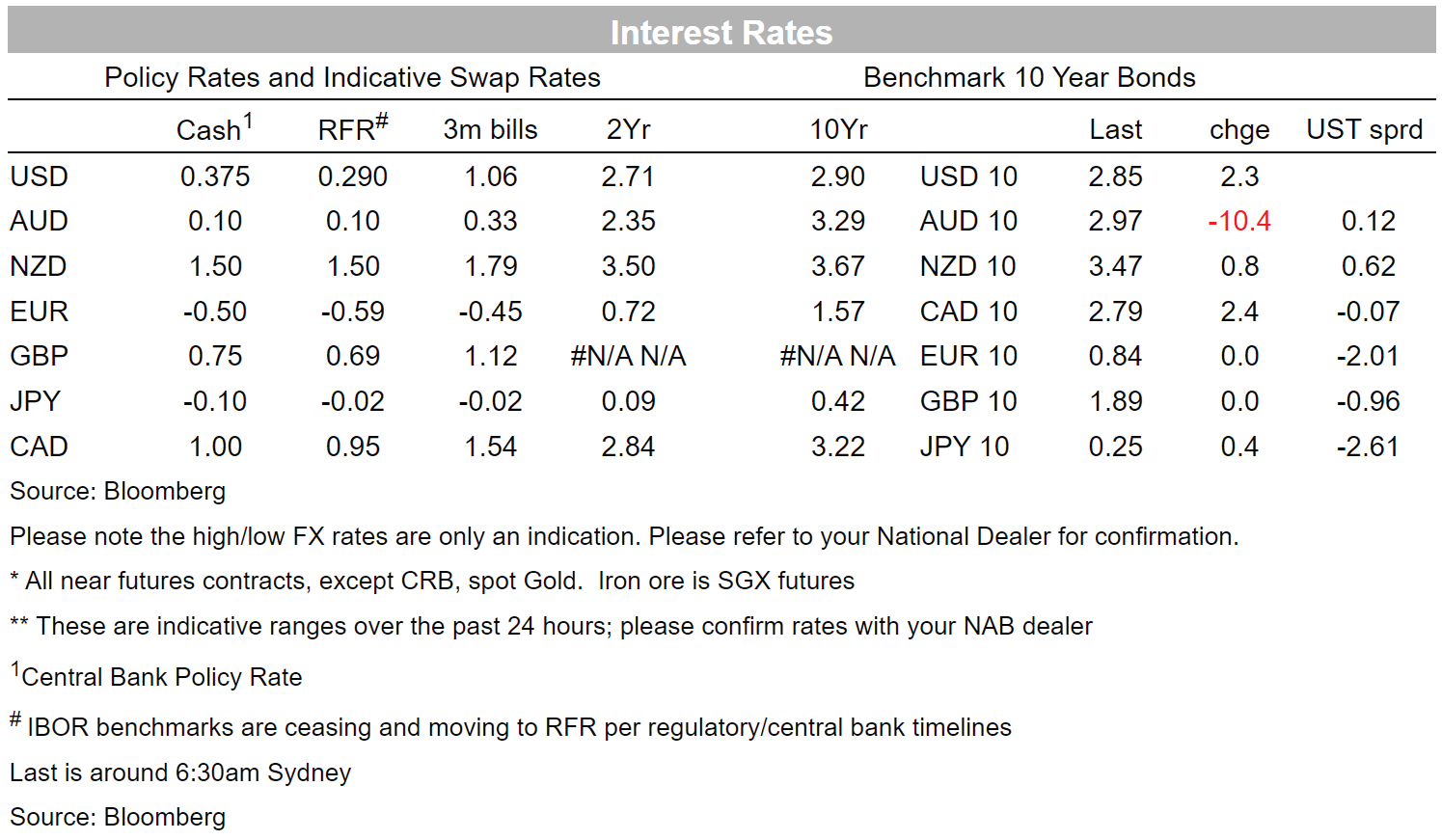

Global yields continued their March higher over the Easter period with the US 10yr yield hitting a fresh cycle of 2.88%, its highest since 2018.

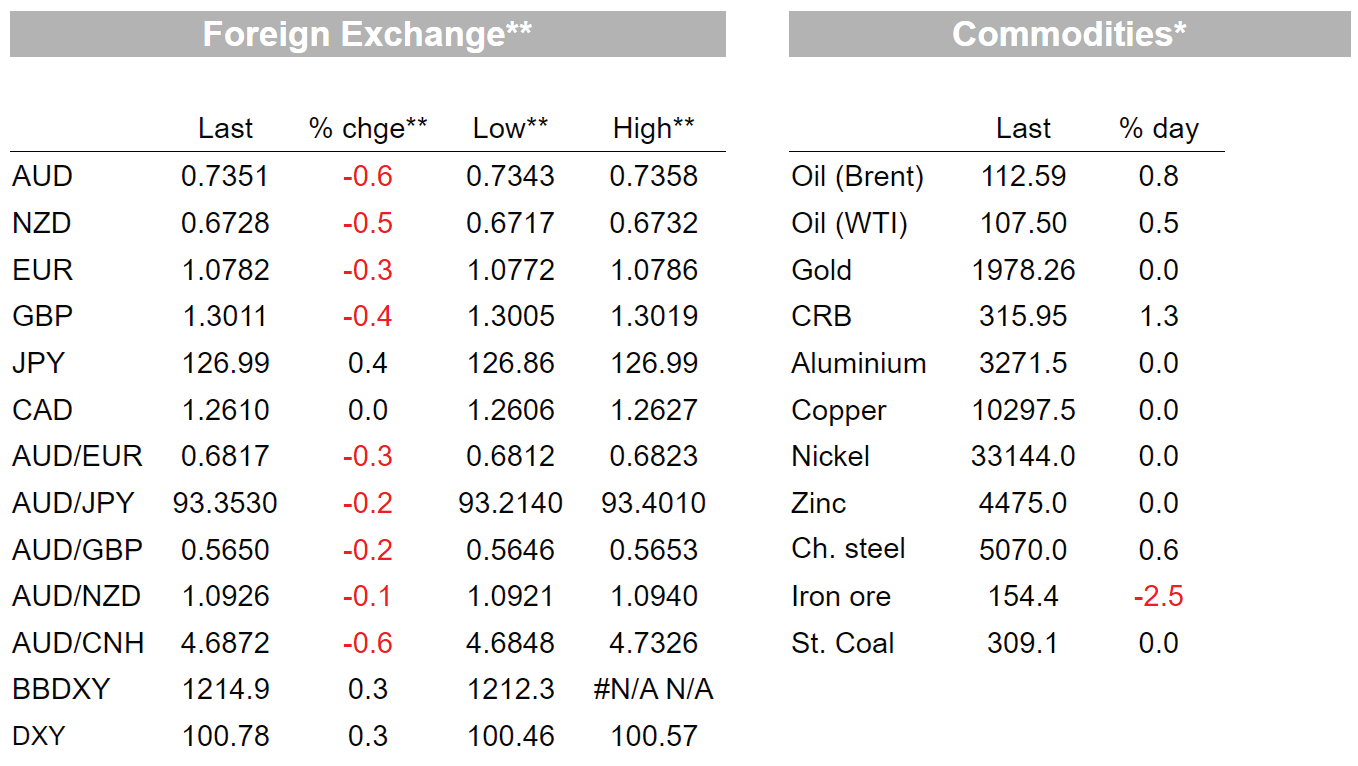

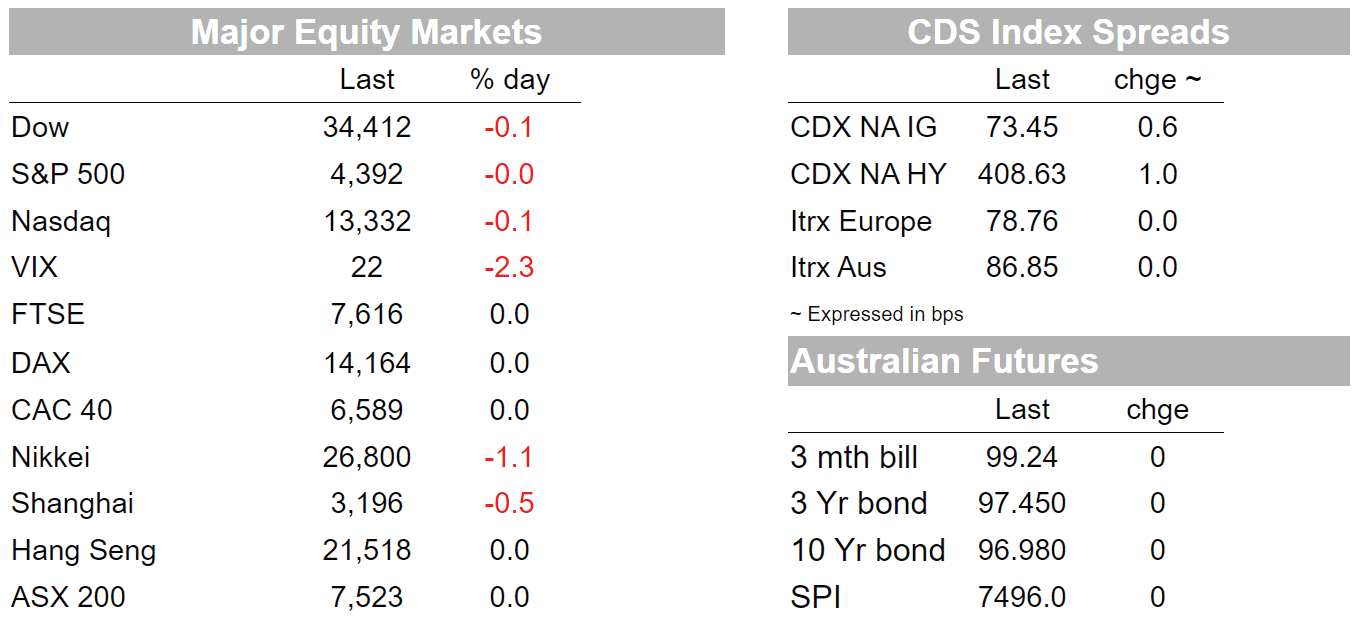

Global yields continued their March higher over the Easter period with the US 10yr yield hitting a fresh cycle of 2.88%, its highest since 2018. The Fed’s Williams was the catalyst for the move on Thursday where the 10yr yield leapt some 17bps in thin trade to 2.83%, with those moves holding on Monday with the 10yr yield currently trading at 2.85%. The other big mover was the oil price with Brent oil at $113 a barrel on a combination of supply disruptions in Libya and headlines on Thursday of the EU drafting a ban on Russian oil imports. In economic news China’s weaker than expected retail sales overshadowed better than expected Q1 GDP figures. More importantly, China’s near-term outlook has dimmed given partial/full lockdowns are now encompassing some 24% of the population or around 40% of GDP. In FX it is all about USD strength with the DXY up 0.7% last week and up another 0.3% on Monday. Risk sentiment as summed up by equities has softened with the S&P500 -2.1% last week and was broadly flat yesterday (S&P500 -0.0%).

First to the Fed’s Williams who spoke on Thursday and was the catalyst for the move higher in yields. The main headline was that he thinks the Fed needs to move “expeditiously towards more-normal levels of the federal funds rate.” Adding that he sees neutral being somewhere in the range of 2% to 2.5%. But what likely got the markets attention was his comments around the limited ability of the Fed to tolerate inflation above 2% . There had been some thought that given the Fed’s dual mandate that if inflation persisted high and growth weakened, the Fed could ease off the brake. Not so according to Williams who quashed any thoughts of the Fed willing to tolerate a period above 2% inflation: “we have a 2% longer-run goal” and “we are going to get inflation back to 2%”.

Williams also noted “we will need to get real interest rates….back to more normal levels…by next year…and we may need to go a little above that depending where inflation is”. One proxy for real interest rates used by many for asset valuations is the US 5yr and 10yr TIP yields and it is worth noting the 10yr TIP is getting closer to positive territory at -0.09% and that the 10yr TIP yield averaged positive around 0.50-1.00% (see Bloomberg: Fed’s Williams on Inflation, Policy, Balance Sheet, worth a listen). Meanwhile as your scribe types the Fed’s Bullard is hitting the airwaves, repeating his hawkish commentary that the Fed should be open to a 75bp move, though “more than 50 basis points is not my base case at this point”. Bullard also repeated he “want[s] to get above neutral as early as the third quarter and try to put further downward pressure on inflation at that point” and hiking to a rate of 3.5% would be appropriate given where inflation is.

Sticking to the US, data flow remains mixed. Retail Sales suggests some moderation occurring with core control retail sales -0.1% m/m against +0.1% expected. Core retail sales have now fallen for two consecutive months (retail was -0.9% m/m in February) and given the Cleveland Fed’s Trimmed Mean CPI in February and March was 0.5% m/m, this suggests a bigger hit to volumes over the past few months. Consumer Confidence also came out and while better than expected at the headline (65.7 against 59.0 expected), the index is still around the levels seen in January 2022 which is still around the lowest levels since 2011. Meanwhile Industrial Production was stronger than expected (0.9% m/m vs. 0.4% expected) as was the NY Empire Fed Manufacturing Survey (24.6 vs. 1 expected). Jobless Claims ticked up to 185k from 167k, but remains at extraordinary low levels.

China’s near-term growth momentum meanwhile looks like it will slow sharply. Analysis by Nomura shows around 24% of the Chinese population (equivalent to 373m, up from 193m last week) are in partial/full lockdown. Importantly the cities that have these restrictions comprise up to 40% of GDP. It’s no surprise then why analysts focused on weaker than expected Retail Sales figures yesterday (-3.5% y/y vs. -3.0% expected) instead of the better than expected Q1 GDP (1.1% q/q vs. 0.7% expected). It is still very unclear when China will/is able to pivot away from its zero-Covid policy and while zero-COVID exists, markets will remain sceptical China can reach its 2022 GDP goal of 5.5%. Meanwhile Shanghai reported its first deaths from Covid-19 on the weekend.

Commodities remain volatile, buffeted by Russia/Ukraine and China’s lockdown. Oil prices have risen with Brent at $112 a barrel on news that Libya’s oil production has fallen by 535k barres a day. The Sharara field in the west of the country, which can pump 300,000 barrels each day, was closed after protesters gathered at the site. Meanwhile Russia’s invasion of Ukraine is likely to step up a notch in the east with President Putin reportedly wanting to a delivery a key victory ahead of May 9 celebrations that mark the Soviet defeat of Nazi Germany. The EU also continues to tighten sanctions on Russia with proposals for a ban on Russian oil likely to emerge after the French presidential elections according to press reports.

Sticking to Europe, on Thursday the ECB left policy settings unchanged, including the accelerated asset purchase program taper announced at the prior meeting. There had been some expectations that a definitive end to APP in Q2 might be confirmed, which would more clearly open the way for a rate hike in July. However, with the ECB retaining optionality on the APP running through Q3 and President Lagarde remaining noncommittal on how long the gap between asset purchase end and tapering might be, pricing for a July rate hike has been trimmed a little. There’s still more than 11bp of hikes priced for July, but a full 25bp hike is now by September. Bond yields initially fell on the ECB news on Thursday night. However, US data then began to be released and the Fed’s Williams started to speak which saw yields leap higher (see above for details).

Finally in FX, the USD is broadly stronger against a backdrop of higher Fed rate hike expectations and softer risk appetite. USD/JPY has reached a new 20-year high, the EUR has fallen to a two-year low after the ECB failed to live up to elevated market expectations and the AUD is back to 0.7349. The EUR has fallen to a two-year low, below 1.08, as the ECB meeting on Thursday night failed to live up to the elevated market expectations.

Read our NAB Markets Research disclaimer

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.