On a seasonally adjusted basis, the NAB Online Retail Sales Index recorded a drop in growth in July

Insight

Speculation about China reopening continues to add some market volatility with WSJ reporting Chinese leaders were considering reopening steps getting some notice.

GE: Industrial production (m/m%), Sep: 0.6 vs. 0.1 exp.

CH: Exports (USD, y/y%), Oct: -0.3 vs. 4.5 exp.

CH: Imports (USD, y/y%), Oct: -0.7 vs. 0.0 exp.

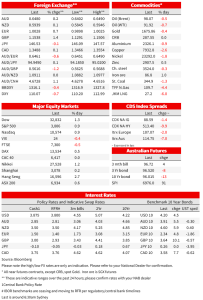

There was little lasting effect from the weekend intervention from Chinese officials citing ‘unswerving’ commitment to the current covid containment strategy. Speculation about reopening continues to add some market volatility with WSJ reporting Chinese leaders were considering reopening steps getting some notice. The AUD began the week about 1.0% lower as some of the rally late last week was pared but has since recovered to be 0.2% higher from Friday. The USD is lower, and bond yields are generally higher with US mid-terms and CPI looming large this week. A late rally has seen US equities push higher in the last hour or so, with the S&P500 up 0.9%.

Markets began the week with some initial pullback early Monday after Chinese officials reaffirmed commitment to the current Covid strategy. Hu Xiang, an official at the National Health Commission said over the weekend that “previous practices have proved that our prevention and control plans and a series of strategic measures are completely correct” in the latest comment from government officials backing the strict containment approach. Despite that push back, hopes of an easing over time remained intact and much of the initial reaction reversed. Hong Kong and Chinese equity markets closed in positive territory yesterday, up 2.7% and 0.2% respectively for the main indices, following the strong 6-9% gains seen last week.

In currencies, the AUD fell around 1% early on Monday, quickly reaching an intraday low of 0.6402, but has since recovered to be up 0.2% at 0.6480. The NZD saw a similar pattern, falling very briefly below 0.5850 before recovering to 0.5939. Elsewhere in currency markets, the DXY was lower, down 0.7% as European currencies rose, and the yen was little changed. The euro gained 0.7% against the dollar, back above parity at $1.0028, while the pound was 1.4% higher.

Helping the view that a reopening could be coming, if not imminently, was a WSJ article reporting Chinese leaders were considering reopening steps but have no set timeline . The reporting notes that officials are proceeding cautiously, weighing the costs of strict controls and the impact on the economy against potential costs of reopening for public health and support for the Party. ‘People familiar with the discussions’ pointed to a long path to anything approaching prepandemic levels of activity, with the timeline stretching to sometime near the end of next year. “One plan under consideration in Beijing, the people said, would be to begin treating Covid-19 as a “Class B” infectious disease following any change in the WHO’s designation.” (WSJ) In a timely reminder of the potential for covid policy to hit output, Apple warned iPhone shipments will be lower than previously expected after China lockdowns affected operations at a supplier’s factory.

Chinese trade data showed a sharper pull-back than expected in October. Exports growth fell 0.3% y/y in October, from +5.7%y/y in September, and sharply below expectations for 4.5% y/y. That implies a large monthly drop in volumes and with the manufacturing sector largely spared form last-month’s tighter COVID restrictions, suggests waning global demand is a key factor. Imports growth also slowed, falling 0.7% y/y from +0.3% and against 0% expected. Exports of clothing, computers, healthcare products, furniture, lights and toys fell over the year.

In bond markets, yields were generally higher. US 2 and 10-year Treasuries are up 4-6bps from last week’s close to 4.72% and 4.20% respectively. Corporate supply is one factor cited as potentially weighing on the market. Europe saw the newest corporate bonds offered in weeks and at least 10 US investment grade offerings to kick off the new week. 10yr German Bunds were up 5bp to 2.34%. Speaking in the last hour on Estonian TV, ECB President Lagarde said that “we have to bring inflation back to 2% in the medium term — that’s our objective, that’s our primary concern, that’s our compass.” She rates will need to increase again but did not provide a suggestion of where rates might need to get to. Earlier, Bank of France Governor Villeroy said in an interview with the Irish Times that “as long as underlying inflation has not clearly peaked, we shouldn’t stop on rates.”

US equities were higher. The S&P500 was unconvincing in eking gains for most of the session, chopping between flat and 0.5% up, but has moved higher in the last hour or so to be 0.9% higher. 9 of 11 sectors were higher, led by communications and energy, while consumer discretionary and utilities lagged. The Dow was up 1.3% and the NASDAQ was 0.9% higher. Meta rallied on plans to cut jobs, while Tesla weighed the most on the broader index.

Elsewhere on the data calendar, German industrial production grew by 0.6% m/m in September, outpacing expectations for a 0.1% rise. Two out of three companies in Europe’s largest economy still reported supply bottlenecks. production in energy-intensive industries such as the chemical industry in September fell by 0.9% m/m and was 9.7 lower over the year. Order backlogs could help support industrial production in the short-term but a 4% drop in new orders points to further weakness ahead.

NAB Markets Research Disclaimer

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.