Asset finance and leasing is in a growth phase in Australia as organisations seek a capital-effective way to modernise and upgrade across a broad range of asset classes and industries.

When we’ve had positive risk sentiment in the past we’ve tended to see a stronger Aussie dollar but that’s not the case today.

https://soundcloud.com/user-291029717/aussie-dollar-falls-despite-contiunued-recovery-hopes?in=user-291029717/sets/the-morning-call

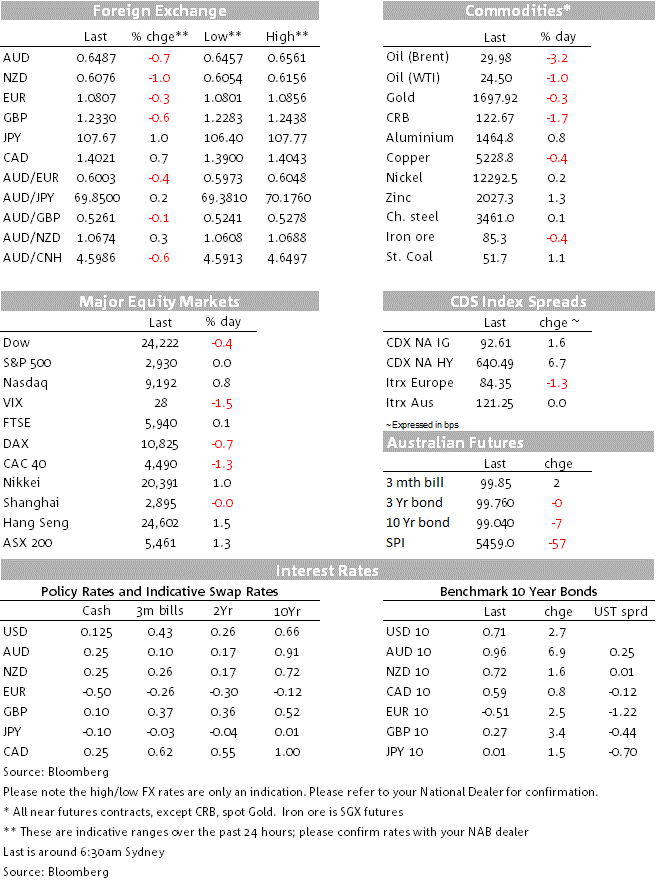

A song gifted by the Killers’ Brandon Flowers to Robbie Williams apparently, the title of which sums up a night where asset markets looks to have been dancing to somewhat different tunes. US equities are finishing in New York mixed with the S&P just in the green, the NASDAQ +0.8% but the Dow -0.5%. US bond yields are higher across the curve while the USD, that has on most days been under at least mild downward pressure when stocks are in the green, is higher against every G10 currency, losses most pronounced versus the NZD (-1%). AUD/USD is 0.7% lower on this time yesterday, back below 0.65. Oil prices are down, after news that Saudi Arabia announced an additional one million bpd voluntary production cut on top of last month’s OPEC+ agreement, with an additional 180,000 bpd reduction from Kuwait and the UAE combined. We’ll leave that one to our commodity research guru to explain.

Just updating the chart of daily new infections outside China, it has shot back up to around 90,000 – Sunday’s number and close to the record highs – having dropped to nearer 60,000 on Saturday, the lowest since March 31st. The latter was evidently a statistical blip/under-reporting. Russia is the new epicentre of new cases in Europe, while the spread of the virus looks to be slowing slightly across much of the rest of Europe. As a result, some additional European countries are loosening restrictions, including France, Switzerland and Greece, while the UK is planning a staged easing for the lockdown but where the instructions from the UK authorities about what is and isn’t to be allowed can perhaps best be described as ‘haphazard’. In the US, New York’s Governor said that certain businesses including construction, curb-side retail, drive-in movie theatres and some recreational activities will reopen from Friday on a regional basis, while NYC’s mayor said that the lockdown is likely to extend into June.

Technology stocks are again at the vanguard of what strength we have seen in US equities, hence the NASDAQ’s significant outperformance versus the Dow and S&P, though in the latter health care and communications, two of the relative winners during the pandemic, have been the most positive sectors outside IT.

The US curve has bear steepened, 2-year Treasuries +2bps, 10s +3bps and the 30-year +5bps. The moves for the most part pre-dated comments from Atlanta Fed President Raphael Bostic who spoke a few hours ago and said “I am not a big fan of going into the negative rate territory…negative rates is one of the weaker tools in the tool kit. I am not anticipating supporting that anytime soon”. We’ll hear from the Fed’s Bullard and Harker tonight, ahead of Fed chair Powell’s keenly awaited speech on Wednesday, where Sunday’s apparently ‘sourced’ report in the WSJ suggest he will push back against the notion of negative rates.

The bear steeping of the US yield curve is about the best explanation on offer for the across-the board gains for the USD, though the moves were afoot prior to Monday’s US market open. The DXY index is up just under 0.5% and more broadly USD gains have been led by the NZD and SEK (both down 1%) JPY (-0.9% and consistent with higher US yields) NOK (-0.7%) and AUD (-0.64% to 0.6490). during the local session Monday, AUD/USD had come within about 10 pips of challenging its April 30 high of 0.6570. The underperformance by the NZD comes despite New Zealand announcing it is easing its stringent COVID-19 restrictions, allowing domestic travel to resume and the hospitality industry to re-open. PM Ardern announced Monday that the country will drop to Alert Level 2 on Thursday. Restaurants, shops, gyms and playgrounds are allowed to re-open and people will be able to meet up with family and friends in groups of up to 10.

Around the local close yesterday China published its April credit and money supply data, which came in stronger than expected in all respects. New Yuan Loans were Y1,700bn down from 2,850bn in March but above the 1,300bn expected. Aggregate Financing at Y3,090bn was below the 5,150bn in March but above the 2,775bn expected and M2 money supply growth accelerated to 11.1% from 10.1% and above the 10.3% consensus. Crucially, Credit growth has accelerated to 12% on a year ago, a positive omen for the ongoing recovery from the Q1 growth collapse. On Sunday, in its quarterly monetary policy report, the PBoC said the country faces unprecedented economic challenges from the coronavirus pandemic and says it will resort to “more powerful” policies to counter the hit to growth. Policy makers will pay more attention to economic growth and jobs among multiple targets, the central bank said in its quarterly monetary policy implementation report, released Sunday. Our take is that we should expect lower interest rates, an increase in access to funding and further reserve requirement ratio cuts.

NAB’s April Business Survey is at 11:30 AET, following the March survey which saw conditions crunch to -21 from -2 and confidence collapse to -66, also from -2 in February.

China April CPI (also 11:30 AET) should show inflation moderating at the CPI level, to 3.7% from 4.3% with falling pork prices, among other things, again one of the key drivers. Outright deflation at the PPI level is seen accelerating, to -2.6% from -1.5% in March.

Offshore tonight the main data points are the US NFIB Small Business Optimism survey, which fell to 96.1 from 104.5 in March and is expected to have fallen further in April, to 85.0 and April US CPI. The latter is seen showing the early disinflationary impact of the lock-downs, expected to falling to 1.7% in ex-food and energy terms from 2.1% in March.

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.