Total spending grew 0.9% in June.

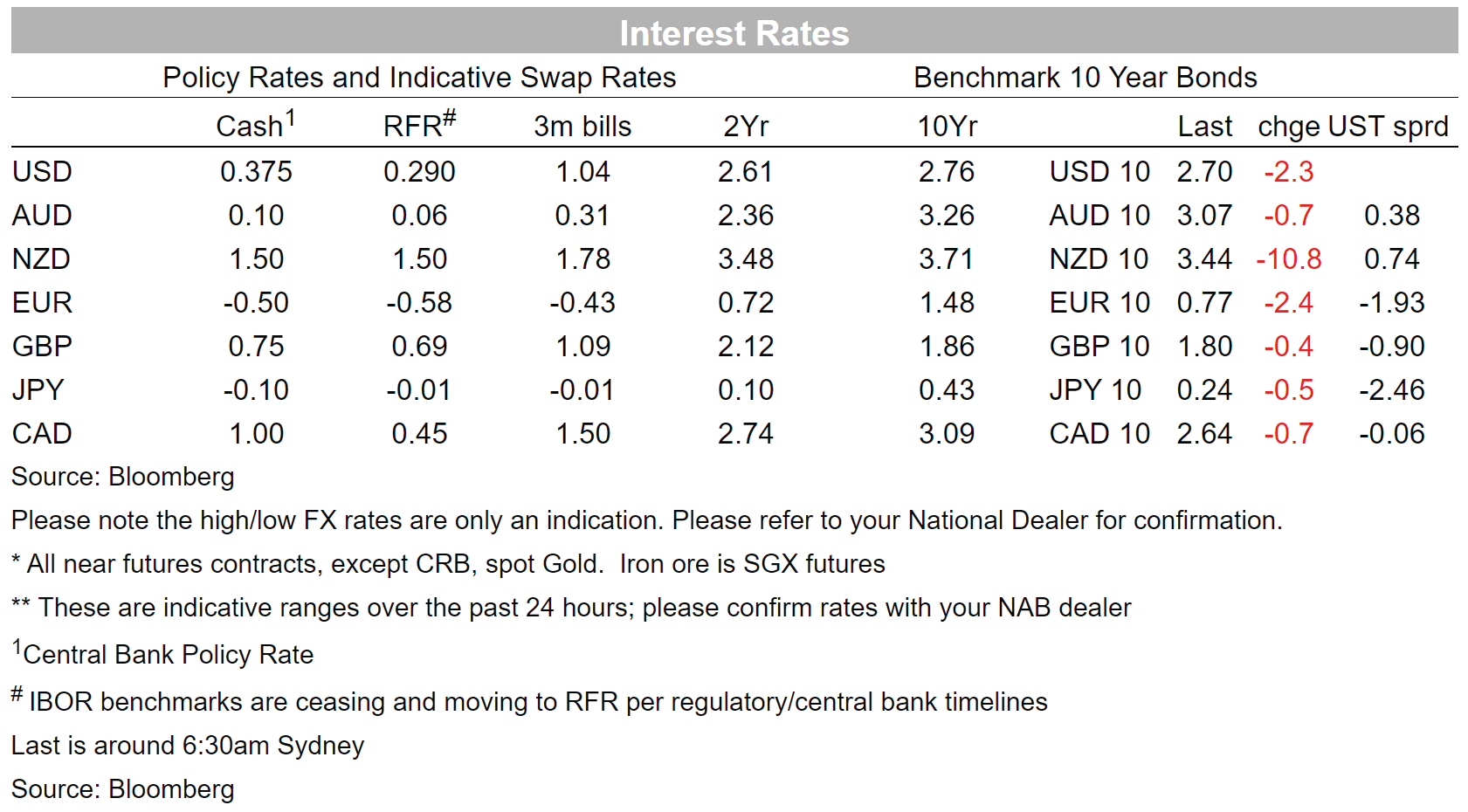

Despite 50 basis point hikes by the Bank of Canada and the RBNZ over the last 24 hours, bond yields haven’t moved a great deal.

25bps central bank rate hikes are suddenly so last year. Fifty is the new twenty five, as demonstrated by the RBNZ yesterday – the first G10 central bank to lift rates in the post-pandemic cycle and the first to do so by 50bps – quickly followed by the Bank of Canada. The Fed is almost bound to follow suit next month, and after another upside surprise in UK CPI yesterday, UK money markets are flirting with a 50-pointer from the Bank of England when it next meets on 5 May (currently about 20% priced) Not NAB’s call, but we can well imagine that down here, markets will move closer to pricing a first RBA tightening – still expected for June – of 40bps. Money market pricing as of last night’s close put the odds of this at almost exactly 50%. Post the RBNZ, our BNZ colleagues haven’t shifted their view for the RBNZ going another 50bps in June.

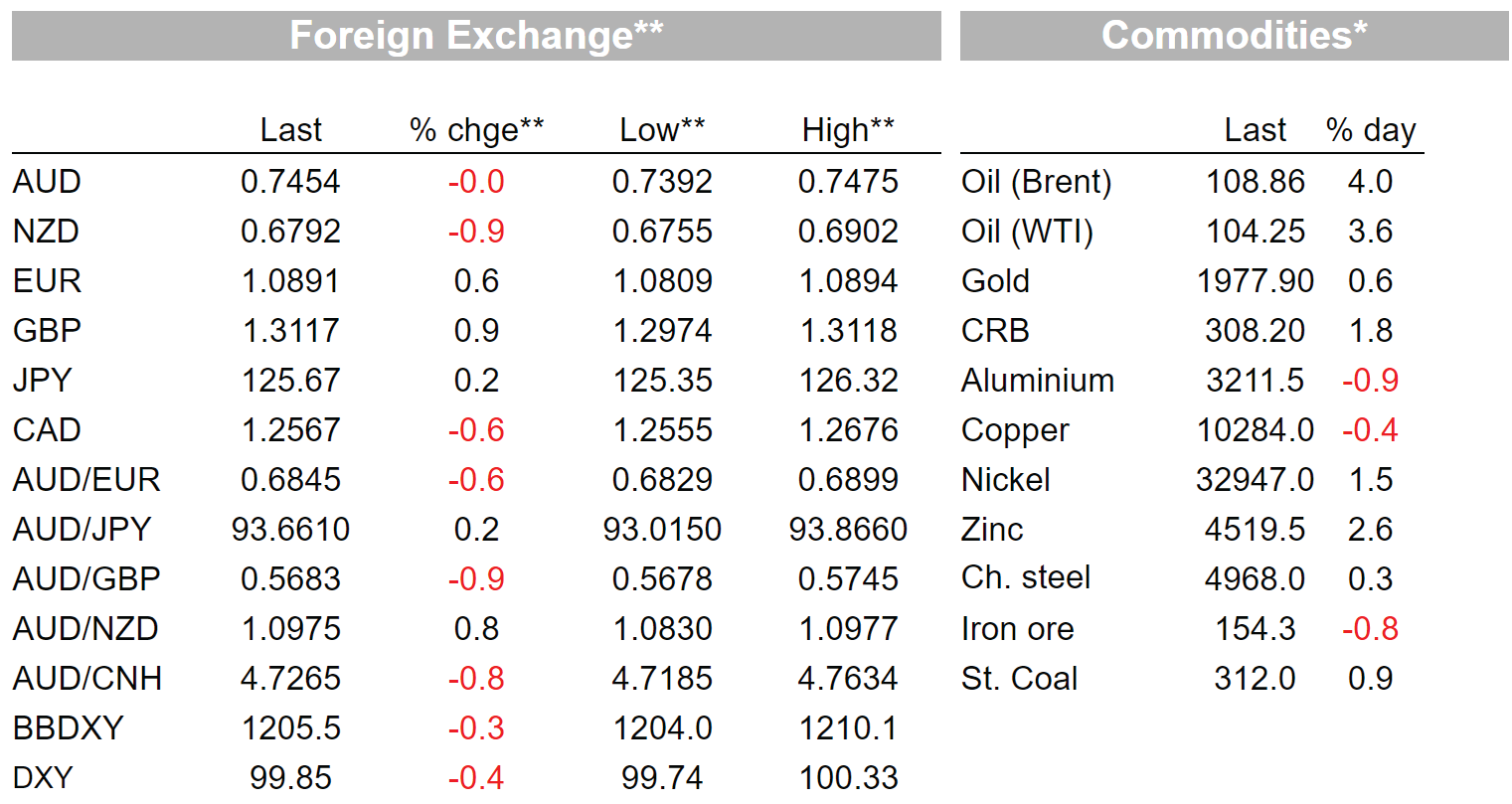

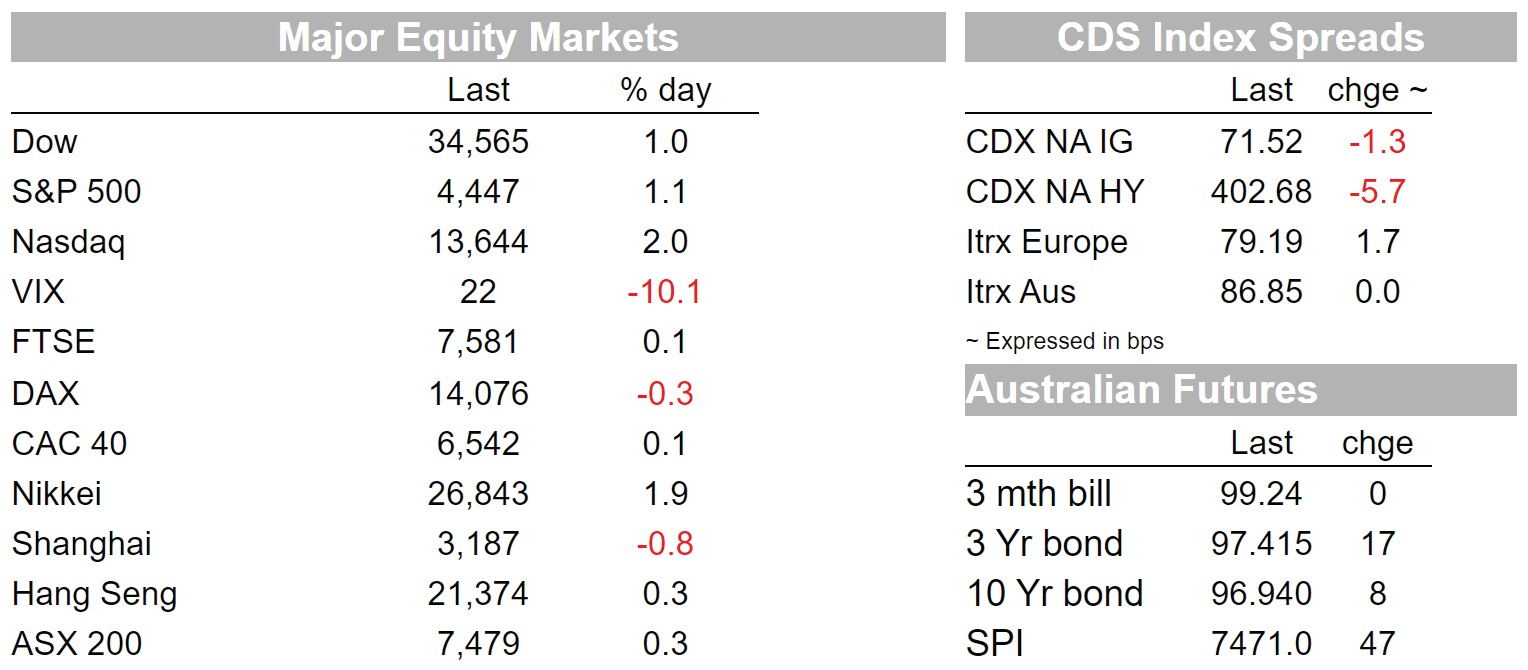

The bigger market moving news in the last 24-hours has been the fall-back in US Treasury yields . Quite why is not clear, other than follow-through from the softer than expected core US CPI on Tuesday night (note that the 30-year yield, down over 10bps at one point, has backed up 5bps or so following a soft 30-yar auction). We noted here on Monday that the common thread across all asset market last week was the seemingly relentless rise in US Treasury yields – at both ends of the yield curve – and which were pressuring equities and lifting the USD dollar, a theme which continued into the early part of this week. Overnight, 10 year Treasuries are down to 2.695% versus an intra-week and cycle high of 2.83% on Tuesday, while 2s, which hit a high of 2.60% on Wednesday of last week, are currently down at 2.35%. In turn, the USD is off its highs (DXY 99.9 from 100.5 earlier in the session) and US equities have finished with gains of 2% for the NASDAQ and 1.1% for the S&P500. This follows a mixed night for European equities and where the Eurostoxx 50 benchmark ended little changed (-0.1%).

The fall bank in Treasury yields has come despite US Producer Price Indices coming in at double consensus market expectations, the ex-food and energy measure up 1% on the month against 0.5% expected, lifting the year-on-year rate to a new cycle high of 9.2% from 8.7% (and the headline to 11.2% from 10.3%). Earlier in the night, UK CPI printed at 1.1% on the month against 0.8% expected, for an annual rise of 7.0% up from 6.2% in February – hence the lift in UK money market pricing for future BoE meetings.

Blame for the fall-back in Treasury yields can’t be laid at the door of incoming Fed speak, Governor Christopher Waller, the latest to weigh in, telling CNBC “I prefer a front-loading approach. So a 50 basis-point hike in May would be consistent with that and possibly more in June and July…We want to get above neutral certainly by the latter half of this year and we need to get closer to neutral as soon as possible.”

The Bank of Canada’s 50bps rate hike was fully expected, in addition to which the BoC said it would commence ‘quantitative tightening’, or ‘QT’, later this month, with its bond portfolio expected to shrink around 40% over the next two years as it lets its bond holdings roll off. The BoC said further tightening should be expected as the cash rate is lifted towards neutral, seen between 2-3%, with Governor Macklem saying it was prepared to move “forcefully ”. The BoC is widely expected to follow up with another 50bps hike at its next meeting in early June (currently about 90% priced).

US equity market gains which, as said, followed the fall-back in Treasury yields, got no help from the kick-off to the US earnings season, where JP Morgan’s Q1 EPS came in at $2.63 (vs $2.69 f/c) on revenue of $30.7bn (vs $30.86bn f/c). So a slight miss on both. Provision for credit losses $1.46bn (said to be on inflation) were well above the estimated $465mn. There was a beat on investment banking revenue, but misses broadly elsewhere. After the results, JPM announced plans for a $30bn share buyback.

In FX, the 0.5% fall-back in ethe DXY USD index is driven by gains for GBP post CPI (0.9%) and CAD post the BOC (+0.6%) together with a 0.5% rise in EUR/USD in front of tonight’s ECB meeting where focus on whether they hint at its Asset Purchase Programme (QE) coming to a halt as early as Q2 not Q3 as previously indicated. Yesterday the NZD got no love out of the RBNZ whose 50-point hike was, in the RBNZ’s words, a front loading of hikes with no lift to the implied terminal rate in their OCR track. NZD losses post the RBNZ saw the AUD/NZD cross lift to as high as 1.0975, its best since August 2020. AUD/USD dipped briefly below 0.74 overnight but is currently back to where it started Wednesday, near 0.7450.

Read our NAB Markets Research disclaimer

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.