Online retail sales growth slowed in May following a fairly strong April

Insight

It’s not something that will continue for long, but US bond yields have risen sharply today, and so have equities. Which one will give in first?

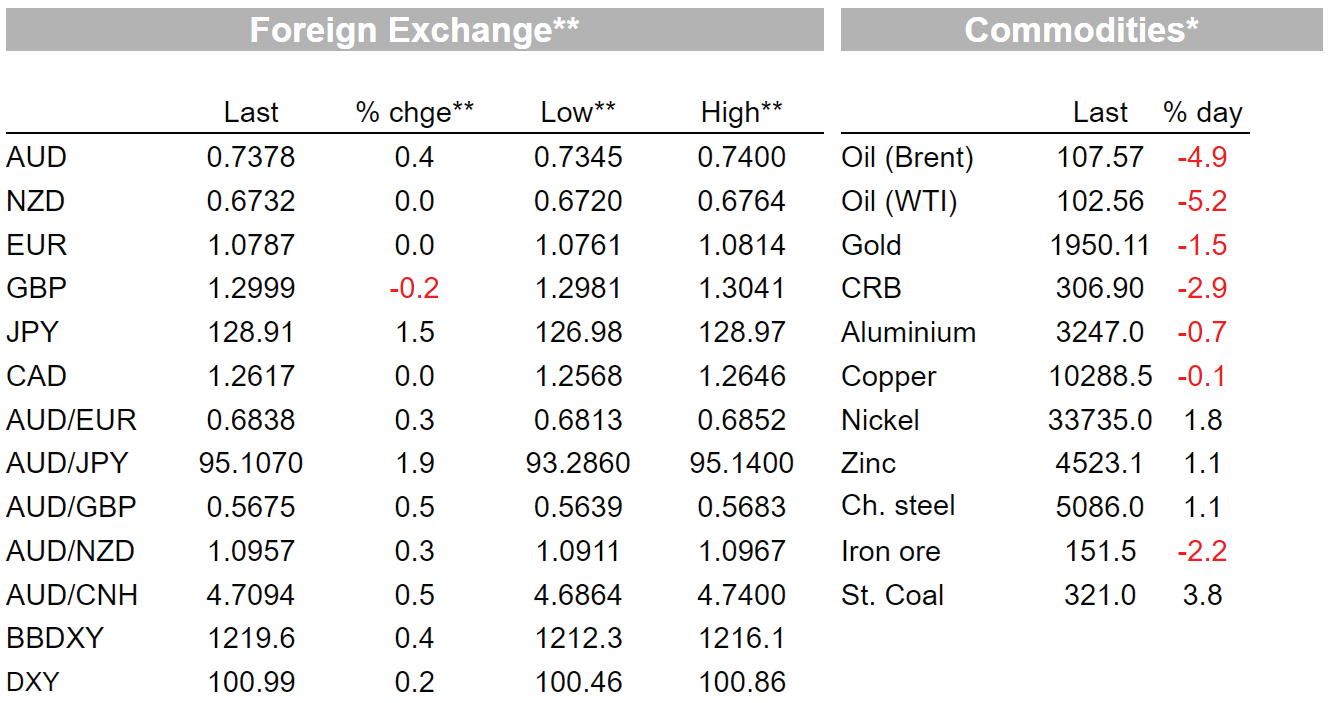

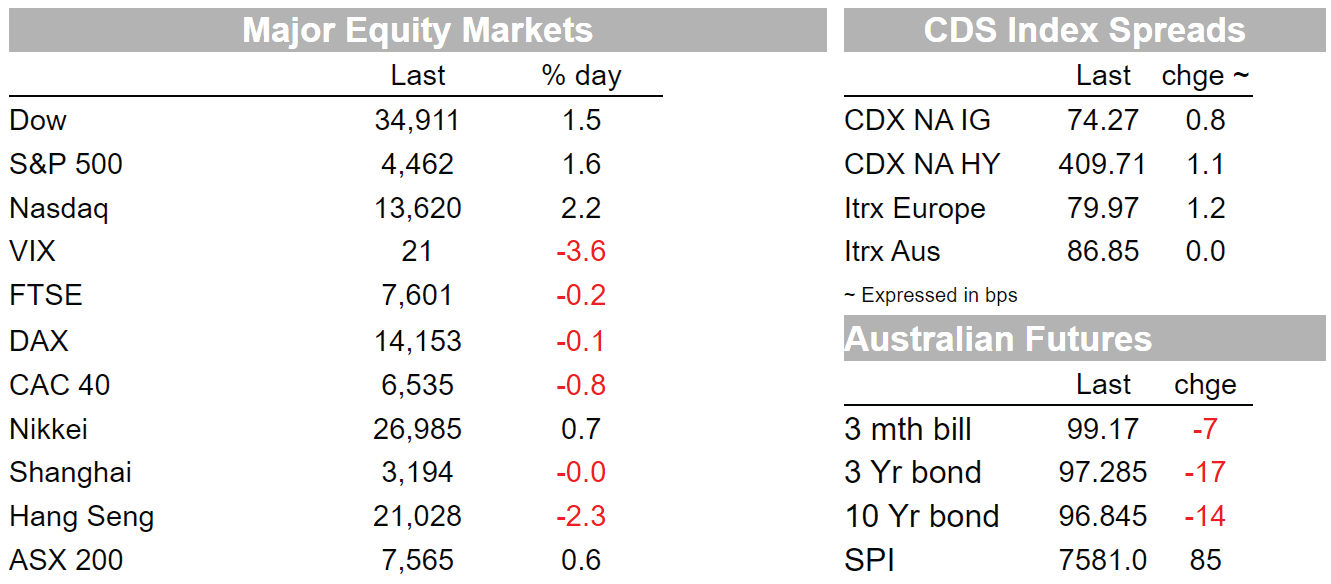

On Tuesday at least, US stocks have defied the pressure from ever-higher Treasury yields to post decent gains, with lower oil prices and a near 80% earnings ‘beat’ thus far in the corporate earnings seasons being credited for the 1.7% gains in the S&P500. Whether that can survive the big Netflix ‘miss’ reported just after the close and which sees its stock own 19% after hours, is one of today’s questions. In currencies, the ongoing rise in USD/JPY (up 1.5% in the last 24 hours) looks to have finally woken up USD/CNH, which has jumped up above 6.40 (6.42) for the first time in six months.

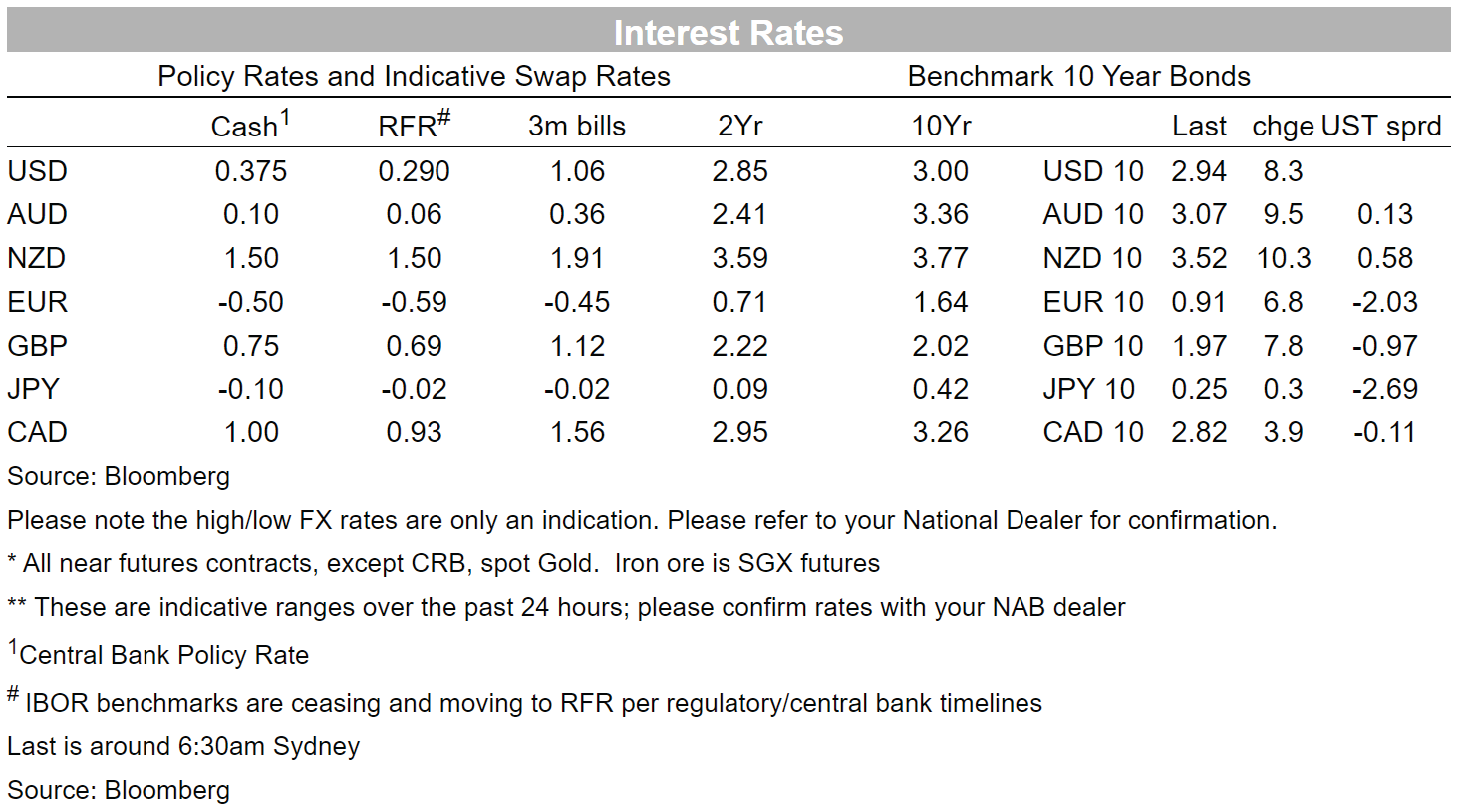

It’s been another busy 24 hours in markets and where the relentless rise in US Treasury yields continues to make the headlines (and which are continuing to rise as fast as I can type), 2s up another 15bps to 2.60% and 10s currently +9bps to 2.94%, so getting perilously close to trading on a 3% handle. Incoming Fed speak has done nothing to detract from the ongoing bond sell-off, Charles Evans the latest to weigh in with comments that the Fed will ‘probably’ have to take rates above neutral, by which he means to 2.5% this year – so including two 50bps hikes – versus the latest FOMC median long run ‘dot’ of 2.40%. Atlanta Fed president Raphael Bostic meanwhile has also been on the wires in the last hour or so, saying that while it’s important to get inflation under control, the Fed should not act with such vigour that they harm the economy, especially with a weaker global outlook. By this he means only that the Fed shouldn’t push rates a ‘long way above neutral’.

Equity market gains have come despite the IMF taking an axe to its 2022 global growth forecasts – admittedly to no surprises – with global growth now put at 3.6% this year down from 4.4% in the January forecast. Europe suffers the biggest downgrades, with Germany’s estimate down by 1.7% and Italy’s by 1.5% (overall Eurozone to 2.8% from 3.9%). This is without Europe agreeing to impose an embargo on Russian oil and gas, which the IMF reckons would take another 2% or so off EZ growth. US downgrades are much more modest while, pointedly, Australia is about the only county to receive a growth upgrade, to 4.2% from 4.1% this year, albeit the IMF’s 2023 estimate is cut by 0.1% to 2.5%. On inflation, the IMF sees Australia CPI at 3.9% this year, sharply higher than its 2.1% January forecast. Coalition politicians are already out milking the growth upgrade and its contrast to the rest of the world, as we should fully expect them to. Other growth downgrades to note include China to 4.4% from 4.8% – so well below the official ‘about 5.5%’ target – while Russia is seen contracting 8.5% this year and Ukraine by 35%.

To some amusement from this scribe, a reversal of Monday’s sharp (Libya-outage led) price gains (Brent and WTI crudes both nearly 6% lower) have been credited alongside incoming corporate earnings for equity gains (consumer discretionaries up 2.9% and the best performing sub-sector of the S&P). This is even though lower IMF global growth estimates are one of the reasons for the oil price fall-back.

The still-stronger USD is also behind the oil price fall-back, where the DXY index has now reached 101, up another 0.2% on the day. The move is led by USD/JPY, which in the last 24 hours has risen another 1.5% to come within a whisker of ¥129. Amid the ongoing rise in US Treasury yields, actions clearly speak louder than words, the latest protests from both BoJ Governor Kuroda and MoF chiel Suzuki thus continuing to go unheeded.

Of particular note in FX overnight is that after weeks during which the Renminbi has traded essentially sideways, USD/CNH burst up through 6.40 yesterday evening our time, to a high of 6.4230 – its highest for six months. It may or may not be coincidental that the sell-off coincided with the acceleration in JPY weakness and where we note that the CNY/JPY cross has just hit the level – around 20.0 – from where China launched its ill-fated CNY devaluation attempt back in 2015 (triggering a China-led global stock market sell-off). China and Japan do after all compete in third market for some good exports.

CNH weakness has not spilled into the G10 currency arena as yet, AUD/USD coming into the New York close little changed at 0.7375. Yesterday’s RBA April Meeting Minuets failed to move the dial, confirming the message from the post meeting Statement that June is more likely than May for a first RBA tightening in this cycle as the RBA awaits both inflation and activity/wages data in the coming months. Also evident, based on a quite lengthy passage in the Minutes about Exchange Settlement (ES) balances, is the Board’s desire to, for now, maintain 0.1% differential on the rate paid on ES balances relative to the Cash Rate, seen as an inference that the first move from the RBA is more likely to be by 15bps to 25bps than 40bps to 0.50%

Finally the only data to note overnight was better than expected US Housing Starts in March , up 0.3% against a 1.6% expected fall, and meaning starts are up 21.6% at an annualised rate in Q1, even with clear sign of dwindling activity given the rise in 30-year fixed rate mortgages this year, currently around 5.25%.

Read our NAB Markets Research disclaimer

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.